Colliers Report: Columbia retail is thriving, not dying

August 1, 2019Key Takeaways

- Columbia retail is not dying, it is thriving- the market absorbed 114,051 square feet during the second quarter of 2019.

- Weighted rental rates will continue to decrease as the vacancy rate continues as decline.

Columbia retail thrives, despite media proclaiming the death of retail

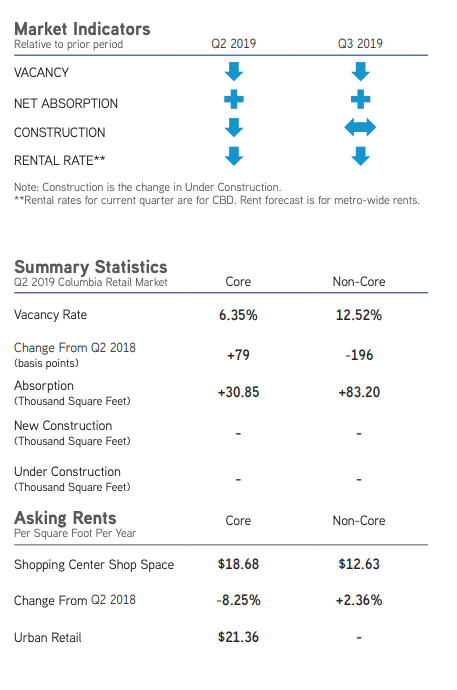

Retail is often denoted as “dying” and experiencing a “retail apocalypse” due to e-commerce; in reality, however, the Columbia retail market has been resilient through it all. Of course, there have been fluctuations in absorption and vacancy rates as tenants attempt to find their niche within the market. However, the Columbia core vacancy rate is only 79 basis points higher than it was one year ago and, in non-core shop space, the vacancy rate is 196 points lower than this time last year. Therefore, if retail was truly dying as the media has been predicting for the last several years, the market would not have healthy numbers and positive activity. In fact, Columbia’s central location within the state and access to several logistic avenues are attractive to omni-channel retailers with an e-commerce warehousing component. In such an instance, e-commerce will boost the Columbia retail market activity and draw new owner/users to construct headquarters and additional omni-channel retail components within the market.

Retail is often denoted as “dying” and experiencing a “retail apocalypse” due to e-commerce; in reality, however, the Columbia retail market has been resilient through it all. Of course, there have been fluctuations in absorption and vacancy rates as tenants attempt to find their niche within the market. However, the Columbia core vacancy rate is only 79 basis points higher than it was one year ago and, in non-core shop space, the vacancy rate is 196 points lower than this time last year. Therefore, if retail was truly dying as the media has been predicting for the last several years, the market would not have healthy numbers and positive activity. In fact, Columbia’s central location within the state and access to several logistic avenues are attractive to omni-channel retailers with an e-commerce warehousing component. In such an instance, e-commerce will boost the Columbia retail market activity and draw new owner/users to construct headquarters and additional omni-channel retail components within the market.

Market Conditions

Shopping Centers

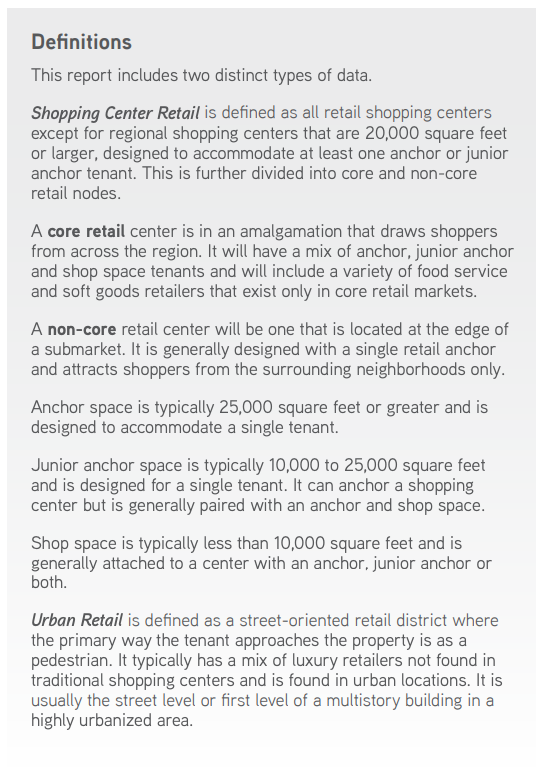

The Columbia shopping center market is comprised of approximately 13.35 million square feet of shop space. During the second quarter of 2019, the overall quarterly market vacancy rate plunged from 10.51% to 9.65%, because the Columbia retail market absorbed 114,051 square feet. There is very little core shopping center space remaining in the market – core vacancy rate dropped to 6.35% and core retailers absorbed 30,847 square feet this quarter. Non-core shopping centers absorbed 83,204 square feet and the non-core quarterly vacancy rate decreased from 13.68% to 12.52% during the second quarter of 2019. The overall average weighted shop space rental rate in the Columbia market was $14.62 per square foot this quarter. The decrease in weighted rental rates is an indication that the few remaining shop spaces are dated or not located in a popular retail spot. Columbia retail weighted rental rates across the submarkets range from $8.00 per square foot up to $24.58 per square foot.

The Columbia shopping center market is comprised of approximately 13.35 million square feet of shop space. During the second quarter of 2019, the overall quarterly market vacancy rate plunged from 10.51% to 9.65%, because the Columbia retail market absorbed 114,051 square feet. There is very little core shopping center space remaining in the market – core vacancy rate dropped to 6.35% and core retailers absorbed 30,847 square feet this quarter. Non-core shopping centers absorbed 83,204 square feet and the non-core quarterly vacancy rate decreased from 13.68% to 12.52% during the second quarter of 2019. The overall average weighted shop space rental rate in the Columbia market was $14.62 per square foot this quarter. The decrease in weighted rental rates is an indication that the few remaining shop spaces are dated or not located in a popular retail spot. Columbia retail weighted rental rates across the submarkets range from $8.00 per square foot up to $24.58 per square foot.

Urban Retail

There are 1.89 million square feet of urban retail in Columbia in seven distinct urban areas. Triple net weighted rental rates for the remaining urban spaces remained relatively unchanged at $21.36 per square foot during the second quarter of 2019. The overall vacancy rate during the second quarter of 2019 increased to 9.50%, with 180,109 square feet of core vacancy and no sublease space available.

There are 1.89 million square feet of urban retail in Columbia in seven distinct urban areas. Triple net weighted rental rates for the remaining urban spaces remained relatively unchanged at $21.36 per square foot during the second quarter of 2019. The overall vacancy rate during the second quarter of 2019 increased to 9.50%, with 180,109 square feet of core vacancy and no sublease space available.

Northeast Columbia

The Northeast Columbia submarket has approximately 3.95 million square feet of retail space and is the largest of all of the Columbia submarket sectors. The Northeast submarket absorbed 44,239 square feet during the second quarter of 2019-Capitol Centre and Park Centre posted the most absorption within this submarket: 35,252 square feet and 22,952 square feet, respectively. The Northeast core subsector posted a net negative 18,453 square feet this quarter due to the net negative absorption of 18,300 square feet at Forum I at the Village of Sandhills. However, core shop space in the Northeast submarket absorbed 62,692 square feet. The overall shopping center vacancy rate in the Northeast dropped from 10.13% during the first quarter of 2019 to 9.01% this quarter, and the overall average quarterly weighted rental rate decreased from $18.93 per square foot to $18.48 per square foot. Core weighted rental rates barely changed from last quarter to this quarter and were $18.21 per square foot. Conversely, non-core rental rates decreased from $19.96 per square foot last quarter to $18.98 per square foot this quarter.

Lexington

The Lexington submarket has grown to 1.94 million square feet and has only a few remaining retail spaces available. The Lexington submarket has been active over the past several quarters; nevertheless, this quarter the submarket posted a net negative absorption of 49,667 square feet. A large chunk of negative absorption occurred in non-core shop space at the Village Square Shopping Center; however, both core and non-core shop space posted negative absorption. The overall vacancy rate within the Lexington submarket rose to 7.29% due to the negative absorption. The core shopping center vacancy rate is only 1.58%, while the Lexington non-core vacancy rate is 17.58%. Due to the heavy Lexington retail traffic and residential influx, the negative momentum is predicted to rebound relatively quickly.

Harbison & St. Andrews

The Harbison & St. Andrews submarket have approximately 3.6 million square feet of retail space, making it the second largest submarket in Columbia. This submarket absorbed 135,862 square feet this quarter, the most in the Columbia submarket. Due to the high positive absorption, the submarket vacancy rate plummeted from 14.39% during the first quarter of 2019 down to 10.62% this quarter. Non-core weighted rental rates during the second quarter of 2019 were $11.87 per square foot for the remaining available space and the average weighted rental rates range varied from $7.50 per square foot in non-core Harbison and St. Andrews areas to $22.00 per square foot.

The Golden Triangle

The Golden Triangle spans two retail corridors on the southeast side of the city, Forest Drive and Garners Ferry/Devine Street. All 1.25 million square feet of shopping centers within this area are considered core with limited space for additional development. The Golden Triangle submarket posted a net negative absorption of 67,597 square feet during the second quarter of 2019. Consequently, the Golden Triangle vacancy rate drastically increased from 3.84% during the first quarter of this year to 9.26% during the second quarter of 2019. The average triple net weighted rental rate for the remaining available retail space has greatly fluctuated from quarter-to-quarter. During the second quarter of 2019, the average weighted rental rate was $24.58 per square foot, which was a slight decrease from the first quarter weighted rental rate of $25.25 per square foot.

Significant Transactions

During the second quarter of 2019, there were 53 retail sale transactions and 63 retail leases were signed from April 2019 through June 2019.

Sales

- Lexington Village, a 30,764-square-foot retail center located at 205 Columbia Avenue, was purchased for $4.9 million by South Coast Commercial, LLC.

Construction Pipeline

Columbia retail construction activity remains at a standstill, as all retail shops have completed construction; there are, however, several retail shopping centers in the planning phase and, when demand increases with new home construction and population growth, new retail construction will likely begin.

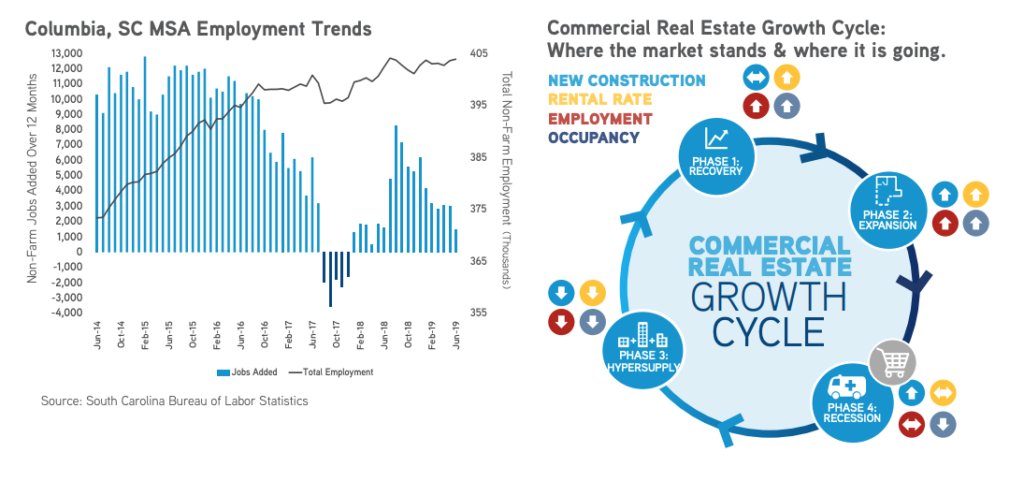

Gross Retail Sales & Employment

Per the Bureau of Labor Statistics’ most recent data through June 2019, there were 1,500 total jobs added to the market over the past year starting June 2018, and the Columbia MSA had a total of 403,900 non-farm employees. Data from the South Carolina Department of Revenue reports gross retail sales in the Columbia MSA from May 2018 through April 2019 reached $28.95 billion. When comparing year-to-year revenue differences on a month-by-month basis, the April 2019 revenue totals are 3.4% higher than they were during April of last year.

Market Forecast

Columbia retail is performing against the grain of a retail apocalypse; no new construction is underway, therefore the vacancy rate is predicted to tighten further in the next couple of quarters until new construction becomes necessary. Big box retail stores are being absorbed by furniture stores and gyms, and tenants are moving around the market to find the appropriate location to serve their clients. New omni-channel retailers will be drawn to the market due to Columbia’s central location within the state, and convenient access to logistic arteries. Weighted rental rates are expected to decrease as the vacancy rate declines further. The remaining available retail spaces are priced lower than those that are already absorbed. The Columbia retail market is expected to continue to post positive performance throughout 2019.

Around South Carolina

Charleston, SC

New Charleston suburban retail construction is expected to deliver before the end of this year. A variety of retail trends are transpiring within the Charleston market, as retailers attempt to find the right location to better reach and serve their target clients. The market posted a net negative absorption of 128,781 square feet this quarter. There are currently 84,534 square feet of retail space under construction throughout the Charleston submarkets The quarterly vacancy rate rose this quarter from 6.07% to 6.97%; core vacancy rate rose from 5.01% to 5.24%, while non-core vacancy rate rose from 7.24% to 8.89%.

Greenville-Spartanburg, SC

The Greenville-Spartanburg market posted a net negative absorption of 269,909 square feet this quarter, largely due to non-core submarkets posting a net negative absorption of 253,688 square feet. Core retail shop spaces posted a net negative absorption of 16,221 square feet. The second quarter average shop space weighted rental rate dropped from $12.20 per square foot during the first quarter of this year to $10.14 per square foot during the second quarter of 2019. Core shopping center weighted rents averaged $17.42 per square foot, while non-core weighted rents averaged $9.90 per square foot.

For additional commercial real estate news, check out our market reports here.

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans