Colliers Report: Logistics are essential amid COVID-19 outbreak

April 17, 2020Research & Forecast Report

Q1-2020 CHARLESTON | INDUSTRIAL

Key Takeaways

- Industrial activity was positive, but nominal during the first quarter of 2020.

- Construction deliveries are anticipated despite delays during the COVID-19 outbreak.

- The actual effects of the outbreak of COVID-19 on the industrial real estate sectors will not be realized for several quarters.

COVID-19 alters supply and demand

There was minimal industrial activity in the Charleston market throughout the first quarter of 2020. However, at the end of the first quarter the COVID-19 outbreak began altering the supply/demand chain on a daily basis. While many businesses switched to remote work environments, companies involved in the logistics chain were deemed essential. They continued to operate at an accelerated pace in order to deliver goods where they were needed throughout the nation. In addition, some industrial properties are being used for medical supplies or temporarily repurposed in order to make essential medical equipment when possible. While the industrial sectors of commercial real estate may fare better than others due to continued demand, the true effects of the Coronavirus will not be known for several quarters.

There was minimal industrial activity in the Charleston market throughout the first quarter of 2020. However, at the end of the first quarter the COVID-19 outbreak began altering the supply/demand chain on a daily basis. While many businesses switched to remote work environments, companies involved in the logistics chain were deemed essential. They continued to operate at an accelerated pace in order to deliver goods where they were needed throughout the nation. In addition, some industrial properties are being used for medical supplies or temporarily repurposed in order to make essential medical equipment when possible. While the industrial sectors of commercial real estate may fare better than others due to continued demand, the true effects of the Coronavirus will not be known for several quarters.

Market Overview

Overall Charleston industrial market

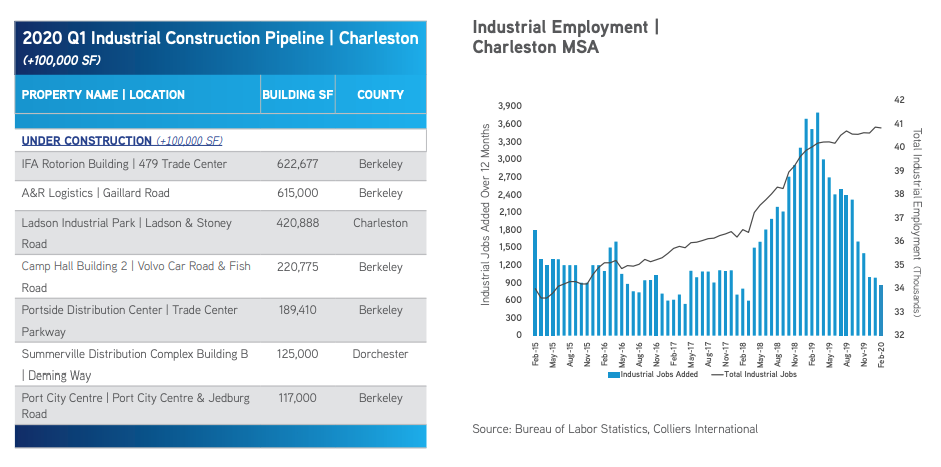

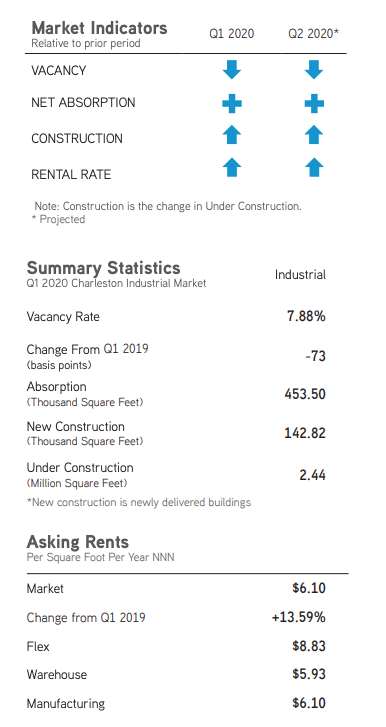

The Charleston industrial market has 57.26 million square feet of industrial inventory with approximately 2.44 million square feet under construction within 10 buildings. In addition, there are approximately 17 buildings proposed to be built within the Charleston market which would add an additional 4.87 million square feet to the industrial inventory. The outbreak of the Coronavirus at the end of the first quarter may delay construction activity due to businesses temporarily closing and lack of access to construction materials; however, the construction is expected to eventually be completed. There were no new buildings delivered to the market this quarter. The Charleston industrial market absorbed 142,818 square feet during the first quarter of 2020; therefore, the overall market vacancy dropped slightly from 8.13% during the fourth quarter of 2019 to 7.88% this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.10 per square foot.

Warehouse/Distribution

The Charleston industrial market warehouse/distribution sector is comprised of 41.73 million square feet within 845 buildings and comprises 72.88% of the Charleston industrial market. There are 9 warehouses totaling 1.81 million square feet under construction throughout the Charleston market, and an additional 15 warehouses totaling 4.34 million square feet are proposed to be built. During the first quarter of 2020 Charleston warehouses absorbed 136,892 square feet, 101,823 square feet was absorbed within the Hanahan/North Rhett submarket. The warehouse/distribution sector vacancy rate decreased slightly to 9.14% this quarter due to positive absorption. The average triple net weighted warehouse rental rate increased from $5.83 per square foot last quarter $5.93 per square foot to begin the year.

Manufacturing

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.07 million square feet of manufacturing space within the Charleston market. There is one building under construction which, upon completion, will add 622,677 square feet of inventory to the market and one 520,000-square-foot building proposed to be built; both are within the Summerville submarket. Few manufacturing spaces are available within the Charleston market and, because of this, no absorption occurred within the Charleston manufacturing sector this quarter. The overall manufacturing vacancy rate remained 4.13% and triple net weighted rental rate during the first quarter of this year averaged $6.10 per square foot due to the lack of quality space remaining.

Flex/R&D

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.46 million square feet. One 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector absorbed 5,926 square feet during the first quarter of 2020 and the vacancy rate within the flex/R&D sector dropped minimally to 5.41%. Due to a lack of quality space remaining in the market, the average triple net weighted rental rate decreased from $9.53 per square foot at the end of last year to $8.83 per square foot this quarter.

Capital Investment & Employment

There have been approximately $239.08 million in capital investments within the Charleston industrial market from the second quarter of 2019 through the first quarter of 2020. The capital investments produced 1,795 jobs, with the types of investors including technology, brewing and distilleries of craft beers, general and medical manufacturing, information technology and logistics. Also, according to the Federal Reserve data through February of 2020, there have been 7,100 jobs added in the Charleston metropolitan statistical area, 812 of which were industrial jobs- 37.56% of those were manufacturing jobs. Overall non-farm employment totals 379,800. The employment rate is still strong at 97.5%; however, in the next few months the numbers are expected to fluctuate due to the effects of COVID-19.

Significant Transactions

There were 9 Charleston industrial sales reported by CoStar during the first quarter of 2020, including a $184 million, 37-property portfolio including two Charleston industrial properties. Leasing activity increased from the fourth quarter of last year to the first quarter of this year. According to CoStar, there were 34 industrial leases executed this quarter.

Sales

- For $3.05 million, Brad Whitley purchased the 85,325-square-foot manufacturing facility located at 111 Old Depot Road.

Leases

- Goodwill Services, Inc. leased 174,920 square feet at 1008-1010 Trident Street in Hanahan, South Carolina.

- Gildan leased 75,760 square feet at 1031 Legrand Boulevard in Charleston, South Carolina.

- XPO Logistics leased 52,000 square feet at 4279 Crosspoint Drive in Ladson, South Carolina.

Market Forecast

Charleston industrial activity during the first quarter of 2020 was positive, but minimal. Construction deliveries are anticipated to eventually deliver despite possible progress delays during the COVID-19 outbreak. Many essential businesses which are staying open across the nation are using the logistics chain to deliver necessary goods and services throughout the country; therefore, several industrial properties have remained open. In addition, industrial buildings may be used temporarily for medical purposes to combat the Coronavirus or to manufacture necessary equipment. While this seems positive for the industrial sector, the true effects of the Coronavirus will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.