Colliers Report: Charleston land deals expected due to industrial demand

January 20, 2021Research & Forecast Report

Q4-2020 CHARLESTON | INDUSTRIAL

Key Takeaways

- Charleston developers search for land sites to acquire new industrial properties; buildings delivering in the next 12-18 months are expected to be absorbed quickly.

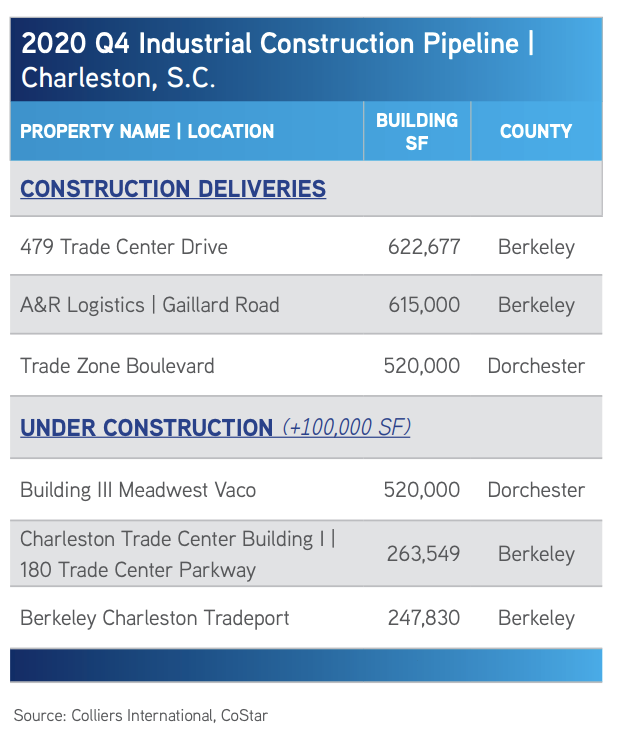

- There are 1.12 million square feet of industrial construction in the Charleston pipeline.

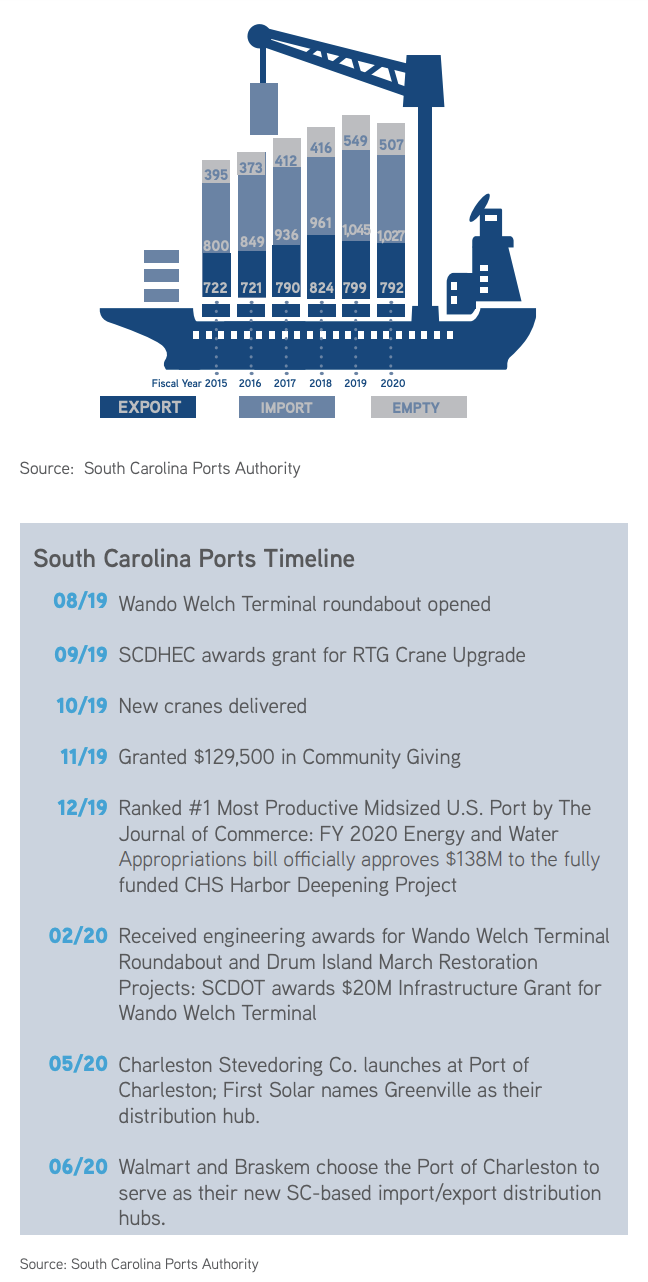

- Increased port capabilities and a positive business climate provide attractive opportunities for business expansion and development.

For additional commercial real estate news, check out our market reports here.

Charleston scrambles for land sites

Charleston continues to attract out-of-market businesses due to the ongoing success of the ports and convenient logistics throughout South Carolina. Due to an uptick in home improvements during the pandemic, home goods, furniture and home improvement businesses are thriving and looking to expand or find new space. In addition, developers are in search of land deals throughout the region. Berkeley County has not rezoned much of the available land; therefore, many new interested developers are searching in Dorchester County. Several of the new deals are enhancing the e-commerce and cold storage sector of industrial activity. Projects that went dormant at the beginning of the pandemic are ramping back up now and property that has been void of activity for a while is primed to be purchased. Despite a high level of construction in process, demand will nearly absorb all of the speculative space as it is delivered to the market in the next 12-18 months. Charleston is on target for an active year of new development and business growth.

Charleston continues to attract out-of-market businesses due to the ongoing success of the ports and convenient logistics throughout South Carolina. Due to an uptick in home improvements during the pandemic, home goods, furniture and home improvement businesses are thriving and looking to expand or find new space. In addition, developers are in search of land deals throughout the region. Berkeley County has not rezoned much of the available land; therefore, many new interested developers are searching in Dorchester County. Several of the new deals are enhancing the e-commerce and cold storage sector of industrial activity. Projects that went dormant at the beginning of the pandemic are ramping back up now and property that has been void of activity for a while is primed to be purchased. Despite a high level of construction in process, demand will nearly absorb all of the speculative space as it is delivered to the market in the next 12-18 months. Charleston is on target for an active year of new development and business growth.

Market Overview

Charleston Industrial Annual Recap

Charleston Industrial Annual Recap

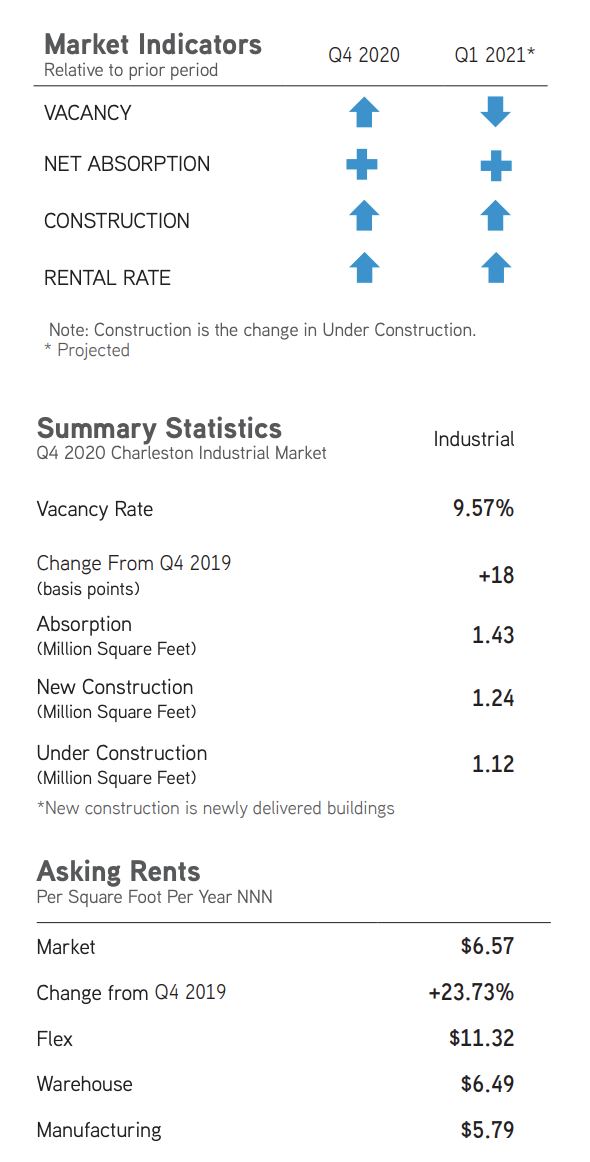

The Charleston industrial market has increased by eight buildings over the past 12 months adding 2.64 million square feet, in addition, there are approximately 1.12 million square feet under construction. The industrial market absorbed 2.4 million square feet from the fourth quarter of 2019 through the fourth quarter of 2020. Due to ongoing construction deliveries, the overall Charleston industrial market vacancy rate has increased from 9.39% during the fourth quarter of last year to 9.57% this quarter. Ongoing demand will continue to decrease the vacancy rate throughout 2021 as new businesses move to the market. Average weighted rental rates for remaining industrial space increased 23.73%, from $5.31 per square foot during the fourth quarter of 2019 to $6.57 per square foot during the fourth quarter of 2020.

Overall Charleston industrial market

The Charleston industrial market has 59.92 million square feet of industrial inventory with 1.23 million square feet under construction within six buildings. There are also approximately 15 buildings proposed to be built within the Charleston market which would add an additional 4.02 million square feet to the industrial inventory. There were two buildings totaling approximately 1.24 million during the fourth quarter of 2020. Charleston submarkets absorbed 1.43 million square feet during the fourth quarter of 2020 led by the Summerville and Berkeley County submarkets. Due to positive absorption this quarter, the overall market vacancy decreased from 10.11% last quarter to 9.57% this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.57 per square foot.

The Charleston industrial market has 59.92 million square feet of industrial inventory with 1.23 million square feet under construction within six buildings. There are also approximately 15 buildings proposed to be built within the Charleston market which would add an additional 4.02 million square feet to the industrial inventory. There were two buildings totaling approximately 1.24 million during the fourth quarter of 2020. Charleston submarkets absorbed 1.43 million square feet during the fourth quarter of 2020 led by the Summerville and Berkeley County submarkets. Due to positive absorption this quarter, the overall market vacancy decreased from 10.11% last quarter to 9.57% this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.57 per square foot.

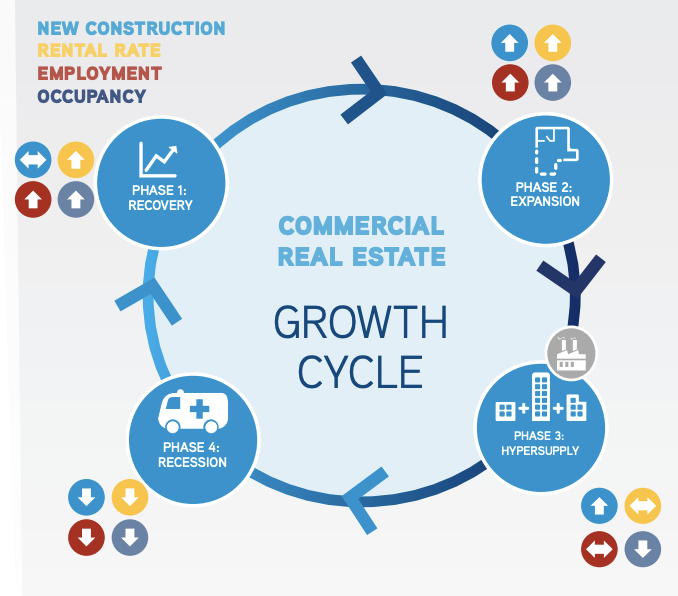

Warehouse/Distribution

The Charleston industrial market warehouse/distribution sector is comprised of 43.77 million square feet within 851 buildings and comprises 73.05% of the Charleston industrial market. There are five warehouses totaling 603,179 square feet under construction throughout the Charleston market, and an additional 13 warehouses totaling 3.77 million square feet are proposed to be built. During the fourth quarter of 2020, Charleston warehouses absorbed 768,503 square feet, 615,000 occurred in the A&R Logistics built-to-suit on Gaillard Road in Berkeley County. Hanahan/North Rhett was the only submarket to post negative absorption to end the year. Positive absorption pushed the quarterly warehouse/distribution sector vacancy rate down to 11.62% during the fourth quarter of this year. The average triple net weighted warehouse rental rate averaged $6.49 per square foot this quarter.

Manufacturing

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.7 million square feet of manufacturing space within the Charleston market. There is one manufacturing facility under construction within the Charleston market totaling 520,000 square feet within the Summerville submarket and one 229,320-square-foot building proposed to be built within North Charleston. The manufacturing market absorbed 649,677 square feet during the fourth quarter of 2020, most of which was in the newly-delivered building located at 479 Trade Center Drive in Berkeley County. Therefore, the overall manufacturing vacancy rate dropped to 4.37% this quarter. Triple net weighted rental rate during the fourth quarter of this year averaged $5.79 per square foot.

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.7 million square feet of manufacturing space within the Charleston market. There is one manufacturing facility under construction within the Charleston market totaling 520,000 square feet within the Summerville submarket and one 229,320-square-foot building proposed to be built within North Charleston. The manufacturing market absorbed 649,677 square feet during the fourth quarter of 2020, most of which was in the newly-delivered building located at 479 Trade Center Drive in Berkeley County. Therefore, the overall manufacturing vacancy rate dropped to 4.37% this quarter. Triple net weighted rental rate during the fourth quarter of this year averaged $5.79 per square foot.

Flex/R&D

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.46 million square feet. One 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector absorbed 15,298 square feet during the fourth quarter of 2020 and the vacancy rate within the flex/R&D sector decreased 3.12% this quarter. The average triple net weighted rental rate increased to $11.32 per square foot during the fourth quarter of 2020.

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.46 million square feet. One 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector absorbed 15,298 square feet during the fourth quarter of 2020 and the vacancy rate within the flex/R&D sector decreased 3.12% this quarter. The average triple net weighted rental rate increased to $11.32 per square foot during the fourth quarter of 2020.

Capital Investment & Employment

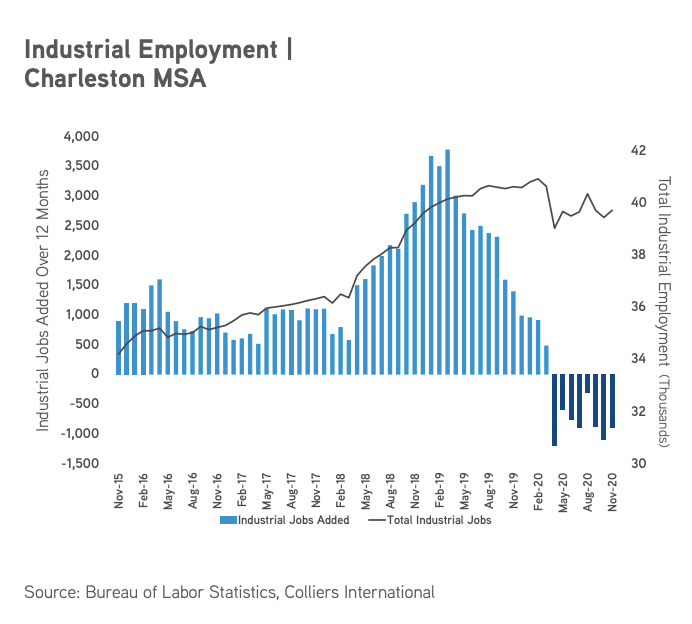

There have been approximately $597.24 million in capital investments within the Charleston industrial market in 2020. Companies new to the market produced 1,588 jobs, while expansions created 594 jobs. The types of investors include cold storage, medical manufacturing, software services and various distribution and logistics centers. Also, according to the Federal Reserve data over the past 12 months due to the temporary shut-downs caused by the Coronavirus, there were 19,400 fewer jobs in the Charleston metropolitan statistical area, 903 of which were industrial jobs. However, that number has improved from 48,200 jobs lost in April when the effects of the pandemic were first realized. Jobs are predicted to continue being restored as temporary closings and Coronavirus restrictions are lifted, then employment numbers will likely normalize. Over the past three months, manufacturing jobs have remained steady at 29,900 jobs; total industrial employment totals 39,700 in Charleston. The Charleston employment rate is strong at 96% during November of 2020 and is recovering faster than the overall United States, whose employment rate was 93.3%.

Significant Transactions

There were 25 Charleston industrial sales reported by CoStar during the fourth quarter of 2020. Leasing activity increased velocity again this quarter and according to CoStar, there were 45 industrial leases executed this quarter.

Leases

- 3 G Distribution signed a 271,580-square-foot expansion at 537 Omni Industrial Park in Summerville, bringing the 587,000-square-foot building to fully-leased capacity.

- Zinus signed a 188,631-square-foot lease at 9735 Patriot Boulevard in Ladson.

- World Depot signed a 109,260-square-foot lease at 1031 Legrand Boulevard in Charleston.

Sales

- For $55 million, Laulima Families LLC purchased a 448,765-square-foot manufacturing facility in Summerville.

- For $17 million, Easterly Government Properties, Inc. purchased a 117,000-square-foot warehouse at 4136 Carolina Commerce Parkway in North Charleston.

- For 3.68 million, Dockside Logistics purchased a 100,500-square-foot warehouse in Winding Wood Commerce Park located at 4756 Highway 58 in Saint George. They are also occupying the building.

Market Forecast

The high volume of construction currently underway will likely deliver in the next 12-18 months and is expected to be absorbed when it completes. Developers are searching for land to purchase, so land sales are predicted to rise in 2021 and more construction will begin in an attempt to meet warehousing and manufacturing needs in the region. The Port of Charleston finished 2020 with its strongest December on record; therefore, sustained port activity in 2021 will feed Charleston industrial demand. Medical manufacturing, cold storage, home goods and automotive-related manufacturing are expected to lead the charge and absorb buildings as they become available. Due to tenant competition for limited availabilities and high-quality building deliveries, Charleston rental rates are expected to rise in 2021. In addition, vacancy rates will drop and absorption will be positive.

A Note Regarding COVID-19 As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.