Colliers Report: In the Greenville-Spartanburg market, elevated interest rates affecting office sales

January 5, 2023Commercial Real Estate Research & Forecast Report

Q4 2022 Greenville-Spartanburg Office

Interest rates and economic uncertainty have caused sales (both investment and owner-occupant) to slow dramatically. Demand still exists in this market, but owners are unwilling to sell. Capitalization rates are higher than they have been in years, therefore, the investor motivation to purchase office buildings has waned. Also, owners who financed their office buildings at a low interest rate are holding on to them. Cash is still the best way to complete deals. Smaller deals using cash transactions are selling at capitalization rates near 6%. These deals are mostly medical office deals and are typically single-tenant, long-term, triple-net deals.

Click here to read the full report.

Key Takeaways

Key Takeaways

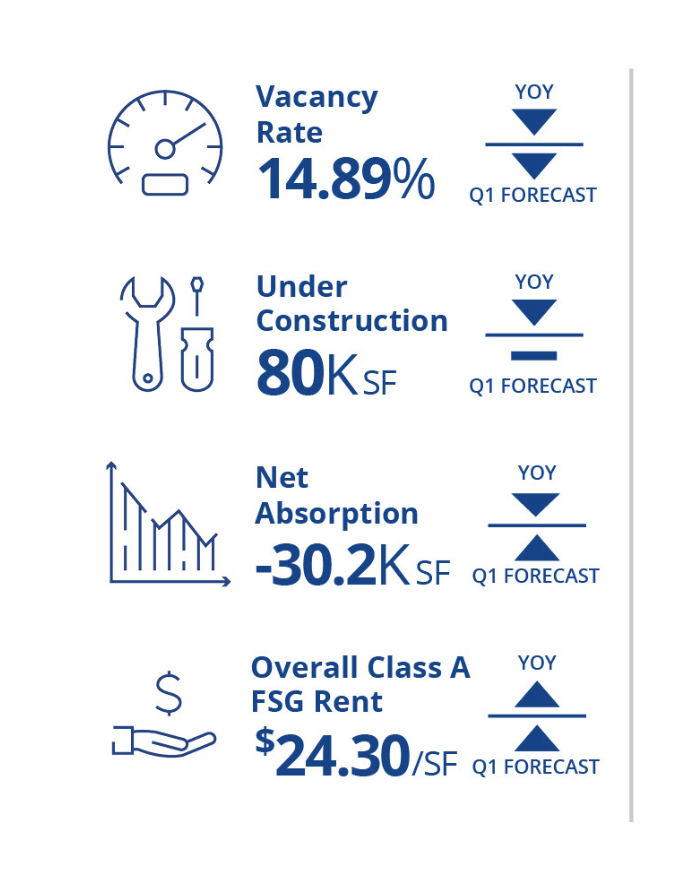

- Office sale velocity has slowed due to increasing interest rates and economic uncertainty

- A few new large blocks of vacancy created most of the negative absorption during the fourth quarter of 2022

- Class A continues to outperform Class B and C offices

Office leasing activity is still robust

Leasing activity has not been impacted by increasing interest rates. Demand continues to exceed supply for Class A office space, particularly in the central business district. High construction prices and lack of supply continue to create challenges for new leases. As a result, landlords are increasing rental rates.