Colliers Report: Vacancy decreases and activity is expected to increase

January 11, 2024Commercial Real Estate Research & Forecast Report

Q4 2023 Greenville-Spartanburg Office

Market Highlights

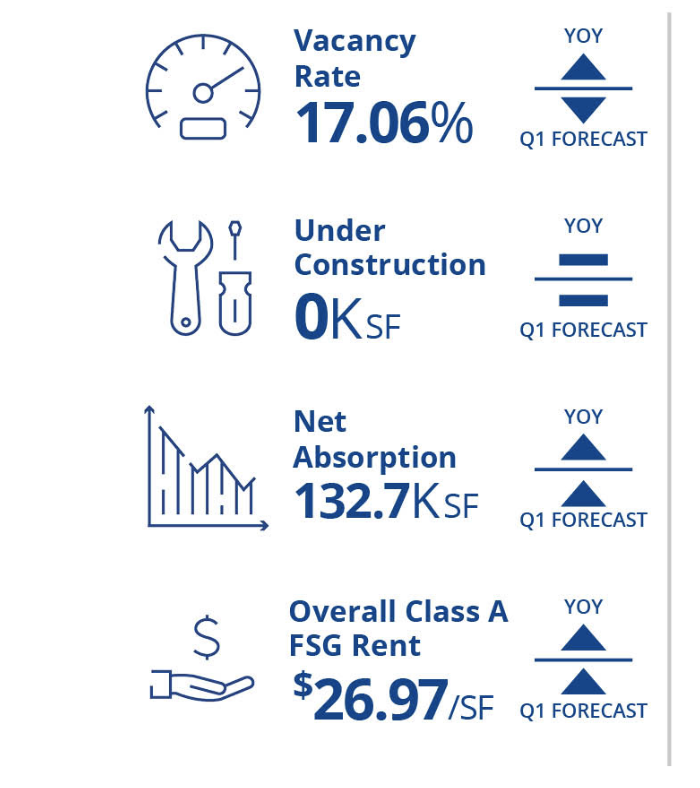

The lack of new construction is anticipated to lead to a decrease in vacancy rates for Class A and B spaces, with activity expected to increase during the next quarter following stabilizing interest rates. Overall, the market remained stable with 132,727 square feet of absorption, bringing vacancy down to 17.06%.

Click here to read the full report.

Key Takeaways

- Office performance remained stable

- Overall vacancy decreased and more activity is expected as interest rates stabilize

- Net absorption was positive despite the delivery of 50,000 square feet

Summary

Class A lease rates may increase in the first quarter, driven by the addition of 50,000 square feet of supply this quarter. However, the landscape of proposed projects underwent a shift, as several initiatives faded away due to the challenging lending environment and high construction costs.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 62 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 22.5 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 65 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.