Colliers Report: Columbia retail has a steady third quarter

November 6, 2019Key Takeaways

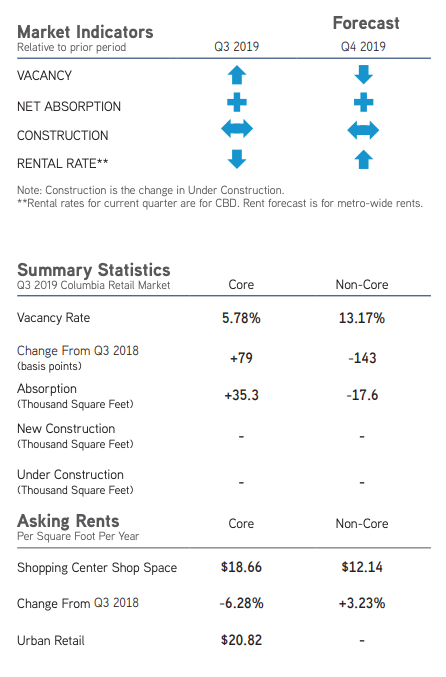

- The Columbia shopping center market absorbed 17,717 square feet during the third quarter of 2019; non-core retail space posted negative absorption of 17,583 square feet, while core retail shops absorbed 35,300 square feet.

- Pop-up shops may appear throughout retail centers more frequently in the next few quarters.

Pop-up shops: a bridge to fully leasing centers

Pop-up shops are less of a trend and more of a retail strategy now that consumers understand more about them. Often pop-ups use social media to expand awareness of the pop-up location and even advertise the shop longer than the actual shop is open; however, pop-ups are highly successful if executed correctly. There are several reasons pop-ups are advantageous:

Pop-up shops are less of a trend and more of a retail strategy now that consumers understand more about them. Often pop-ups use social media to expand awareness of the pop-up location and even advertise the shop longer than the actual shop is open; however, pop-ups are highly successful if executed correctly. There are several reasons pop-ups are advantageous:

- To test out a “cold” market with a new brand in order to gauge the opportunity to thrive;

- Allow one-on-one interaction with customers allowing them to evaluate products and answer consumer questions;

- Introduce a new line of a known brand so consumers can try samples from a company they already trust;

- Consumers are likely to show up and shop so they do not miss out on a opportunity.

Listed above are a few ways retailers can succeed using pop-up shops, nevertheless owners of retail centers can also bridge the gap to a fully-leased building by allowing pop-ups to rent space for short periods of time. Not only will it bring in revenue but it will also drive traffic to shopping centers; therefore, allowing for a vibrant and renewed environment for surrounding shops. If pop-ups have considerable success, they may become long-term tenants as well.

Market Overview

The Columbia shopping center market is comprised of approximately 13.38 million square feet of shop space and absorbed 17,717 square feet during the third quarter of 2019. Non-core shop space posted a negative absorption of 17,583 square feet; however in the Northeast Columbia submarket non-core shops absorbed 32,684 square feet, half of which was caused by Caliber Collision absorbing 15,000 square feet on Killian Road. All of the core positive absorption was in the Harbison/St. Andrews submarket due to stores such as Rainbow, PetCo and Shoe Carnival pushing the total market core space absorption to 35,300 square feet.

The non-core vacancy rate rose from 12.44% during the second quarter of 2019 to 13.17% this quarter, but the core vacancy rate dropped from 6.35% to 5.78% due to the positive absorption. The overall average shop space rental rate in the Columbia market was $14.22 per square foot during the third quarter of 2019. The decrease in weighted rental rates is an indication that the few remaining shop spaces are dated or not located in a popular retail spot, therefore the rental rates are lower. Columbia retail rental rates across the submarkets range from $8.00 per square foot up to $24.36 per square foot.

Market Forecast

Columbia retail is still posting positive absorption in many submarkets and core retail space is most desirable, although non-core shops offer many options, sizes and pricing variations. The vacancy rate is expected to decline next quarter because there are no buildings currently under construction.

The type of retail that will continue to perform well across the submarkets are fitness centers/gyms, restaurants automobile servicing centers and customer service and experience-oriented shops. The most frequent leases executed are between 3,000 square feet and 6,000 square feet; however, big box retail trends dictate the spaces will likely be filled by fitness centers and furniture stores. Pop-up shops will show up throughout Columbia during the holiday season next quarter.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q3 Retail Columbia Report