Choosing a Health Care or Durable Power of Attorney

April 29, 2019by Laird W. Green

While no one wants to think about incapacity, everyone should have a plan to handle his or her incapacity, whether physical or mental. Who would you want to make medical decision for you or to take care of your finances when you are unable? Making these choices can be emotionally difficult and seem overwhelming. Nevertheless, for successful planning and guidance for your loved ones in the event of your incapacity, making these decisions ahead of time is extremely important.

In planning for incapacity, you should implement a health care power of attorney (HCPOA) as well as a durable power of attorney (DPOA). Both are legal documents that allow you to name another individual to make medical (HCPOA) or financial (DPOA) decisions for you when you are no longer able to make those decisions for yourself. An attorney can easily draft these documents for you, or you can complete the standard power of attorney forms for your state.

Health care power of attorney (HCPOA)

In a HCPOA document, you appoint an agent to be your representative for your medical care. You can also outline your desires for care regarding organ donation, life-sustaining treatment, and feeding tubes. Be sure that the Health Information and Portability Accountability Act (HIPAA) authorization is included in the document as this provision gives your agent the authority to access your medical records and speak to your medical providers about these records.

Durable power of attorney (DPOA)

In a DPOA document, you appoint an agent to be your representative for your legal and financial affairs. The agent can manage a broad range of financial interests for you including paying your bills, accessing your financial accounts, and investing on your behalf. Your agent must act in your best interest.

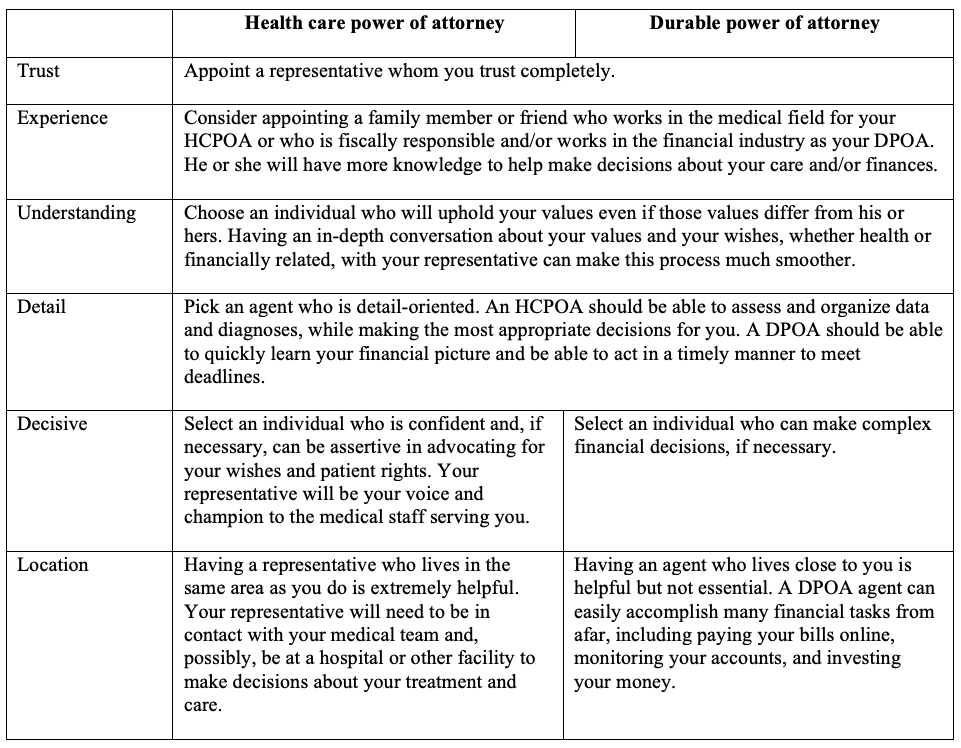

Consider the following factors when choosing the right person to make health care or financial decisions for you:

You may decide to appoint different individuals as your HCPOA and DPOA based on experience and knowledge. Once you determine whom you want to appoint as your agents, have a conversation with each person to explain his or her duties as an agent as well as tell him or her your wishes and desires regarding medical care and financial obligations. You may also want to share the location of your medical statements, health insurance cards, and financial documents. Name an alternative agent in case your first named agent is unable to serve as your power of attorney.

After your documents have been signed, review them every five years as your wishes may change. If you experience a life-changing event—divorce, death of a spouse, change in ability of an agent to serve, or a serious diagnosis—you will want to update your documents. Continue to have ongoing conversations with your agents regarding your ideas for your medical and financial care.

Executing HCPOAs and DPOAs will provide you and your family with peace of mind knowing that someone is there to take care of your medical and financial needs if you become incapacitated—a true gift to your loved ones.

Laird W. Green, CFP® graduated from Furman University in 1992 with a BA in History. She received a Master of Arts in Public History and a Master of Library and Information Science from the University of South Carolina in 1998. Laird received the CFP® designation in 2002 and began working for Abacus Planning Group in 2016. Laird is one of seven Abacus shareholders. Located in the Greenville office, Laird works closely with clients to understand their objectives in order to develop, implement, and monitor a comprehensive financial plan to achieve those goals.

Abacus

Abacus is a financial advisory and investment counsel firm known for its passion in creating success for clients and family businesses through skillful listening and smart financial decision making. Managing over a billion dollars on behalf of its 220 plus clients, Abacus consists of a team of multi-disciplinary experts who work collaboratively to serve its clients.