Colliers Report: Charleston is becoming an industrial hub

April 12, 2019Key Takeaways

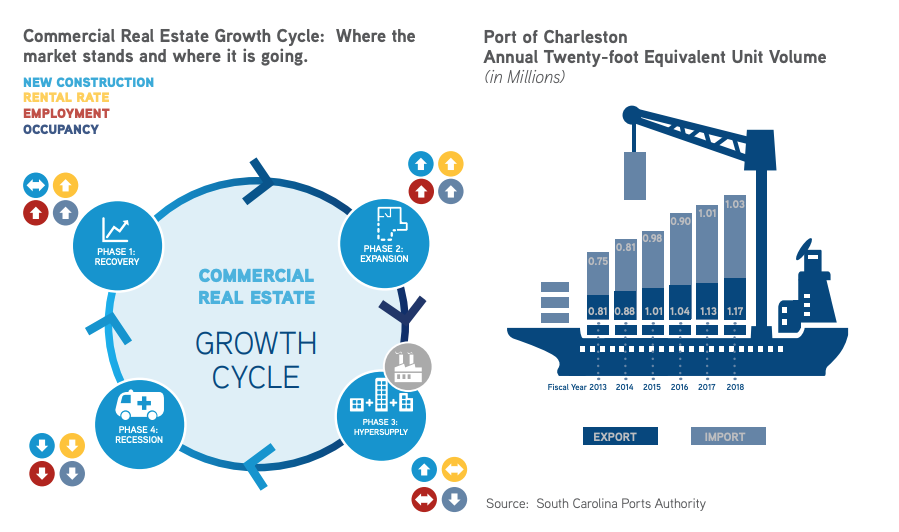

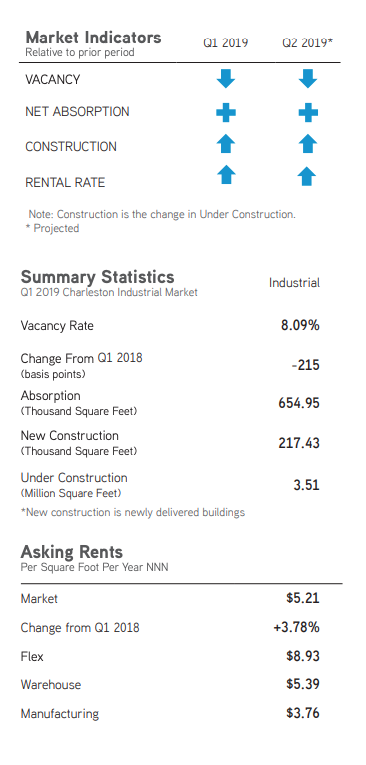

- Demand for Charleston industrial space is rising; the market absorbed 654,951 square feet during the first quarter of 2019.

- Six new buildings totaling 217,431 square feet were added to the market this quarter, and 3.51 million square feet are under construction.

- The overall average weighted market rental rate continues to rise quarter over quarter.

- The deepening of the Port of Charleston harbor is a major contributor to the increasing industrial activity throughout the region.

Port of Charleston included in federal budget proposal

Port of Charleston included in federal budget proposal

The Port of Charleston has been an economic driver for the Charleston market for hundreds of years, and now the deepening of the Port of Charleston harbor is a major contributor to the increasing industrial activity throughout the region. That activity is expected to escalate further if Congress approves the proposed $138 million federal funding included in the 2020 fiscal year budget. This federal money will push the harbor deepening project toward completion, which will increase port activity and add to the logistics pipeline feeding the import/export portion of the industrial market throughout Charleston. When the harbor deepening is completed, it will accommodate larger container vessels whose imports can then be transported to the inland ports and distributed throughout the country. Likewise, goods manufactured in the United States will have a convenient export route out of the Port of Charleston. With the completion of the deeper harbor, Charleston will have the deepest Eastern seaport. If the federal funding is approved, Charleston will be one step closer to quickly becoming an east coast industrial hub.

Market Overview

The Charleston industrial market has approximately 54.20 million square feet of industrial inventory within 1,072 buildings. There were six new buildings delivered to the Charleston market this quarter, which added 217,431 square feet. There are also 19 buildings currently under construction totaling 3,511,495 square feet. The Charleston industrial market absorbed 654,951 square feet during the first quarter of 2019, led by the North Charleston submarket absorption of 419,490 square feet. The overall market vacancy rate decreased from 8.95% during the fourth quarter of last year to 8.09% this quarter. The average triple net market weighted rental rate continues to increase quarter over quarter, and it rose from $4.95 per square foot last quarter to $5.21 per square foot during the first quarter of 2019.

Warehouse/Distribution

The Charleston industrial market warehouse/distribution sector is comprised of 39.17 million square feet within 829 buildings and comprises 72.27% of the Charleston industrial market. Four new warehouses were delivered to this sector during the first quarter of this year, which added 74,863 square feet to the overall warehouse market. There are also currently 18 warehouses totaling 2,888,818 square feet under construction. The warehouse/distribution sector absorbed 560,356 square feet this quarter, and most of the positive absorption was within the North Charleston submarket; 7555 Palmetto Commerce Parkway absorbed 123,816 square feet and Crosspoint Building 6 absorbed 104,000 square feet this quarter. Likewise, the warehouse vacancy rate dropped from 9.73% during the fourth quarter of last year to 8.46% this quarter. The average triple net weighted warehouse rental rate rose from $5.03 per square foot during the fourth quarter of 2018 to $5.39 per square foot during the first quarter of this year.

Manufacturing

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 10.71 million square feet of manufacturing space within the Charleston market. There is currently one 622,677-square-foot manufacturing building under construction at 479 Trade Center, excluding the remaining square feet under construction at the Volvo manufacturing facility. In addition, there is also one 520,000-square-foot building proposed to be built, and one new 117,568-square-foot manufacturing plant was delivered to the Charleston market at 635 Omni Industrial Park – Samet Building 1. The overall Charleston manufacturing sector absorbed 26,024 square feet during the first quarter of 2019 and the manufacturing vacancy rate rose from 6.68% during the fourth quarter of 2018 to 7.46% during this quarter. The average triple net weighted rental rate increased during the first quarter of this year to $3.96 per square foot, up from $3.53 per square foot last quarter.

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.32 million square feet. One 25,000-square-foot flex/R&D building was delivered to the market at 1270 Drop Off Drive in the Summerville submarket completing the current flex/R&D construction pipeline. This sector absorbed 68,571 square feet this quarter and the vacancy rate decreased from 7.43% during the fourth quarter of last year to 6.38% during the first quarter of 2019. The average triple net weighted rental rate held steady at around $8.93 per square foot, up two cents higher than the fourth quarter of 2018 weighted rental rate.

Capital Investment & Employment

From February 2018 through February 2019, there have been $1.06 billion of expansion and new capital investments within the Charleston industrial market. The capital investments produced 1,852 jobs, with the types of investors including the automotive sector/specialty military vehicle production, artificial intelligence, pharmaceutical development, supply chain management and varied manufacturing. Also, according to the Federal Reserve data through February of 2019, there have been 7,300 jobs added in the Charleston MSA, 700 of which were industrial jobs. The manufacturing sector of industrial employment added 600 jobs and while the number of jobs being added is less than it previously was, the employment rate is a healthy 97.2%. Overall non-farm employment totals 362,700 and has increased 2.01% from February 2018 through February 2019.

Significant Transactions

There were 22 Charleston industrial sale transactions reported on CoStar during the first quarter of 2019. Leasing activity continued at a steady pace during the first quarter and, according to CoStar, there were 29 industrial leases executed from January 2019 through March 2019. There were two 120,000-square-foot leases executed by undisclosed tenants.

Sales

- Sycamore Partners purchased a 526,316-square-foot Class A industrial building for $32 million. It is located at 6 Corporate Parkway in Goose Creek.

- For approximately $1.78 million, Brad Whitley purchased a 22,300-square-foot industrial building located at 6695 Jet Park Road in North Charleston.

Leases

- CBX executed a 65,000-square-foot industrial lease at 9004 Sightline Drive in Ladson.

- Also at 9004 Sightline Drive in Ladson, Narrow Isle Productions LLC executed a 50,000-square-foot warehouse lease.

Construction Pipeline

Delivered

- Samet Building 1, located at 635 Omni Industrial Boulevard, completed construction on a 117,568-square-foot manufacturing building in the Summerville submarket.

- 1270 Drop Off Road is the site of a completed 25,000-square-foot flex building within the Summerville submarket.

- Landmark Business Park, Building 300, located at 9551 Palmetto Commerce Parkway in North Charleston, is now the site of a completed 24,300-square-foot warehouse.

- The North Charleston submarket has a completed 20,250-square-foot Class B warehouse at 7035 Cross Country Road.

- Jet Industrial Park in North Charleston is the site of a 16,313-square-foot warehouse which completed construction this quarter.

- 2125 North Center Street, Building 500 completed construction on a 14,000-square-foot warehouse in the North Charleston submarket.

Under Construction

(including specialty industrial space & +100,000 square feet)

- The IFA Rotorion Building, located at 479 Trade Center, currently has 622,677 square feet under construction.

- At 1334 Drop Off Road – Building 1 in Summerville, there is currently a 561,600-square-foot warehouse under construction.

- At Highway 78, in the Summerville submarket, a 425,000-square-foot warehouse is currently under construction.

Ladson Industrial Park, which is in the North Charleston submarket, has a 420,888-square-foot warehouse under construction. - Construction began on a 364,000-square-foot warehouse, within the North Charleston submarket, at 4289 Crosspoint Drive.

- There is a 262,080-square-foot Class A industrial building under construction on Patriot Boulevard in Ladson.

- The Summerville Distribution Complex on Deming Way is the site of a 250,000-square-foot warehouse currently under construction.

- 7777 Palmetto Commerce Parkway is the construction site of a 196,450-square-foot warehouse within the North Charleston submarket.

- The Palmetto Trade Center is in Phase 1 of construction on a 142,700-square-foot warehouse within the North Charleston submarket.

- Construction continues on a 100,000-square-foot warehouse at Omni Samet Building 5, located on Omni Industrial Drive.

Market Forecast

The Charleston industrial region has many elements contributing to its positive market activity: strong logistics, rapid population growth, encouraging business climate and employment creation, to name a few. As the Port of Charleston harbor deepening project continues, the list of top manufacturers and distributors interested in locating to the region grows longer, led by Mercedes, Volvo and Boeing 787 Dreamliner manufacturing. All aspects of the industrial market are expected to continue on a positive track: construction will move in an upward trend and is predicted to be absorbed relatively quickly, causing the overall market vacancy rate to decrease. With newly delivered, high-quality buildings being added to the market, the rental rates are also likely to rise.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q1 Industrial Charleston Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans