Colliers Report: Columbia office market may face turbulent year in 2021, (or will it?)

January 4, 2021Research & Forecast Report

Q4-2020 COLUMBIA, SC | OFFICE

Key Takeaways

- Tenants of 2.8 million square feet surveyed throughout Columbia indicate only 48% are physically occupying their offices at year end 2020.

- Downtown Columbia offices absorbed 9,833 square feet overall this quarter, Class B offices within the central business district were most active.

- The most significant factor limiting absorption in Columbia is the increase in available sublease space.

- Landlords are forecasted to become more aggressive in trying to obtain new tenants and in renewing existing tenants.

- The Columbia office market will face challenges as companies restructure their operations to include downsizing and remote work environment.

Owners strive for stability in the Columbia office market

Columbia offices fared well through the economic uncertainties of 2020 brought on by the 2020 global pandemic. Tenants remained cautious and simply “stood still” while awaiting a vaccine to slow the spread of Coronavirus. Office occupancy was healthy during the year; however, there are likely challenging times in the year ahead as the market reacts to effects of the pandemic. Out of 2.8 million square feet of tenant surveys throughout the central business district towers and suburban office parks, approximately 43% have returned to work in their Columbia offices. Locally-owned businesses have adapted their operations to include social distancing and safety precautions so they could return to work. Nationally-operated companies were prone to put remote-only working orders in place well into 2021; therefore, their offices are sitting vacant. While the current occupancy reflects a stagnant year, occupancy rates will likely decline next year as tenants give back excess space due to downsizing or remote working. The longer a tenant is working remotely the more likely they may be to attempt to restructure their space needs to less than they lease now.

Columbia offices fared well through the economic uncertainties of 2020 brought on by the 2020 global pandemic. Tenants remained cautious and simply “stood still” while awaiting a vaccine to slow the spread of Coronavirus. Office occupancy was healthy during the year; however, there are likely challenging times in the year ahead as the market reacts to effects of the pandemic. Out of 2.8 million square feet of tenant surveys throughout the central business district towers and suburban office parks, approximately 43% have returned to work in their Columbia offices. Locally-owned businesses have adapted their operations to include social distancing and safety precautions so they could return to work. Nationally-operated companies were prone to put remote-only working orders in place well into 2021; therefore, their offices are sitting vacant. While the current occupancy reflects a stagnant year, occupancy rates will likely decline next year as tenants give back excess space due to downsizing or remote working. The longer a tenant is working remotely the more likely they may be to attempt to restructure their space needs to less than they lease now.

Market Overview

Annual Columbia Office Recap

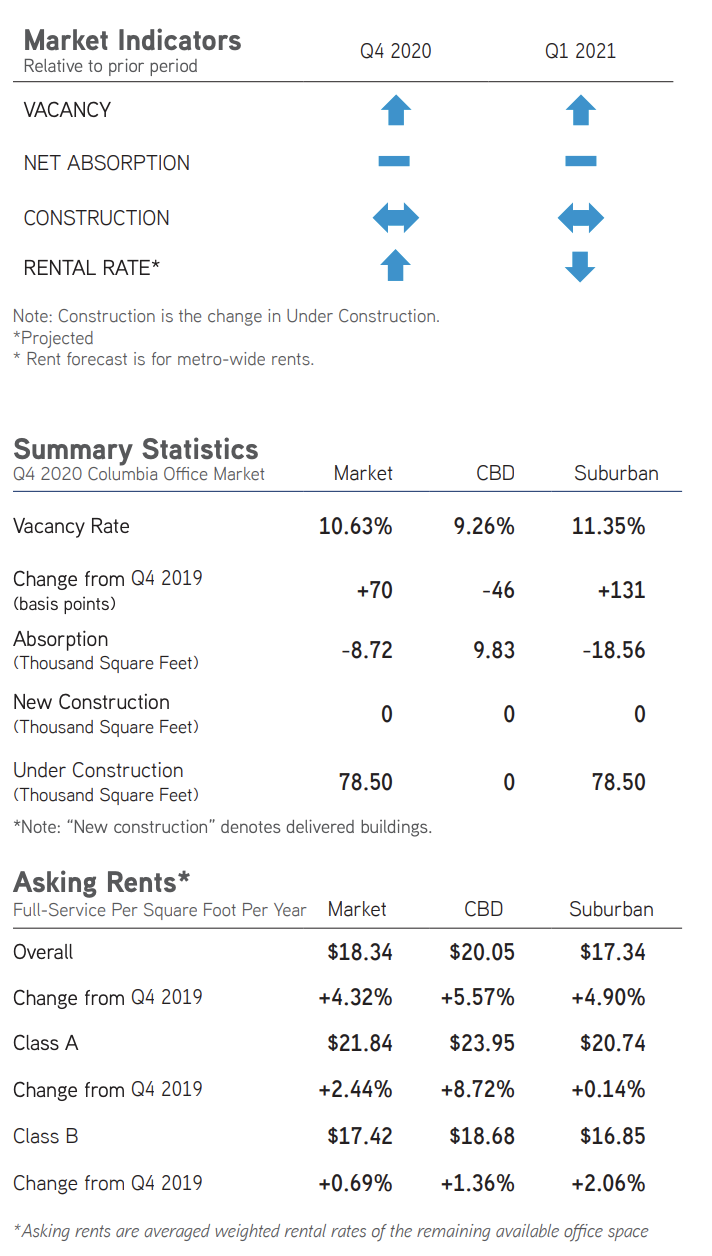

Offices in Columbia posted a negative 116,066 square feet of annual absorption during 2020, most of which was in suburban, Class A space. Negative absorption was offset by the central business district absorbing 26,462 square feet. The major factor contributing to negative absorption is the upsurge in available sublease space this year; it increased from 38,254 square feet during the fourth quarter of 2019 to 105,734 square feet this quarter. This level of available sublease space is anticipated to significantly increase during the first half of 2021. Due to the overall annual negative absorption, the office market vacancy rate increased from 9.93% during the fourth quarter of last year to 10.63% during the fourth quarter of 2020. Rental rates have steadily declined throughout this year and a decline is anticipated in order to compete with available sublease space.

Overall Columbia Market

The Columbia office market is comprised of approximately 16.59 million square feet and posted a negative absorption of 8,728 square feet during the fourth quarter of 2020. This is an indication of tenants being cautious and “staying put” while waiting to see what happens with the 2020 global pandemic. Class B offices absorbed 3,581 square feet; however, Class A and C offices posted minimal negative absorption. As a result of the negative absorption this quarter, the overall market vacancy rate rose from 10.57% last quarter to 10.63% during the fourth quarter of this year. The overall market weighted full service rental rates averaged $18.34 per square foot. Class A office weighted rental rates averaged $21.84 per square foot. Landlords will likely have to temporarily lower some of their building rental rates in order to compete with the lower-priced sublease availabilities.

Columbia Business District (CBD)

The Columbia central business district consists of 5.76 million square feet with very limited new office construction being planned for downtown Columbia. Each quarter of 2020, more evidence of the negative effects of the pandemic became apparent. Central business district sublease space increased from 52,988 square feet during the third quarter of 2020 to 65,275 square feet during the fourth quarter of this year. Despite an increase in sublease availabilities, downtown offices absorbed 9,833 square feet. Class B offices were most active and absorbed 10,584 square feet. Due to positive central business district absorption, the vacancy rate decreased from 9.43% last quarter to 9.26% during the fourth quarter of 2020. The overall average full service weighted rental rate in downtown offices decreased from $21.77 per square foot during the third quarter of 2020 to $21.05 per square foot this quarter, Class A offices averaged $23.95 per square foot.

Suburban

The Columbia suburban markets consist of 10.84 million square feet of office properties and there is one 78,500-square-foot building under construction at 1001 Clovis Point Way in the Cayce/West Columbia submarket. The suburbs posted a negative absorption of 18,561 square feet, split relatively equally among all three classes. Only three submarkets posted any activity at all, thereby proving tenants are currently on hold. Fourth quarter negative absorption drove the suburban vacancy rate up slightly from 11.18% last quarter to 11.35%. Overall suburban office full service average weighted rental rates rose to 17.34 per square foot. The rental rate averages ranged from $24.25 per square foot in Lexington Class A suburban offices to $9.50 per square foot in Class C office space.

According to Costar, during the fourth quarter of 2020 there were approximately 16 office sale transactions and 42 executed office leases or renewals within the Columbia market.

Fourth Quarter Sale

- LM Cola Partners, LLC purchased the Landmark Office and Medical Park located in Columbia. It was a 215,000-square-foot, three-building office park transaction.

Fourth Quarter Leases

- South Carolina Department of Social Services renewed their 51,266-square-foot lease at 1628 Browning Road in Columbia.

- Carolina Innovative Research signed an 11,150-square-foot lease at 301 Greystone Boulevard in Columbia.

Market Forecast

Looking ahead to 2021, Columbia office market will have a temporary downturn before returning to positive activity following 2021. Next year occupancy will decline as companies give up excess space due to business reductions or remote restructuring. On a positive note, recovery will begin when companies who have continued to work throughout the pandemic expand and take advantage of the vacant or sublease space that becomes available. In addition, the vacant space will give tenants an opportunity to upgrade to larger or redefined work environment.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.