Colliers Report: 2019 record-breaking industrial expansion adds 9.99M SF to the Greenville-Spartanburg market

January 31, 2020Research & Forecast Report

Q4-2019 GREENVILLE-SPARTANBURG | INDUSTRIAL

Key Takeaways

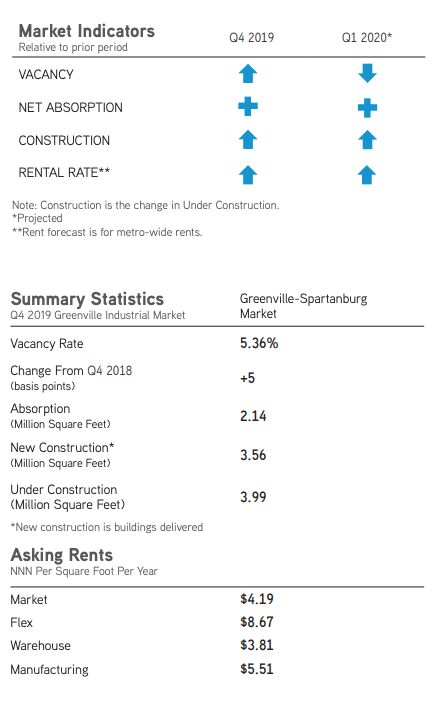

- The overall Greenville-Spartanburg industrial annual market vacancy rate only increased five basis points despite quarterly fluctuations, even with a record number of spec space deliveries.

- Industrial annual net absorption reached approximately 9.60 million square feet in 2019.

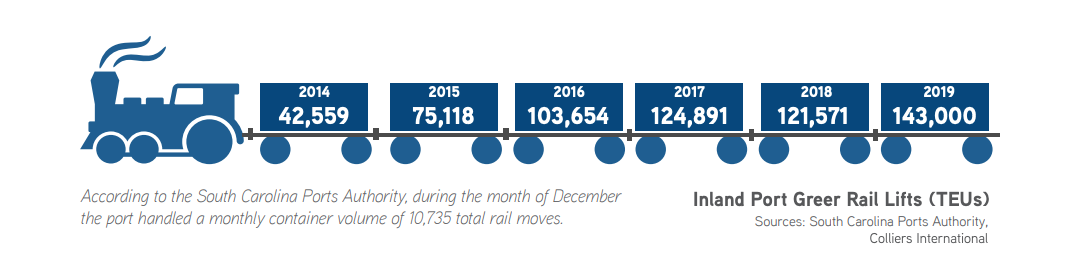

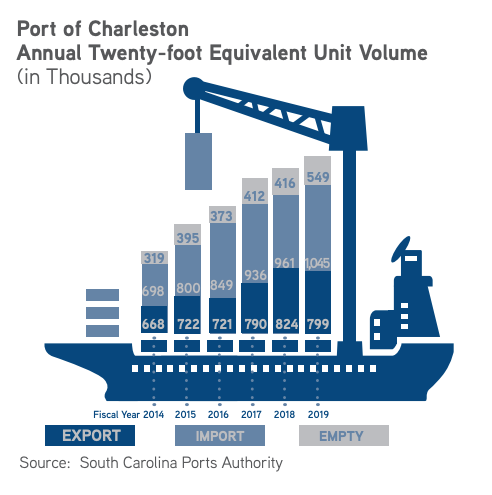

- During the calendar year 2019, the South Carolina Ports Authority reached a record-breaking container volume at the Port of Charleston and Inland Port in Greer.

For additional commercial real estate news, check out our market reports here.

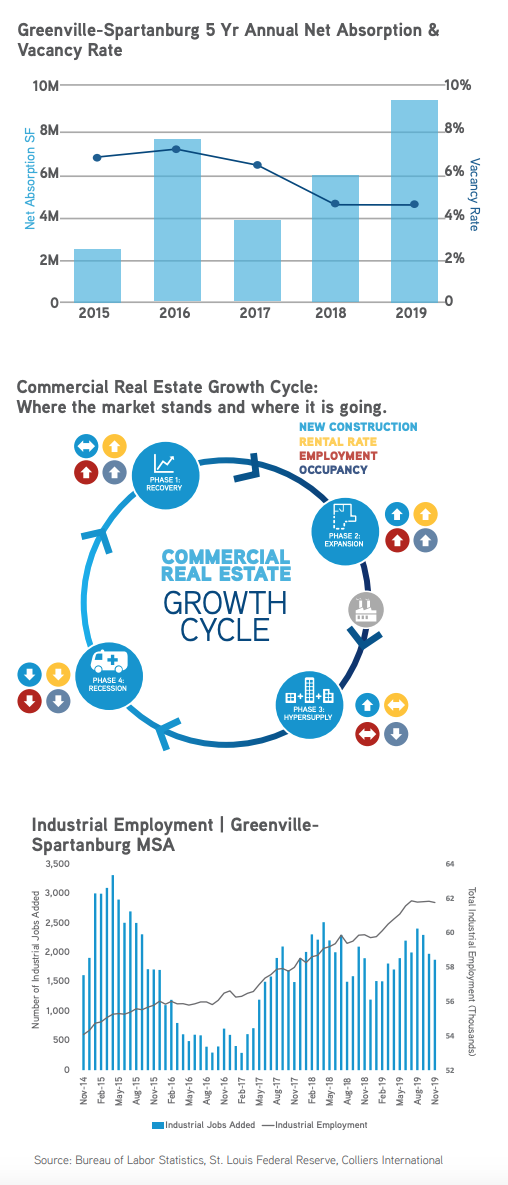

The market posted a record-high net absorption of approximately 9.60 million square feet from the fourth quarter of 2018 through the fourth quarter of 2019. The overall Greenville-Spartanburg industrial market vacancy rate only increased five basis points from the fourth quarter of 2018 until year-end 2019 ending at 5.36%, despite a record number of spec space deliveries this year. With an increasing number of availabilities, location and specifications are increasingly driving the decision-making process in this market.

Throughout 2019, there were 33 buildings delivered to the market adding 9.99 million square feet of industrial inventory to the Greenville-Spartanburg market. This is due to increased speculative development in the overall market in addition to the completion of large build-to-suit projects throughout the region. Despite a record number of deliveries and leasing, rental rates have held stable throughout the year. With the increased amount of Class A space on the market, tenants and users are increasingly looking at Class A space as an alternative to Class B, demonstrating a flight to quality.

There has been an uptick in investment sales and institutional-grade investors in this market. With recent major mergers within large owners of institutional real estate, investment and portfolio sales are up. This region is seeing cap rate compression due to these sales, indicating more aggressive capital in the market.

South Carolina Ports

According to a 2019 economic impact study conducted by the University of South Carolina Darla Moore School of Business, the South Carolina Ports Authority is responsible for 224,963 jobs across South Carolina, or one in every 10 jobs; 52% of this impact is concentrated in the Upstate. In 2019, the South Carolina ports system produced $63.4 billion in annual economic impact, generated more than $12.8 billion in labor income and $1.1 billion in annual tax revenue.

According to a 2019 economic impact study conducted by the University of South Carolina Darla Moore School of Business, the South Carolina Ports Authority is responsible for 224,963 jobs across South Carolina, or one in every 10 jobs; 52% of this impact is concentrated in the Upstate. In 2019, the South Carolina ports system produced $63.4 billion in annual economic impact, generated more than $12.8 billion in labor income and $1.1 billion in annual tax revenue.

The S.C. Ports Authority had its best calendar year in the history of its operations. There was a 5% increase year-over-year from 2018 to 2019 and the ports handled 2.44 million twenty-foot equivalent container units (TEUs). In addition, the Inland Port Dillon and Inland Port Greer also increased activity by 41% from 2018 to 2019, breaking previous records with a 190,539 combined rail moves.

The South Carolina Ports Authority President and CEO Jim Newsome stated,

“We enter 2020 with a great decade of growth behind us, during which we doubled our volumes, tripled our asset base and added more than 200 people to our team. Our cargo growth and efficient terminals are only made possible through the dedication of our team and the broader maritime community.”

According to the South Carolina Ports Annual Report, by 2021 the first phase of the Leatherman terminal is set to open and the Wando terminal will have fifteen 155-foot-tall ship-to-shore cranes with the ability to manage three 14,000-TEU ships concurrently.

Market Overview

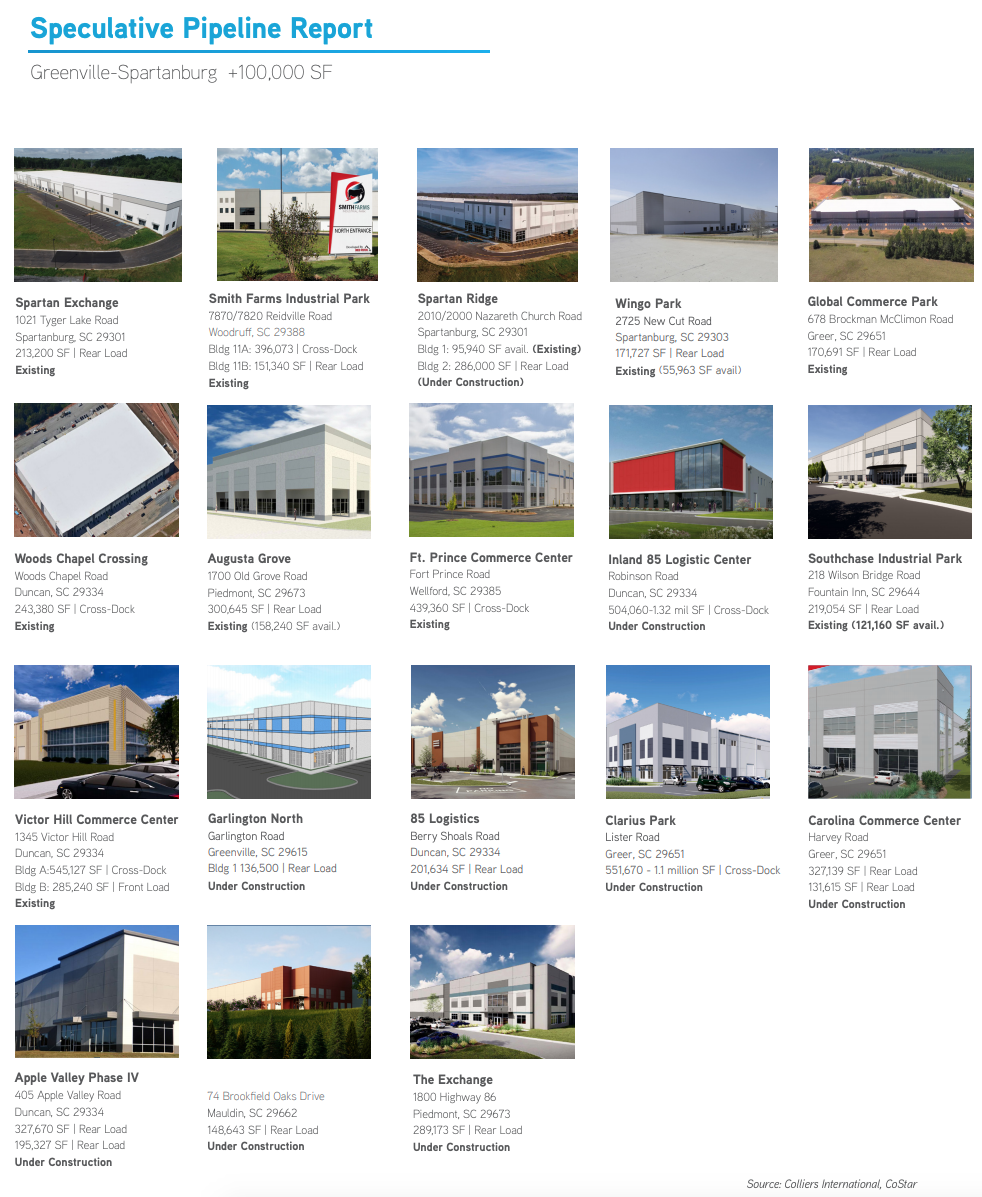

Comprised of approximately 210.76 million square feet, there are currently 3.99 million square feet among 17 buildings under construction and 15 additional proposed properties totaling 1.92 million square feet delivering throughout the Greenville-Spartanburg market. During the fourth quarter of 2019, 3.56 million square feet of industrial buildings were delivered and 1.78 million square feet were absorbed. Subsequently, the quarterly market vacancy rate increased from 4.59% to 5.36%.

Flex/R&D

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.42 million square feet. One 12,000-square-foot flex/R&D building is under construction at 10 Webb Road in Greenville and no new flex buildings were delivered to the market during the fourth quarter of 2019. The sector absorbed 67,245 square feet this quarter and the vacancy rate dropped slightly from 8.76% last quarter to 7.52% during the fourth quarter of 2019. The average weighted rental rate was $8.67 per square foot at year-end 2019, a slight increase over last quarter’s average rent of $8.48 per square foot.

Significant Transactions

Within the Greenville-Spartanburg market, CoStar reported 27 signed leases and 49 sale transactions during the fourth quarter of 2019.

Sales

- Veyron & Co, LLC purchased a $323 million, six-property portfolio to include the 708,067-square-foot distribution center located at 6135 Anderson Mill Road wherein a sale/leaseback was performed with Keurig Dr. Pepper.

- LBA Realty purchased a 432,120-square foot facility for $34.2 million located at 4011 Highway 417 in Woodruff. This was part of a larger 16-property portfolio.

- For $19 million, STAG Industrial, Inc. purchased a 273,000-square-foot warehouse located in the Spartan Ridge Logistic Center 1 at 2010 Nazareth Church Road in Spartanburg.

Leases

- Michelin North America, Inc. leased 204,952 square feet at 101 Harrison Bridge Road in Simpsonville.

- Cleveland Golf leased 97,894 square feet at 218 Wilson Bridge Rd in Fountain Inn.

- Timken renewed their lease for 303,190 square feet at 120 Hidden Lake Circle in Duncan.

- Airsys leased 59,481 square feet at 7820 Reidville Rd in Greer.

- Fehrer leased 105,216 square feet at the 230 Commerce Court warehouse in Duncan.

Capital Investment & Employment

In the fourth quarter of 2019, there were approximately $61.5 million in capital investments from new companies, accounting for 461 jobs. Existing company expansions accounted for $510.91 million in new capital, creating 2,917 additional jobs within the Greenville-Spartanburg region. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing and software, communications and logistics. According to the Bureau of Labor Statistics data through November of 2019, 1,872 industrial jobs have been added to the market in the past 12 months. In addition, industrial employment, which encompasses both manufacturing and wholesale trade employment, comprised 10.3% of the Greenville-Spartanburg total employment, or about 81,700 jobs regionally.

Market Forecast

The South Carolina industrial market will benefit from the recently negotiated U.S.-China Trade Deal and USMCA. The two most pertinent aspects of the deal affecting South Carolina industrial markets promote increased purchases of American products and tariff relief on Chinese products. These changes will lead to an increase in imports and exports. The Port of Charleston is already performing exceedingly well, reporting record-breaking numbers in 2019. Since the Port of Charleston is the gateway to the South Carolina logistics pipeline, the demand for industrial space will continue to climb through 2020. The Greenville-Spartanburg industrial market is healthy and, despite a record number of spec building deliveries throughout 2019, the demand remains high and spec buildings are predicted to absorb in the first half of 2020.

For additional commercial real estate news, check out our market reports here.