Colliers Report: Home improvement and discount stores are active in the Greenville-Spartanburg market

October 27, 2020Research & Forecast Report

Q3-2020 GREENVILLE-SPARTANBURG | RETAIL

Key Takeaways

- Greenville-Spartanburg retail shops posted minimal activity this quarter; the overall vacancy rate increased marginally to 10.92%.

- Fast casual restaurant facilities are evolving to keep up with customer needs.

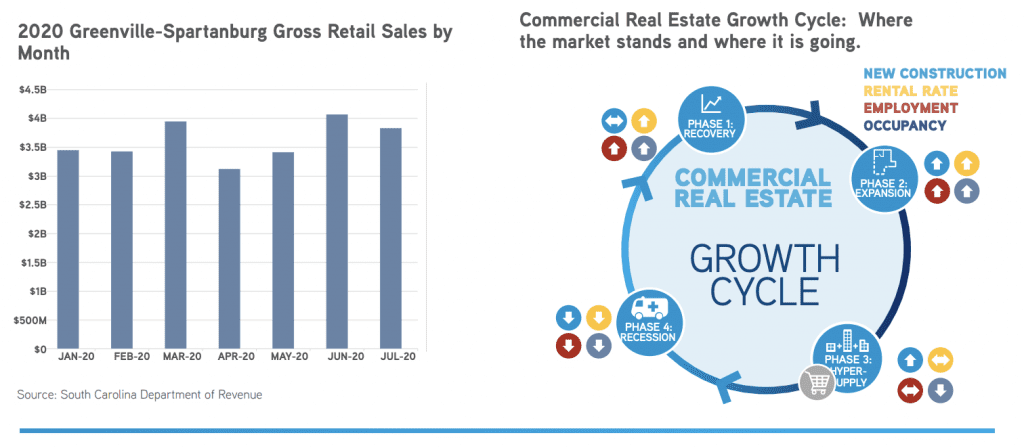

- Throughout the Greenville-Spartanburg market, gross retail sales are higher month-over-month now than they were pre-pandemic.

For additional commercial real estate news, check out our market reports here.

Quick service restaurants adapt to changing pandemic conditions

Quick service restaurants were gaining sales momentum prior to COVID-19 due to speedy service, convenience and ongoing upgrades to food quality – beginning the trend from fast food to fast casual restaurants. Aesthetic changes and healthy option upgrades led to increased business velocity. Throughout the pandemic, adaptive quick service restaurants continue to thrive by adding curbside pick-up, call ahead ordering and delivery options. In addition, many are decreasing the indoor dining area square footage and adding extra drive-thrus or outdoor seating to provide an enhanced level of safety to diners. Furthermore, restaurant owners are looking to purchase existing buildings rather than constructing new restaurants due to rising construction prices and difficulty getting necessary construction materials. Suburban locations are popular for adding new stores so they are closer to residential areas where many people are still working remotely.

Quick service restaurants were gaining sales momentum prior to COVID-19 due to speedy service, convenience and ongoing upgrades to food quality – beginning the trend from fast food to fast casual restaurants. Aesthetic changes and healthy option upgrades led to increased business velocity. Throughout the pandemic, adaptive quick service restaurants continue to thrive by adding curbside pick-up, call ahead ordering and delivery options. In addition, many are decreasing the indoor dining area square footage and adding extra drive-thrus or outdoor seating to provide an enhanced level of safety to diners. Furthermore, restaurant owners are looking to purchase existing buildings rather than constructing new restaurants due to rising construction prices and difficulty getting necessary construction materials. Suburban locations are popular for adding new stores so they are closer to residential areas where many people are still working remotely.

Market Overview

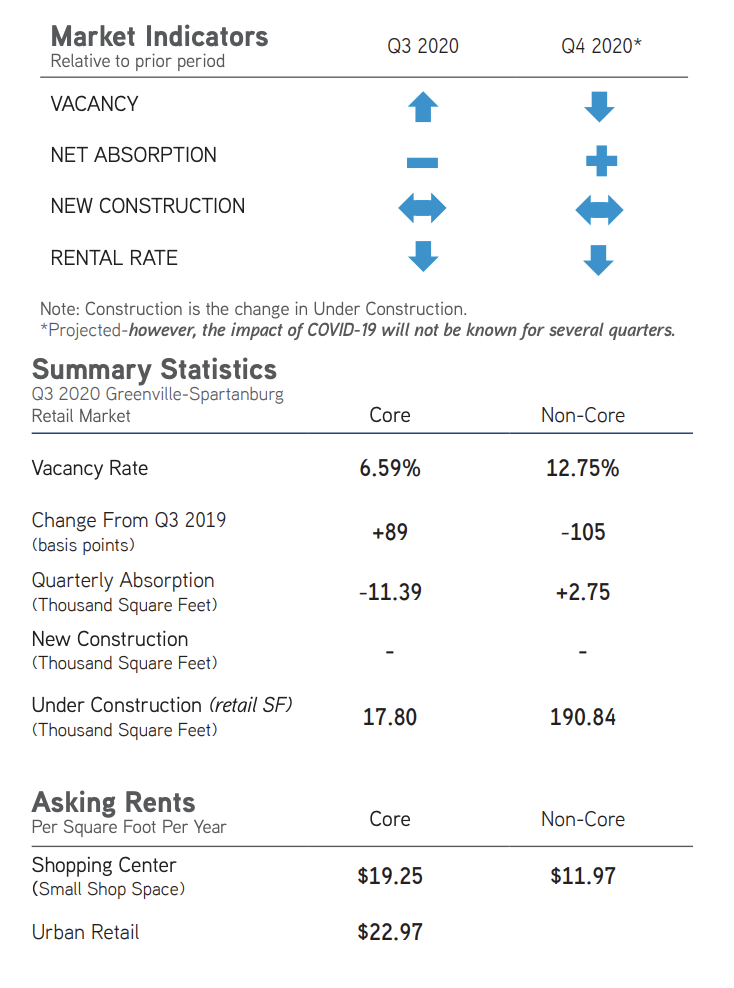

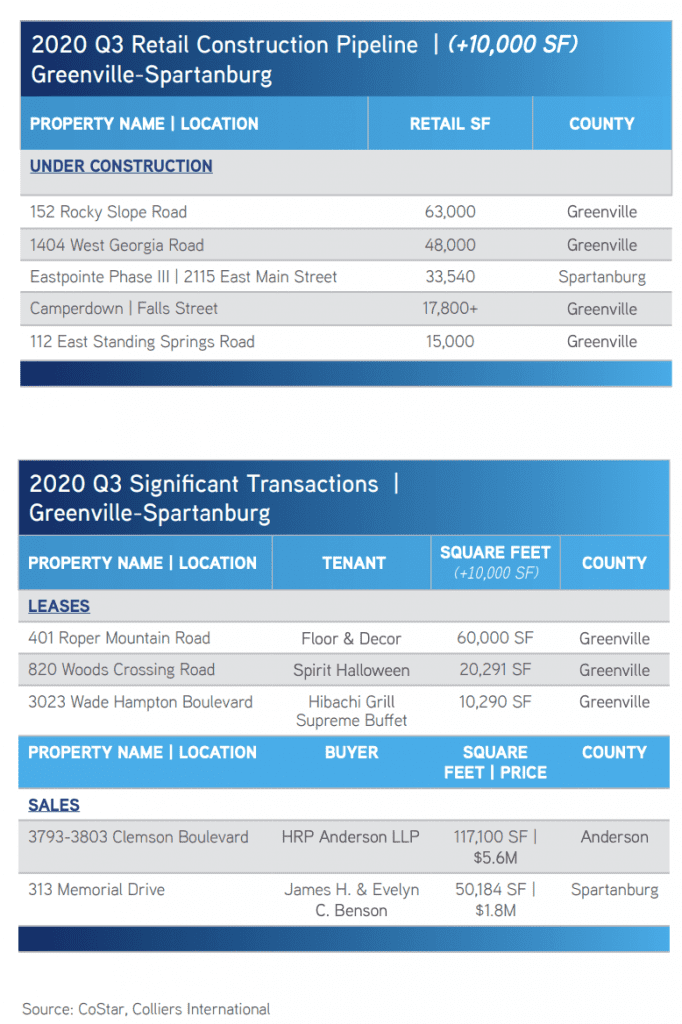

The Greenville-Spartanburg retail market is comprised of approximately 17.59 million square feet of retail space. During the third quarter of 2020, the market posted an overall negative absorption of 8,628 square feet. While core retail space posted a negative 11,387 square feet; non-core shops absorbed 2,759 square feet. There are positive deals currently under negotiation but not much activity occurred during the third quarter. No new construction was delivered to the market this quarter; however, there are 208,640 square feet under construction throughout the Greenville-Spartanburg submarkets. Upon completion, non-core shops will comprise 190,840 square feet, and 17,800 square feet will be located in core retail within the Camperdown development. The overall quarterly vacancy rate increased slightly due to negative absorption from 10.88% during the second quarter of 2020 to 10.92% this quarter. Weighted rental rates for available shops spanned from $4.00 per square foot in Belton-Honea Path non-core retail shops to approximately $27.00 per square foot in Duncan-Lyman non-core retail space.

The Greenville-Spartanburg retail market is comprised of approximately 17.59 million square feet of retail space. During the third quarter of 2020, the market posted an overall negative absorption of 8,628 square feet. While core retail space posted a negative 11,387 square feet; non-core shops absorbed 2,759 square feet. There are positive deals currently under negotiation but not much activity occurred during the third quarter. No new construction was delivered to the market this quarter; however, there are 208,640 square feet under construction throughout the Greenville-Spartanburg submarkets. Upon completion, non-core shops will comprise 190,840 square feet, and 17,800 square feet will be located in core retail within the Camperdown development. The overall quarterly vacancy rate increased slightly due to negative absorption from 10.88% during the second quarter of 2020 to 10.92% this quarter. Weighted rental rates for available shops spanned from $4.00 per square foot in Belton-Honea Path non-core retail shops to approximately $27.00 per square foot in Duncan-Lyman non-core retail space.

Market Forecast

The Greenville-Spartanburg market activity was relatively minimal this quarter but, going forward, activity is expected to pick up. Suburban retail activity will likely increase as shop owners provide convenience by locating near residential neighborhoods while consumers continue working from home. In addition, shops providing goods at discounted rates such as Dollar General, Big Lots, Five Below, Shoe Show, etc. are expected to make a surge due to economic uncertainty and the tendency for consumers to buy items at discounted rates during the pandemic. Also, grocery stores, coffee shops, home goods providers and car washes are popping up throughout the state and are anticipated to continue their success by adding new stores. In addition, gross retail sales are higher month-over-month now than they were pre-pandemic. All of these factors bode well for Greenville-Spartanburg increasing retail activity in the coming quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.