Colliers Report: Columbia retail vacancies provide new opportunities

August 10, 2020Research & Forecast Report

Q2-2020 COLUMBIA | RETAIL

Key Takeaways

- Some retailers closed their doors this quarter, however, some had been struggling prior to the COVID-19 loss of business.

- Retailers are altering their shops and restaurants in order to provide a safe environment and positive experience for all consumers.

- Columbia retail vacancies are lower and rental rates are higher than they were one year ago-prior to the Coronavirus.

For additional commercial real estate news, check out our market reports here.

Providing new options for customers

In an attempt to continue conducting business throughout the pandemic, many restaurants now have opened for indoor business but with only half of the tables available for seating to customers. In addition, parking lots are often partially blocked off to accommodate outdoor seating. Online websites have been updated for ease of use and walk-up or drive-thru options have been implemented in order to enhance productiveness and to provide options for all clientele.

In an attempt to continue conducting business throughout the pandemic, many restaurants now have opened for indoor business but with only half of the tables available for seating to customers. In addition, parking lots are often partially blocked off to accommodate outdoor seating. Online websites have been updated for ease of use and walk-up or drive-thru options have been implemented in order to enhance productiveness and to provide options for all clientele.

Retailers are spacing out their indoor merchandise and having sidewalk sales so customers are able to shop in person. However, fitting rooms are mostly unavailable, but return policies have been relaxed in order to raise the customer comfort level regarding “buying before trying.” Businesses are also limiting the number of shoppers at one time, setting up sanitizing stations and reinforcing mandatory masks upon entering the establishment in order to provide a safe environment and positive experience for all shoppers.

Market Overview

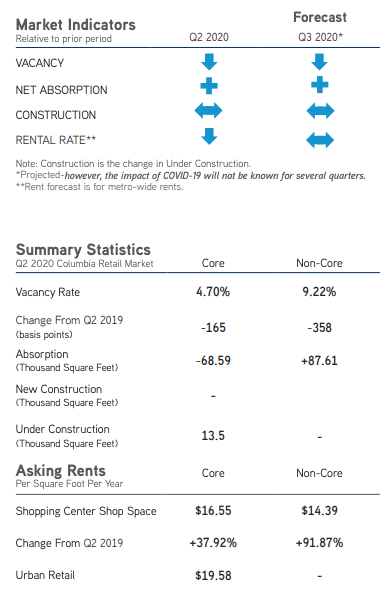

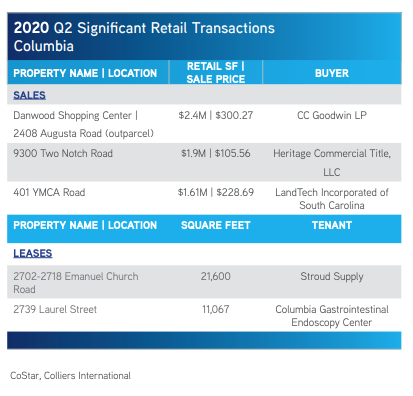

The Columbia shopping center market is comprised of approximately 13.47 million square feet of shop space and posted a positive absorption of 19,028 square feet overall during the second quarter of 2020. While core shop space posted a negative absorption of 68,585 square feet mostly due to Hobby Lobby leaving East Forest Plaza. Non-core retail shops absorbed 87,613 square feet. New vacancies in core areas of the submarket will create opportunities for retailers to locate to a central location with single-entrance access, which is attractive during the pandemic because retailers have more control over the safety of their customers shopping in their stores.

There were no new construction deliveries this quarter in the Columbia retail market. Due to positive absorption this quarter, the overall Columbia retail market vacancy rate decreased slightly from 7.28% last quarter to 7.14%. Overall core shop vacancy rate increased from 3.59% during the first quarter of this year to 4.70% during the second quarter of 2020. Conversely, the non-core Columbia vacancy rate dipped from 10.42% last quarter to 9.22% this quarter. Columbia retail rental rates across the submarkets ranged from $8.94 per square foot in the North Columbia submarket up to $18.86 per square foot in Northeast Columbia.

There were no new construction deliveries this quarter in the Columbia retail market. Due to positive absorption this quarter, the overall Columbia retail market vacancy rate decreased slightly from 7.28% last quarter to 7.14%. Overall core shop vacancy rate increased from 3.59% during the first quarter of this year to 4.70% during the second quarter of 2020. Conversely, the non-core Columbia vacancy rate dipped from 10.42% last quarter to 9.22% this quarter. Columbia retail rental rates across the submarkets ranged from $8.94 per square foot in the North Columbia submarket up to $18.86 per square foot in Northeast Columbia.

Market Forecast

A few of the retailers in the Columbia market which closed their doors this quarter, had been struggling prior to the COVID-19 loss of business. Construction activity will likely stall until more of the existing vacancies are filled; therefore, the market may continue to post positive absorption despite the pandemic.

Conversely, new vacancies will provide retailers an opportunity to evaluate their current space and upgrade their real estate. Retail spaces that will be especially popular are those which provide ease of access, and ability of curbside pickup. These shops will afford the tenant more control over their space such as being able to limit the amount of customers through their doors, setting up sanitizing stations outside of the entrance and allowing outdoor shopping and/or dining where space permits.

Conversely, new vacancies will provide retailers an opportunity to evaluate their current space and upgrade their real estate. Retail spaces that will be especially popular are those which provide ease of access, and ability of curbside pickup. These shops will afford the tenant more control over their space such as being able to limit the amount of customers through their doors, setting up sanitizing stations outside of the entrance and allowing outdoor shopping and/or dining where space permits.

Retailers, as well as consumers, are learning to cope with new regulations and as everyone becomes more comfortable with the safety precautions throughout retail shops, the consumer traffic may pick up. While there are predicted to be many changes occurring within the retail sector, the true effects of the Coronavirus will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.