Colliers Report: Columbia industrial is in a “space race”

October 9, 2020Research & Forecast Report

Q3-2020 COLUMBIA | INDUSTRIAL

Key Takeaways

- The Columbia industrial market outperformed expectations with a total absorption of 229,640 square feet during the third quarter of 2020.

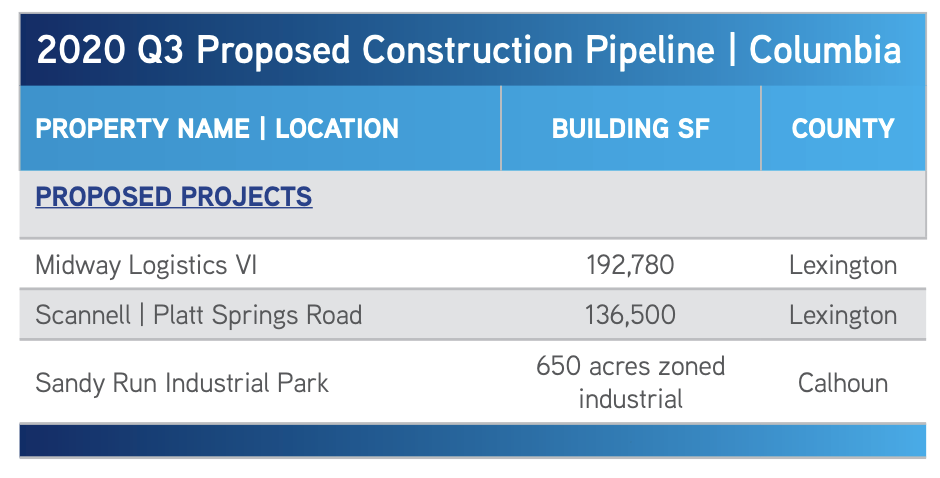

- Over the next year, construction activity is predicted to increase considerably in order to keep up with market demand.

Columbia industrial activity is robust

Columbia’s industrial market vacancy rate is 3.93% overall, and there are very few buildings currently available to lease. Several proposed projects are planned to begin construction soon, but there is at least an eight month wait before the next wave of new building deliveries. This rise in demand has put Columbia in a “space race.” There are two factors to the space race. Prospective tenants must act quickly because they are competing against one another for a small pool of available buildings. In the meantime, developers are racing to get product out of the ground to accommodate market demand. Until the vacancy rate increases, tenants will need to react quickly to secure available space. Industrial construction in the Columbia market is expected to boom over the next few quarters to keep up with demand.

Columbia’s industrial market vacancy rate is 3.93% overall, and there are very few buildings currently available to lease. Several proposed projects are planned to begin construction soon, but there is at least an eight month wait before the next wave of new building deliveries. This rise in demand has put Columbia in a “space race.” There are two factors to the space race. Prospective tenants must act quickly because they are competing against one another for a small pool of available buildings. In the meantime, developers are racing to get product out of the ground to accommodate market demand. Until the vacancy rate increases, tenants will need to react quickly to secure available space. Industrial construction in the Columbia market is expected to boom over the next few quarters to keep up with demand.

Market Overview

Overall Columbia

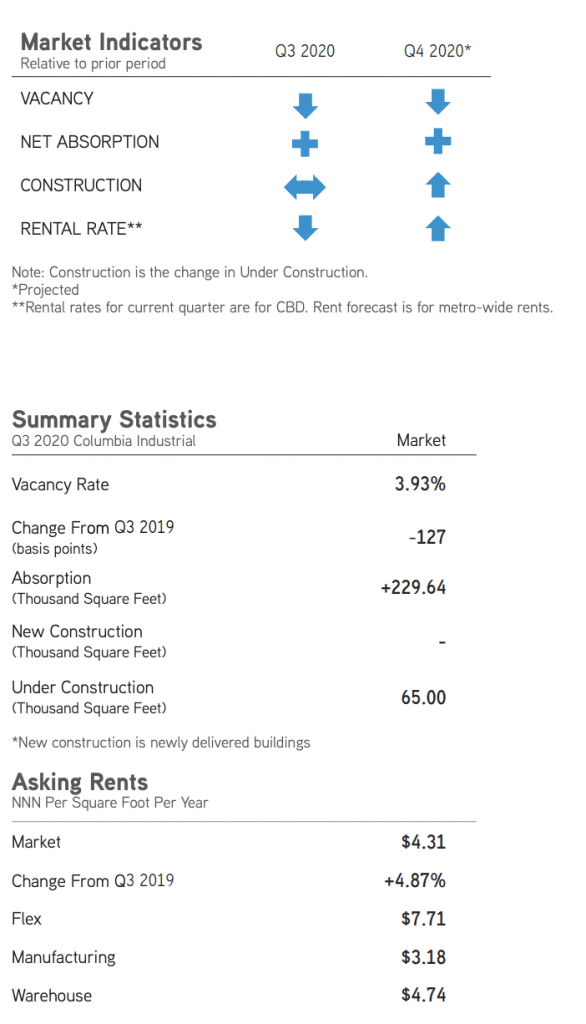

The Columbia industrial market is comprised of 73.18 million square feet. During the third quarter of 2020, the industrial market absorbed 229,640 square feet led by the warehouse sector. No new industrial buildings were delivered to the Columbia market during the third quarter; however, one building is currently under construction at 397 Millennium Drive in Orangeburg which, upon completion, will add 65,000 square feet to the market. Due to positive absorption, the quarterly vacancy rate dropped from 4.24% during the second quarter of 2020 to 3.93% during the third quarter of 2020. The overall average market rental rate for available industrial space was $4.31 per square foot during the third quarter of this year.

Warehouse/Distribution

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.37 million square feet. This sector absorbed 221,778 square feet during the third quarter of 2020. The Cayce/West Columbia warehouse led the way with the highest absorption of 173,636 square feet, followed by East Columbia warehouses absorbing 109,042 square feet. The quarterly warehouse vacancy rate dropped to 2.98% and there are nine submarkets with a vacancy rate of less than 3%. The overall average weighted rent for warehouses rose from $4.33 per square foot during the second quarter of this year to $4.74 per square foot this quarter.

Manufacturing

The manufacturing sector in the Midlands is comprised of 25.32 million square feet and there is one 65,000-square-foot manufacturing facility located at 397 Millennium Drive under construction. The overall manufacturing vacancy rate decreased slightly from 4.92% during the second quarter of 2020 to 4.88% this quarter due to 10,800 square feet of absorption. The absorption occurred within the Southeast Columbia submarket at 1125 Joe Louis Drive.

Flex/R&D

The flex/R&D sector in the Midlands has 2.49 million square feet within its submarkets and this sector posted a negative absorption of 2,938 square feet during the third quarter of 2020. The quarterly vacancy rate increased marginally from 11.40% during the second quarter of 2020 to 11.52% this quarter. Flex/R&D average weighted rental rate for the remaining availabilities increased to $7.71 per square foot during the third quarter of 2020.

Capital Investment & Employment

Over the past twelve months ending August 2020, there have been $109.4 million in new capital investments and $311.88 million in capital investment expansions, accounting for 1,247 jobs announced within the Columbia region. The types of investors include chemical manufacturing, advanced manufacturing | fabrication, pharmaceutical manufacturing and health care. According to the Federal Reserve data through August of 2020, industrial employment comprises 12% of Columbia’s total employment, or about 46,200 jobs in the Midlands region. There were 918 less industrial jobs in the Columbia MSA over the past twelve months due to Coronavirus temporary closings and unemployment. However, the unemployment numbers in Columbia normalize as each month passes. The current employment rate in Columbia is 92.3%.

Significant Transactions

Sales

- For $2.6 million, Spirit Realty Capital, Inc. purchased the 55,134-square-foot distribution center located at 121 South Woodside Parkway in West Columbia.

- For $1 million, Columbia Terminal LLC purchased a 13,377-square-foot industrial building located at 253 Dooley Road in Lexington.

Leases

- *OTR Wheel Engineering executed a renewal at 100 Perfection Way in Darlington County that expanded them into approximately 63,247 additional square feet, bringing their total to 94,680 square feet and bringing the 180,000-square-foot building to full occupancy.

- TreeHouse Foods, Inc. leased 150,000 square feet at Midway Logistics IV in West Columbia, bringing the building to full occupancy.

- *Ring Container Technologies leased 50,000 square feet at 995 Old York Road in Chester County.

- Hahl, Inc. leased 23,636 square feet at 3430 Platt Springs Road in West Columbia.

- Free World Trade Inc. leased 23,200 square feet at 200 East Church Street in Ridgeway.

Market Forecast

Following the pandemic, not only has the Columbia industrial market weathered the storm, but demand is on the rise. There is very little space available within the market due to high demand coupled with low supply. Therefore, over the next year, construction activity is predicted to increase significantly in order to keep up with market demand. As new construction is delivered to the market around the third quarter of next year, the overall market rental rates are expected increase due to the high quality of the new space delivering and the competition to lease it. Also, adding to the need for space, employment numbers within the region are normalizing and capital investments are increasing as more out-of-market investors take notice of Columbia. All of these factors will lead to a sustained increase in Columbia industrial activity over the next year.

*NOTE: These deals are significant and will not show up in the other market reports (excluding the South Carolina industrial report); therefore, they are included in the Columbia report.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.