Colliers Report: Shifting supply chain trends and e-commerce bolster industrial demand in Greenville-Spartanburg

February 3, 2021Research & Forecast Report

Q4-2020 GREENVILLE-SPARTANBURG | INDUSTRIAL

Key Takeaways

- During the fourth quarter of 2020, Greenville-Spartanburg industrial market absorbed 1.73 million square feet.

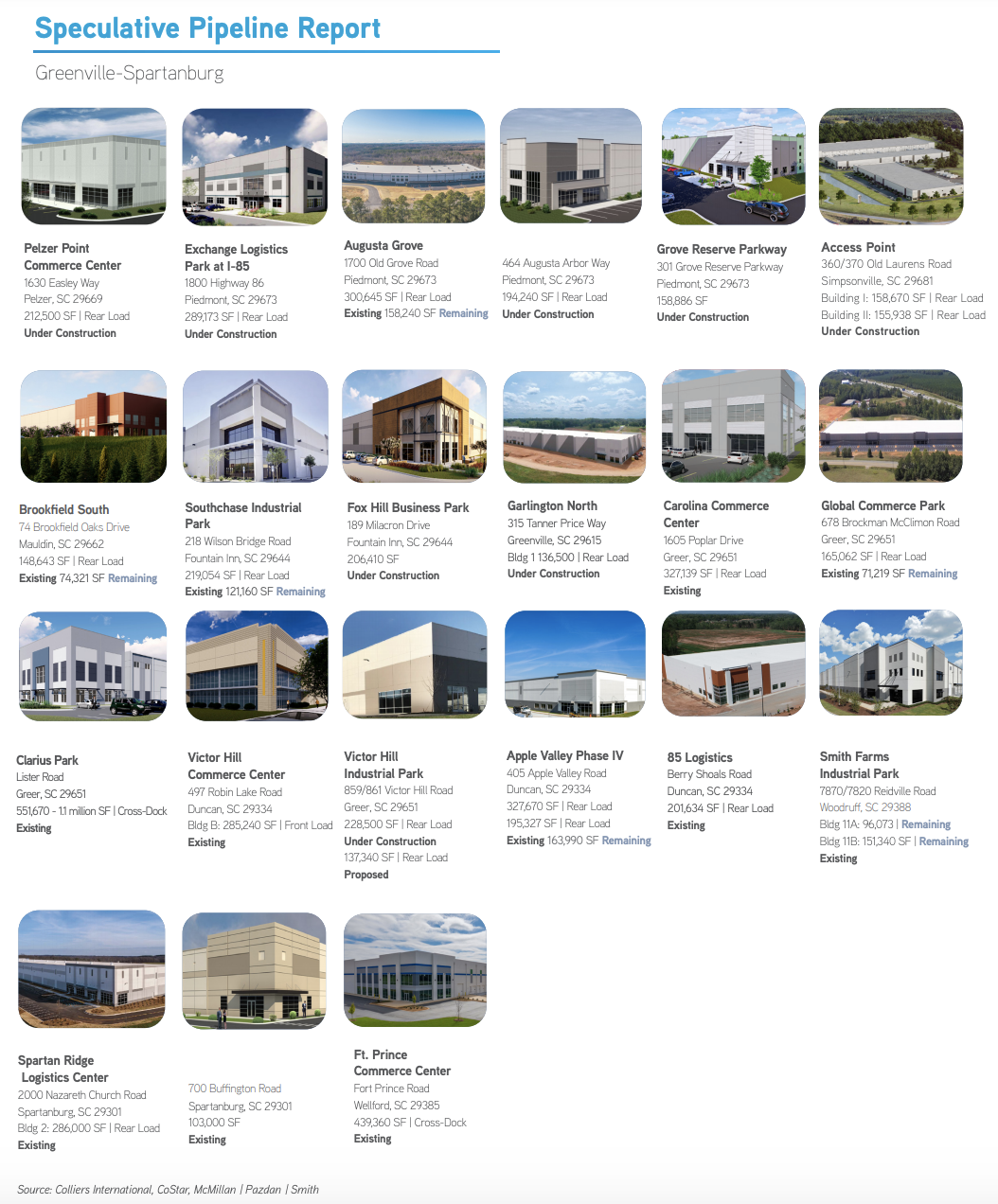

- There are approximately 2.51 million square feet among 14 buildings under construction and another 2.66 million square feet proposed to begin construction.

- Within the next three months, the delivered speculative construction will likely be absorbed and new development will be crucial to keep up with growing demand.

For additional commercial real estate news, check out our market reports here.

New development will be necessary in 2021

As onshoring and supply chain optimization continues, the Greenville-Spartanburg market will gain new industrial development and expansions through 2022. Manufacturers are moving portions of their operations from overseas to North America and creating demand for additional industrial space throughout the region. Current aerospace and automotive industries are attracting new companies to the market who can contribute to their ever changing manufacturing processes and supply chains. E-commerce, cold storage and warehouse/distribution centers continue to need additional space due to disruption caused by the pandemic. Within the next three months as the remaining speculative space is absorbed, new development will begin to keep pace with ongoing demand. Numerous leases and sales were executed in 2020. Based on these booked transactions, a decrease in overall vacancy is expected with positive net absorption immediately in the first two quarters.

As onshoring and supply chain optimization continues, the Greenville-Spartanburg market will gain new industrial development and expansions through 2022. Manufacturers are moving portions of their operations from overseas to North America and creating demand for additional industrial space throughout the region. Current aerospace and automotive industries are attracting new companies to the market who can contribute to their ever changing manufacturing processes and supply chains. E-commerce, cold storage and warehouse/distribution centers continue to need additional space due to disruption caused by the pandemic. Within the next three months as the remaining speculative space is absorbed, new development will begin to keep pace with ongoing demand. Numerous leases and sales were executed in 2020. Based on these booked transactions, a decrease in overall vacancy is expected with positive net absorption immediately in the first two quarters.

Market Overview

Greenville-Spartanburg Market Annual Recap

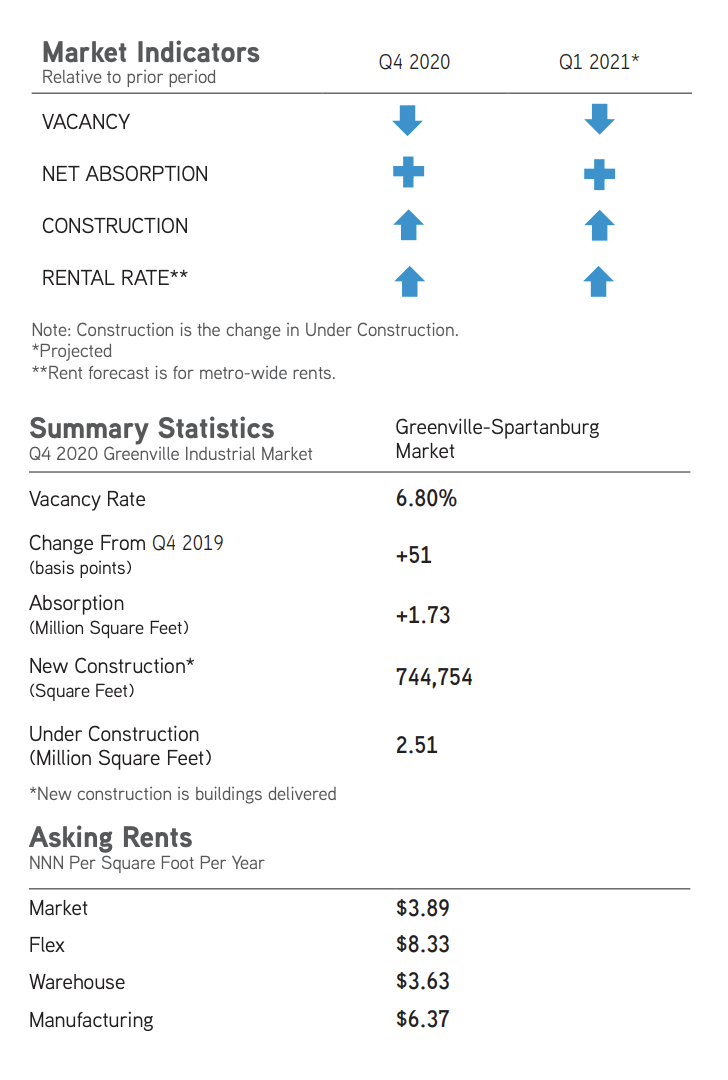

Over the past year, the Greenville-Spartanburg industrial market absorbed 1.99 million square feet. Even though 2020 was the year of the pandemic, industrial activity increased dramatically during the third and fourth quarters. Two-thirds of the speculative construction delivered throughout the year was absorbed. Despite 3.89 million in new construction deliveries in 2020, the overall quarterly vacancy rate only increased by 51 basis points.

Greenville-Spartanburg Market

Comprised of approximately 214 million square feet, there are approximately 2.51 million square feet among 14 buildings under construction and another 2.66 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the fourth quarter of 2020, the market absorbed 1.73 million square feet. Highway 101 corridor was the most active submarket and absorbed 1.15 million square feet during the fourth quarter. According to Costar, the warehouse sector led the way in activity throughout the Greenville-Spartanburg industrial market and posted 90.39% of the absorption. Consequently, the quarterly vacancy rate decreased from 7.29% last quarter to 6.80% at year end. Costar also reported the overall asking weighted rental rate increased slightly from the third quarter and averaged $3.89 per square foot.

Comprised of approximately 214 million square feet, there are approximately 2.51 million square feet among 14 buildings under construction and another 2.66 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the fourth quarter of 2020, the market absorbed 1.73 million square feet. Highway 101 corridor was the most active submarket and absorbed 1.15 million square feet during the fourth quarter. According to Costar, the warehouse sector led the way in activity throughout the Greenville-Spartanburg industrial market and posted 90.39% of the absorption. Consequently, the quarterly vacancy rate decreased from 7.29% last quarter to 6.80% at year end. Costar also reported the overall asking weighted rental rate increased slightly from the third quarter and averaged $3.89 per square foot.

Flex/R&D

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.45 million square feet. There are currently two flex buildings proposing to add 114,500 square feet to the Greenville-Spartanburg market. This sector posted negative absorption of 2,007 square feet during the fourth quarter of 2020, increasing the quarterly vacancy rate slightly from 8.64% last quarter versus 8.68% during the fourth quarter of 2020. According to Costar, the average asking weighted rental rate increased slightly to $8.33 per square foot.

Significant Transactions

CoStar reported 31 signed leases and 44 sale transactions during the third quarter of 2020.

Sales

- Exeter Property Group purchased an 11.32 million-square-foot, 52-property portfolio for $239.4 million including nine properties throughout South Carolina.

- Pattillo Industrial Real Estate purchased a 148,643-square-foot distribution center for $13.43 million in Greenville at 74 Brookfield Oaks Drive.

- ABS Management & Development Corporation purchased a 525,262-square-foot warehouse for $13 million in Fountain Inn at 1372 North Old Laurens Road.

- Lexington Property Trust purchased a 213,200-square-foot facility for $18.6 million at 1021 Tyger Lake Rd in Spartanburg.

Leases

- Minghua USA, Inc. leased 134,000 square feet at 1121 Woods Chapel Road in Duncan.

- Upward Sports leased 60,000 square feet at a warehouse located at 1300 Hayne Road in Spartanburg.

- Revman leased 100,000 square feet at 1335 Hayne Street in Spartanburg.

- DHL Supply Chain leased 131,614 square feet at 1601 Poplar Drive Extension in Greer.

Capital Investments and Employment

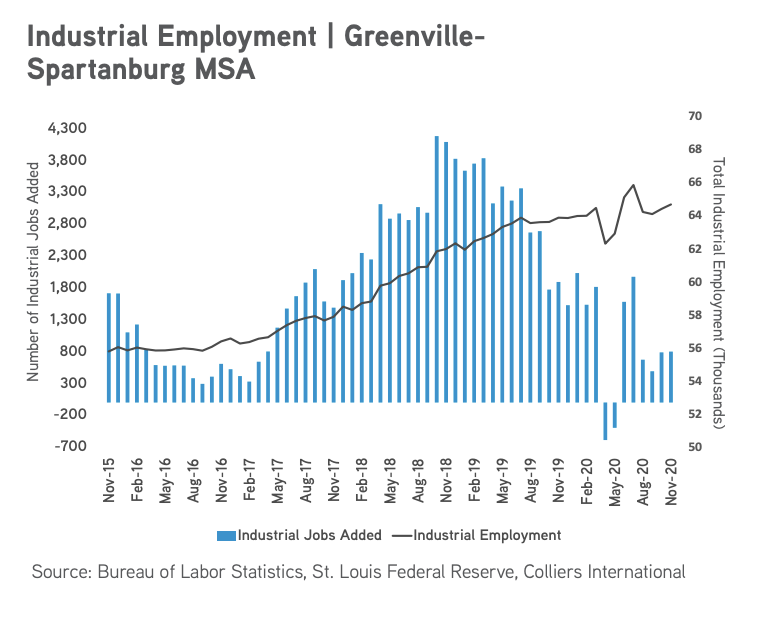

During 2020 there were approximately $452.31 million in capital investments from new companies, accounting for 1,261 jobs. Existing company expansions accounted for $840.07 million in new capital, creating 1,474 additional jobs in Greenville-Spartanburg. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing, e-commerce fulfillment and software communications. The Bureau of Labor Statistics data reported there are 798 more industrial jobs in November of 2020 than there were in November of 2019. Total employment has increased by 1.3% over the past 12 months and is showing signs of normalizing as people return to work and vaccine distribution begins. The unemployment rate is steadily decreasing month-by-month. As of November 2020, the Greenville-Mauldin-Easley MSA unemployment rate declined to 3.6% and in Spartanburg it decreased to 4.3%.

During 2020 there were approximately $452.31 million in capital investments from new companies, accounting for 1,261 jobs. Existing company expansions accounted for $840.07 million in new capital, creating 1,474 additional jobs in Greenville-Spartanburg. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing, e-commerce fulfillment and software communications. The Bureau of Labor Statistics data reported there are 798 more industrial jobs in November of 2020 than there were in November of 2019. Total employment has increased by 1.3% over the past 12 months and is showing signs of normalizing as people return to work and vaccine distribution begins. The unemployment rate is steadily decreasing month-by-month. As of November 2020, the Greenville-Mauldin-Easley MSA unemployment rate declined to 3.6% and in Spartanburg it decreased to 4.3%.

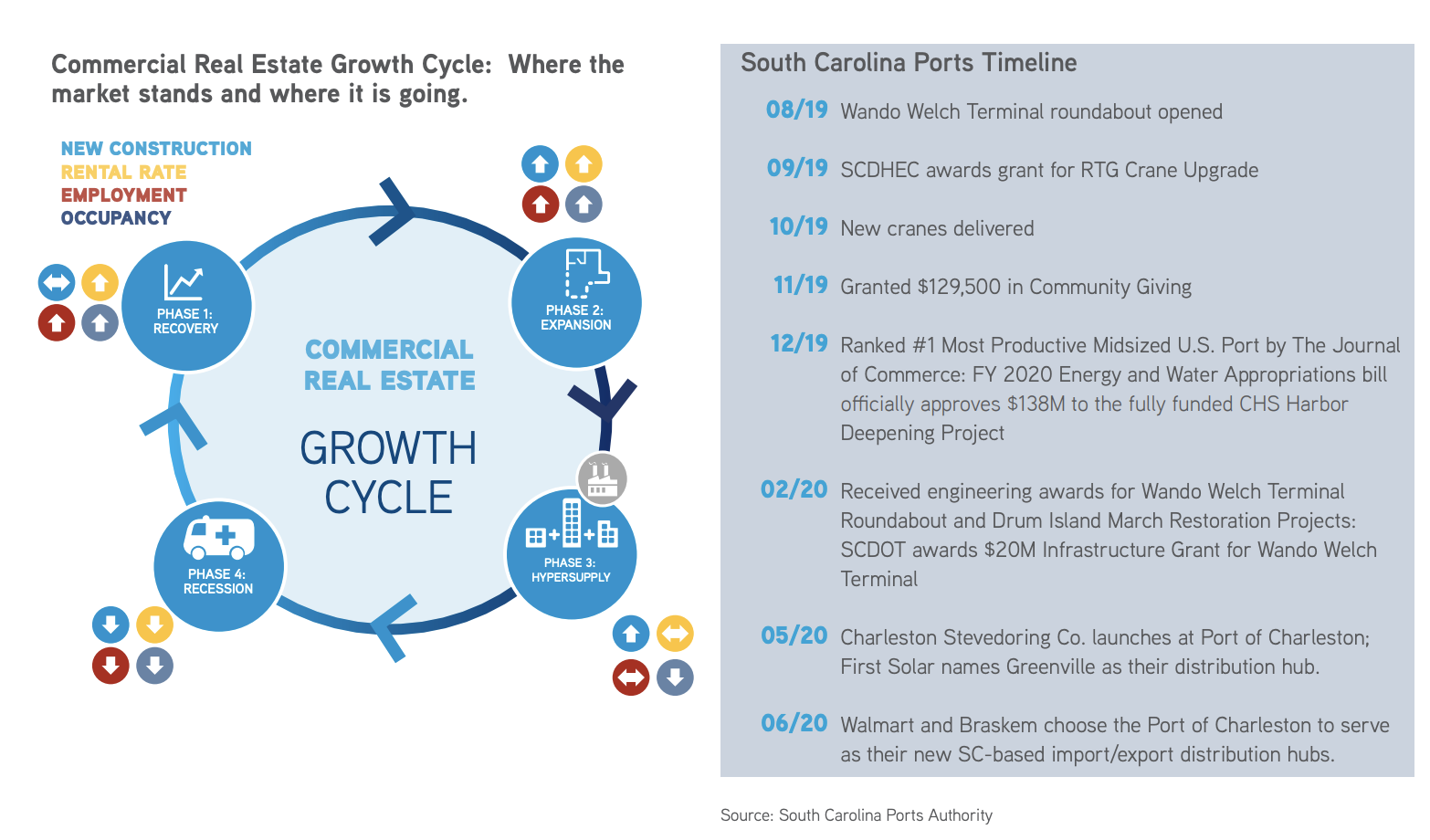

Market Forecast

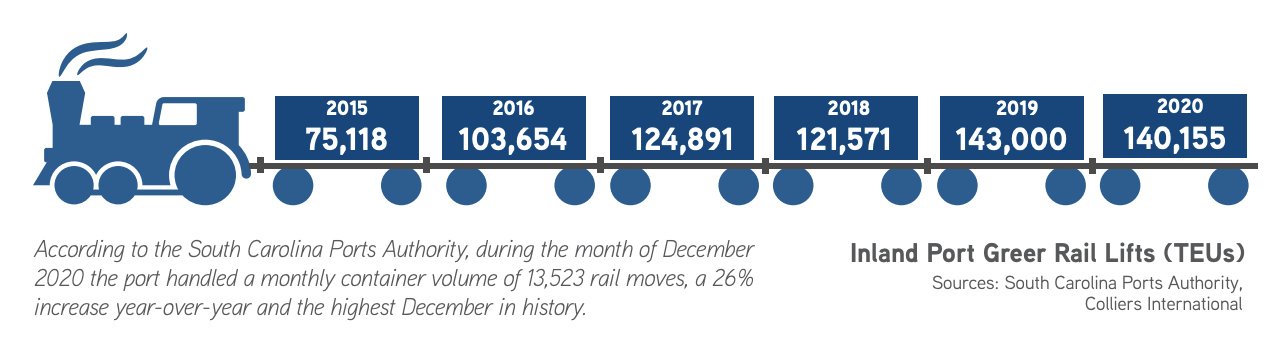

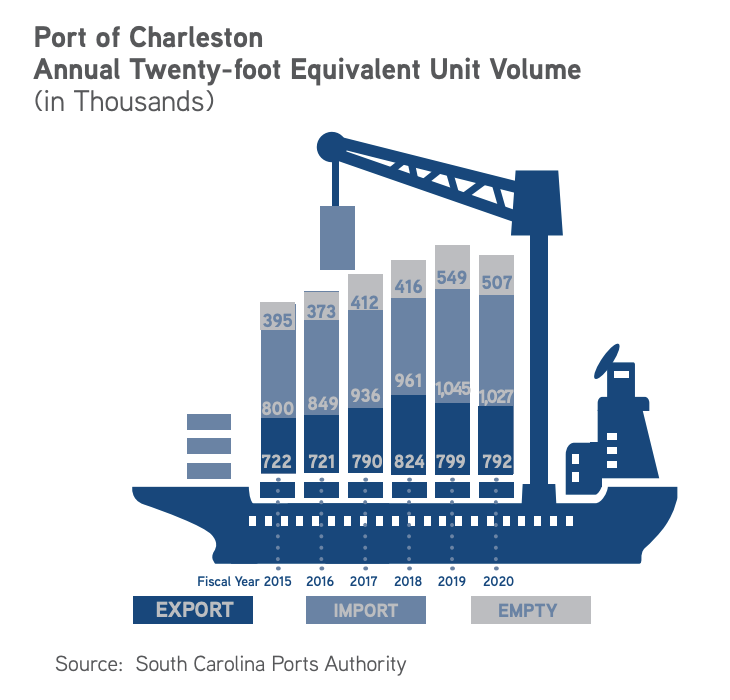

The Greenville-Spartanburg market can expect major announcements in the next 3-6 months as manufacturers relocate portions of their operations from overseas to North America. The Port of Charleston improvements are shifting industrial activity from the west coast to the east coast. Statewide planned infrastructure improvements and increased inland and coastal port activity will further boost industrial activity and demand. BMW will likely draw new suppliers to the region to support Plant Spartanburg’s new model rollouts. Supply chain optimization of existing Greenville-Spartanburg manufacturers will increase demand in the area. Finally, a shift in logistics towards last-mile distribution is prompting industrial users to locate closer to residential areas for more efficient goods delivery versus existing around one main hub. The Greenville-Spartanburg market is a prime location to open new secondary hubs. Within the next three months, the speculative construction delivered will likely be absorbed and new development will be necessary to keep up with growing demand.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.