Leasing vs. Buying a Car: Which one is right for you?

June 30, 2023By Carolyn A. Stewart

If you have been in the market for a new (or used) car in the last 2-3 years, you are probably aware that the cost of buying a car has skyrocketed. According to the Kelley Blue Book, the average price of a new car was $46,526 in April 2022. With pandemic-related supply chain problems still present and no end in sight, you might be considering leasing a vehicle instead of buying. Which is best for you?

For most people, buying a car is still the financially optimal move. No matter what, you are going to come out ahead in the long run when you buy a car—whether you pay cash or use financing—over leasing a car. Even though the lower monthly payments on a lease might look attractive, you will pay thousands more with two separate three-year leases than if you bought a car over the same period. Additionally, with leasing you are simply paying to “rent” the vehicle during the period it’s depreciating the most and not building any kind of ownership interest. Also, what happens if you don’t like the car, or you find out you can’t make your payments? If that is the case, you may be charged up to the full lease amount for early termination.

On the other hand, if you are in a financial position where you are no longer building wealth nor are you worried about running out of money, then the car decision becomes more about priorities than numbers. If you know you want to drive a new vehicle with the latest features every 2-3 years and simply drop the car off at the dealership at the end of that time, then leasing may be a good option if you want a new car frequently.

With leasing, you may be also surprised to see a relatively small down payment along with the lower monthly payments. Some contracts also include routine maintenance and oil changes. However, always keep in mind that the dealer will make up costs in other ways. A typical lease contract includes mileage restrictions, which could range from 10-15 thousand miles per year and charge between 10-25 cents per mile over that amount. At the end of your contract, you could also be subject to “excessive damage” fees, which may be up to the discretion of the dealer. Generally, they expect the car to be in showroom condition when it is returned. If you don’t expect to drive too much, and/or do not have kids or pets to put your car at an increased risk for damage, then these restrictions won’t matter.

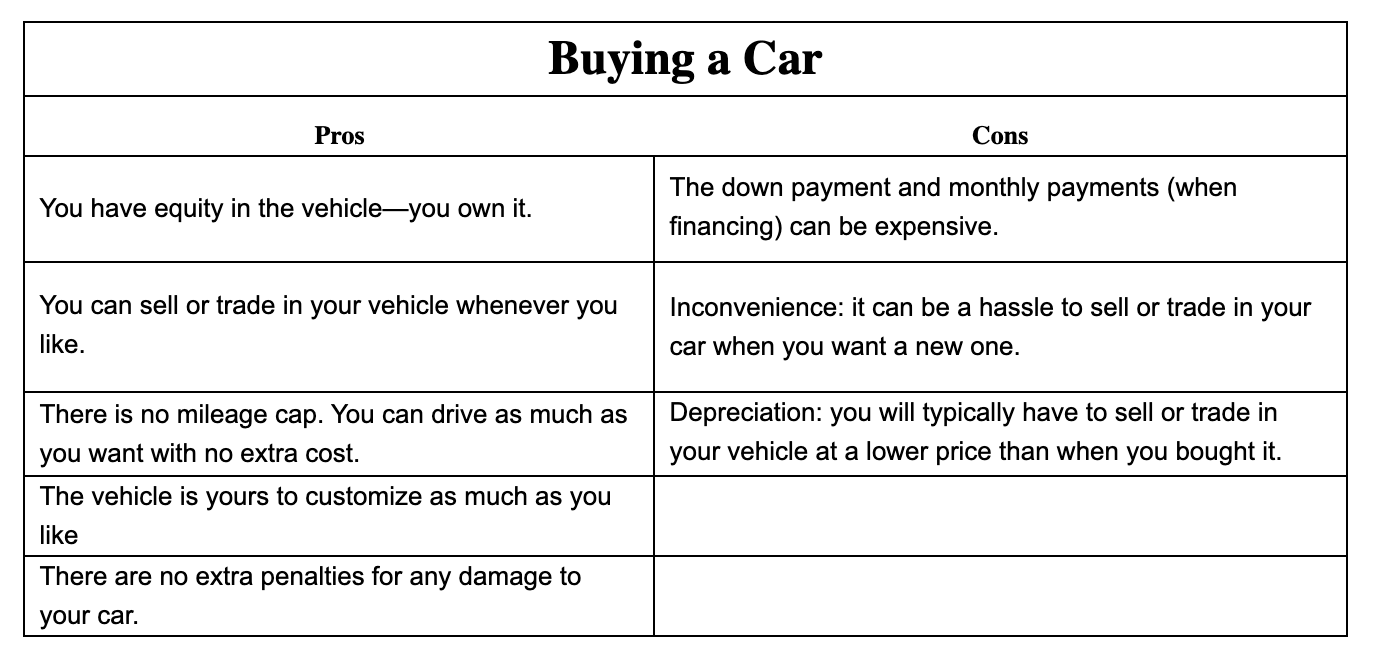

The following graph shows the pros and cons of buying vs. leasing a car:

Buying a new or used car is still the most financially savvy choice despite the higher costs stemming from current supply chain snags. For those few in the right financial position who don’t drive often and care about having the newest features every few years, leasing could be a better option—it all depends upon what your financial situation is at the time. As with any major financial purchase, do your homework before making any important new vehicle decision.

Carolyn A. Stewart graduated from Virginia Tech in 2021 with a B.S in Finance. Carolyn is pursuing her Certified Financial Planner (CFP®) designation. Prior to joining Abacus in 2021, Carolyn was active in her student chapter of the Financial Planning Association.

Abacus is a financial advisory and investment counsel firm focused on serving families with shared assets from businesses to commercial real estate to oil and gas holdings. Managing over $1.7 billion on behalf of its 250-plus families, Abacus consists of a team of multi-disciplinary experts who work collaboratively to serve its clients.