Colliers Report: Columbia warehouse space in high demand

January 21, 2020Key Takeaways

- Trade negotiations between the U.S. and China will likely benefit Columbia through increasing imports and exports; therefore, raising demand from out-of-market users seeking a location in Columbia due to its central location and accessibility to logistics.

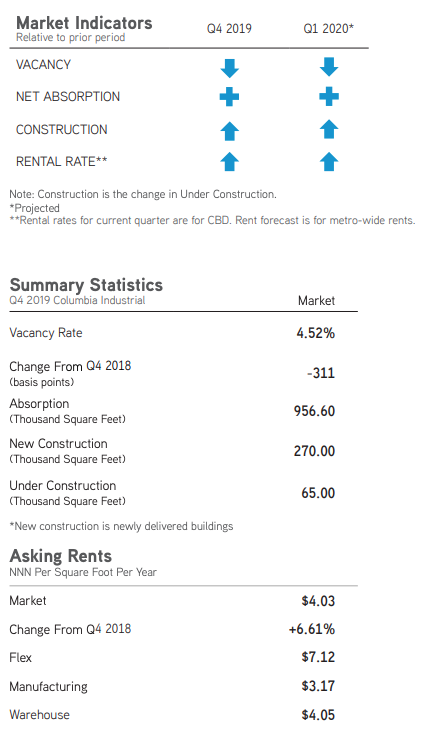

- Over the past year, the Columbia industrial market has absorbed 3.30 million square feet and the vacancy rate decreased 311 basis points to 4.52% at year-end.

- There were five industrial buildings delivered during 2019 adding 1.02 million square feet to the Columbia industrial market.

- Columbia warehouse space is being absorbed as soon as it is delivered to the market; the Orangeburg County submarket warehouse sector alone absorbed 417,817 square feet during the fourth quarter of 2019.

For additional commercial real estate news, check out our market reports here.

2019 Industrial Recap

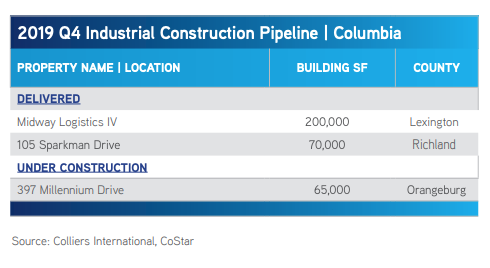

The Columbia industrial market had a phenomenal year absorbing 3.30 million square feet. There were five building delivered to the market during 2019, four of them were delivered to the Southeast Columbia submarket: China Jushi located at 1460 Pineview Drive is a new 660,135-square-foot manufacturing facility, 105 Sparkman Drive is the site of a new 70,000-square-foot flex/R&D building, 126 Atlas Court is a new 46,000-square-foot warehouse and Shop Grove Commerce Park located at 101 Sparkman Drive is the site of a new 45,000-square-foot warehouse. There was also one 200,000-square-foot warehouse delivered to the Cayce/West Columbia submarket at Midway IV. The Columbia overall market vacancy rate decreased from 7.79% during the fourth quarter of 2018 to 4.52% during the fourth quarter of 2019. The average market weighted rental rate has increased from $3.78 per square foot at the end of 2018 to $4.03 per square foot at year-end 2019.

The Columbia industrial market had a phenomenal year absorbing 3.30 million square feet. There were five building delivered to the market during 2019, four of them were delivered to the Southeast Columbia submarket: China Jushi located at 1460 Pineview Drive is a new 660,135-square-foot manufacturing facility, 105 Sparkman Drive is the site of a new 70,000-square-foot flex/R&D building, 126 Atlas Court is a new 46,000-square-foot warehouse and Shop Grove Commerce Park located at 101 Sparkman Drive is the site of a new 45,000-square-foot warehouse. There was also one 200,000-square-foot warehouse delivered to the Cayce/West Columbia submarket at Midway IV. The Columbia overall market vacancy rate decreased from 7.79% during the fourth quarter of 2018 to 4.52% during the fourth quarter of 2019. The average market weighted rental rate has increased from $3.78 per square foot at the end of 2018 to $4.03 per square foot at year-end 2019.

Market Overview

Overall Columbia

The Columbia industrial market is comprised of 72.51 million square feet. During the fourth quarter of 2019, the market absorbed 956,603 square feet, over half of which was absorbed within the warehouse sector. Orangeburg County was the submarket with the highest absorption of 417,817 square feet, followed by Northeast Columbia with 209,500 square feet of absorption. There is currently one building under construction which, upon completion, will add 65,000 square feet to the market. Two buildings were delivered to the market during the fourth quarter of 2019 adding 270,000-square-foot to the Columbia market. The quarterly vacancy rate dropped from 5.48% during the third quarter of 2019 to 4.52% at year-end. The overall average market rental rate for available industrial space rose from $3.95 per square foot during the third quarter of 2019 to $4.03 per square foot at the end of 2019.

Warehouse/Distribution

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.33 million square feet. One 200,000-square-foot warehouse was delivered at Midway Logistics IV, a within the Cayce/West Columbia submarket, and one 67,000-square-foot warehouse is proposed to be built within the Lexington submarket. This sector absorbed 644,506 square feet during the fourth quarter of 2019, 446,967 square feet were absorbed within Orangeburg warehouses. The quarterly warehouse vacancy rate drastically decreased from 5.03% during the third quarter of 2019 to 4.03% at year-end- there are six submarkets with a vacancy rate of less than 1%. The overall average weighted rent for warehouses rose to $4.05 per square foot during the fourth quarter of this year due to warehouse rental rates ranging from $1.00 per square foot in the Orangeburg submarket to $10.00 per square foot in the Northwest Columbia submarket.

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.33 million square feet. One 200,000-square-foot warehouse was delivered at Midway Logistics IV, a within the Cayce/West Columbia submarket, and one 67,000-square-foot warehouse is proposed to be built within the Lexington submarket. This sector absorbed 644,506 square feet during the fourth quarter of 2019, 446,967 square feet were absorbed within Orangeburg warehouses. The quarterly warehouse vacancy rate drastically decreased from 5.03% during the third quarter of 2019 to 4.03% at year-end- there are six submarkets with a vacancy rate of less than 1%. The overall average weighted rent for warehouses rose to $4.05 per square foot during the fourth quarter of this year due to warehouse rental rates ranging from $1.00 per square foot in the Orangeburg submarket to $10.00 per square foot in the Northwest Columbia submarket.

Manufacturing

The manufacturing sector in the Midlands has 24.85 million square feet and there is currently one manufacturing facility under construction that, upon completion will add 65,000 square feet to the inventory. The manufacturing sector absorbed 308,684 square feet during the fourth quarter of 2019, mostly within the Northeast Columbia submarket at 1080 Jenkins Brothers Road. Due to the positive leasing activity, the manufacturing vacancy rate decreased from 5.81% last quarter to 4.57% during the fourth quarter of 2019. The weighted rental rate for available manufacturing space averaged $3.17 per square foot at year-end.

The manufacturing sector in the Midlands has 24.85 million square feet and there is currently one manufacturing facility under construction that, upon completion will add 65,000 square feet to the inventory. The manufacturing sector absorbed 308,684 square feet during the fourth quarter of 2019, mostly within the Northeast Columbia submarket at 1080 Jenkins Brothers Road. Due to the positive leasing activity, the manufacturing vacancy rate decreased from 5.81% last quarter to 4.57% during the fourth quarter of 2019. The weighted rental rate for available manufacturing space averaged $3.17 per square foot at year-end.

Flex/R&D

The Flex/R&D sector in the Midlands has 2.32 million square feet within its submarkets. One 70,000-square-foot flex/R&D property was delivered to the Southeast Columbia submarket during the fourth quarter of 2019. This sector absorbed 3,413 square feet; however, the vacancy rate increased due to the 70,000-square-foot new construction becoming available, in addition to the other building vacancies. The quarterly vacancy rate increased from 10.97% to 13.50%. Flex/R&D average weighted rental rate for the remaining availabilities decreased from $8.31 per square foot during the third quarter of 2019 to $7.12 per square foot at year-end.

Capital Investment & Employment

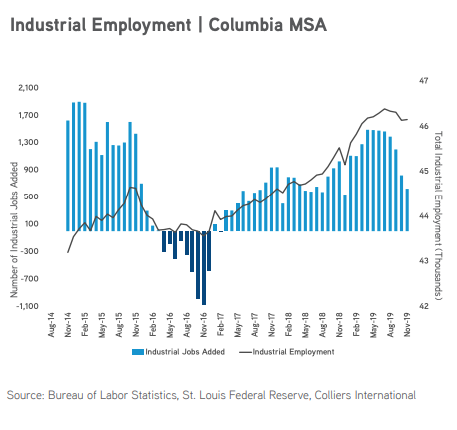

Through the fourth quarter of 2019, there have been $230.90 million in new capital investments and $79.10 million in capital investment expansions, accounting for 967 jobs announced within the Columbia region. The types of investors include chemical manufacturing, advanced manufacturing | fabrication, energy production and marine manufacturing. According to the Federal Reserve data through November 2019, industrial employment comprises 11.4% of Columbia’s total employment, or about 46.2 million jobs in the Midlands region. There were 3,300 non-farm jobs added to the market during the past 12 months ending November 2019, and industrial employment made up approximately 18.9% of the total jobs added or 625 jobs.

Significant Transactions

According to CoStar, there were 30 industrial sale transactions and 17 industrial leases signed during the fourth quarter of 2019.

Sales

- For $34.3 million, STAG Industrial, Inc. purchased the 450,000-square-foot manufacturing facility at 1000 Technology Drive in West Columbia and negotiated a sale | leaseback with Flextronics.

- For $14.6 million, W.P. Carey, Inc. purchased the 212,978-square-foot distribution center located at 670 Industrial Drive, in Lexington, as part of a portfolio sale.

- The new owner negotiated a sale | leaseback with Apex Tool Group, LLC for this space.

- For $4.1 million, Lee & Associates purchased a 70,757-square-foot warehouse at Carolina Pines III located at 116 Belk Court and negotiated a sale | leaseback with Hodell-Natco Industries, Inc.

Leases

- As mentioned above, Apex Tool Group leased 212,978 square feet at 670 Industrial Drive in the Lexington submarket.

- Jushi USA Fiberglass Co. Ltd. leased 122,419 square feet at 209 Flintlake Road in the Northeast Columbia submarket.

- Jemison Metals leased 70,568 square feet at 2630 Hwy 15 South in the Sumter County submarket.

- Husqvarna Consumer Outdoor Products NA Inc. leased 54,043 square feet at 3130 Bluff Road in the Southeast Columbia submarket.

Market Forecast

The South Carolina industrial markets will benefit from the recently negotiated U.S.-China Trade Deal. The two most pertinent aspects of the deal affecting South Carolina industrial markets promote increased purchases of American products and tariff relief on Chinese products; thus, leading to an increase in imports and exports. Therefore, the demand for out-of-market industrial powerhouses to locate throughout South Carolina is expected to rise in 2020. With increased demand, new construction will likely be necessary within the Columbia warehouse sector, because the occupancy rate is already 95.97% and is predicted to continue on an upward trajectory. In addition, with increasing imports and exports; manufacturers will seek locations within areas convenient to trade logistics; therefore, Columbia’s central location may draw new manufacturers to the region next year. Rental rates are expected to rise in 2020 due to limited space availabilities and new construction deliveries.

For additional commercial real estate news, check out our market reports here.