Colliers Report: South Carolina Hospitality Market Updates

August 7, 2024

Download and Read Full Report Here

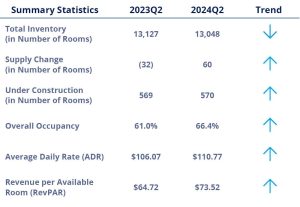

Columbia

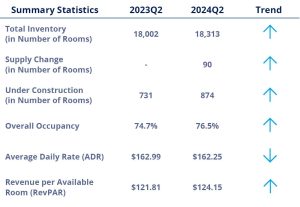

Columbia’s hospitality market continues to perform well with revenue per available room (RevPAR) showing gains across all classes and occupancy rates and average daily rates (ADR) increasing overall.

The market continues to attract interest from developers, with 570 rooms under construction and additional starts likely.

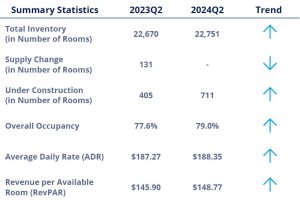

While Charleston has been impacted to some extent by increased U.S. international travel demand, the effect has been offset as group occupancies have risen in 2024 to 24% of total occupancy.

Overall occupancy, ADR and RevPAR have increased slightly with upscale and higher classes performing better than economy and midscale as budget travelers are squeezed by depleted savings.

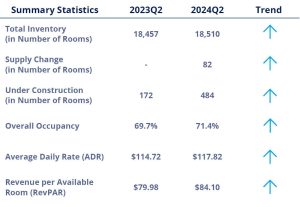

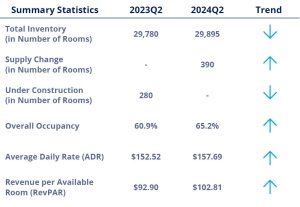

The Greenville-Spartanburg hotel market continues its overall transformation as the leisure travel segment becomes more prominent, though business travel remains the market’s primary driver.

Occupancy rose slightly to 71.4%, significantly above the market’s long-term average of 60.9%. Upscale and upper upscale properties performed best, with RevPAR and ADR both reaching single-month highs in Q2.

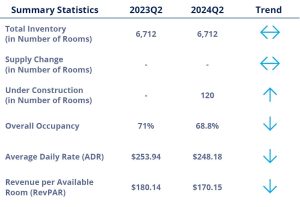

The Hilton Head/Beaufort market continues to demonstrate strong performance, with the predominant upscale, upper upscale and luxury segments normalizing after the post-pandemic travel boom.

The three top segments each registered slight decreases in RevPAR driven by lower occupancy rates, though the market’s fundamentals remain solid.

Across classes, Savannah’s hospitality market continues to perform similarly to 2023 with occupancy up slightly, while ADR and RevPAR slipped for midscale through upscale properties.

Occupancy and revenue remain high enough to support a strong construction pipeline with a wave of 586 rooms delivering in Q3.

Myrtle Beach showed year-over-year improvement, but the state’s largest tourism market by inventory hasn’t fully recovered to the pandemic-era highs of 2021.

The market remains focused on middle-class family travel with economy through upper midscale properties showing the greatest gains in occupancy and RevPAR.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 66 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 23 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 66 countries, our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. With annual revenues of $4.3 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, X @Colliers or LinkedIn.