Colliers Report: Charleston’s flexible office options viable for small businesses

June 29, 2020Research & Forecast Report

Q2-2020 CHARLESTON | OFFICE

Key Takeaways

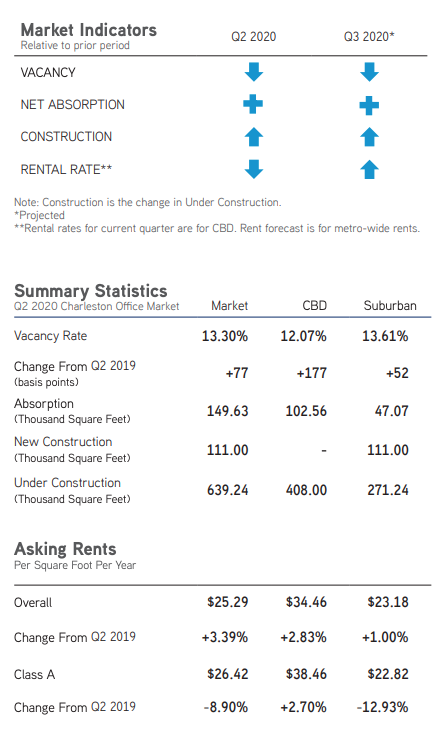

- The Charleston office market absorbed 149,627 square feet during the second quarter of 2020, pulling the overall vacancy rate down to 13.30%.

- Due to rising operational costs pushing rental rates up, the demand for flexible office options will likely rise to accommodate small businesses in the Charleston market.

Rising demand for flexible office space

Rising demand for flexible office space

In a post-COVID-19 Charleston office market, operational costs are potentially on the rise forcing rental rates to climb. This is the necessary result of office owners taking safety and cleanliness precautions to ensure tenants can operate comfortably, while simultaneously practicing social distancing guidelines. Some tenants will even expand into larger spaces in order to allow more space per employee. However, these factors present obstacles to small business owners. Smaller companies do not have the ability to rent larger space to adapt to social distancing or to even pay the rising rental rates for a minimal office space. The demand for flexible office options will likely rise to accommodate small businesses in the Charleston market. Flexible office spaces allow smaller companies to have a physical address, a support team, and a remote-working network. In addition, business owners have the option to choose the type of office which is needed-whether it be one reserved desk or a small team collaboration area. Furthermore, if the flexible office has an entrance separate from other tenants, small business owners will be attracted to the option of minimal contact with other building tenants. For larger companies that may be worried about density in their single office location or for companies that may want satellite locations to accommodate the trend of employees working closer to home during and post-Covid, the hub-and-spoke multiple location model is gaining popularity for local, regional and national companies. Companies will retain their centralized office location and will establish additional smaller locations in the various submarkets of the Charleston Metro Area. Since the Charleston economy remains positive post COVID-19, it will follow that new businesses will begin to pop-up throughout the market. With flexible office space options in Charleston, both large and small businesses will be able to thrive.

Market Overview

Overall Charleston Market

The Charleston office market is comprised of approximately 14.24 million square feet and there are currently 12 office buildings under construction which, upon completion, will add 639,240 square feet to the office market. In addition, there are 13 proposed offices totaling 1.01 million square feet adding to the construction pipeline. There were three office buildings delivered to Charleston during the second quarter of 2020 adding 111,000 square feet of suburban office space to the market. Overall the Charleston market absorbed 149,627 square feet during the second quarter of 2020, despite the office restrictions during the Coronavirus. Therefore, due to the positive absorption, the overall quarterly vacancy rate dropped from 3.67% last quarter to 13.30% during the second quarter of 2020. Charleston office market rental rates were slightly lower at $25.65 per square foot during the second quarter of 2020, but are expected to rise in the next few quarters due to rising operational costs.

Central Business District

Central Business District

The central business district has 89 buildings totaling 2.92 million square feet in Charleston and there are currently 368,000 square feet of office buildings under construction. Downtown Charleston offices absorbed 102,560 square feet during the second quarter of 2020, 95,577 square feet of which was Class A office space. Due to the positive leasing activity, the downtown vacancy rate decreased from 15.58% during the first quarter of 2020 to 12.07% this quarter.The average weighted rental rate during the second quarter of 2020 was $34.46 per square foot for the remaining downtown availabilities.

Suburban Conditions

The Charleston suburban office market is comprised of 11.32 million square feet and there are seven offices totaling 271,240 square feet under construction throughout the suburban submarkets. Three new office buildings were completed in the suburban submarkets adding 111,000 square feet to the market. Even though new offices were delivered this quarter, the suburbs absorbed 47,067 square feet. Class B offices absorbed 39,466 square feet which is 83.85% of the total absorption. West Ashley and Summerville/Goose Creek are where the majority of positive absorption occurred. The suburban vacancy rate dropped from 13.18% last quarter to 13.61% during the second quarter of this year. The overall suburban average weighted rental rate for the remaining availabilities increased from $22.72 during the first quarter of 2020 to $23.18 per square foot this quarter.

Significant Transactions

According to Costar, there were 10 office sales within the Charleston market this quarter. In addition, there were 64 leases executed during the second quarter of 2020; all but four were under 10,000 square feet and several were with undisclosed tenants.

Office-Using Employment

Office-using employment covers jobs related to the professional and business services, financial activities and information sectors. According to the most recent data from the Bureau of Labor Statistics, employment decreased considerably during the first quarter of 2020 due to the rise in COVID-19 unemployment claims. From April 2019 through April 2020, there were 44,700 less jobs; office-using jobs decreased by 8,666. Now that many of the Coronavirus restrictions have been relaxed or removed, many of the employees with unemployment claims will return to work; therefore, the employment numbers are expected to somewhat normalize during the second half of this year.

Market Forecast

As COVID-19 restrictions are relaxed or removed, some employers will continue to use remote workers while others will bring employees back to work. However, most offices will implement guidelines limiting visitors, adhering to social distancing and providing a safer post-virus environment. Due to the many changes, rental rates will rise to balance increasing operational costs owners are faced with. In addition, small business owners will be looking for flexible office options in order to conduct business with the least amount of rent and overhead costs. Nevertheless, the overall true effects of the Coronavirus will not be fully realized for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.