Gov. Henry McMaster Announces Line Item Vetoes of FY 2023-2024 State Budget

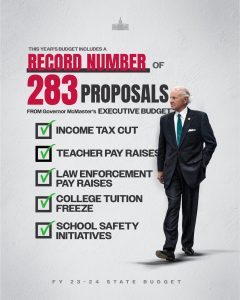

June 20, 2023Governor Henry McMaster today announced his Line Item Vetoes of the FY 2023-2024 State Budget at a press conference. The budget includes a record number of 283 of Governor McMaster’s Executive Budget proposals totaling $3.3 billion. These proposals include an income tax cut, teacher and law enforcement pay raises, school safety initiatives, a college tuition freeze, and a transformative investment in preserving our state’s environmental and cultural heritage.

The governor also used his budget veto message to call on the state’s colleges and universities to make preparations to reduce tuition, fees, charges, and any other items placed on the bill paid by students and parents by reducing their overall operating costs.

Hailing the legislative session as one of the most substantial in decades, the governor issued only 11 vetoes totaling $1.5 million, which he says highlights the successful collaborative approach that he and his staff utilized in crafting this budget in partnership with the General Assembly.

For a copy of the governor’s veto message, click here.

“Over the last six years, our successful partnership with the General Assembly has produced resounding win after win for the people and prosperity of South Carolina,” said Governor McMaster. “From the beginning of the budget process – to right now, we have communicated, collaborated and cooperated with the legislative leadership. It has been unprecedented, and it is my hope that in the future, this will become the rule rather than the exception.”

The governor’s priorities funded in the final budget include the following notable proposals (all statements are attributable to Governor Henry McMaster):

Resilience

“As I have said before, economic growth and the preservation of our shared natural heritage and environment are not opposing objectives which must be balanced as in a competition, one against the other. Instead, they – and our educational successes – are complementary, intertwined, and inseparable, each dependent on the other.

“This budget provides $200 million to the Office of Resilience, for the purpose of identifying and preserving culturally or environmentally significant properties and tracts in which public access is in jeopardy of being lost forever due to development, mismanagement, flooding, erosion or from storm damage.”

Teacher Pay Raises

“In the area of K-12 education, we continue to make remarkable progress in raising teacher pay. Six years ago the minimum starting salary of a teacher in South Carolina was $30,113 and the average teacher salary was below the Southeastern average. Today, the minimum starting salary of a teacher in South Carolina is $40,000, and the average teacher salary now exceeds the Southeastern average.

“This budget increases teacher salaries by $2,500 at every step of the state salary schedule, making the new minimum starting teacher salary $42,500. My goal by 2026 is a minimum starting salary of at least $50,000.”

School Safety

“Placing an armed, certified school resource officer (SRO) in every school, in every county, all day, every day, has been one of my top priorities as governor.

“At my request, the General Assembly began funding a grant program administered by the Department of Public Safety, to provide school districts with funds to hire more resource officers for our state’s 1,283 public schools. The grant program has been very successful, going from 406 SROs in 2018 to 1,170 SROs in 2023, representing almost 94% of all schools in the state.

“We also provided the South Carolina Law Enforcement Division with funds to create the Center for School Safety and Targeted Violence. Located at the old Gilbert Elementary School, this partnership with Lexington School District One will provide a state-of-the-art training center for law enforcement and school personnel from around the state.”

Income Tax Cut

“Until recently, South Carolina had the highest personal income tax rate in the southeast and the 12th highest in the nation. No more. Last year, I was honored to sign into law the largest income tax cut in state history. This year taxpayers will keep an additional $96.2 million of their hard-earned money instead of sending it to state government.”

College Tuition Freeze

“This year marks the fourth consecutive year that we froze college tuition for in-state students, while providing additional funding for needs-based financial aid at any in-state public or private college, university, or at our 16 technical colleges.

“Such an unprecedented investment in higher education demands greater accountability. And restraint and economy by the institutions when it comes to the total bill paid by college students and parents.

“Therefore, when we begin the executive budget process in November, every college and university will be expected to provide my office with a detailed listing of the institutions’ plans to reduce tuition, fees, charges, and any other items placed on the bill paid by our students and parents.

“In addition, every college and university will be expected to provide a detailed listing of programs, degrees, or other offerings that the institution will eliminate or consolidate to better align with the state’s future workforce needs and to reduce operating costs.”

Workforce Scholarships

“Our state’s booming economy has created 105,000 open jobs, virtually all in high-demand, skilled trades and professions. Working with the South Carolina Technical College System, we created Workforce Scholarships for the Future at our 16 technical colleges – so residents can get the degree or credentials they need to fill one of those open jobs in high-demand careers like manufacturing, healthcare, computer science, information technology, transportation, logistics, or construction.

“In the last two years, this very successful program has allowed over 10,000 South Carolinians to earn an industry credential in high-demand careers.”

Law Enforcement Pay Raises

“To keep South Carolinians safe, we must maintain a robust law enforcement presence – and properly ‘fund the police.’ Our state law enforcement agencies continue to lose valuable and experienced personnel because they are unable to remain competitive with pay and benefits.

“Thanks to the comprehensive compensation review conducted by the Department of Administration, our state law enforcement and criminal justice agencies have begun to stem the tide of personnel loss with recruitment and retention pay raises provided. This budget continues that by providing an additional $25.3 million for recruitment and retention pay raises in FY 23-24.”