Colliers Report: Industrial supply and demand changes daily due to COVID-19

April 21, 2020

Research & Forecast Report

Q1-2020 GREENVILLE-SPARTANBURG | INDUSTRIAL

Key Takeaways

- Many industrial businesses remain open in order to manufacture and deliver necessities throughout the nation during the Coronavirus pandemic.

- Due to continuing demand, construction will be delayed but continues despite COVID-19 set-backs.

- The actual effects of the outbreak of COVID-19 on the industrial real estate sectors will not be realized for several quarters.

For additional commercial real estate news, check out our market reports here.

Demand accelerates within industrial sectors

Greenville-Spartanburg market activity was positive, but minimal throughout the first quarter of 2020. However, at the end of the first quarter the COVID-19 outbreak began altering the supply/demand chain on a daily basis. While many businesses switched to remote work environments, companies involved in the logistics chain were deemed essential. They continued to operate at an accelerated pace in order to deliver goods where they were needed throughout the nation. In addition, some industrial properties are being used for medical supplies or temporarily repurposed in order to make essential medical equipment when possible. While the industrial sectors of commercial real estate may fare better than others due to continued demand, the true effects of the Coronavirus will not be known for several quarters.

Greenville-Spartanburg market activity was positive, but minimal throughout the first quarter of 2020. However, at the end of the first quarter the COVID-19 outbreak began altering the supply/demand chain on a daily basis. While many businesses switched to remote work environments, companies involved in the logistics chain were deemed essential. They continued to operate at an accelerated pace in order to deliver goods where they were needed throughout the nation. In addition, some industrial properties are being used for medical supplies or temporarily repurposed in order to make essential medical equipment when possible. While the industrial sectors of commercial real estate may fare better than others due to continued demand, the true effects of the Coronavirus will not be known for several quarters.

Market Overview

Greenville-Spartanburg Market

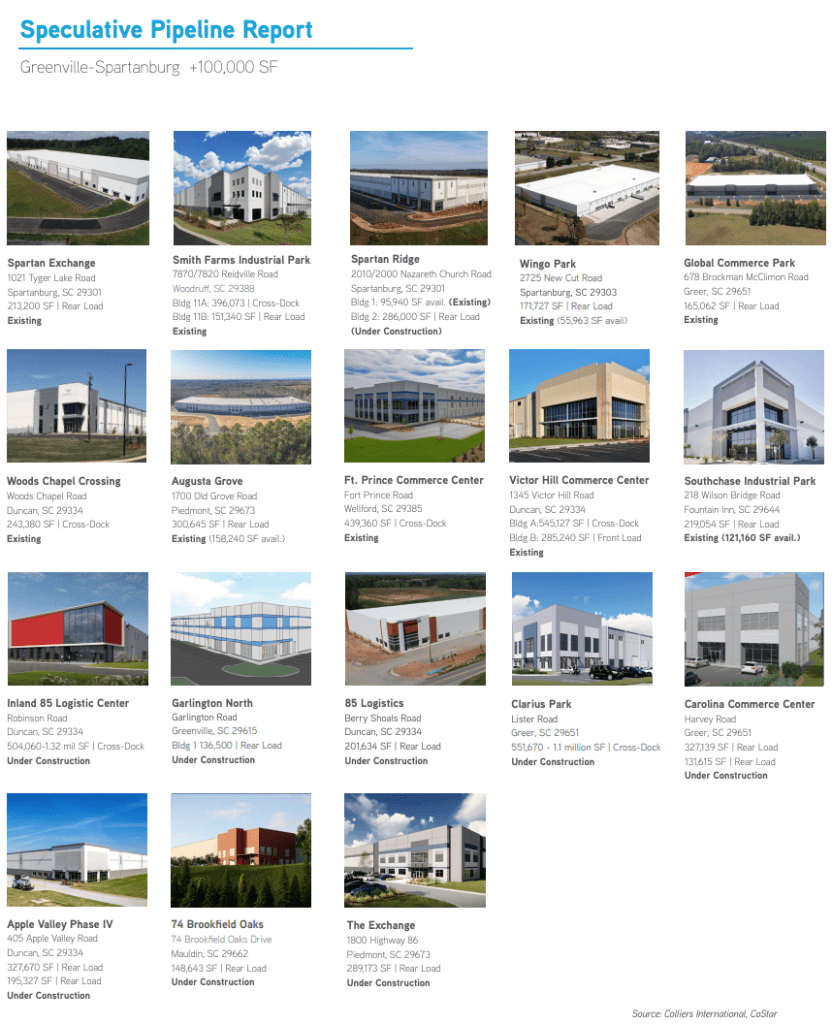

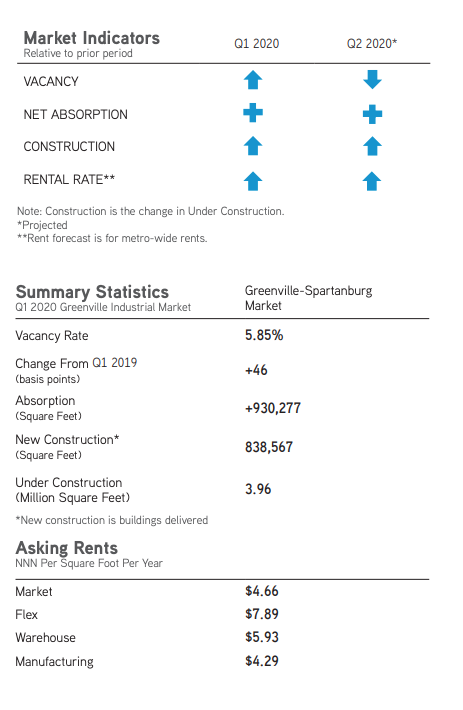

Comprised of approximately 211.94 million square feet, there are currently 3.96 million square feet among 20 buildings under construction and approximately 1.12 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the first quarter of 2020, 838,567 square feet of industrial buildings were delivered and 930,277 square feet were absorbed. Subsequently, the quarterly market vacancy rate increased slightly from 5.79% to 5.85%. The overall weighted rental rate during the first quarter of 2020 increased slightly over last quarter and averaged $4.66 per square foot.

Flex/R&D

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.48 million square feet with one 12,000-square-foot flex/R&D building under construction at 10 Webb Road in Greenville and approximately 1.12 million square feet proposed to begin construction. No new flex buildings were delivered to the market during the first quarter of 2020. The sector absorbed 23,428 square feet this quarter and the quarterly vacancy rate was 8.62%. The average weighted rental rate decreased slightly to $7.89 per square foot.

Significant Transactions

Within the Greenville-Spartanburg market, CoStar reported 29 signed leases, three were over 100,000 square feet – one tenant was undisclosed. There were also 30 sale transactions during the first quarter of 2020.

Sales

- For $184 million, Weston, Inc. purchased 37 industrial properties across North and South Carolina.

- For $5 million, Connelly Builders purchased an 80,000-square-foot manufacturing facility located at 7021 Augusta Road in Greenville. It included a sale/leaseback transaction.

- For $2 million, Erik Estrada purchased a 37,000-square-foot manufacturing facility at 3 Quality Way in Greenville.

Leases

- Electrolux leased an 156,000-square-foot warehouse located at 201 Schmidt Plaza Road in Anderson, South Carolina.

- Bontex leased an 100,000-square-foot warehouse located at 131 Retlaw Court in Duncan, South Carolina.

Capital Investment & Employment

Capital Investment & Employment

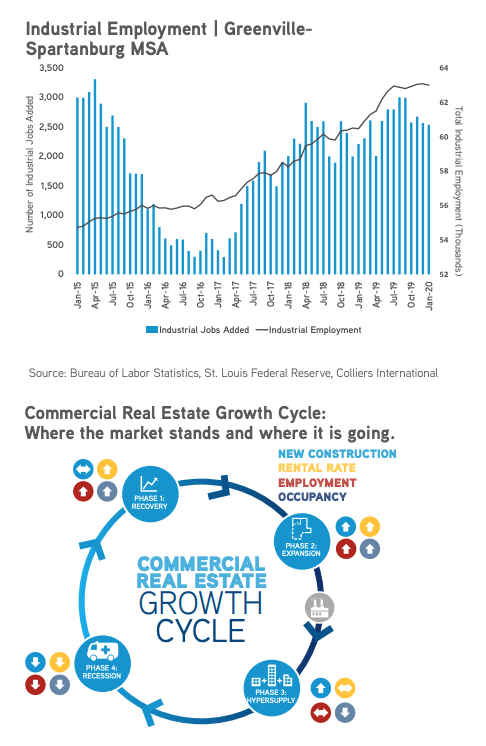

From April of 2019 through March of 2020, there were approximately $373.51 million in capital investments from new companies, accounting for 1,337 jobs. Existing company expansions accounted for $712.31 million in new capital, creating 3,150 additional jobs within the Greenville-Spartanburg region. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing and software, communications, solar farming and logistics. According to the Bureau of Labor Statistics data through January of 2020, 4,300 industrial jobs were added to the market in the past 12 months. In addition, industrial employment comprised 10.7% of the Greenville-Spartanburg total employment, or about 63,900 jobs regionally.

Market Forecast

Industrial activity in the Greenville-Spartanburg market was steady during the first quarter of 2020. There are currently 3.96 million square feet of industrial buildings currently under construction in the market. Despite construction progress delays during the COVID-19 outbreak and temporary business closings-demand is high and construction is still expected to eventually complete. Many essential businesses which are staying open across the nation are using the logistics chain to deliver necessary goods and services throughout the country; therefore, many industrial properties have remained open. While this seems positive for the industrial sector, the true effects of the Coronavirus will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate. The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.