Colliers Report: Suburban offices draw new tenants

April 2, 2019

Research & Forecast Report

Q1-2019 CHARLESTON | OFFICE

Key Takeaways

As new construction is delivered to the market, vacancy rates and rental rates are expected to rise.

As new construction is delivered to the market, vacancy rates and rental rates are expected to rise.- The demand in the suburban submarkets is strong due to population growth within the region.

Commuters and new residents fill jobs

As the Charleston region’s business climate thrives, new jobs are being created faster than they can be filled. While the job creation pace is slower than it was one year ago, there are still 364,000 non-farm jobs in the Charleston Metropolitan Area. The Charleston labor force needs employees to fill these available jobs, because within the metro area 97.2% of the employable residents already have jobs. As the region continues to prosper, the new jobs will need to be filled by employees commuting into the Charleston Metro Area from the surrounding regions, or by people moving to the area. According to the Charleston Chamber of Commerce, the Charleston Metro Area is growing by 38 people per day; while 10 of those are attributable to new births, 28 of them are new residents and possible employees moving to the area. In addition, Charleston is attractive to out-of-town people due to the city receiving high accolades, including being named by Milken #16 in the “Top 25 Best Performing Large Cities – where America’s jobs are created and sustained”. In addition Charleston was acclaimed for strong performance in both the five- and one-year high-tech GDP growth (ranked #12 and #5, respectively). All of these factors will draw both commuters and out-of-town prospects to the Charleston Metropolitan Area in order to fill jobs.

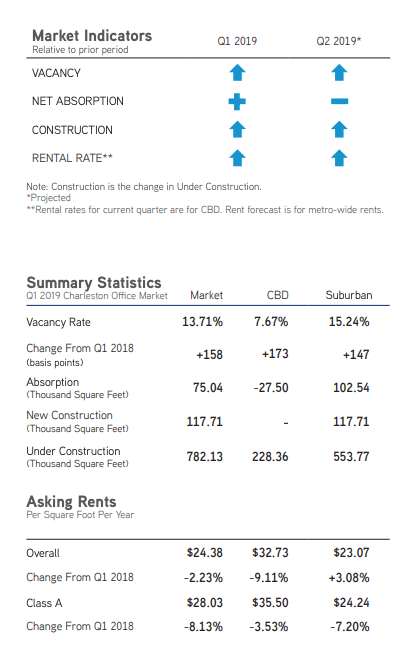

Market Conditions

The Charleston office market is comprised of 13,510,054 square feet in 389 office buildings within seven Charleston submarkets. Two new office buildings were delivered to the market this quarter, adding 117,714 square feet to the market. The overall office market absorbed 75,039 square feet during the first quarter of 2019; the central business district’s net negative absorption of 27,496 square feet was offset by the suburban absorption of 102,535 square feet. The overall vacancy rate rose again from 13.52% last quarter to 13.71% during the first quarter of 2019. Due to rapid quarter-over-quarter construction delivery, the office market demand has been unable to catch up with the market supply. There are currently 14 buildings under construction throughout the market which, when completed, will add 782,126 square feet to the market. Higher quality available space and new construction delivering to the market caused the average weighted rental rate to rise from $23.55 per square foot during the fourth quarter of last year to $24.38 per square foot during the first quarter of 2019. Likewise, the overall average Class A weighted rental rate increased from $25.43 per square foot during the fourth quarter of 2018 to $28.03 per square foot.

Central Business District

The central business district has 86 buildings totaling 2,727,015 square feet in Charleston, and the submarket posted a net negative absorption of 27,496 square feet this quarter; 35 Prioleau Street and 174 Meeting Street contributed a net negative 29,015 square feet. During the first quarter of 2019, no new construction was delivered to the downtown sector. The central business district vacancy rate rose from 6.66% last quarter to 7.67% during the first quarter of 2019. The average weighted rental rate for the remaining downtown availabilities increased from $32.29 per square foot during the fourth quarter of last year to $32.73 per square foot this quarter indicating there are high quality offices available.

Suburban Conditions

The Charleston suburban office market is comprised of 303 office buildings totaling 10,783,039 square feet and two buildings adding 117,714 square feet to the office suburbs were delivered this quarter. The suburbs are in high demand and absorbed 102,535 square feet this quarter, the Class A suburban market had the most activity and absorbed 94,856 square feet. Despite the positive absorption due to high demand, the suburban office vacancy rate rose from 14.78% during the fourth quarter of 2018 to 15.24% during the first quarter of 2019. New construction deliveries each quarter are causing the weighted rental rates to rise quarter-over-quarter. The overall suburban market average weighted rental rate for the remaining availabilities rose from $22.56 per square foot during the fourth quarter of last year to $23.07 per square foot this quarter.

Significant Transactions

According to CoStar, during the first quarter of 2019, 110 office leases were executed in the Charleston market, including a 40,000-square-foot undisclosed tenant who signed a lease at 1156 Bowman Road and two undisclosed tenants who signed leases on the seventh and eighth floors of 22 Westedge Street in Charleston. CoStar reported 31 office sale transactions from January 2019 through March 2019, although some of the largest sales were by undisclosed buyers and one included an office condominium.

Sales

- The Cigna Building, located at 16 Fairchild Street in Charleston, is a 67,744-square-foot Class A office building and was purchased for $8 million by The Becker Organization.

- A 13,381-square-foot Class B office building located at 897 Von Kolnitz Road was purchased by White & White Investments, LLC for $3.15 million.

Construction Pipeline

Construction Pipeline

Construction activity is robust in the Charleston market. Currently, there are 782,126 square feet of office space under construction.

Under Construction

- 22 Westedge Street continues construction on a 153,358-square-foot office building located within the central business district.

- Ferry Wharf construction continues at 75 Port City Landing and, when completed, will be a 125,000-square-foot office building.

- 4920 Ohear Avenue has a 110,000-square-foot Class A office building under construction within the Upper North Charleston submarket.

- A 75,000-square-foot office is under construction on Broad Street in the Charleston central business district.

- At Ingleside Gateway, construction began on a 60,000-square-foot Class A office building.

- 4854 Ohear Avenue is the 60,000-square-foot site of the ongoing redevelopment at Garco Mill.

- Truluck Center, located at 1012 Saint Andrews Boulevard in West Ashley, has a 32,000-square-foot Class A office building under construction.

- 1014 Saint Andrews Boulevard is the site of a 32,000-square-foot Class A office building where construction began this quarter.

- A 30,000-square-foot office on Rose Drive is under construction in Summerville.

- A 26,400-square-foot Class B office building is currently under construction on Ingleside Boulevard in the Lower North Charleston submarket.

- 297 Seven Farms Drive continues construction on a 25,500-square-foot Class A office in Daniel Island.

- 108 Benton’s Lodge Road in the Summerville/Goose Creek submarket has a 20,000-square-foot Class B office building under construction.

- 1070 Jenkins Road has a 20,000-square-foot Class B office building under construction in the West Ashley submarket.

- On Tract-A-2-1 on Ingleside Boulevard is the future site of a 12,868-square-foot Class B office building which is now under construction.

Completions

Completions

- A 100,000-square-foot Class A office building completed at Nexton with the address of 5500 Front Street in Summerville.

- A 17,714-square-foot Class B office building located at 730 West Coleman Boulevard was completed in Mt. Pleasant.

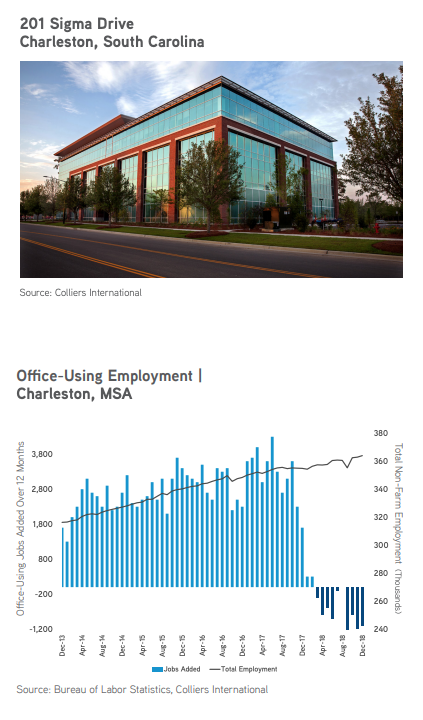

Office-Using Employment

Office-using employment covers jobs related to the professional and business services, financial activities and information sectors. According to the most recent December 2018 data from the Bureau of Labor Statistics, there were 1,100 fewer office-using jobs during December of 2018 than there were in December of last year. The addition of office-using jobs peaked in the summer of 2017, in Charleston and there were a lot of jobs being added at that time as the economy was recovering. However, total non-farm employment has increased by 9,100 jobs in the past 12 months, and as of December 2018 and according to the Bureau of Labor Statistics, the unemployment rate remains at an all-time low of 2.8%.

Market Forecast

The Charleston Metropolitan Area’s population growing; therefore, there will be more employees to fill jobs and a budding demand for additional office space. Rental rates continue to rise each quarter as new office space is delivered to the market. Also, due to construction deliveries quarter-over-quarter, the office vacancy rate is increasing. Currently, 782,126 square feet of office property is under construction and another 688,522 square feet of offices are proposed to be built. As the Charleston suburbs add convenient residential areas and new residents migrate to these regions, the suburban office buildings are expected to be absorbed relatively quickly; however, net absorption may be negative into the third quarter of this year while the demand catches up to the supply.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q1 Office Charleston Report

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

SOCIAL LINKS

Categories

- Accounting

- Advice

- Architecture

- Banking and Finance

- Business Services

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Engineering

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Food

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Hospitality

- Insurance

- Law

- Life

- Manufacturing

- Marketing and Communications

- Military

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Sports

- Technology

- The Arts

- Transportation

Follow us

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans

Categories

- Accounting

- Advice

- Agriculture

- Architecture

- Banking and Finance

- Business Services

- Chamber

- Churches

- Commercial Real Estate

- Construction

- Conversations

- Economic Development

- Education

- Employment

- Energy

- Entertainment

- Entrepreneurship

- Environmental

- Festivals & Special Events

- Financial Advisors

- Government

- Headlines

- Health & Wellness

- Health Care Providers

- Hi-Tech/ Information Tech

- Home Remodel/ Maintenance

- Hospitality

- Hotels

- Insurance

- Law

- Life

- Local Industry

- Manufacturing

- Marketing and Communications

- Military

- Music

- Non Profit

- Op-Ed

- Philanthropy

- Podcast

- Politics

- Public Safety

- Residential Real Estate

- Restaurant

- Retail

- Social Scene

- Sports

- Telecommunications

- The Arts

- Transportation

- Utilities

Categories

- Advice

- Agriculture

- Chamber

- Echoes & Insights

- Economic Development

- Education

- Employment

- Entertainment

- Environmental

- Festivals & Special Events

- Government

- Health & Wellness

- Health Care Providers

- Hospitality

- Laurens County Sports

- Law

- Local Industry

- Manufacturing

- Marketing and Communications

- Music

- Non Profit

- Public Safety

- Social Scene

- The Arts

- Veterans