Colliers Report: Local retail will thrive on residential boom

May 10, 2019

Research & Forecast Report

Q1-2019 COLUMBIA | RETAIL

Key Takeaways

- Overall absorption in the Columbia retail market was positive; non-core retail is outperforming core retail centers.

- An evolving retail trend to provide services on a local level with enhanced convenience and an omni-channel preference is growing in popularity.

- Submarkets, such as Lexington, with a dense residential population are expected to perform well.

To download the complete report: 2019 Q1 Retail Columbia Report

Lexington demands additional retail

The Lexington market growth potential is limitless for retailers interested in a new location. Lexington County has transformed over the past 50 years from an agricultural area to a residential family community with excellent public schools, reasonable housing options and convenient access to major highways and transportation arteries. Now Lexington is being transformed further with population and employment growth, a residential housing boom and a new trend in localized retail capable of transforming the Lexington landscape. Employment is strong within Lexington County, with the unemployment rate at 2.4%, lower than both the South Carolina and United States unemployment averages. The entire Lexington County region is home to approximately 290,642 people as of 2017. From 2010 to 2018, the total Lexington County population has increased 18.49%. In addition, the 2023 population projection for Lexington County is estimated to grow at an additional growth rate of 9.94%. In addition to an increasing population and strong employment structure, the Lexington housing units have increased 16.25% from 2010 to 2018 and are projected to continued on a upward path, growing another 9.08% by 2023. With the housing and population growth comes a demand for convenient services, entertainment and leisure activity options. Couple the increasing demand with an evolving trend of retailers specializing their products and catering to local residents who live in close vicinity to their shops, and Lexington is the perfect submarket for retail to grow exponentially.

The Lexington market growth potential is limitless for retailers interested in a new location. Lexington County has transformed over the past 50 years from an agricultural area to a residential family community with excellent public schools, reasonable housing options and convenient access to major highways and transportation arteries. Now Lexington is being transformed further with population and employment growth, a residential housing boom and a new trend in localized retail capable of transforming the Lexington landscape. Employment is strong within Lexington County, with the unemployment rate at 2.4%, lower than both the South Carolina and United States unemployment averages. The entire Lexington County region is home to approximately 290,642 people as of 2017. From 2010 to 2018, the total Lexington County population has increased 18.49%. In addition, the 2023 population projection for Lexington County is estimated to grow at an additional growth rate of 9.94%. In addition to an increasing population and strong employment structure, the Lexington housing units have increased 16.25% from 2010 to 2018 and are projected to continued on a upward path, growing another 9.08% by 2023. With the housing and population growth comes a demand for convenient services, entertainment and leisure activity options. Couple the increasing demand with an evolving trend of retailers specializing their products and catering to local residents who live in close vicinity to their shops, and Lexington is the perfect submarket for retail to grow exponentially.

Market Conditions

Shopping Centers

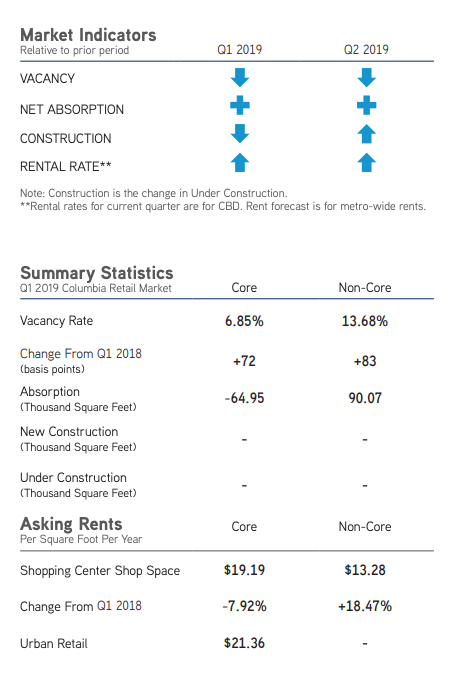

The Columbia shopping center market is comprised of approximately 13.35 million square feet and absorbed 25,118 square feet during the first quarter of 2019. Non-core shop space continues to perform well, and retail shops in non-core shopping areas absorbed 90,068 square feet, while the core retail sector posted a net negative absorption of 64,950 square feet. Overall shop space weighted rental rates for the remaining available space increased from $14.30 per square foot during the fourth quarter of 2018 to $15.15 per square foot this quarter; however, core weighted rental rates decreased from $20.75 per square foot last quarter to $19.19 per square foot during the first quarter of 2019. The core vacancy rate also increased in core shopping centers from 5.80% last quarter to 6.85% this quarter, so it stands to reason the weighted rental rate average in the core sector would decrease due to lesser quality space becoming available this quarter. Conversely, the non-core vacancy rates decreased from 14.94% during the fourth quarter of last year to 13.68% this quarter and the weighted rental rate average in non-core shops increased from $12.17 per square foot to $13.28 per square foot during the first quarter of 2019.

The Columbia shopping center market is comprised of approximately 13.35 million square feet and absorbed 25,118 square feet during the first quarter of 2019. Non-core shop space continues to perform well, and retail shops in non-core shopping areas absorbed 90,068 square feet, while the core retail sector posted a net negative absorption of 64,950 square feet. Overall shop space weighted rental rates for the remaining available space increased from $14.30 per square foot during the fourth quarter of 2018 to $15.15 per square foot this quarter; however, core weighted rental rates decreased from $20.75 per square foot last quarter to $19.19 per square foot during the first quarter of 2019. The core vacancy rate also increased in core shopping centers from 5.80% last quarter to 6.85% this quarter, so it stands to reason the weighted rental rate average in the core sector would decrease due to lesser quality space becoming available this quarter. Conversely, the non-core vacancy rates decreased from 14.94% during the fourth quarter of last year to 13.68% this quarter and the weighted rental rate average in non-core shops increased from $12.17 per square foot to $13.28 per square foot during the first quarter of 2019.

Urban Retail

There are 1.89 million square feet of urban retail in Columbia in seven distinct urban areas. Triple net weighted rental rates for the remaining urban spaces rose to $21.36 per square foot during the first quarter of 2019. The overall vacancy rate during the first quarter of 2019 decreased to 8.72%, with 164,666 square feet of core vacancy and no sublease space available.

Northeast Columbia

The Northeast Columbia submarket has approximately 3.95 million square feet of retail space and is the largest of all of the Columbia submarket sectors. The Northeast submarket absorbed 22,410 square feet during the first quarter of 2019, mostly in non-core space located at the Crossing Shopping Center. While there was some core activity within this submarket, it was insignificant and the core sector posted a net negative absorption of 1,980 square feet. The overall Northeast submarket vacancy rate dropped slightly from 10.70% at the end of last year to 10.13% during the first quarter of this year. There was a little fluctuation in the average weighted rental rate within the Northeast also; the average weighted rental rate increased from $18.36 per square foot during the fourth quarter of 2018 to $18.93 per square foot this quarter.

Harbison & St. Andrews

The Harbison & St. Andrews submarket has approximately 3.6 million square feet of retail space, making it the second largest submarket in Columbia. This submarket sector posted a net negative absorption of 17,749 square feet during the first quarter of 2019; however, there are plans for Value City to fill the vacant Toys R Us store in the coming months. Due to the negative absorption, the Harbison & St. Andrews vacancy rate rose from 13.90% last quarter to 14.39% during the first quarter of 2019. Once again, the average triple net Harbison & St. Andrews submarket weighted rental rates are low because there were no core rental rates on available space to average. While non-core weighted rental rates during the first quarter of 2019 were $12.40 per square foot for the remaining available space, the average weighted rental rates range varied from $22.00 per square foot down to $7.50 per square foot in non-core Harbison and St. Andrews areas.

Lexington

The Lexington submarket has grown to 1.94 million square feet and has only a few remaining retail spaces available. The Lexington sector continues to post steady market activity during the first quarter of 2019, absorbing 28,300 square feet this quarter. Non-core submarkets absorbed 24,100 square feet of retail space this quarter, while core retail space absorbed 4,200 square feet. The robust Lexington submarket vacancy rate dropped 146 basis points from 6.19% during the fourth quarter of last year to 4.73% this quarter. There are still only 11,812 square feet of core retail space remaining in this submarket, and the core vacancy rate was 0.95%. The Lexington average weighted triple net rental rates for retail space rose from $23.88 per square foot to $24.56 per square foot at the end of the first quarter of 2019. A new addition coming to the Lexington submarket by the first quarter of 2020 is the Publix Greenwise Market; this organic store with high-quality, natural products will be located on Sunset Boulevard.

The Golden Triangle

The Golden Triangle spans two retail corridors on the southeast side of the city, Forest Drive and Garners Ferry/Devine Street, and all 1.25 million square feet of shopping centers within this area are considered core, with limited space for additional development. The Golden Triangle submarket posted a net negative absorption of 26,166 square feet during the first quarter of 2019; 20,350 square feet of the negative absorption was within East Forest Shopping Center. Consequently, the Golden Triangle vacancy rate increased from 1.74% during the fourth quarter of last year to 3.84% during the first quarter of this year. The average triple net weighted rental rate for the remaining available retail space jumped from $20.52 per square foot during last quarter up to $25.25 per square foot this quarter; this jump in rental rate is due to higher quality space availabilities at Rosewood Crossing and Forest Park Shopping Center.

Significant Transactions

During the first quarter of 2019, there were 61 retail sale transactions, including a five-property portfolio sale on Sunset Boulevard in Lexington that was purchased for $18.55 million. Also, 67 retail leases were signed from January 2019 through March 2019, many of which were undisclosed and all but one were under 10,000 square feet.

Sales

- For $17.56 million, Agree Realty Corporation purchased the 41,169-square-foot retail shop located at 555 Jamil Road in Columbia.

- Baker and Baker Real Estate Developers, LLC purchased, for $3.2 million, the 99,777-square-foot retail shop located at 7325 Two Notch Road.

Construction Pipeline

Construction activity is at a standstill, as all retail shops have completed construction; however, there are several proposed retail shopping centers in the planning phase. Construction activity is expected to pick up as demand increases, especially in the Lexington and Northeast Columbia submarkets.

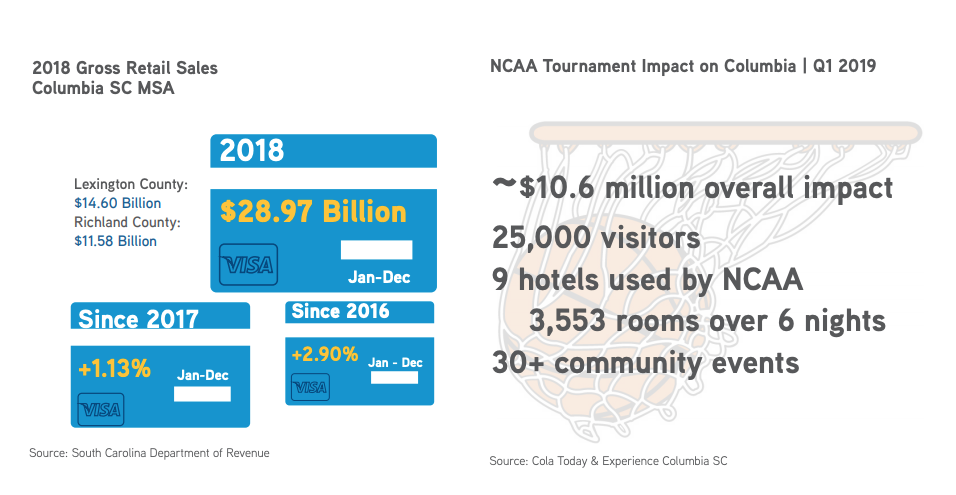

Gross Retail Sales & Employment

Per the Bureau of Labor Statistics’ most recent data from February 2019, there were 3,300 total jobs added to the market over the past year starting February 2018, and the Columbia MSA had a total of 403,100 non-farm employees. Data from the South Carolina Department of Revenue reports gross retail sales in the Columbia MSA reached $31.82 billion in 2018. When comparing year-to-year revenue differences on a month-by-month basis, there was a 17.1% spike in revenue in June of 2018, but by the end of the year the monthly revenue totals were 3.8% lower than they were at the start of 2018.

Market Forecast

Columbia retail is performing well in non-core regions as the retail trend for localized and specialty retail services moves closer to residential areas to become more convenient and offer high efficiency to a local customer base. As this retail trend continues, brick-and-mortar shops are predicted to perform well so long as they are willing to adhere to their clients’ changing preferences and provide an omni-channel shopping presence. Certain areas are expected to grow more rapidly than others; Lexington will be a thriving region in the next few quarters due to rapid population and residential growth and strong employment providing an highly accessible client base.

Around South Carolina

Charleston, SC

The Charleston market had no new retail buildings delivered to the market during the first quarter of 2019. The market posted a net negative absorption of 90,387 square feet this quarter, which was almost equally split between core and non-core retail shops. There are currently 133,771 square feet of retail space under construction throughout the Charleston submarkets and another 187,880 square feet proposed to be built. The overall market vacancy rate increased from 5.53% during the fourth quarter of last year to 6.17% this quarter.

Greenville-Spartanburg, SC

In the Greenville-Spartanburg market, non-core retail vacancy rates dropped and the non-core sector posted positive absorption. Overall GSA market vacancy rates are expected to drop by mid-year due to very little construction in the retail pipeline. Overall, urban retail vacancy rates in this submarket are decreasing quarter-over-quarter and the overall average urban market rental rate is higher due to strong demand to locate within walkable urban retail space.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q1 Retail Columbia Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans