Colliers Report: Columbia industrial market outperforms expectations amid pandemic

July 28, 2020Research & Forecast Report

Q2-2020 COLUMBIA | INDUSTRIAL

Key Takeaways

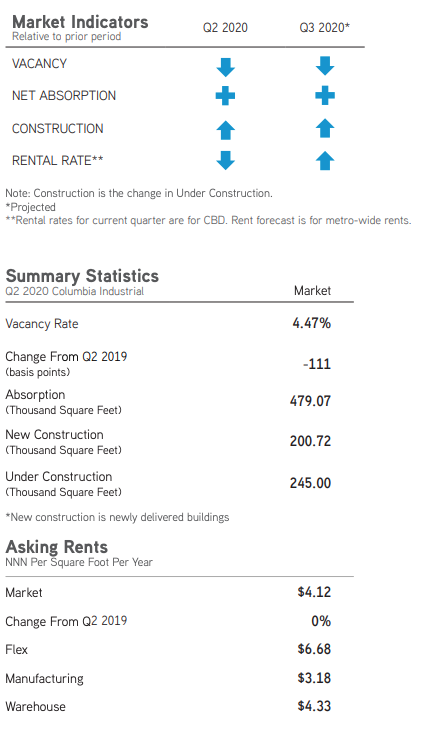

- The Columbia industrial market outperformed expectations with a total absorption of 479,072 square feet during the second quarter of 2020.

- Due to positive absorption, the quarterly vacancy rate dropped from 4.86% during the first quarter of 2020 to 4.47% this quarter.

- The actual effects of the outbreak of COVID-19 on the industrial real estate sector will not be realized for several quarters.

Columbia industrial weathers the storm

Columbia industrial weathers the storm

Industrial activity throughout the nation was expected to perform better than other sectors due to essential employee services, e-commerce shopping and distribution centers remaining open while other businesses were forced to close at the onset of COVID-19. However, the Columbia industrial market outperformed expectations with a total absorption of 479,072 square feet. The activity was mainly concentrated within manufacturing and warehousing facilities. Manufacturing absorbed 352,700 square feet and the warehouse sector absorbed 113,960 square feet. Due to the positive activity, the overall market vacancy rate decreased to 4.47%. Also, construction activity continued and a 200,720-square-foot industrial building located at 145 Millennium Drive finished construction this quarter and 245,000 square feet are currently under construction. There are still many transactions expected to complete in the next few quarters despite the uncertainty surrounding COVID-19; therefore, Columbia industrial activity is anticipated to be strong enough to continue to weather the storm.

Market Overview

Overall Columbia

The Columbia industrial market is comprised of 73.10 million square feet. During the second quarter of 2020, the market absorbed 479,072 square feet. Orangeburg County was the submarket with the highest absorption of 200,720 square feet followed by Northeast Columbia where 146,735 square feet was absorbed. One 200,720-square-foot building located at 145 Millennium Drive was delivered to the Orangeburg submarket, and there are two buildings under construction which, upon completion, will add 245,000 square feet to the market. Due to positive absorption, the quarterly vacancy rate dropped from 4.86% during the first quarter of 2020 to 4.47% this quarter. The overall average market rental rate for available industrial space was $4.12 per square foot this quarter.

Warehouse/Distribution

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.43 million square feet. This sector absorbed 113,960 square feet during the second quarter of 2020. The quarterly warehouse vacancy rate dropped to 3.33% and there are eight submarkets with a vacancy rate of less than 3%. The overall average weighted rent for warehouses rose from $4.14 per square foot during the first quarter of this year to $4.33 per square foot this quarter. Average weighted rental rates in the Columbia market range from $1.95 per square foot in Saluda County to $10.00 per square foot in the Northwest Columbia submarket.

Manufacturing

The manufacturing sector in the Midlands has 25.14 million square feet and there are currently two manufacturing facilities located at Lexington Industrial Park and 397 Millennium Drive under construction that, upon completion, will add 245,000 square feet to the inventory. One fully-leased new manufacturing 200,720-square-foot building was delivered to the Columbia market this quarter at 145 Millennium Drive in Orangeburg. The overall manufacturing vacancy rate decreased from 6.38% during the first quarter of 2020 to 5.77% this quarter due to 151,980 square feet of absorption. Most of the positive absorption occurred within the Northeast Columbia submarket at 1080 Jenkins Brothers Road. The weighted rental rate for available manufacturing space averaged $3.18 per square foot during the second quarter of this year.

The flex/R&D sector in the Midlands has 2.52 million square feet within its submarkets and this sector absorbed 12,412 square feet and the quarterly vacancy rate increased to 12.97% during the second quarter of 2020. Flex/R&D average weighted rental rate for the remaining availabilities decreased from $7.84 per square foot during the first quarter of 2020 to $6.68 per square foot this quarter.

Capital Investment & Employment

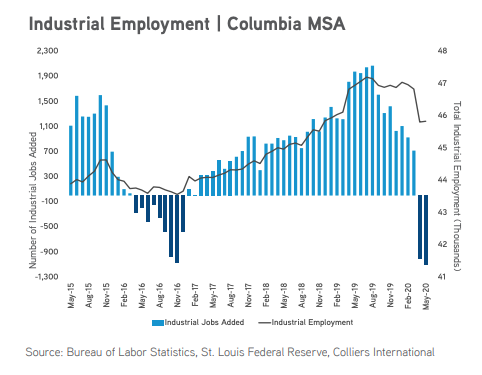

Over the past twelve months ending June 2020, there have been $22.90 million in new capital investments and $96.08 million in capital investment expansions, accounting for 816 jobs announced within the Columbia region. The types of investors include chemical manufacturing, advanced manufacturing | fabrication, marine manufacturing and health care. According to the Federal Reserve data through May of 2020, industrial employment comprises 12.20% of Columbia’s total employment, or about 45,800 jobs in the Midlands region. There were 1,112 less industrial jobs in the Columbia MSA over the past twelve months due to Coronavirus temporary closings and unemployment. Unemployment is expected to normalize upon Coronavirus restrictions being relaxed or lifted; the current employment rate in Columbia is 94.6%.

Significant Transactions

Sales

- For $19.3 million, Reman LLC purchased a 388,000-square-foot Orangeburg warehouse located at 2500 Rowesville Road. They performed a sale/leaseback to Aco Distribution & Warehousing.

Leases

- Allied Air signed a 200,720-square-foot lease at 145 Millennium Drive in Orangeburg.

Market Forecast

Columbia industrial properties performed well during the second quarter of 2020 despite the predicted slowdown caused by the Coronavirus. New construction completed this quarter and demand is high enough to expect projects in the pipeline to continue to progress. Record low vacancies will force the rental rates to rise. Due to the strong need of essential businesses using production and distribution facilities, and Columbia’s central location within the state, industrial activity is not expected to slow in the next few quarters amid COVID-19. While this seems positive for the industrial sector, the true effects of the pandemic will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.