Colliers South Carolina Report: Hospitality Market Updates

April 30, 2024

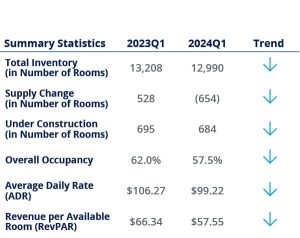

Columbia

With 685 rooms currently under construction, Columbia’s hospitality market is well-positioned for the market resurgence expected in 2025.

This expected resurgence is driven by continued weekday use from business and government sectors and an increase in weekend leisure bookings.

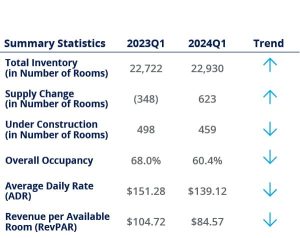

Charleston

Charleston

Charleston’s hospitality market started slow in the first quarter of 2024, with better performance expected throughout the remainder of 2024.

Overall lower performance in the first quarter of 2024 can partially be attributed to the hospitality industry stabilizing from the surge in activity following COVID-19. The addition of 623 rooms to the market contributed to a decrease in occupancy.

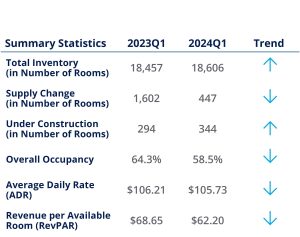

Greenville-Spartanburg

Greenville-Spartanburg

With increases in the number of rooms under construction, Greenville-Spartanburg is positioned favorably to capitalize on expected activity increases in the market in 2025.

This optimism for 2025 is driven by the potential softening of interest rates which may increase disposable income for leisure bookings. The construction pipeline is also creating optimism for the end of 2024 and beginning of 2025 with an expected addition of 344 rooms.

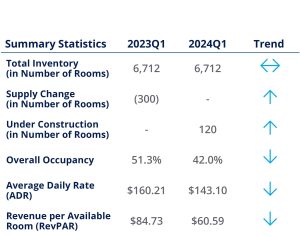

Hilton Head/Beaufort

Hilton Head/Beaufort

The leisure hospitality sector has experienced a nationwide softening throughout the United States for the first quarter of 2024, and Hilton Head and Beaufort are not exceptions.

Occupancy, ADR and RevPAR all decreased year-over-year, however, construction has begun to increase with 120 rooms expected to deliver in 2025.

Savannah

Savannah

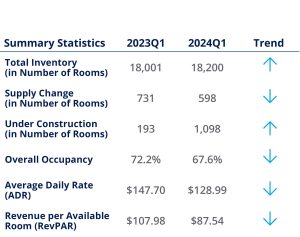

Savannah’s performance in the first quarter of 2024 was the most stable in terms of occupancy, however, decreases in ADR and RevPAR were still prevalent.

Despite the performance decreases, Savannah has the largest hospitality construction pipeline in the market area with 1,098 rooms expected to deliver at a consistent pace through the second quarter of 2025.

Myrtle Beach

Myrtle Beach

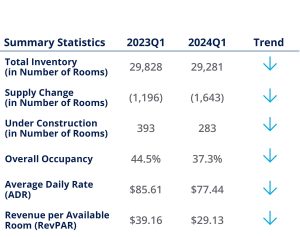

Like most markets in South Carolina and across the United States, Myrtle Beach experienced a softer start in the first quarter of 2024.

Due to the cyclical seasonality of the market, activity and performance are expected to increase through the warmer months of the second and third quarters with beach visitors.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 66 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 23 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 66 countries, our 19,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. With annual revenues of $4.3 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, X @Colliers or LinkedIn.