Colliers Report: Columbia central business district has high-quality office space available

July 2, 2019Key Takeaways

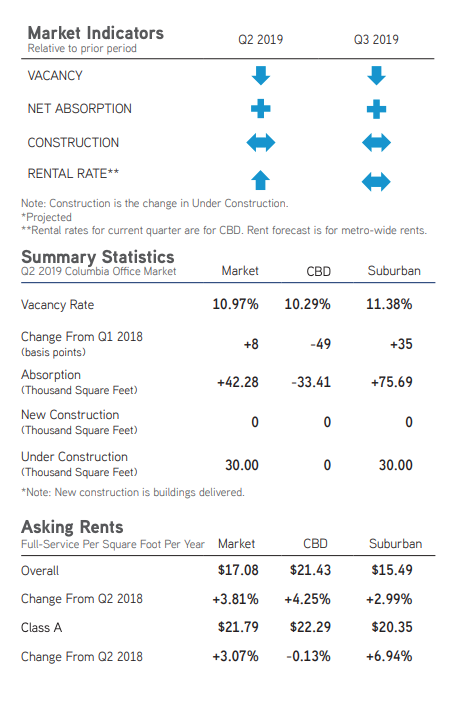

- Columbia’s office market posted a positive absorption of 42,283 square feet due to the healthy suburban market activity during the second quarter.

- Weighted rental rates rose this quarter as a result of higher-priced, quality available space within the central business district.

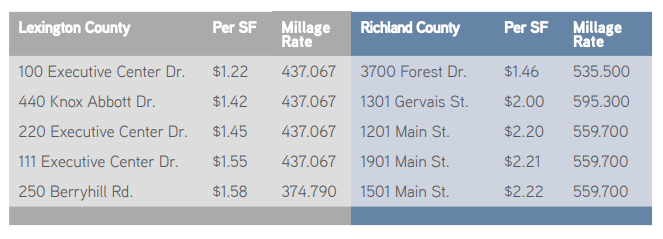

- A variance in tax burdens is creating a competitive environment between Richland County and Lexington County.

For additional commercial real estate news, check out our market reports here.

Creating competition between counties

Creating competition between counties

Property taxes are often a deciding factor for new businesses interested in locating within a business district. Before moving, business owners will ask questions about how high the property taxes are within the district and if there are tax breaks for business owners. The answers to these questions will either assist or deter the region’s efforts to draw new businesses.

According to the Tax Foundation, property tax is the principal source of revenue for localities. Taxes are imposed on business owners in every region; however, some counties have higher tax millage charges than others. A multitude of local political subdivisions such as counties, school boards and other agencies have specific millage charges as well. For this reason, the tax burden is less in Lexington County than it is in Richland County, creating a competitive, rather than cooperative, business environment between the two counties. As an example, below are office buildings from each county and the property taxes per square foot charged for each building and the millage rate.

The property tax charges are higher in Richland County. Of course, businesses desiring a downtown location may be willing to pay higher rates. However, due to parking struggles and a shortage of available space within the Columbia central business district, business owners may begin to locate in Lexington County more often than Richland County due to a lower level of property tax burden per square foot. The counties need to work in cooperation with one another in order to bring new businesses to both regions, instead of shuffling tenants from one region to the other.

Market Overview

Overall Columbia Market: Positive absorption lowers weighted rental rates

The Columbia office market is comprised of 16.12 million square feet of office properties within 8 submarkets. Construction continues on a 30,000-square-foot office building within the Cayce/West Columbia submarket. The overall market absorbed 42,283 square feet, and the vacancy rate dropped from 11.21% during the first quarter of 2019 to 10.97% this quarter. Also, due to higher quality space absorption throughout many submarkets, the overall market weighted rental rates dropped slightly from $17.73 per square foot last quarter to $17.08 per square foot during the second quarter of 2019.

Columbia Business District (CBD): Quality space is available

The Columbia central business district consists of 5.56 million square feet and construction activity will remain at a standstill due to the high cost of new construction, lack of downtown parking and few downtown development options. Downtown office buildings posted a net negative absorption of 33,406 square feet; therefore, the central business district market vacancy rate rose from 9.62% during the first quarter of this year to 10.29% this quarter. In addition, the overall downtown weighted rental rates rose to $21.43 per square foot during the second of 2019 due to high quality space availabilities at: First Citizens Bank at 1230 Main Street; 1441 Main; Meridian at 1320 Main Street; 700 Gervais and Capitol Center at 1201 Main Street.

Suburban: High demand for suburbs continues

The Columbia suburban markets consist of 10.51 million square feet of office properties and there is one building under construction at 100 Corporate Boulevard in the Cayce/West Columbia submarket. The suburbs absorbed 75,689 square feet overall. Northeast Columbia absorbed 42,000 square feet with a large portion of that being attributable to the absorption of 25,007 square feet at 7909 Parklane Road. The Forest Acres submarket absorbed 38,656 square feet. The suburban vacancy rate dropped from 12.10% during the first quarter of 2019 to 11.38% this quarter, the Cayce/West Columbia submarket had the lowest vacancy rate of 3.60% followed by East Columbia’s vacancy rate of 3.72%, even though these submarkets are two of the smallest in the market, there is a high demand to locate there. The suburban market average weighted rental rates dropped from $16.48 per square foot during the first quarter of 2019 to $15.49 per square foot this quarter.

Significant Transactions

This quarter there were 28 sale transactions, according to CoStar. During the second quarter of 2019, there were also 51 leases, most were signed by undisclosed tenants or were smaller than 10,000 square feet.

Sales

- Boyd Watterson GSA REIT purchased the 186,000-square-foot office located at 300 Outlet Pointe Boulevard in Columbia for $21 million.

- The Brown Building, a 12,813-square-foot office located at 1730 Main Street in Columbia, was purchased for $2.17 million.

Significant Leases

- Dot Charter School leased the entire 21,580-square-foot office building located at 2015 Marion Street in Columbia.

Construction Pipeline

Construction Pipeline

Under Construction

- Construction continues at 100 Corporate Boulevard, a soon-to-be 30,000-square-foot office building within the Cayce/West Columbia submarket.

Employment

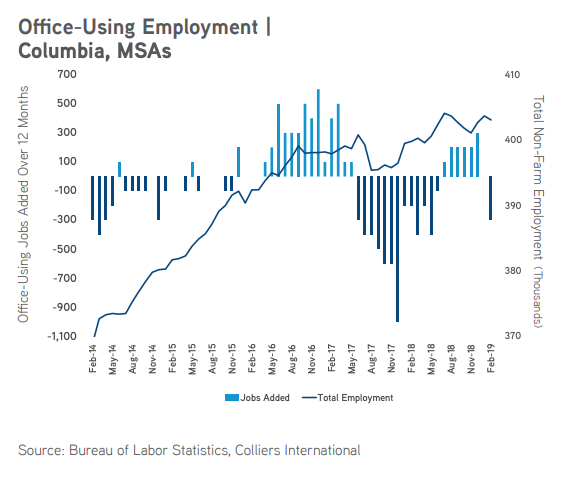

Office-using employment are those jobs related to the professional and business services, financial activities and information sectors. According to the most recent February 2019 data from the Bureau of Labor Statistics, within the Columbia Metro Statistical Area (MSA) there were 300 less jobs during February of this year than there were in February 2018. However, there were 3,300 total jobs added over the past twelve months, raising the total non-farm employment to 403,100. The Columbia unemployment rate continues to drop and was at 2.8% as of April 2019. Manufacturing and construction jobs have posted the most employment growth during the second quarter of 2019.

Market Forecast

Columbia’s central business district is undergoing a lull in office market activity; however, the suburban submarkets have piqued the interest of office tenants due to the submarket’s ample free parking, close proximity to residential areas and lower rental costs. Office development is not a viable option within the central business district because of rising construction costs. In addition, the central business district is situated in Richland County where there is a higher tax burden than the surrounding counties. Owners and tenants will continue to locate within Lexington County submarkets. Quality offices within the central business district will likely be absorbed in the coming quarters which will cause the weighted rental rates to decrease; absorption in suburban markets will be positive for the next few quarters.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q2 Office Columbia Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans