Colliers Report: Charleston’s industrial demand and new construction on the rise

July 17, 2019Key Takeaways

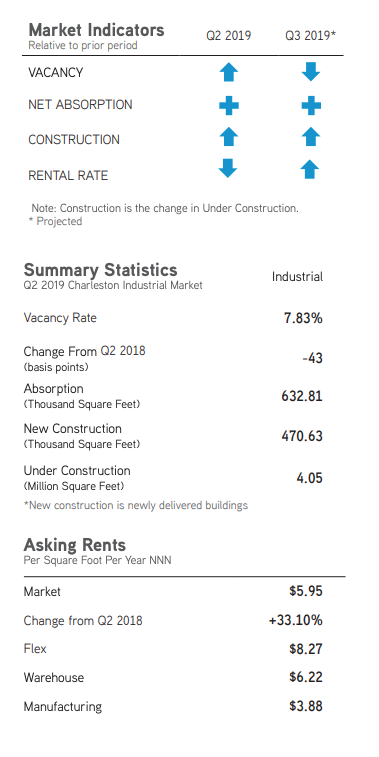

- Quarter-over-quarter the Charleston industrial market continues to post positive absorption; during the second quarter of 2019 the market absorbed 632,810 square feet.

- The manufacturing sector has few availabilities remaining and this quarter the vacancy rate dropped to 6.37%; likewise, the flex/R&D vacancy rate dropped to 4.18%..

To download the complete report: 2019 Q2 Industrial Charleston Report

Decentralized distribution hubs drive South Carolina demand

Decentralized distribution hubs drive South Carolina demand

The decentralization of distribution hubs is a direct result of suppliers meeting the delivery demands of consumers within hours to one day of their orders, rather than having one main hub that delivers within a few days. This shift has driven the industrial demand up throughout South Carolina because the entire state has access to logistical suppliers such as the Port of Charleston and the Inland Ports of Dillon and Greer. It follows then that industrial occupiers desire a location within regions with the highest population growth and, according to the most recent U.S. Census data, South Carolina’s population is expected to increase to 5.46 million by the year 2020.

Rising industrial demand is evidenced through the absorption numbers over the past year and a half. Last year, the South Carolina industrial market absorbed 12.84 million square feet and already this year that number has been surpassed; 13.47 million square feet have been absorbed across the state. Absorption is expected to continue trending upward throughout the year as demand rises and more manufacturers and distributors locate across the state.

Market Overview

Overall Charleston industrial market: Positive absorption and new construction expected

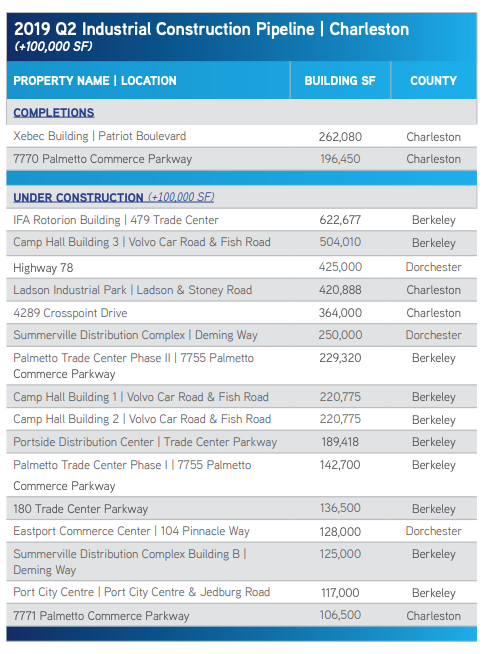

The Charleston industrial market has 55.64 million square feet of industrial inventory with approximately 4.05 million square feet under construction within 23 buildings. In addition, there are approximately 3.78 million square feet of buildings proposed to be built within the Charleston market. There were three new buildings delivered to the market this quarter which added 470,630 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 632,810 square feet during the second quarter of 2019; three submarkets: North Charleston, Berkeley County and Clements Ferry absorbed a net total of 540,875 square feet. However, the overall market vacancy rate increased slightly from 8.15% during the first quarter of this year to 8.71% this quarter. The overall market average triple net weighted rental rate dropped slightly this quarter to $5.95 per square foot.

Warehouse/Distribution: Consistent growth quarter-over-quarter

The Charleston industrial market warehouse/distribution sector is comprised of 40.21 million square feet within 834 buildings and comprises 72.27% of the Charleston industrial market. There are 20 warehouses totaling 3.18 million square feet under construction throughout the Charleston market, and an additional 11 warehouses totaling 3.26 million square feet are proposed to be built. Warehouses throughout Charleston absorbed 431,715 square feet this quarter; however, the vacancy rate rose to 9.85% because three warehouses were delivered to the market adding 458,530 square feet of direct vacancies. The average triple net weighted warehouse rental rate dropped slightly from $6.47 per square foot during the first quarter of this year to $6.22 per square foot this quarter.

Manufacturing: Positive absorption and construction underway

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.03 million square feet of manufacturing space within the Charleston market. Excluding the remaining square feet under construction at the Volvo manufacturing facility, there are two buildings under construction which, upon completion, will add 851,997 square feet of inventory to the market. In addition, there is one 520,000-square-foot building proposed to be built. The overall Charleston manufacturing sector absorbed 109,712 square feet during the second quarter of 2019 and the manufacturing vacancy rate dropped from 7.37% during the first quarter of 2018 to 6.37% during this quarter. The average triple net weighted rental rate decreased during the second quarter of this year to $3.88 per square foot.

Flex/R&D: Limited space is available

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.40 million square feet. One 10,783-square-foot flex building is under construction at 2467 Charleston Highway and no additional flex buildings are currently proposed to be built. This sector absorbed 91,383 square feet this quarter and the vacancy rate decreased from 6.25% during the first quarter of this year to 4.18% during the second quarter of 2019. The average triple net weighted rental rate dropped to $8.27 per square foot this quarter.

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.40 million square feet. One 10,783-square-foot flex building is under construction at 2467 Charleston Highway and no additional flex buildings are currently proposed to be built. This sector absorbed 91,383 square feet this quarter and the vacancy rate decreased from 6.25% during the first quarter of this year to 4.18% during the second quarter of 2019. The average triple net weighted rental rate dropped to $8.27 per square foot this quarter.

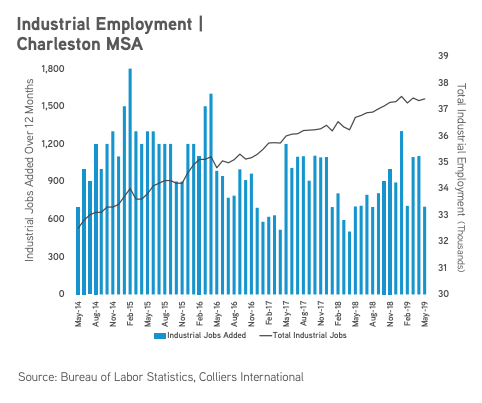

Capital Investment & Employment

During the first two quarters of 2019, there have been $118.5 million of new capital investments within the Charleston industrial market. The capital investments produced 537 jobs, with the types of investors including varied manufacturing, shipping and logistics, and distilleries of craft beers. Also, according to the Federal Reserve data through May of 2019, there have been 9,500 jobs added in the Charleston metropolitan statistical area, 699 of which were industrial jobs. The manufacturing sector of industrial employment added 600 jobs and while the number of jobs being added is less than it previously was, the employment rate is 97%. Overall non-farm employment totals 372,700 and has increased 1.9% from May 2018 through May 2019.

There were 25 Charleston industrial sale transactions reported by CoStar during the second quarter of 2019. Leasing activity increased during the second quarter and, according to CoStar, there were 33 industrial leases executed from April 2019 through June 2019. The two leases greater than 100,000 square feet were signed by undisclosed tenants: one unnamed tenant at 7410 Magi Road leased 302,400 square feet and another undisclosed tenant at 4500 Goer Drive leased 100,000 square feet.

Sales

- STAG Industrial, Inc. purchased 6 Corporate Boulevard, a 526,316-square-foot Class A distribution facility in Goose Creek, for $40.4 million.

- For $5.95 million, GFI Partners LLC purchased a 106,300-square-foot distribution building located at 7240 Cross Park Drive in North Charleston.

Market Forecast

Absorption is expected to continue trending upward as the demand for distribution hubs to locate in Charleston, and all of South Carolina, increases. There are currently 4.05 million square feet of industrial buildings under construction and they are expected to be leased quickly upon completion. As new construction delivers to the market, the rental rates will increase; however, the high demand will drive the vacancy rate lower despite the new deliveries. Industrial users will also purchase new buildings or contract for a build-to-suit in order to meet their distribution and warehouse needs. Industrial market activity in Charleston will be positive throughout 2019 in both the manufacturing and warehouse sectors.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q2 Industrial Charleston Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans