Colliers Report: South Carolina industrial construction delivers despite the pandemic

August 5, 2020Research & Forecast Report

Q2-2020 SOUTH CAROLINA | INDUSTRIAL

Key Takeaways

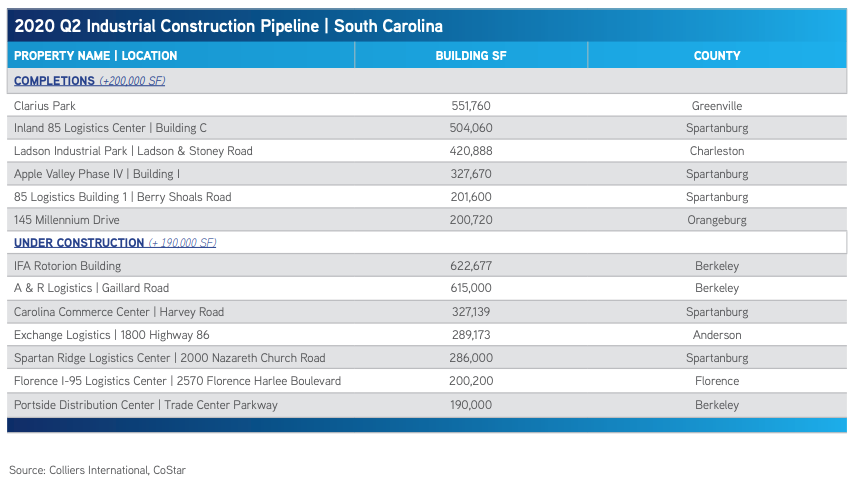

- Despite predictions of construction delays, the South Carolina industrial market had 3.01 million square feet of construction completions during the second quarter of 2020.

- Vacancy rate increased this quarter due to speculative construction deliveries; however, these vacancies are expected to be absorbed by year-end.

- Tertiary markets are becoming popular for new residents; therefore, submarkets throughout the state may see an increase in demand for housing. New residents will be positive for the workforce shortage.

For additional commercial real estate news, check out our market reports here.

Quarterly S.C. Market Overview

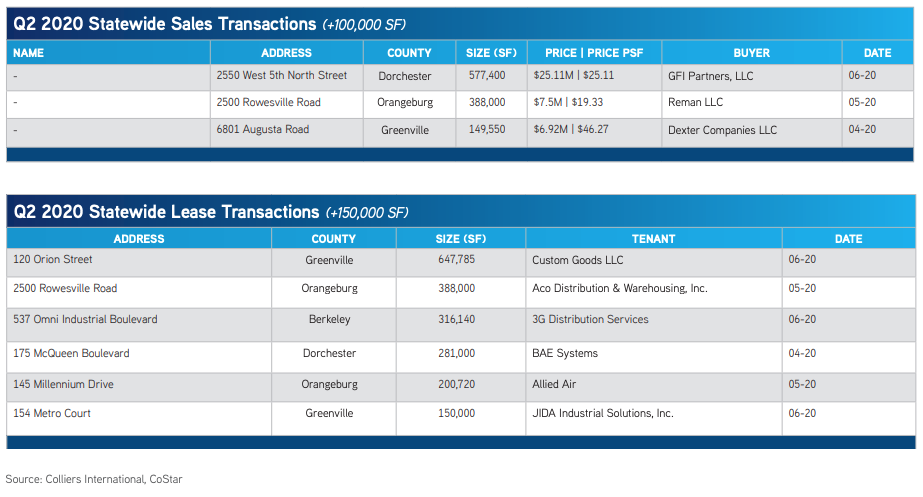

The South Carolina industrial market is comprised of 447,47 million square feet within 6,960 buildings. During the second quarter of 2020, construction activity completed despite the pandemic and the market added 14 buildings totaling approximately 3.01 million square feet throughout South Carolina. Also, there are 19 buildings totaling 4.12 million square feet, in addition to 35 buildings proposed to be built which will add approximately 6.66 million throughout the state upon completion. The South Carolina industrial markets absorbed 1.64 million square feet this quarter led by Columbia’s absorption of 479,072 square feet. Due to the vast amount of construction deliveries throughout South Carolina, the vacancy rate increased from 7.09% last quarter to 7.35% this quarter. The South Carolina triple net market rental rate for the remaining available industrial space averaged $4.20 per square foot during the second quarter of 2020.

Augusta | Aiken (South Carolina portion)

The South Carolina portion of the Augusta | Aiken market is comprised of 13.59 million square feet, over half of which is manufacturing space. No new industrial buildings were delivered to this market; however, the 40,000-square-foot AmbioPharm expansion continued construction. Augusta | Aiken submarkets absorbed 26,826 square feet during the second quarter of 2020, most of the absorption was in manufacturing space. The vacancy rate decreased slightly from 13.93% last quarter to 13.73% due to the small amount of positive absorption. The weighted rental rate for the South Carolina portion of the Augusta | Aiken region averaged $2.91 per square foot during the second quarter of 2020.

Charleston

The Charleston industrial market has 58.05 million square feet of industrial inventory with 1.67 million square feet under construction. In addition, there are approximately 18 buildings proposed to be built within the Charleston market which would add an additional 4.70 million square feet to the industrial inventory. The Charleston submarkets posted a negative absorption of 154,849 square feet because there were two nearly-vacant industrial buildings totaling 545,000 square feet delivered within the Charleston market. Due to new construction deliveries, the overall market vacancy rose from 8.85% last quarter to 9.97% this quarter. The overall market average triple net weighted rental rate decreased this quarter to $5.95 per square foot.

Charlotte (South Carolina portion)

The South Carolina portion of the Charlotte submarket has an industrial inventory totaling 40.17 million square feet, and there are currently 87,500 square feet of warehouse space currently under construction. Two warehouses totaling 182,089 square feet were delivered to the Charlotte market during the second quarter of 2020. The Charlotte market absorbed 416,427 square feet, 315,360 square feet of the positive absorption was within warehouse space. As a result, the overall quarterly market vacancy rate decreased from 10.17% during the first quarter to 9.54% during the second quarter of 2020. Average weighted rental rates for the remaining industrial space averaged $4.43 per square foot at mid-year 2020.

Columbia

The Columbia industrial market is comprised of 73.10 million square feet. During the second quarter of 2020, the market absorbed 479,072 square feet. Orangeburg County was the submarket with the highest absorption of 200,720 square feet followed by Northeast Columbia where 146,735 square feet was absorbed. One 200,720-square-foot building located at 145 Millennium Drive was delivered to the Orangeburg submarket, and there are two buildings under construction which, upon completion, will add 245,000 square feet to the market. Due to positive absorption, the quarterly vacancy rate dropped from 4.86% during the first quarter of 2020 to 4.47% this quarter. The overall average market rental rate for available industrial space was $4.12 per square foot this quarter.

Florence | Myrtle Beach

The Florence | Myrtle Beach market is comprised of 38.37 million square feet of industrial properties and absorbed 465,938 square feet during the second quarter of 2020, all of the positive absorption occurred within manufacturing space. No new buildings were delivered to the market during the second quarter of 2020, but construction continues on two warehouses which, upon completion, will add 309,400 square feet to the market. Due to the positive absorption this quarter, the vacancy rate decreased from 7.95% last quarter to 6.73% this quarter. The overall Florence | Myrtle Beach weighted rental rates increased to $3.34 per square foot at mid-year.

Greenville-Spartanburg

Comprised of approximately 213.86 million square feet, there are currently 1.76 million square feet among 9 buildings under construction and approximately 1.97 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the second quarter of 2020, the market absorbed 117,104 square feet; however, there were 2.08 million square feet delivered to the market. Subsequently, the quarterly vacancy rate rose from 6.20% last quarter to 7.11% during the second quarter of this year. The overall weighted rental rate during the second quarter of 2020 decreased slightly from last quarter and averaged $3.61 per square foot.

Savannah (South Carolina portion)

The Savannah market within South Carolina has 10.32 million square feet of industrial space and the market absorbed 231,274 square feet- manufacturing and warehouse space both absorbed over 100,000 square feet. There is one 17,500-square-foot warehouse under construction, however, no new buildings delivered to the market during the second quarter of 2020. Due to positive absorption, the overall quarterly vacancy rate decreased from 5.72% last quarter to 3.47% this quarter. Savannah’s triple net weighted rental rate averaged $4.72 per square foot during the second quarter of 2020.

Market Forecast

Thanks to the rising popularity of locating to tertiary markets and affordable housing options throughout the state, demand will likely increase due to new residents in South Carolina. In addition, an influx of new residents will be positive for the labor pool, adding more employees to fill jobs. Industrial construction deliveries were completed this quarter despite the Coronavirus; demand for the speculative space is strong enough to post positive absorption and lower vacancy rates throughout year-end. In addition, the delivery of high-quality space throughout the market will push the average rental rate up throughout South Carolina markets. While this all appears positive for the industrial sector, the true effects of the pandemic will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.