Colliers Report: Columbia’s industrial absorption predicted to surpass previous years

July 23, 2019Research & Forecast Report

Q2-2019 COLUMBIA | INDUSTRIAL

Key Takeaways

- 1.20 million square feet is currently under construction and expected to deliver within the next two quarters.

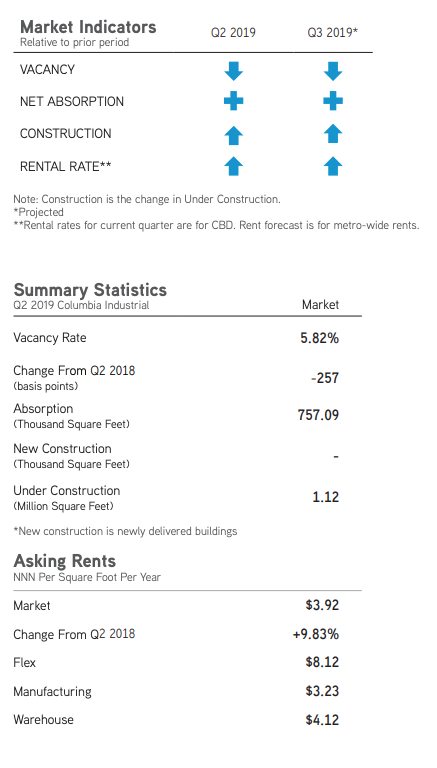

- Absorption reached 757,094 square feet during the second quarter of 2019 and the overall market vacancy rate dropped to 5.82%.

Absorption has increased exponentially

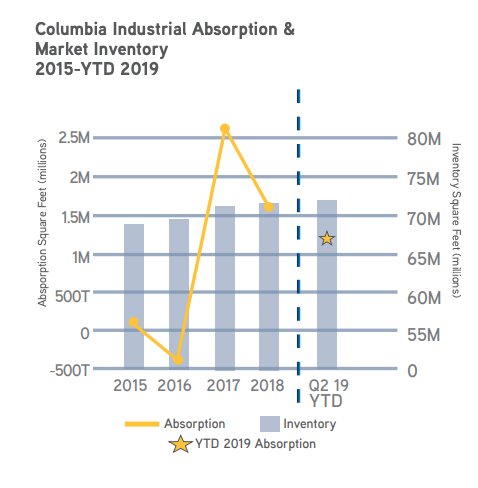

Absorption within the Columbia industrial market has fluctuated over the last several years, however, overall demand has grown exponentially in the last two years. Annual absorption during 2015 was 919,796 square feet and during 2016 the market actually posted a net negative absorption of 401,718 square feet. Conversely, the 2017 annual absorption total was 2.57 million square feet and last year it was 1.52 million square feet. During the first two quarters of 2019, absorption reached 1.22 million square feet and is predicted to be positive through year-end due to an increase in industrial demand caused by intensifying industrial activity throughout South Carolina. With 1.2 million square feet currently under construction, and 76% of it already pre-leased; the robust Columbia industrial market activity shows no signs of slowing.

Absorption within the Columbia industrial market has fluctuated over the last several years, however, overall demand has grown exponentially in the last two years. Annual absorption during 2015 was 919,796 square feet and during 2016 the market actually posted a net negative absorption of 401,718 square feet. Conversely, the 2017 annual absorption total was 2.57 million square feet and last year it was 1.52 million square feet. During the first two quarters of 2019, absorption reached 1.22 million square feet and is predicted to be positive through year-end due to an increase in industrial demand caused by intensifying industrial activity throughout South Carolina. With 1.2 million square feet currently under construction, and 76% of it already pre-leased; the robust Columbia industrial market activity shows no signs of slowing.

Market Overview

Overall Columbia industrial market: New construction will be quickly absorbed

The Columbia industrial market is comprised of 71.29 million square feet of industrial space. There are approximately 1.20 million square feet under construction within six buildings. The Columbia industrial market absorbed 757,094 square feet this quarter, led by the Orangeburg County submarket which absorbed 317,203 square feet. The overall market vacancy rate dropped from 6.88% during the first quarter of 2019 to 5.82% this quarter. Also, the overall average market rental rate for the remaining available space increased from $3.85 per square foot last quarter to $3.92 per square foot during the second quarter of 2019.

Warehouse/Distribution: Positive absorption and rising rental rates

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 44.71 million square feet. This sector absorbed 432,628 square feet this quarter and the quarterly vacancy rate dropped from 6.88% to 4.65%. There are three warehouses under construction in the Columbia market: Midway Logistics IV, a 200,000-square-foot warehouse within the Cayce/West Columbia submarket, a 67,000-square-foot, build-to-suit warehouse within the Lexington Industrial Park and Shop Grove Commerce Park located at 101 Sparkman Drive, a 45,000-square-foot warehouse in the Southeast Columbia submarket. The overall average weighted rent for warehouses increased slightly from $3.98 per square foot during the last quarter to $4.12 per square foot during the second quarter of 2019.

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 44.71 million square feet. This sector absorbed 432,628 square feet this quarter and the quarterly vacancy rate dropped from 6.88% to 4.65%. There are three warehouses under construction in the Columbia market: Midway Logistics IV, a 200,000-square-foot warehouse within the Cayce/West Columbia submarket, a 67,000-square-foot, build-to-suit warehouse within the Lexington Industrial Park and Shop Grove Commerce Park located at 101 Sparkman Drive, a 45,000-square-foot warehouse in the Southeast Columbia submarket. The overall average weighted rent for warehouses increased slightly from $3.98 per square foot during the last quarter to $4.12 per square foot during the second quarter of 2019.

Manufacturing: New construction expected by year-end

The manufacturing sector in the Midlands has 24.22 million square feet and there are currently two manufacturing facilities under construction that, upon completion (which is predicted to be by the end of this year) will add 725,135 square feet to the inventory. The manufacturing sector absorbed 268,229 square feet of space this quarter, led by Fairfield County and Orangeburg County. Due to the high positive absorption, the manufacturing vacancy rate dropped from 8.61% during the first quarter of 2019 to 7.50% this quarter. In addition to space leasing quickly within this sector, the average weighted rental rate rose from $2.97 per square foot during the first quarter of 2019 to $3.23 per square foot during the second quarter of 2019.

Flex/R&D: Minimal, but positive activity

The Flex/R&D sector in the Midlands has 2.37 million square feet within its submarkets, with one 70,000-square-foot flex/R&D property currently under construction within the Southeast Columbia submarket. This sector absorbed 56,237 square feet during the second quarter of 2019 and the quarterly vacancy rate decreased from 13.19% to 10.82%. Flex/R&D average weighted rental rate for the remaining availabilities rose from $7.74 per square foot last quarter to $8.12 per square foot during the second quarter of 2019.

Capital Investment & Employment

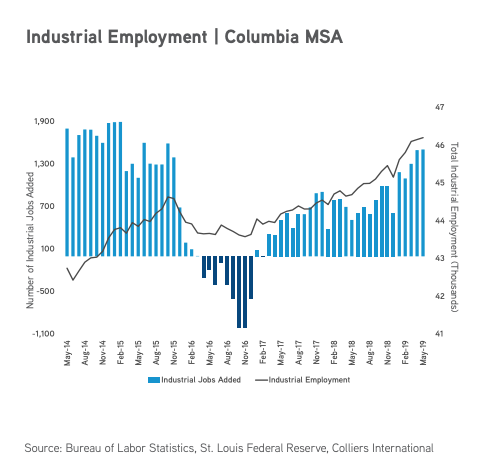

During the first two quarters of 2019 there have been $185.5 million in new capital investments and $9.5 million in capital investment expansions, accounting for 562 jobs announced within the Columbia region. Most of the jobs will be within the new JUUL assembly facility announced in Lexington County. Other types of investors range from plastic injection molding to solar energy and solar farms to a chemical manufacturer. Of the capital investments announced, 75% of them were manufactures of some kind. According to the Federal Reserve data through May 2019, industrial employment comprises 11.4% of Columbia’s total employment, or about 46.2 million jobs in the Midlands region. There were 1,509 industrial jobs added during the past 12 months ending May 2019. The Columbia industrial market proves appealing to investors on the employment front, with industrial jobs accounting for 48.7% of all jobs added during the past 12 months.

During the first two quarters of 2019 there have been $185.5 million in new capital investments and $9.5 million in capital investment expansions, accounting for 562 jobs announced within the Columbia region. Most of the jobs will be within the new JUUL assembly facility announced in Lexington County. Other types of investors range from plastic injection molding to solar energy and solar farms to a chemical manufacturer. Of the capital investments announced, 75% of them were manufactures of some kind. According to the Federal Reserve data through May 2019, industrial employment comprises 11.4% of Columbia’s total employment, or about 46.2 million jobs in the Midlands region. There were 1,509 industrial jobs added during the past 12 months ending May 2019. The Columbia industrial market proves appealing to investors on the employment front, with industrial jobs accounting for 48.7% of all jobs added during the past 12 months.

Significant Transactions

According to CoStar, there were 14 industrial sale transactions and 17 industrial leases signed during the second quarter of 2019, the largest of which, was a 150,000 square feet lease at 825 Bistline Drive in West Columbia by an undisclosed tenant.

Sales

- VEREIT, Inc. purchased the Amazon fulfillment center located in the Saxe Gotha Industrial Park at 4400 12th Street extension in West Columbia as part of a $407.52 million, six-property portfolio sale.

Construction Pipeline

Under Construction

- Construction at the 660,135-square-foot China Jushi manufacturing facility in southeast Columbia continues.

- Construction continued on the fourth Midway Logistics building, which will be 200,000 square feet.

- Construction broke ground at 105 Sparkman Drive, a 70,000-square-foot flex/R&D building

- Construction began in Orangeburg County on a 65,000-square-foot manufacturing facility located at 397 Millennium Drive.

- Construction continued on a 45,000-square-foot warehouse at 101 Sparkman Drive in the Southeast Columbia submarket.

Market Forecast

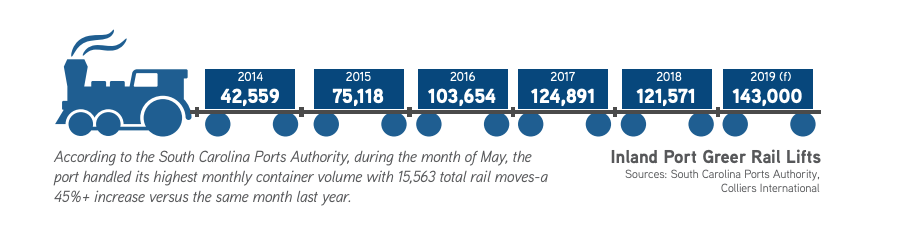

Port activity is setting records in the Port of Charleston, as well as, the Inland Port Dillon and Inland Port Greer; therefore, industrial activity throughout the state will continue on a positive trajectory. New manufacturing and distribution tenants are drawn to the region thanks to its central location and convenient access logistically to the entire state and the rest of the nation. As South Carolina moves toward becoming an industrial hub, the Columbia industrial market vacancy rate will continue to drop, despite new construction delivery in the next two quarters. Average weighted rental rates for available industrial space will increase with new, higher-quality deliveries; however, because they will be absorbed quickly, the increase may be short-lived. This year’s absorption, throughout the Columbia market, is set to surpass previous years.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q2 Industrial Columbia Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans