Colliers Report: Heathcare market continues expansion despite economic headwinds

February 21, 2023Commercial Real Estate Research & Forecast Report

Q4 2022 South Carolina Medical Office

By Ron Anderson | Vice President of Research & Information Technology

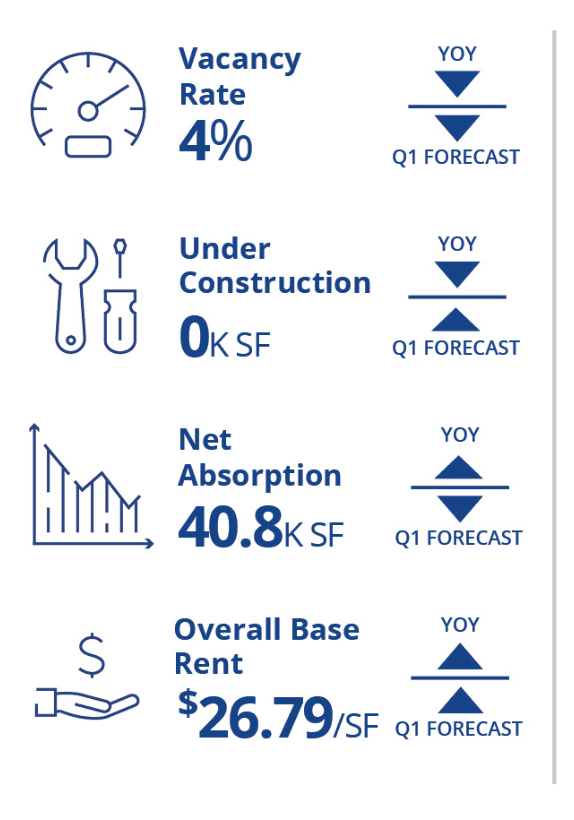

Market Highlights

The medical office market in South Carolina continues to experience steady expansion driven by above average population growth and societal aging. Healthcare providers are consistently improving their network of medical providers in an effort to better connect with patients.

Click here to read the full report.

Key Takeaways

- Nearly 41,000 square-feet were absorbed

- Construction continues to be limited

- Investors are attracted to medical buildings because of

the market fundamentals

Summary

Competition among these healthcare providers guarantees activity will continue despite inflation and rising interest rates. In addition, non-clinical providers continue to look at methods to trim costs by relocating away from hospital campuses.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 62 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 18 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 65 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.