Colliers Report: Greenville-Spartanburg pre-leased retail construction deliveries are expected into 2020

February 24, 2020

Research & Forecast Report

Q4-2019 GREENVILLE-SPARTANBURG | RETAIL

Key Takeaways

- Construction is often delivering pre-leased and the Greenville-Spartanburg retail market should expect this trend to continue throughout the first half of 2020, if not longer.

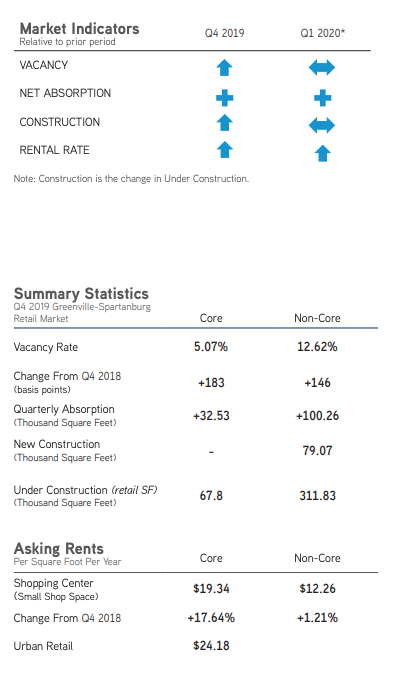

- Due to new construction deliveries throughout the year, the overall average retail rental rate rose to $12.80 per square foot at year end 2019. Rental rates in core retail spaces averaged 19.34 per square foot, while urban retail shops averaged $24.18 per square foot. In non-core retail space the rent averaged $12.26 per square foot.

Over the past 12 months, the Greenville-Spartanburg retail market absorbed 98,037 square feet despite the delivery of 132,795 square feet of new construction deliveries. New buildings contributing to the positive absorption were mostly pre-leased, free-standing shops such as: Harbor Freight, Dollar General and Dollar Tree. In addition, the fast casual restaurants Moe’s and Chicken Salad Chick were delivered to the Spartanburg submarket. Overall, the Greenville-Spartanburg retail market has remained resilient despite a few new vacant buildings leading to fluctuating vacancies, market vacancy rate only rose to 10.33% at year end 2019. Meanwhile, the urban retail vacancy rate dropped to 8.11% during the fourth quarter of 2019; 158 basis points lower than the fourth quarter of last year. Due to higher rents associated with new construction deliveries, the overall average retail rental rate rose from $10.39 per square foot during the fourth quarter of 2018 to $12.80 per square foot at year end 2019.

Market Overview

The Greenville-Spartanburg retail market is comprised of approximately 17.19 million square feet of retail space and absorbed 132,795 square feet overall during the fourth quarter of 2019. The positive absorption was spread throughout several Greenville-Spartanburg submarkets; however, non-core spaces outpaced core shops posting a quarterly absorption of 100,261 square feet, while core spaces absorbed 32,534 square feet. Due to positive absorption and the delivery of occupied new construction, the quarterly vacancy rate was 10.33% during the fourth quarter of 2019, 105 basis points lower than during the third quarter of 2019. Urban retail thrives in Greenville due to a vast a variety of shops within walking distance of several office building clusters and convenient parking options. The Greenville urban retail vacancy decreased from 8.41% during the third quarter of 2019 to 8.11% during the fourth quarter of 2019. The range of rental rates spanned from $5.00 per square foot in non-core retail shops to $26.13 per square foot in urban retail stores.

Market Forecast

Despite the second quarter downturn in market activity due to the negative effects of e-commerce on brick-and-mortar retail, the Greenville-Spartanburg market is once again posting positive activity. Construction is often delivering pre-leased and the market is strong enough to expect this trend to continue throughout the first half of 2020, if not longer. There are currently 359,630 square feet under construction throughout the Greenville-Spartanburg retail market. The completion of new construction is anxiously awaited and, while new space is predicted to absorb quickly, remaining shops may suffer and require an upfit in order to draw new tenants. Developers may heed caution before beginning to build proposed construction projects to ensure demand will drive the need for new construction.

Retailers throughout the region offering convenience to consumers, unique foods or fun experiences should expect continued success throughout 2020 because they are generally internet-proof. Weighted rental rates fluctuate based on the quality of available space; therefore, with new construction deliveries anticipated in 2020, the Greenville-Spartanburg retail rental rates will continue on an upward trend.

For additional commercial real estate news, check out our market reports here.