Colliers Report: Charleston office market anxiously awaits delivery of new construction

January 3, 2020Research & Forecast Report

Q4-2019 CHARLESTON | OFFICE

Key Takeaways

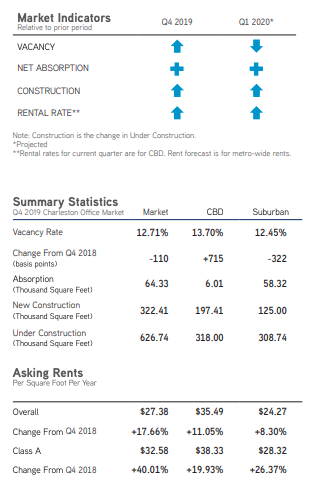

- During the fourth quarter of 2019, the overall Charleston office market absorbed 64,329 square feet.

- New construction and upgraded space availabilities increased the overall average weighted rental rate to $25.72 per square foot during the fourth quarter of 2019.

- Due to completed construction outweighing absorption, the overall vacancy rate rose slightly from 10.74% last quarter to 11.74% this quarter.

- Positive office-using job creation will be necessary to increase office demand.

2019 Office Recap

2019 Office Recap

Over the past 12 months, there were 14 office buildings delivered to the Charleston market adding 719,068 square feet. Despite the office deliveries this year, the Charleston office market vacancy rate has decreased from 13.81% during the fourth quarter of 2018 to 12.71% this quarter. Charleston offices absorbed 725,704 square feet and while all of the class sectors posted positive absorption, all of the positive absorption occurred within Class A and B properties. Lower North Charleston had the highest absorption of 232,375 square feet followed by Upper North Charleston absorbing 157,122 square feet. Due to building upgrades and new office deliveries, the average weighted rental rate for the remaining office space in Charleston rose from $23.27 per square foot during the fourth quarter of last year to $25.72 per square foot during the fourth quarter of 2019.

Market Overview

Overall Charleston Market

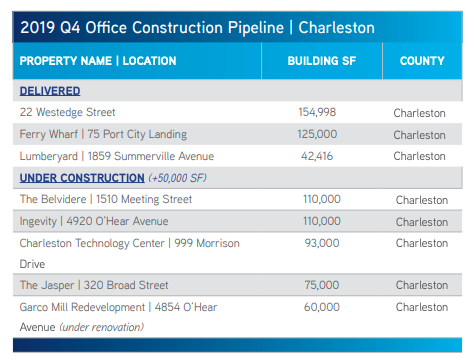

The Charleston office market is comprised of approximately 14.06 million square feet within 399 office buildings. There are currently 12 office buildings under construction which, upon completion, will add 626,740 square feet to the office market and one office undergoing renovations. In addition, there are 13 proposed offices totaling 999,600 square feet adding to the construction pipeline. There were three office buildings delivered to Charleston during the fourth quarter of 2019 adding 322,414 square feet. The overall Charleston office market absorbed 64,329 square feet and, due to the square feet of completed construction outweighing absorption, the overall vacancy rate rose slightly from 10.74% last quarter to 12.71% this quarter. Also, likely due to new construction and high quality space availabilities, the overall average weighted rental rate rose from $24.78 per square foot during the third quarter of 2019 to $27.38 per square foot this quarter.

The Charleston office market is comprised of approximately 14.06 million square feet within 399 office buildings. There are currently 12 office buildings under construction which, upon completion, will add 626,740 square feet to the office market and one office undergoing renovations. In addition, there are 13 proposed offices totaling 999,600 square feet adding to the construction pipeline. There were three office buildings delivered to Charleston during the fourth quarter of 2019 adding 322,414 square feet. The overall Charleston office market absorbed 64,329 square feet and, due to the square feet of completed construction outweighing absorption, the overall vacancy rate rose slightly from 10.74% last quarter to 12.71% this quarter. Also, likely due to new construction and high quality space availabilities, the overall average weighted rental rate rose from $24.78 per square foot during the third quarter of 2019 to $27.38 per square foot this quarter.

Central Business District

The central business district has 89 buildings totaling 2.93 million square feet in Charleston and there are currently 318,000 square feet of office buildings under construction. During the fourth quarter of 2019 22 Westedge Street was delivered to the central business district adding 154,998 square feet, and the Lumberyard’s delivery located at 1859 Summerville Avenue added 42,416 square feet. Downtown Charleston offices absorbed 6,007 square feet this quarter with offices classified as Class A and B absorbing a total of 10,457 square feet, while Class C office properties posted a negative absorption of 4,450 square feet. The vacancy rate increased from 7.68% during the third quarter of 2019 to 13.70% at year end mostly due to new construction deliveries. The average weighted rental rate was $35.49 per square foot for the remaining downtown availabilities during the fourth quarter of this year; the delivery of high quality spaces continues to drive the rental rate upward.

Suburban Conditions

The Charleston suburban office market is comprised of 11.13 million square feet within 310 office buildings. There are eight offices totaling 308,740 square feet under construction throughout the suburban submarkets and one building is under renovation at Garco Mill in Lower North Charleston. Also, Ferry Wharf, a 125,000-square-foot office building was added to the Mount Pleasant submarket during the fourth quarter of 2019. Overall, the suburbs absorbed 58,322 square feet this quarter; Class A office space absorption of 41,115 square feet accounted for more than half of the total suburban absorption. Mount Pleasant posted the healthiest submarket absorption of 49,378 square feet this quarter. Despite positive absorption and ongoing office demand, the suburban office vacancy rate rose from 10.74% during the third quarter of this year to 12.45% this quarter. The overall suburban market average weighted rental rate for the remaining availabilities increased to $24.27 per square foot this quarter.

Significant Transactions

According to CoStar, during the fourth quarter of 2019 leasing activity was steady, there were 71 office leases executed in the Charleston market. The largest leases were signed by undisclosed tenants; sublease activity also ramped up this quarter. CoStar reported 21 office sale transactions from October 2019 through December 2019.

Sales

For $3.1 million, Turner Property Management LLC purchased 297 Seven Farms Drive, a 30,442-square-foot office building located in the Daniel Island submarket.

For $3.1 million, Turner Property Management LLC purchased 297 Seven Farms Drive, a 30,442-square-foot office building located in the Daniel Island submarket.

Construction Pipeline

Construction activity continues to be positive in the Charleston market. Currently, there are 686,740 square feet of office space under construction or undergoing renovations.

Office-Using Employment

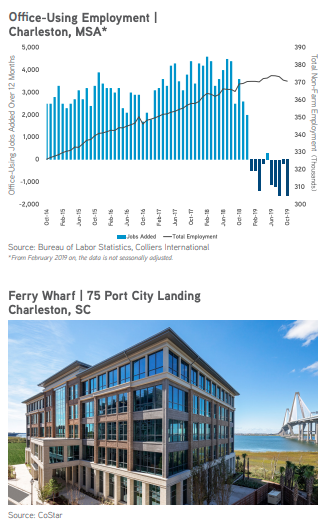

Office-using employment covers jobs related to the professional and business services, financial activities and information sectors. According to the most recent October 2019 data from the Bureau of Labor Statistics, there were 1,600 fewe

r office-using jobs during October of 2019 than there were in October of last year which will decrease office demand, unless more office-using jobs are created. Despite less office jobs this year, total non-farm employment has increased by 1,600 jobs in the past 12 months. The top 3 employment sectors within Charleston are Trade, Transportation and Utilities, Government and Professional and Business Services. According to the Bureau of Labor Statistics, as of October 2019 the unemployment rate remains low at 1.8%, much lower than the national unemployment rate of 3.6%.

r office-using jobs during October of 2019 than there were in October of last year which will decrease office demand, unless more office-using jobs are created. Despite less office jobs this year, total non-farm employment has increased by 1,600 jobs in the past 12 months. The top 3 employment sectors within Charleston are Trade, Transportation and Utilities, Government and Professional and Business Services. According to the Bureau of Labor Statistics, as of October 2019 the unemployment rate remains low at 1.8%, much lower than the national unemployment rate of 3.6%.

Market Forecast

Tensions rise when entering an election year as fears of policy changes and economic downturns mount. However, most economists agree a recession is not predicted to happen next year. Charleston’s economy will be strong enough to withstand political or policy changes, which could negatively affect the nation, due to tourism and global trade connections positively impacting the region. Charleston’s office market is forecasted to continue on a positive tract. New office-using job creation is necessary in order to raise the demand for office space. Charleston’s strong economy will likely attract business owners looking for a thriving environment in which to locate, leading to positive job creation, office market absorption and lowering vacancy rates. As office owners continue to upgrade dated spaces and new construction delivers to the market, weighted rental rates are expected to continue rising in the next few quarters.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q4 Office Charleston Report