A Guide to Bunching Charitable Contributions

February 27, 2023by Stephen E. Maggard, CFP®

Giving generously to charity is often a topic near and dear to our clients’ hearts; close behind on the priority list is limiting the amount of taxes due to the IRS. When passed into law in late 2017, the Tax Cuts Jobs Act almost doubled taxpayers’ allowable standard deduction. Instead of deducting $13,000 from income in 2018, joint taxpayers could now deduct $24,000 from income. Because of this increase in deductions, many taxpayers are no longer able to itemize any charitable contributions, often leaving them to hope that the IRS will give them some credit for their philanthropic giving.

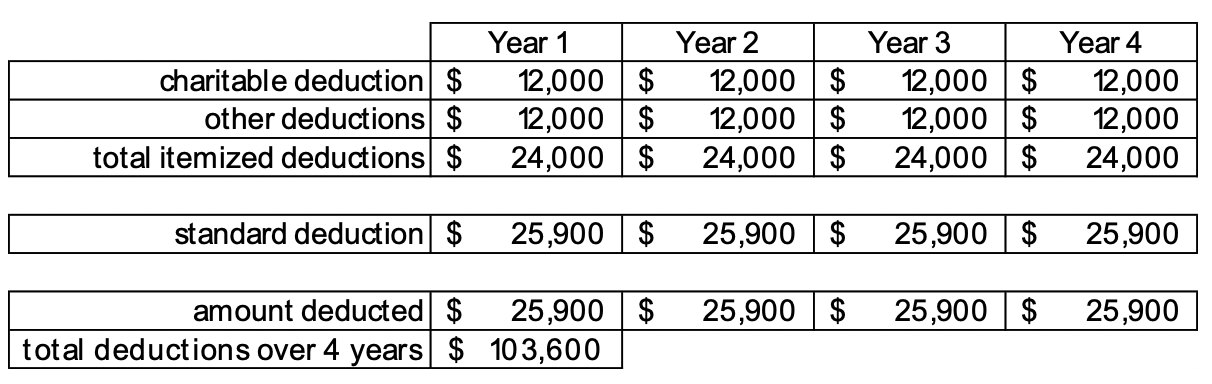

The chart below is an example of a four-year giving period under the higher standard deduction:

In the above, a joint taxpayer contributes $12,000 each year to charity over a four-year period. When combined with other deductions, the total itemized deduction is $24,000. However, since the standard deduction of $25,900 is the greater of the two, taking the standard deduction is most advantageous.

Over 4 years, the standard deduction results in $103,900 of cumulative deductions. But, is there a better way? Perhaps. The giving strategy of bunching charitable contributions through a Donor Advised Fund (DAF) may be a better way. A DAF provides a unique planning opportunity that is often referred to as “bunching” charitable contributions.

To understand the strategy, know that when making charitable contributions through a Donor Advised Fund, it is the contribution to the Fund that receives the tax deduction, not the subsequent distribution. Donor Advised Funds then allow you to make distributions to your charity of choice on your own timeline.

For example, if you contributed $20,000 to a Donor Advised Fund in December of 2022, you would receive a deduction of $20,000 in 2022. However, if desired, you could wait to distribute the funds to your favorite charities until 2023.

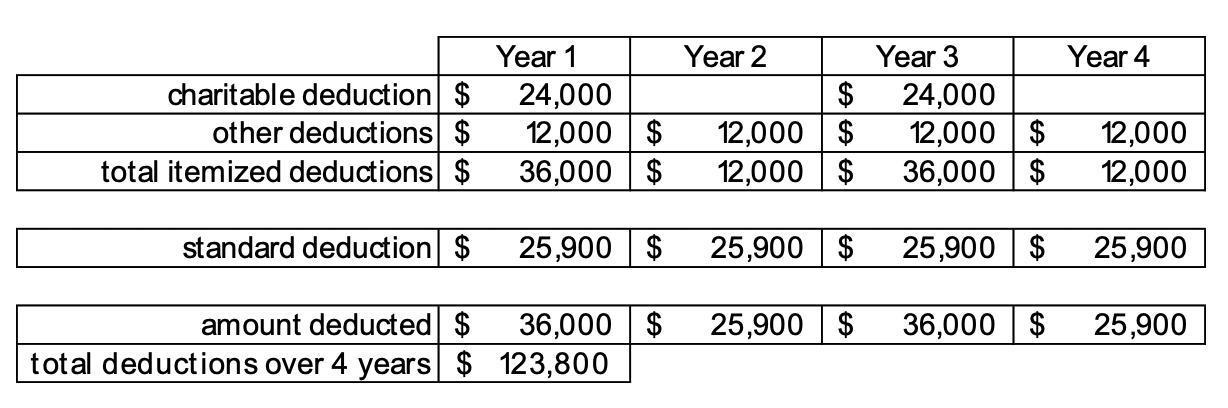

Consider a second example in the following chart of using a Donor Advised Fund:

In year one, the above has the taxpayer doubling, “bunching,” annual gifts by giving to the Donor Advised Fund. The charity can still receive the funds according to the taxpayer’s plan throughout years 1 and 2. However, two years’ worth of tax deductions occur in the first year.

This pushes the taxpayer’s year 1 itemized deductions to $36,000 which exceeds the standard deduction by $10,100. After taking the standard deduction in year 2, the taxpayer “doubles up” again in year 3 for another $36,000 in deductions.

Over the four-year period, the taxpayer’s cumulative deductions equal $123,800, which exceeds the first scenario by $20,200. For South Carolina taxpayers paying the highest income tax bracket, this amounts to $8,787 in tax savings over four years.

In addition to saving on taxes, taxpayers can use this strategy to increase the basis of stocks in their portfolios. By gifting highly appreciated stock to a Donor Advised Fund, then using the cash originally intended to be given to charity to buy the same stock, the taxpayer effectively “resets” their basis in their stock position. The taxpayer incurs fewer capital gains when the time comes to sell the stock (since the basis will have increased).

Giving to charity is important to us, as well as to our clients. While we enjoy helping clients be generous with their wealth, we also try to pay the IRS its fair share, and no more.

Stephen E. Maggard graduated Cum Laude from Presbyterian College in 2012 with a BA in History. After seven years in the US Army, Stephen entered the private sector. Stephen earned a Certificate in Financial Planning from Florida State University in 2020 before joining Abacus in July 2020. Stephen received the CFP® designation in 2022.

Abacus is a financial advisory and investment counsel firm known for its passion in creating abundance for clients and family businesses through skillful listening and smart financial decision making. Managing over a $1.7 billion on behalf of its 250 plus families, Abacus consists of a team of multi-disciplinary experts who work collaboratively to serve its clients.