Colliers Report: Industrial demand will exceed supply in the next few months: new development is essential

February 5, 2021Research & Forecast Report

Q4-2020 SOUTH CAROLINA | INDUSTRIAL

Key Takeaways

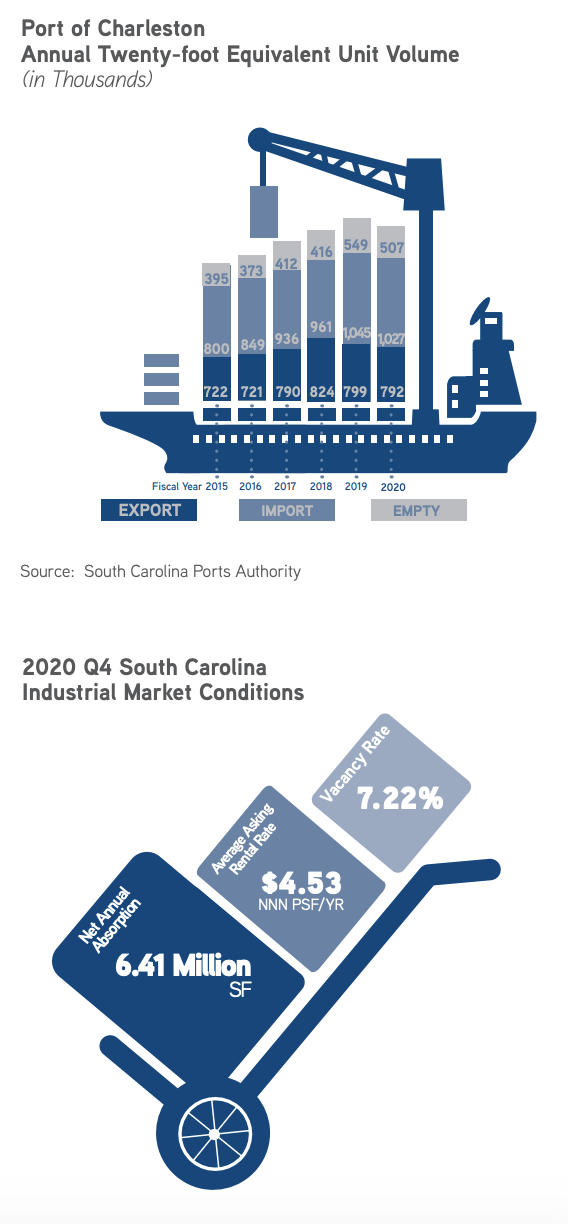

- The South Carolina industrial market absorbed 6.41 million square feet throughout 2020, dropping the vacancy rate to 7.22%, despite 7.64 million square feet of construction deliveries.

- There are 28 buildings totaling 5.51 million square feet under construction and 39 buildings proposed to be built which will add approximately 7.61 million square feet throughout the state upon completion.

- Within the next three months, the delivered speculative construction will likely be absorbed and new development will be crucial to keep up with growing demand.

For additional commercial real estate news, check out our market reports here.

Annual S.C. Market Overview

The South Carolina industrial market is comprised of 449.20 million square feet within 6,967 buildings. Throughout 2020, the market absorbed 6.41 million square feet, 3.05 million square feet was absorbed within manufacturing space and 2.98 million square feet was leased in South Carolina warehouses. Despite 7.64 million square feet of construction deliveries this year, the overall annual vacancy rate in South Carolina industrial properties decreased from 7.29% during the fourth quarter of 2019 to 7.22% this quarter. There are also 28 buildings totaling 5.51 million square feet under construction and 39 buildings proposed to be built which will add approximately 7.61 million square feet throughout the state upon completion. The South Carolina triple net weighted market rental rate for the remaining available industrial space increased 5.59% over the past year and averaged $4.53 per square foot at year-end 2020.

The South Carolina industrial market is comprised of 449.20 million square feet within 6,967 buildings. Throughout 2020, the market absorbed 6.41 million square feet, 3.05 million square feet was absorbed within manufacturing space and 2.98 million square feet was leased in South Carolina warehouses. Despite 7.64 million square feet of construction deliveries this year, the overall annual vacancy rate in South Carolina industrial properties decreased from 7.29% during the fourth quarter of 2019 to 7.22% this quarter. There are also 28 buildings totaling 5.51 million square feet under construction and 39 buildings proposed to be built which will add approximately 7.61 million square feet throughout the state upon completion. The South Carolina triple net weighted market rental rate for the remaining available industrial space increased 5.59% over the past year and averaged $4.53 per square foot at year-end 2020.

Augusta | Aiken (South Carolina portion)

The South Carolina portion of the Augusta | Aiken market is comprised of 13.59 million square feet, over half of which is manufacturing space. No new industrial buildings were delivered to this market; however, the 40,000-square-foot AmbioPharm expansion continued construction. Augusta | Aiken submarkets absorbed 9,954 square feet during the fourth quarter of 2020; therefore, the vacancy rate dropped minimally from 13.14% during the third quarter of 2020 to 13.07% this quarter. The weighted rental rate for the South Carolina portion of the Augusta | Aiken region averaged $2.96 per square foot during the fourth quarter of 2020.

Charleston

The Charleston industrial market has 59.92 million square feet of industrial inventory with 1.23 million square feet under construction within six buildings. There are also approximately 15 buildings proposed to be built within the Charleston market which would add an additional 4.02 million square feet to the industrial inventory. There were two buildings totaling approximately 1.24 million during the fourth quarter of 2020. Charleston submarkets absorbed 1.43 million square feet during the fourth quarter of 2020 led by the Summerville and Berkeley County submarkets. Due to positive absorption this quarter, the overall market vacancy decreased from 10.11% last quarter to 9.57% this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.57 per square foot.

Charlotte (South Carolina portion)

The South Carolina portion of the Charlotte submarket has an industrial inventory totaling 40.03 million square feet, and there are currently 87,500 square feet of warehouse space currently under construction. No new industrial buildings were delivered in the South Carolina portion of Charlotte this quarter. The Charlotte market posted negative 533,033 square feet at year-end, most of which was within two buildings. As a result, the overall quarterly market vacancy rate increased considerably from 9.76% last quarter to 11.09% during the fourth quarter of 2020. Average weighted rental rates for the remaining industrial space averaged $4.32 per square foot at year-end 2020.

Columbia

The Columbia industrial market is comprised of 73.21 million square feet. During the fourth quarter of 2020, the industrial market absorbed 187,125 square feet led by the manufacturing sector. No new industrial buildings were delivered to the Columbia market during the fourth quarter; however, five buildings are currently under construction which, upon completion, will add 1.82 million square feet to the market. Due to positive absorption, the quarterly vacancy rate dropped from 4.05% during the third quarter of 2020 to 3.81% during the fourth quarter of 2020. The overall average market weighted asking rental rate for available industrial space was $4.80 per square foot during the fourth quarter of this year.

Florence | Myrtle Beach

The Florence | Myrtle Beach market is comprised of 38.57 million square feet of industrial properties and absorbed 258,475 square feet during the fourth quarter of 2020; 350,000 square feet was absorbed within manufacturing space, while warehouse space posted a negative 91,525 square feet. No new buildings were delivered to the market during the fourth quarter of 2020, but construction continues on one warehouse which, upon completion, will add 109,200 square feet to the market. The vacancy rate decreased from 7.03% during the third quarter of 2020 to 6.36% at year-end 2020. The overall Florence | Myrtle Beach weighted rental rates decreased to $3.59 per square foot this quarter.

Greenville-Spartanburg

Comprised of approximately 214 million square feet, there are approximately 2.51 million square feet among 14 buildings under construction and another 2.66 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. There were two warehouses and one manufacturing facility delivered to the market this quarter adding 744,754 square feet to the overall inventory. During the fourth quarter of 2020, the market absorbed 1.73 million square feet. Highway 101 corridor was the most active submarket and absorbed 1.15 million square feet during the fourth quarter. The warehouse sector led the way in activity throughout the Greenville-Spartanburg industrial market and posted 90.39% of the absorption. Consequently, the quarterly vacancy rate decreased from 7.29% last quarter to 6.80% at year end. According to Costar, the overall asking weighted rental rate increased slightly from the third quarter and averaged $3.89 per square foot this quarter.

Savannah (South Carolina portion)

The Savannah market within South Carolina has approximately 10.32 million square feet of industrial space and the market posted a net negative absorption of 415,879 square feet, most of which was in manufacturing space and within two buildings. There is one 17,500-square-foot warehouse under construction, however, no new buildings delivered to the market during the fourth quarter of 2020. Due to negative absorption, the overall quarterly vacancy rate increased significantly from 2.88% last quarter to 6.91% this quarter. Savannah’s triple net weighted rental rate averaged $3.46 per square foot during the fourth quarter of 2020.

Market Forecast

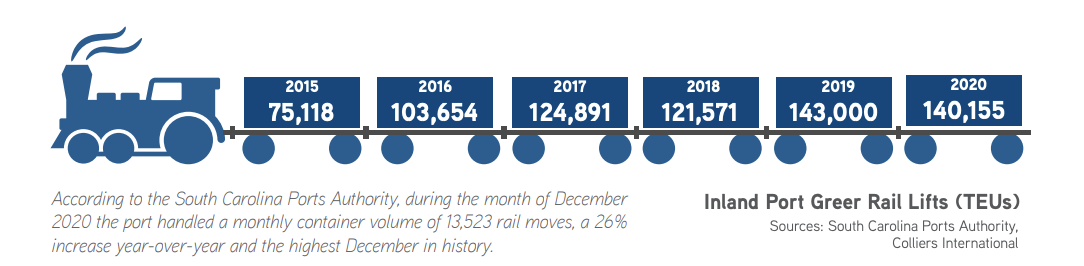

The Port of Charleston improvements are shifting industrial activity from the west coast to the east coast. Statewide planned infrastructure improvements and increased inland and coastal port activity will further boost industrial activity and demand. Supply chain optimization of existing manufacturers will increase demand throughout the state. Finally, a shift in logistics toward last-mile distribution is prompting industrial users to locate closer to residential areas for more efficient goods delivery versus existing around one main hub. South Carolina submarkets are a prime location to open new secondary hubs. Within the next few months, the speculative construction delivered will likely be absorbed and new development will be necessary to keep up with growing demand in South Carolina. Due to extraordinary growth; positive absorption, increasing rental rates and lowering vacancy rates are likely through 2021.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.