Colliers Report: Charleston awaits construction completions, few spaces are available

October 24, 2019

Research & Forecast Report

Q3-2019 CHARLESTON | INDUSTRIAL

Key Takeaways

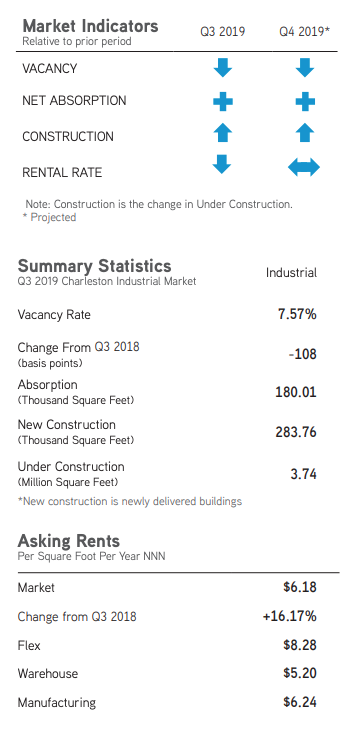

- Until new construction is delivered to the market, there are few available space options; the overall vacancy rate dropped to 7.57% this quarter.

- The Charleston market absorbed 180,005 square feet during the third quarter of 2019; the positive absorption was within the warehouse sector of the industrial market.

- Robotics are shifting much of the industrial workforce from physical labor to technology and automation-based training in order to remain efficient.

To download the complete report: 2019 Q3 Industrial Charleston Report

Robotics have changed the nature of warehousing and manufacturing

Robotics have changed the nature of warehousing and manufacturing

The nature of warehouse and manufacturing employment training has changed drastically over the last ten years. The knowledge areas have shifted from heavy manual labor and mechanical skills to technology-based knowledge. It is necessary to attract employees with the appropriate knowledge in order to run a business efficiently. Another way warehouse and manufacturing has changed over the years is the addition of robotics in order to minimize mistakes and automate some aspects of production. Robotics do not have to look like the traditional image of complex, human-like robots. According to Conveyco.com, listed below are several types of robotics in use everyday.

- Automated Storage and Retrieval Systems (AS/RS): these systems are used to retrieve items using a preset route either on a fixed track or using a crane arm to locate, remove and replace an object once it has been used appropriately.

- Goods-to-Person Technology (G2P): this system is similar to AS/RS listed above; however, once the item is retrieved, it is then given to a person who uses it or fills an order with the goods delivered.

- Automated Guided Vehicles (AGVs): these vehicles are used for large loads and are often guided by magnetic strips or tracks and predetermined routes within the warehouse or manufacturing facility.

- Automated Guided Carts (AGCs): these vehicles are used for smaller loads and are often guided by magnetic strips or tracks and predetermined routes within the warehouse or manufacturing facility.

- Autonomous Mobile Robots (AMRs): these robots are useful in fulfillment environments because they are able to navigate without human intervention due to a complex system of onboard sensors, maps and computers.

- Articulated Robotic Arms: this robot is essentially a multi-jointed limb used for the purpose of: receiving and storage, picking and packing, shipping and production.

While robotics are taking the place of many functions within the warehouse/manufacturing sector, they are allowing people to fill technology-based jobs operating these robots. Therefore, the heavy lifting and physical strains of many industrial jobs are being replaced by robots, thus improving efficiency and removing the physical strain previously placed on warehouse and manufacturing employees.

Market Overview

Overall Charleston industrial market

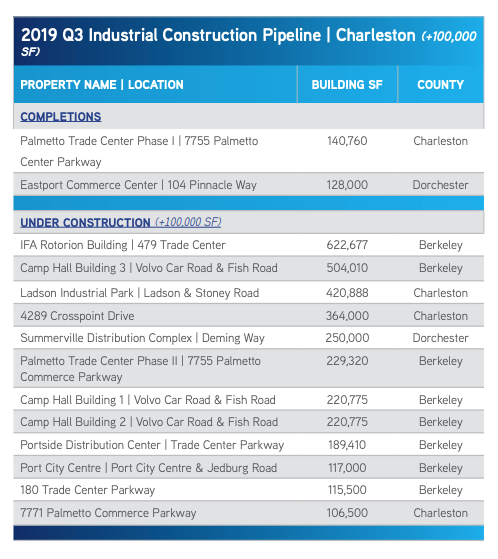

The Charleston industrial market has 56.33 million square feet of industrial inventory with approximately 3.74 million square feet under construction within 20 buildings. In addition, there are approximately 13 buildings proposed to be built within the Charleston market which would add an additional 3.88 million square feet to the industrial inventory. There were three new buildings delivered to the market this quarter which added 283,760 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 180,005 square feet during the third quarter of 2019. Because new construction deliveries surpassed absorption during the third quarter of 2019, the overall vacancy rate increased slightly from 7.49% during the second quarter of 2019 to 7.57% during this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.18 per square foot.

The Charleston industrial market has 56.33 million square feet of industrial inventory with approximately 3.74 million square feet under construction within 20 buildings. In addition, there are approximately 13 buildings proposed to be built within the Charleston market which would add an additional 3.88 million square feet to the industrial inventory. There were three new buildings delivered to the market this quarter which added 283,760 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 180,005 square feet during the third quarter of 2019. Because new construction deliveries surpassed absorption during the third quarter of 2019, the overall vacancy rate increased slightly from 7.49% during the second quarter of 2019 to 7.57% during this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.18 per square foot.

Warehouse/Distribution

The Charleston industrial market warehouse/distribution sector is comprised of 40.85 million square feet within 840 buildings and comprises 72.52% of the Charleston industrial market. There are 17 warehouses totaling 2.88 million square feet under construction throughout the Charleston market, and an additional 11 warehouses totaling 3.34 million square feet are proposed to be built. Warehouses throughout Charleston absorbed 208,434 square feet this quarter; the Summerville submarket led the way and absorbed 265,997 square feet this quarter due to 1334 Drop Off Drive leasing 371,600 square feet this quarter. The warehouse/distribution sector vacancy rate increased to 8.54% this quarter due to construction deliveries – up from 8.50% last quarter. The average triple net weighted warehouse rental rate increased marginally from $6.22 per square foot last quarter to $6.24 per square foot this quarter.

Manufacturing

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.09 million square feet of manufacturing space within the Charleston market. There are two buildings under construction which, upon completion, will add 851,997 square feet of inventory to the market. In addition, there is one 520,000-square-foot building proposed to be built within the Summerville submarket. There are a few available manufacturing spaces left within the Charleston market and because of this, there was no absorption during the third quarter of 2019. Therefore, the overall manufacturing vacancy rate remains unchanged at 5.29%. The average triple net weighted rental rate during the third quarter of this year is $5.20 per square foot.

Flex/R&D

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.39 million square feet. One 10,783-square-foot flex building is under construction at 2467 Charleston Highway and one 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector posted a negative absorption of 28,429 square feet this quarter largely due to the Limehouse Product building located at 4791 Trade Street posting a negative absorption of 21,521 square feet. Due to the negative absorption, the vacancy rate increased from 3.67% during the second quarter of this year to 4.32% during the third quarter of 2019. The average triple net weighted rental rate was $8.28 per square foot this quarter

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.39 million square feet. One 10,783-square-foot flex building is under construction at 2467 Charleston Highway and one 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector posted a negative absorption of 28,429 square feet this quarter largely due to the Limehouse Product building located at 4791 Trade Street posting a negative absorption of 21,521 square feet. Due to the negative absorption, the vacancy rate increased from 3.67% during the second quarter of this year to 4.32% during the third quarter of 2019. The average triple net weighted rental rate was $8.28 per square foot this quarter

Capital Investment & Employment

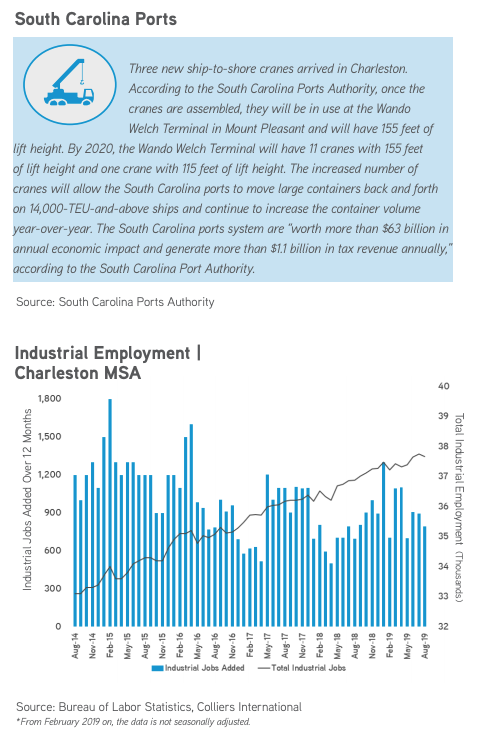

There have been $202.95 million of new capital investments within the Charleston industrial market during 2019. The capital investments produced 1,125 jobs, with the types of investors including brewing and distilleries of craft beers, manufacturing and logistics. Also, according to the Federal Reserve data through August of 2019, there have been 7,300 jobs added in the Charleston metropolitan statistical area, 792 of which were industrial jobs. The manufacturing sector of industrial employment added 600 jobs and while the number of jobs being added is less than it previously was, the employment rate is 97.5%. Overall non-farm employment totals 373,400 and has increased 2.1% from August 2018 through August 2019.

Significant Transactions

There were 15 Charleston industrial sales reported by CoStar during the third quarter of 2019. Leasing activity decreased from the second quarter to the third quarter, according to CoStar; however, there were still 22 industrial leases executed from July 2019 through September 2019. There were four leases over 100,000 square feet signed by undisclosed tenants in the Charleston market. In addition, a $94.39 million, 10-property portfolio was also purchased including one Charleston industrial property.

Sales

- The Medical University of South Carolina (MUSC) purchased the 106,500-square-foot industrial building located at 7771 Palmetto Commerce Parkway for $28 million.

- The manufacturing facility located at 105 East Port Lane was purchased by STAG Industrial, Inc. for $7.1 million.

Market Forecast

The warehouse sector of the Charleston industrial market is expected to continue posting positive absorption due to the industrial growth within the region and thanks to continual record-breaking shipments at the Port of Charleston. Until new construction is delivered to the market, there will be very few options remaining for industrial tenants to choose from. Charleston has a positive workforce environment with employment trending upward; therefore, future growth within the industrial market is anticipated. Robotics are changing the nature of warehouse and manufacturing employment throughout the world; therefore, Charleston will also see more robots working within the industrial sector in the future.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q3 Industrial Charleston Report