Colliers Report: Greenville-Spartanburg’s increased office availabilities present opportunities for tenants

January 5, 2021

Research & Forecast Report

Q4-2020 GREENVILLE-SPARTANBURG | OFFICE

Key Takeaways

- The effects of the pandemic continue to impact the Greenville-Spartanburg office market with increased sublease space and negative absorption.

- There are currently 2.08 million square feet of vacant office space, 833,162 square feet, of which would be classified as Class A. This presents an opportunity for tenants to upgrade to a quality space.

- Office tenants are choosing to become owner occupants by purchasing office space due to low interest rates and the freedom to operate their own space.

- Rental rates are expected to remain flat or decline slightly in the coming quarters until sublease space is absorbed.

Renew, upgrade or relocate from another market

This year the pandemic has enhanced the importance of personal distance. While some businesses are choosing to work remotely into next year and renew their current leases; others are returning to the office, but may feel the need for a need for new or upgraded space in order to ensure safety measures and social distancing. There are currently 2.08 million square feet of vacant office space, 833,162 square feet of which would be classified as Class A. These availabilities give tenants the opportunity to upgrade to a larger or higher quality space. Furthermore, out-of-market businesses can relocate headquarters to Greenville or start a new business. This is a unique time in the Greenville-Spartanburg office market for tenants to take advantage of in order to enhance their work environment and improve their office space.

This year the pandemic has enhanced the importance of personal distance. While some businesses are choosing to work remotely into next year and renew their current leases; others are returning to the office, but may feel the need for a need for new or upgraded space in order to ensure safety measures and social distancing. There are currently 2.08 million square feet of vacant office space, 833,162 square feet of which would be classified as Class A. These availabilities give tenants the opportunity to upgrade to a larger or higher quality space. Furthermore, out-of-market businesses can relocate headquarters to Greenville or start a new business. This is a unique time in the Greenville-Spartanburg office market for tenants to take advantage of in order to enhance their work environment and improve their office space.

Owner occupants gain freedom by purchasing their own space

The pandemic has altered the way of life for many people this year. One distinctive way it may change commercial real estate is by tenants choosing to become owner occupants by tenants purchasing their own office. With historically low interest rates, buying an office building is gaining attraction from both local and out-of-market investors. Owning an office affords owner/occupants freedom to control their own space by implementing their own cleaning schedule, air filtration system, and regulating the amount of visitors/other tenants in and out of the building. In addition, real estate is a solid investment for a tenant who has the capital to purchase their own building and become an owner/occupant – especially if it is a multi-tenant building where other tenants are already paying rent.

Market Overview

Annual Greenville-Spartanburg Office Recap

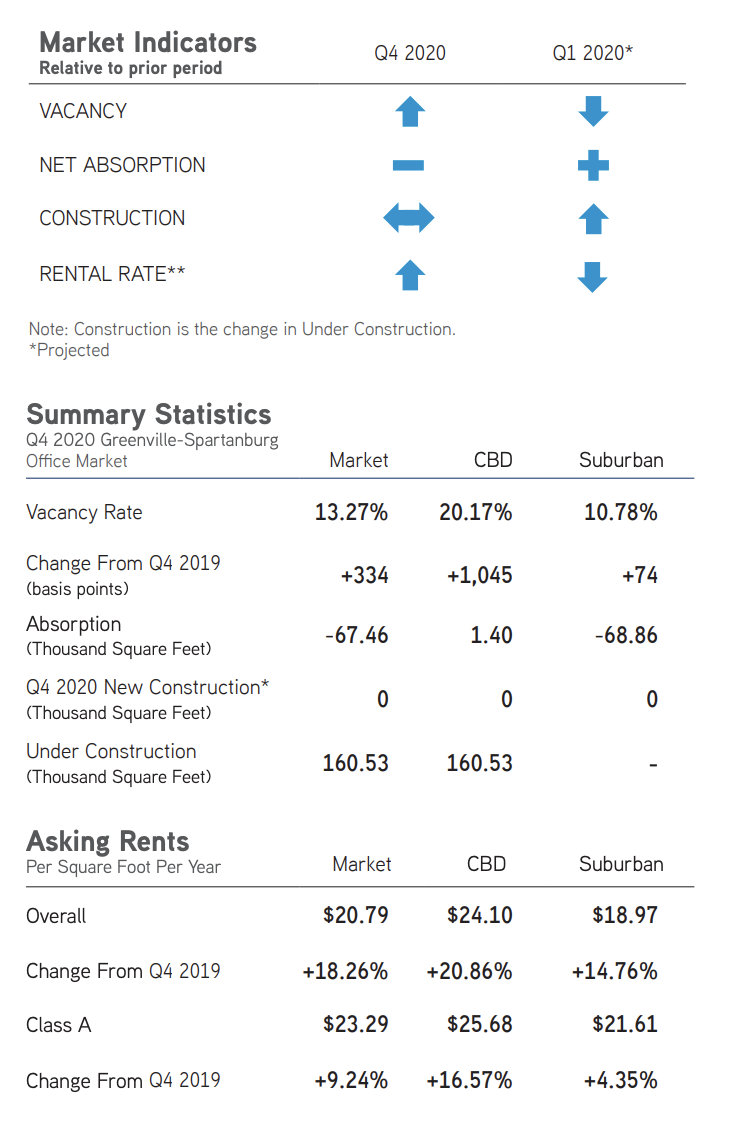

The effects of the pandemic are becoming evident throughout the Greenville-Spartanburg office market. Over the past year, sublease availabilities have nearly doubled from 149,654 square feet during fourth quarter of 2019 to 272,048 square feet during the fourth quarter of 2020. The suburbs posted a negative annual absorption of 338,168 square feet, while the central business district posted a negative 107,481 square feet of annual absorption. Therefore, the overall market posted a negative annual absorption of 445,649 square feet. Consequently, the annual vacancy rate increased from 9.11% at the end of last year to 11.97% this quarter. Two offices delivered to the market adding 57,483 square feet this year while remaining office construction was delayed due to shortage and delay in supply deliveries and general economic uncertainty, but are expected to gain speed in 2021. Overall market rental rates increased slightly over the past year from $20.58 per square foot to $20.79 per square foot, rental rates are expected to decrease in the next few quarters until most of the lower-priced sublease space is absorbed.

The effects of the pandemic are becoming evident throughout the Greenville-Spartanburg office market. Over the past year, sublease availabilities have nearly doubled from 149,654 square feet during fourth quarter of 2019 to 272,048 square feet during the fourth quarter of 2020. The suburbs posted a negative annual absorption of 338,168 square feet, while the central business district posted a negative 107,481 square feet of annual absorption. Therefore, the overall market posted a negative annual absorption of 445,649 square feet. Consequently, the annual vacancy rate increased from 9.11% at the end of last year to 11.97% this quarter. Two offices delivered to the market adding 57,483 square feet this year while remaining office construction was delayed due to shortage and delay in supply deliveries and general economic uncertainty, but are expected to gain speed in 2021. Overall market rental rates increased slightly over the past year from $20.58 per square foot to $20.79 per square foot, rental rates are expected to decrease in the next few quarters until most of the lower-priced sublease space is absorbed.

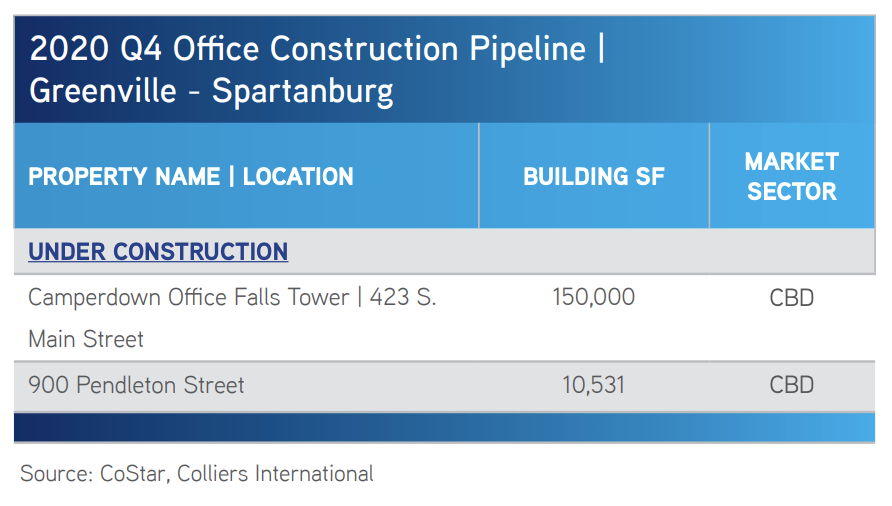

Overall Greenville-Spartanburg Market

The Greenville-Spartanburg office market consists of 17.41 million square feet. There are currently two office buildings under construction and another 286,720 square feet are proposed to be built, but have not yet broken ground. The effects of the pandemic continue to impact the Greenville-Spartanburg office market with increased sublease space and negative absorption. Overall the market posted a negative 67,456 square feet of quarterly absorption. Over half of the negative absorption occurred in Class C offices; however, 26,700 square feet of negative absorption was in Class A office space. Many tenants are choosing to “wait it out” and are not contributing to the market activity as only 33 buildings posted any activity this quarter. Negative quarterly absorption forced the vacancy rate upward from 11.58% during the third quarter of 2020 to 11.97% this quarter. Overall average Greenville-Spartanburg weighted rental rate was $20.79 per square foot this quarter, ranging from $6.50 per square foot in Spartanburg County to $30.00 per square foot in the Greenville central business district. Average weighted rental rates in Class A office space averaged $23.29 per square foot during the fourth quarter of 2020.

Greenville Central Business District (CBD)

The Greenville central business district is comprised of 4.43 million square feet. Central business district office activity is basically at a “stand still” currently as business owners wait on new vaccine distribution before making any decisions. During the fourth quarter of 2020, downtown offices absorbed 1,403 square feet. The minimal market activity confirms the hesitancy of tenants to make any permanent decisions amidst the pandemic. Due to marginal fourth quarter absorption, the vacancy rate decreased by 3 basis points from 15.31% last quarter to 15.28% this quarter. Average weighted downtown rental rates increased to $24.10 per square foot this quarter from $23.35 per square foot during the third quarter of this year. Likewise, Class A office property weighted rental rates rose to $25.68 per square foot up from $25.39 per square foot last quarter.

Suburban

The Greenville-Spartanburg suburban office submarkets consist of 12.99 million square feet. No buildings are under construction, nor were there new construction deliveries this quarter. However, there are currently four offices proposed to be built which will add 274,720 square feet to the suburbs. Suburban offices posted a negative absorption of 68,859 square feet during the fourth quarter of 2020. Current suburban sublease space increased by 43,032 square feet from the third quarter of this year. Most of the negative absorption occurred within the I-385/85 submarket in Class A offices. Due to the negative activity, the suburban vacancy rate rose from 10.31% during the third quarter of this year to 10.84% this quarter. The overall average rental rate for the remaining suburban office space was marginally higher this quarter at $18.97 per square foot, the averages ranged from $25.50 per square foot in Class A I-385/85 suburban office space down to $6.50 per square foot in Class C Spartanburg County offices.

Significant Transactions

During the fourth quarter of 2020, there were 39 office sale transactions, the largest of which were medical offices. Also, according to CoStar, 41 leases were signed within the Greenville-Spartanburg submarkets.

- Vectrus, Inc. leased 14,215 square feet at Independence Corporate Park in Greenville.

- Quest Global Services NA, Inc. leased 11,998 square feet at Independence Corporate Park in Greenville.

Office-Using Employment

Office-using employment are those jobs related to the professional and business services, financial activities and information sectors, within the combined Greenville-Spartanburg-

Market Forecast

Increasing vacancies within the Greenville-Spartanburg office market offer tenants an opportunity to upgrade to a higher quality space, purchase their own office or renew their current lease. Larger availabilities will also attract out-of-market businesses to the region because the business climate is positive and employment rates are improving month-over-month. In the next few quarters, sublease will likely be absorbed before direct vacant space because it is generally priced lower. Due to this, owners may temporarily lower rental rates in order to compete. The pace of new construction is anticipated to pick up in 2021 as the vaccine is distributed and companies resume a normal working environment.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.