Colliers Report: Columbia office rents- going up again

October 4, 2019Research & Forecast Report

Q3-2019 COLUMBIA | OFFICE

Key Takeaways

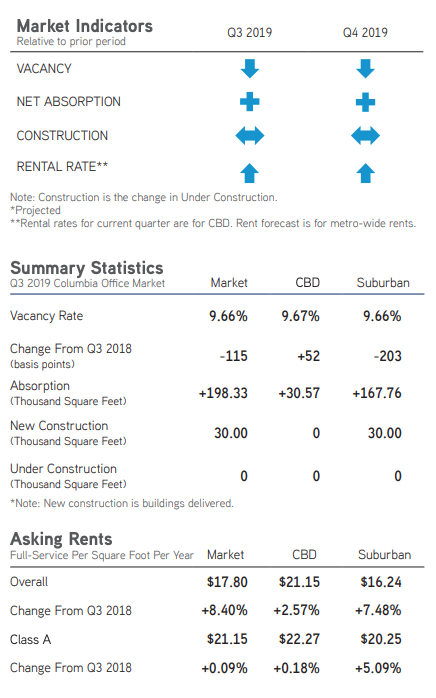

- Columbia’s overall office market absorbed 198,328 square feet – 109,760 square feet, of which, was absorbed in the St. Andrews submarket.

- The overall office market vacancy rate dropped from 10.93% last quarter to 9.66% during the third quarter of 2019.

- Columbia building owners continue to upgrade building amenities in order to retain tenants.

- Given the tight office market, rental rates will continue to rise.

For additional commercial real estate news, check out our market reports here.

Amenities will increase tenant longevity and raise rental rates

No new office construction is underway in Columbia; therefore, it is up to building owners to take action in order to increase tenant satisfaction and building rental rates. In order for tenants to remain content within their current buildings, landlords will need to add even more new amenities and upgrade the quality of existing buildings – especially in those suites or areas which have often sat unused or in need of a face lift. Landlords will continue adding amenities such as:

No new office construction is underway in Columbia; therefore, it is up to building owners to take action in order to increase tenant satisfaction and building rental rates. In order for tenants to remain content within their current buildings, landlords will need to add even more new amenities and upgrade the quality of existing buildings – especially in those suites or areas which have often sat unused or in need of a face lift. Landlords will continue adding amenities such as:

- upgraded technology throughout the building;shared common areas with coworking space, meeting spaces and social collaboration areas;

- fitness centers;

- green areas for eating and working;

- walkable restaurant options;

- laundry delivery | concierge services;

- onsite car wash;

- security services.

While some of these options may not be possible, added tenant services and reconfiguring common area spaces with fresh finishes, new collaboration configurations and enhanced technology are always an option. Even though not much space is available within the Columbia office market, tenants will find a new location if they are not satisfied; therefore, upgrading common areas and adding services to ensure tenant satisfaction are always a good idea. In addition, upgrades will lead to higher rental rates in buildings and increase the overall building value.

Market Overview

Overall Columbia Market

The Columbia office market is comprised of 16.29 million square feet of office properties within 8 submarkets. Construction completed on a 30,000-square-foot office building within the Cayce/West Columbia submarket. The overall market absorbed 198,328 square feet – 109,760 square feet, of which, was absorbed in the St. Andrews submarket. The vacancy rate dropped from 10.93% last quarter to 9.66% during the third quarter of 2019. The overall average weighted rental rate in the Columbia office market rose to $17.80 per square foot this quarter, just a slight increase over the $17.16 per square foot rental rate from the second quarter of this year.

Columbia Business District (CBD)

The Columbia central business district consists of 5.60 million square feet and construction activity remains at a standstill due to the high cost of new construction and few downtown office development options. Downtown office buildings absorbed 30,572 square feet this quarter with only three leases above 10,000 square feet. The overall downtown vacancy rate dropped from 10.30% last quarter to 9.67% during the third quarter of 2019. In addition, the overall downtown weighted rental rates was $21.15 per square foot during the third quarter of 2019 due to 193,857 square feet of high-quality, Class A availabilities.

Suburban

The Columbia suburban markets consist of 10.68 million square feet of office properties and one building completed construction at 100 Corporate Boulevard in the Cayce/West Columbia submarket. The suburbs absorbed 167,756 square feet overall, with the St. Andrews market accounting for 109,760 square feet of the positive absorption. The suburban vacancy rate dropped from 11.26% during the second quarter of this year to 9.66% this quarter. The Irmo/Chapin submarket has no available space remaining, and the Cayce/West Columbia and East Columbia submarkets both have a vacancy rate lower than 1%. The suburban market average weighted rental rate increased from $15.49 per square foot last quarter to $16.24 per square foot during the third quarter of 2019.

This quarter there were 30 sale transactions, according to CoStar. During the third quarter of 2019, there were also 53 leases, most leases were between 2,000 square feet to 5,000 square feet.

Sales

- Casey Management purchased the 88,000-square-foot IKON Building at 7 Technology Circle in Columbia for $6.3 million.

- Cason Development Group LLC purchased the 27,309-square-foot office building at 1813 Main Street for $1.5 million.

Significant Leases

- CDM Smith, Inc. renewed a 14,920-square-foot lease for office space on the 10th floor of 1441 Main Street.

Construction Pipeline

Delivered

- Construction completed at 100 Corporate Boulevard, a 30,000-square-foot office building within the Cayce/West Columbia submarket.

Employment

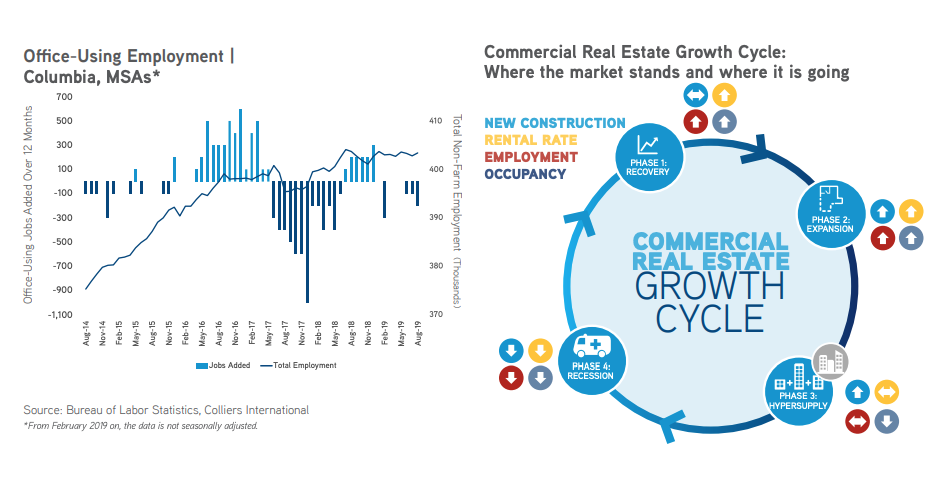

Office-using employment are those jobs related to the professional and business services, financial activities and information sectors. According to the most recent August 2019 data from the Bureau of Labor Statistics, within the Columbia Metro Statistical Area (MSA) there were 200 less jobs during August of this year than there were in August 2018. Total non-farm employment totaled 403,400 within the Columbia MSA in August 2019. The Columbia unemployment rate remains low at 3.1% as of August of this year. Government, Trade, Transportation and Utilities and Professional and Business Services are the top three employment sectors contributing to the Columbia MSA employment during August of 2019.

Market Forecast

The Columbia office market downtown development is nonexistent right now due to high construction prices and few development options. In the meantime, building owners can offer tenants added amenities in order to retain them and boost their rental rates while no new development is on the horizon. Most of the positive Columbia office absorption will continue to be within the suburbs due to a variety of office options, free parking and reduced commuter time for tenants. Average weighted rental rates for the remaining availabilities in Columbia will remain relatively high until the Class A office suites in the CBD are leased; however, they are not predicted to increase further until building upgrades are completed or tenant services are added as amenities.

For additional commercial real estate news, check out our market reports here.