Colliers Report: Stringent lending requirements slowed hotel investment activity

February 1, 2023Commercial Real Estate Research & Forecast Report

Q4 2022 South Carolina Hotel

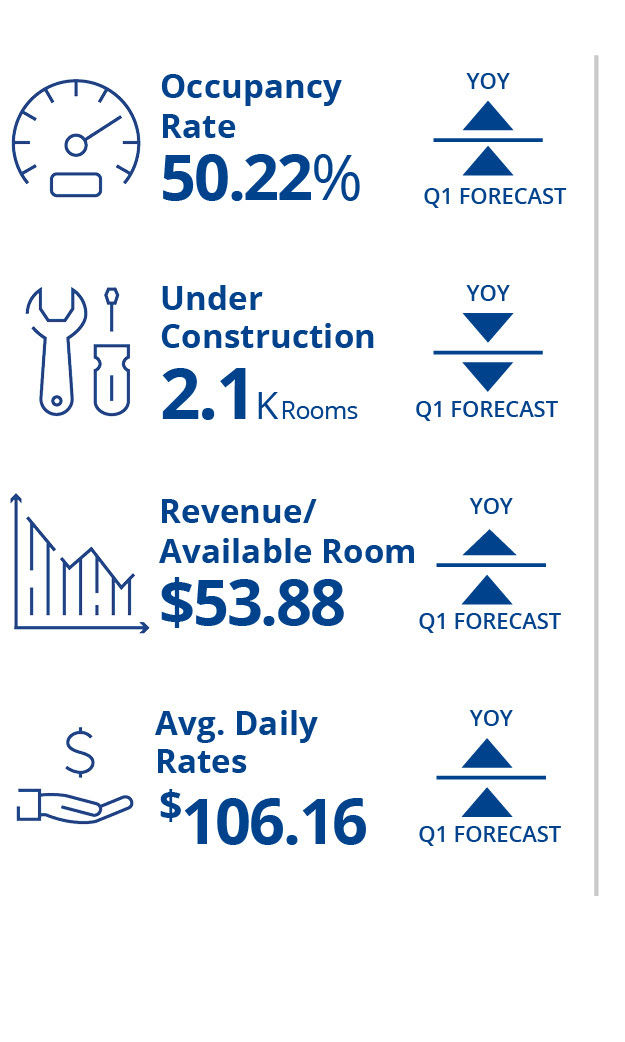

Market Highlights

The capital market slowdown in the latter half of 2022 continues to negatively influence the hotel market. Interest rates are sharply higher and capital is significantly less available than it was during the first half of 2022 due to stringent underwriting and lower loan-to-value ratios. These circumstances have had a direct impact on the hotel investment market which slowed during the fourth quarter of 2022.

Click here to read the full report.

Key Takeaways

- Strong revenue and earnings growth have partially offset the decrease in hotel values

- Moderate revenue growth is expected in 2023

Summary

A disconnect between buyer and seller expectations is also becoming a factor because the pricing perspective of sellers continues to be influenced by the strong metrics evident in the first half of 2022, but buyers are limited due to the more stringent requirements to secure debt.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 62 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 18 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 62 countries, our more than 17,000 enterprising professionals work collaboratively to provide expert advice to real estate occupiers, owners and investors. With annualized revenues of $4.3 billion and $65 billion of assets under management, we maximize the potential of property and accelerate the success of our clients and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.