Colliers Report: Single tenant investment demand is high – supply is lacking

August 23, 2021Commercial Real Estate Research & Forecast Report

Single tenant investment demand is high – supply is lacking

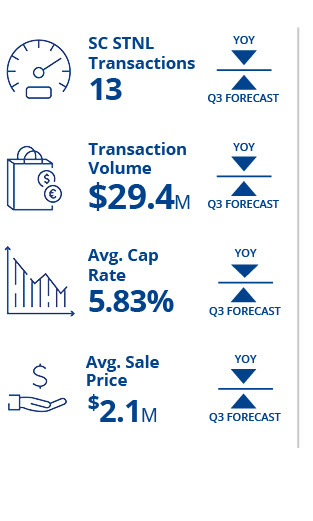

Market Highlights

Cap rates remained compressed with a nominal average change in single tenant net lease assets during the first half of 2021. Overall, demand for quality investment-grade credit properties has remained high while supply has continued to be a challenge for investors.

Click here to read the full report.

Key Takeaways

- Capitalization rates for single tenant investments continue to compress as demand increases

- Single tenant deal volume was moderate

- Lack of supply is a challenge

Summary

Due to minimal returns on the higher quality assets, these short term lease deals have become much more attractive to investors than they have been in years prior. As the country continues to open up we will see increased transaction volume, especially in activity-based retail like gyms and movie theatres that were forced to close during the pandemic.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 67 countries, our more than 15,000 enterprising professionals work collaboratively to provide expert advice to real estate occupiers, owners and investors. For more than 25 years, our experienced leadership with significant insider ownership has delivered compound annual investment returns of almost 20% for shareholders. With annualized revenues of $3.0 billion ($3.3 billion including affiliates) and $40 billion of assets under management, we maximize the potential of property and accelerate the success of our clients and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.