Colliers Report: Columbia industrial experiencing record growth

January 29, 2021Research & Forecast Report

Q4-2020 COLUMBIA | INDUSTRIAL

Key Takeaways

- Columbia’s industrial market is experiencing unparalleled growth. Over the past year, the market absorbed 989,322 square feet (net) despite 447,720 square feet of new construction deliveries.

- Over the next year, construction activity is predicted to increase. However, until more product is available, tenants will need to plan ahead and pre-lease in order to secure industrial space.

For additional commercial real estate news, check out our market reports here.

Columbia industrial availability continues to tighten

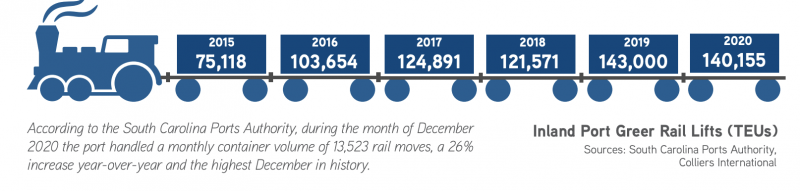

Columbia’s industrial market is experiencing historically low vacancy and increasing rental rates for many reasons. Economic growth within the region is at an all-time high driven by a shift in consumer behavior from bricks-and-mortar to e-commerce, expansion of manufacturing throughout the U.S., and the Port of Charleston growth and supply chain optimization increasing access to two-thirds of the U.S. population. In addition, public investments are planned for infrastructure improvements within the ports, railway lines and interstate routes.

Columbia’s industrial market is experiencing historically low vacancy and increasing rental rates for many reasons. Economic growth within the region is at an all-time high driven by a shift in consumer behavior from bricks-and-mortar to e-commerce, expansion of manufacturing throughout the U.S., and the Port of Charleston growth and supply chain optimization increasing access to two-thirds of the U.S. population. In addition, public investments are planned for infrastructure improvements within the ports, railway lines and interstate routes.

Columbia industrial growth was evidenced over the past five years by the overall inventory increasing by an average of 765,000 square feet added each year. Despite construction deliveries during the five-year period, approximately 1 million square feet was absorbed each year and vacancy rate decreased from 10% in 2016 to 3.81% in 2020. Current construction that is underway is already being pre-leased due to high demand throughout the market. All of these factors show Columbia industrial growth is on the upswing with no signs of slowing in 2021.

Market Overview

Annual Columbia Industrial Recap

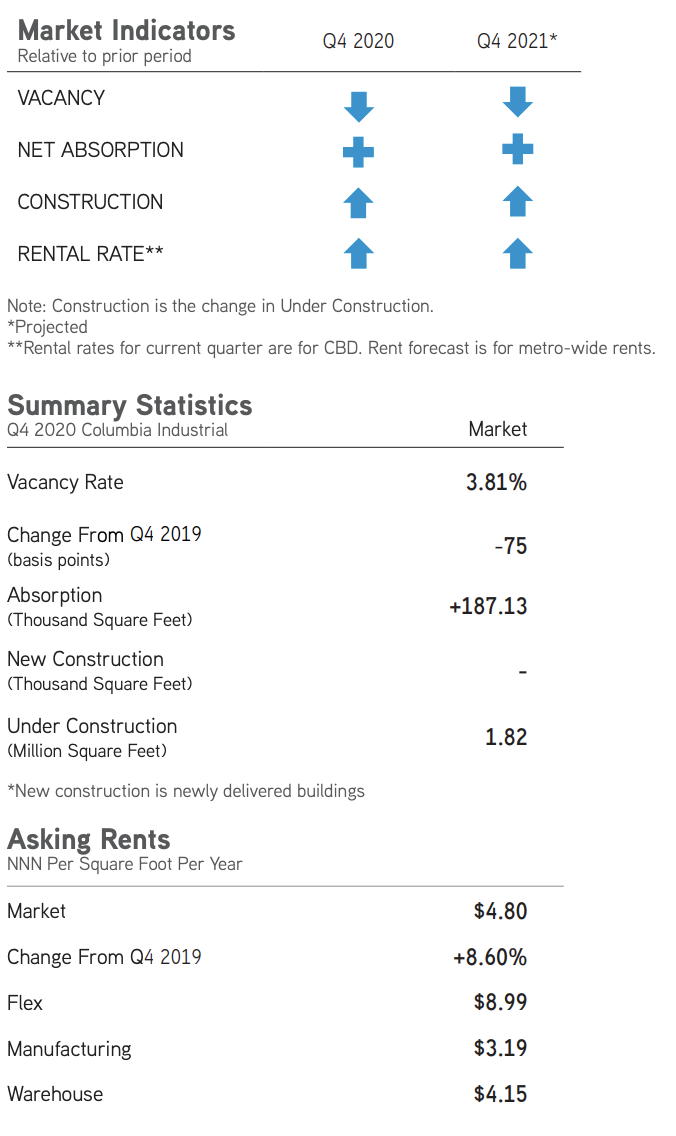

Over the past year, Columbia’s industrial inventory has increased by 447,720 square feet. Despite an increase in inventory during 2020, the market absorbed 989,322 square feet (net). There are currently 1.82 million square feet under construction and another 931,000 square feet proposed to begin construction in the next 12-18 months. In addition, 803 Industrial Park has the potential to increase by four buildings with up to 1 million square feet of development, and Sandy Run, as conceptualized, has the capability to add 6 million square feet to the market. New development and high tenant velocity forced overall market weighted asking rental rates upward by 8.6%.

Overall Columbia

The Columbia industrial market is comprised of 73.21 million square feet. During the fourth quarter of 2020, the industrial market absorbed 187,125 square feet led by the manufacturing sector. No new industrial buildings were delivered to the Columbia market during the fourth quarter; however, five buildings are currently under construction which, upon completion, will add 1.82 million square feet to the market. Due to positive absorption, the quarterly vacancy rate dropped from 4.05% during the third quarter of 2020 to 3.81% during the fourth quarter of 2020. The overall average market weighted asking rental rate for available industrial space was $4.80 per square foot during the fourth quarter of this year.

Warehouse/Distribution

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.37 million square feet. There is currently one 192,780-square-foot warehouse under construction at Midway Logistics VI in West Columbia. This sector posted a net negative absorption of 94,815 square feet mainly due to one building located at 2400 Highway 1 South posting a negative 200,000 square feet of absorption in Kershaw County. Due to posting negative absorption this quarter, the warehouse vacancy rate increased from 3.14% during the third quarter of 2020 to 3.35% this quarter. Overall average weighted asking rent for warehouses ended the year averaging $5.15 per square foot.

Manufacturing

The manufacturing sector in the Midlands is comprised of 25.33 million square feet and there are four manufacturing facilities currently under construction. Two are located at Saxe Gotha Industrial Park: a 104,000-square-foot Lexington County speculative building and a 200,343-square-foot expansion at Nephron is underway. In addition, a 1.26 million-square-foot brewery is under construction at Pine View Industrial Park and a 65,000-square-foot facility is underway at 397 Millennium Drive. The overall manufacturing vacancy rate decreased significantly from 4.88% during the third quarter of 2020 to 3.84% this quarter due to 262,800 square feet of absorption. Most of the absorption occurred within Newberry and Orangeburg Counties. Overall average manufacturing weighted asking rental rates increased from $3.05 per square foot during the third quarter of this year to $3.19 per square foot to end 2020.Flex/R&D

The flex/R&D sector in the Midlands has 2.51 million square feet within its submarkets and this sector absorbed 19,140 square feet during the fourth quarter of 2020 led by the East Columbia submarket. Overall quarterly vacancy rate decreased from 12.05% during the third quarter of 2020 to 11.84% this quarter. Flex/R&D average weighted rental rate for the remaining availabilities increased to $8.99 per square foot during the fourth quarter of 2020.

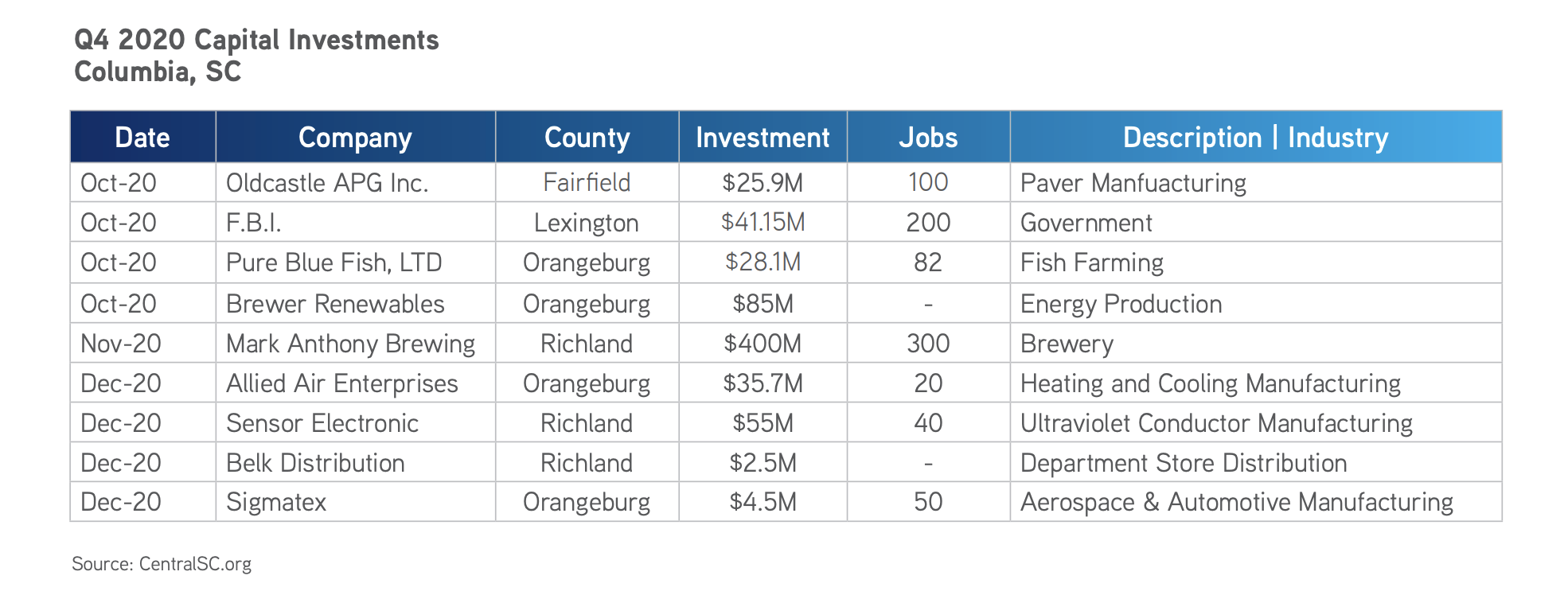

Capital Investment & Employment

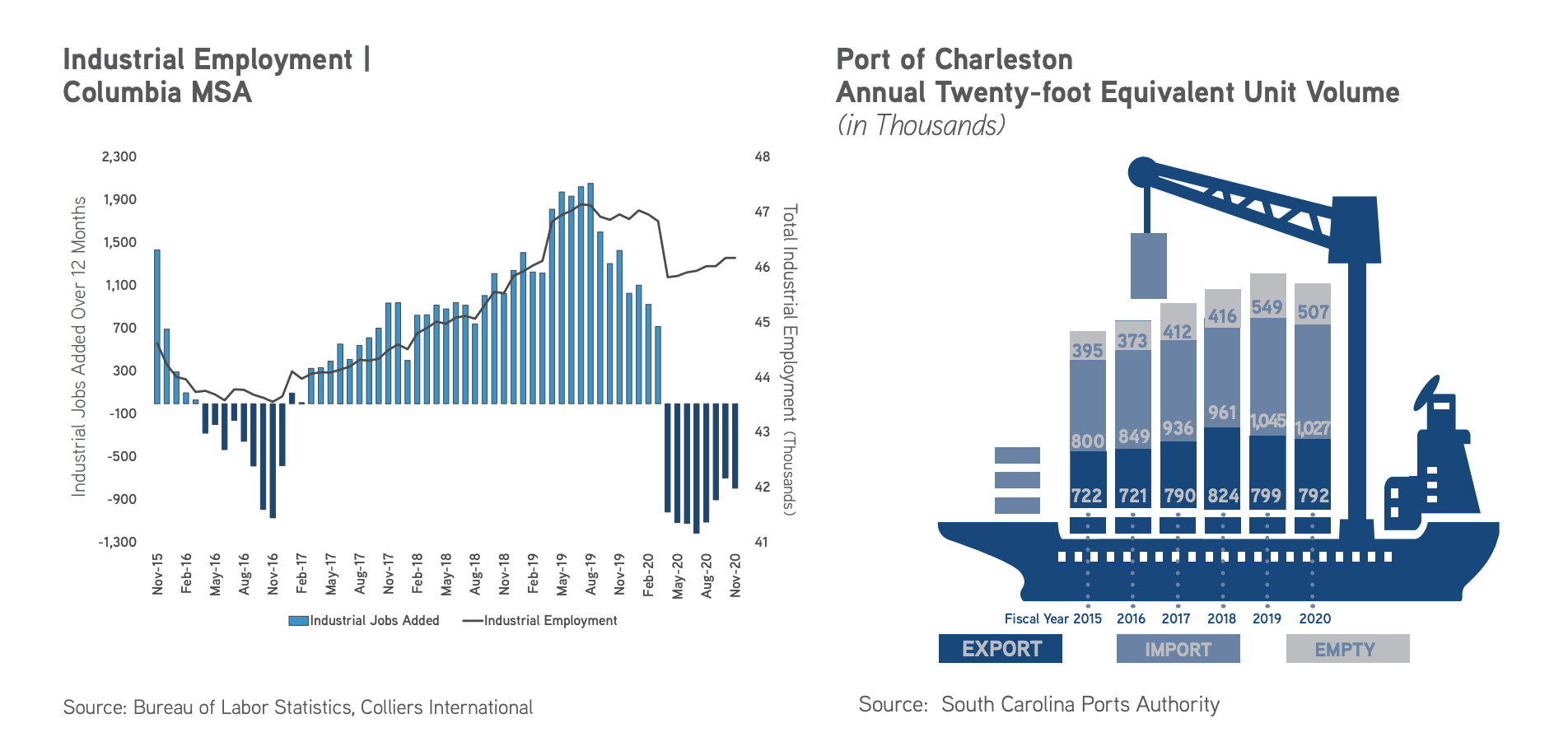

During 2020, there have been $266.65 million in new capital investments and $316.98 million in capital investment expansions, accounting for 1,593 total new jobs announced within the Columbia region. The types of investments include a brewery, chemical manufacturing, advanced manufacturing | fabrication, pharmaceutical manufacturing, food and energy production and department store distribution. According to the Bureau of Labor Statistics Federal Reserve data through November of 2020, industrial employment comprises 11.8% of Columbia’s total employment, or about 46,200 jobs in the Midlands region. There were 790 less industrial jobs in the Columbia MSA over the past twelve months due to Coronavirus temporary closings and unemployment. However, the unemployment numbers in Columbia normalize as each month passes. The current overall employment rate in Columbia is 96.10%.

Significant Transactions

Sales

- For $7.8 million, 201 Metropolitan Drive LLC purchased a 285,000-square-foot warehouse facility in West Columbia.

- For $4.73 million, Brabham Oil Company, Inc. purchased a 110,000-square-foot warehouse located at 130 Pinnacle Point Court within the Pinnacle Point Business Park in Columbia.

- For $3.38 million, NV, LLC purchased a three-building, portfolio totaling 136,000-square-foot at 1, 4 and 95 Sunbelt Boulevard in Columbia.

- For $3.15 million, Schattdecor Inc. purchased a 61,300-square-foot distribution center at 138 Zenker Road in Lexington.

- For $1.9 million, Farallon Capital Management, L.L.C. purchased a 40,000-square-foot distribution center at 103 Vantage Point Drive in Overlook Business Park in West Columbia.

- For $1.3 million, Weston Group Inc. purchased a 97,639-square-foot light manufacturing facility at 5921-6011 Shakespeare Road in Columbia.

Leases

- DSV Solutions LLC leased 90,078 square feet at 809 Bookman Road in Elgin.

- Home Depot U.S.A. Inc. leased 68,040 square feet on Bistline Drive in West Columbia.

Market Forecast

The Columbia industrial market has experienced a tremendous amount of growth and due to continuing demand, activity is not expected to slow anytime soon. The future growth of the market will be driven by e-commerce, cold storage, manufacturing and increased Port of Charleston activity. The Columbia market is conveniently located near interstates situating the market in a key location for logistic expansions. There are already many new projects planned within the Northeast Richland, Cayce and West Columbia submarkets. Pre-leasing is expected as projects that are underway near completion, and any proposed projects that deliver within the next 12-18 months are expected to be absorbed quickly. Currently, there is a lack of speculative space within the market which will force rental rates upward as tenants compete for available space. Due to extraordinary growth, positive absorption, increasing rental rates and lowering vacancy rates are likely through 2021.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.