Colliers Report: Columbia’s industrial market is stable with positive absorption

October 31, 2019

Research & Forecast Report

Q3-2019 COLUMBIA, SC | INDUSTRIAL

Key Takeaways

- Columbia’s industrial market absorbed 627,170 square feet during the third quarter of 2019.

- Due to Columbia’s central location within a state thriving on industrial manufacturing and distribution, industrial activity is predicted to be steady in the coming quarters.

- Robotics are shifting much of the industrial workforce from physical labor to technology and automation-based training in order to remain efficient.

Robotics in warehouse and manufacturing

The nature of warehouse and manufacturing employment training has changed drastically over the last ten years. The knowledge areas have shifted from heavy manual labor and mechanical skills to technology-based knowledge. It is necessary to attract employees with the appropriate knowledge in order to run a business efficiently. Another way warehouse and manufacturing has changed over the years is the addition of robotics in order to minimize mistakes and automate some aspects of production. Robotics do not have to look like the traditional image of complex, human-like robots. According to Conveyco.com, listed below are several types of robotics in use everyday.

The nature of warehouse and manufacturing employment training has changed drastically over the last ten years. The knowledge areas have shifted from heavy manual labor and mechanical skills to technology-based knowledge. It is necessary to attract employees with the appropriate knowledge in order to run a business efficiently. Another way warehouse and manufacturing has changed over the years is the addition of robotics in order to minimize mistakes and automate some aspects of production. Robotics do not have to look like the traditional image of complex, human-like robots. According to Conveyco.com, listed below are several types of robotics in use everyday.

- Automated Storage and Retrieval Systems (AS/RS): these systems are used to retrieve items using a preset route either on a fixed track or using a crane arm to locate, remove and replace an object once it has been used appropriately.

- Goods-to-Person Technology (G2P): this system is similar to AS/RS listed above; however, once the item is retrieved, it is then given to a person who uses it or fills an order with the goods delivered.

- Automated Guided Vehicles (AGVs): these vehicles are used for large loads and are often guided by magnetic strips or tracks and predetermined routes within the warehouse or manufacturing facility.

- Automated Guided Carts (AGCs): these vehicles are used for smaller loads and are often guided by magnetic strips or tracks and predetermined routes within the warehouse or manufacturing facility.

- Autonomous Mobile Robots (AMRs): these robots are useful in fulfillment environments because they are able to navigate without human intervention due to a complex system of onboard sensors, maps and computers.

- Articulated Robotic Arms: this robot is essentially a multi-jointed limb used for the purposes of: receiving and storage, picking and packing, shipping and production.

While robotics are taking the place of many functions within the warehouse/manufacturing sector, they are allowing people to fill technology-based jobs operating these robots. Therefore, the heavy lifting and physical strains of many warehouse jobs are being replaced by robots, thus improving efficiency and removing the physical strain previously placed on warehouse and manufacturing employees.

Market Overview

Overall Columbia

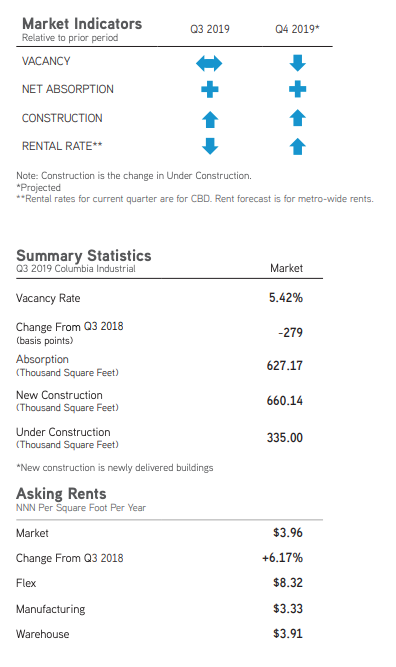

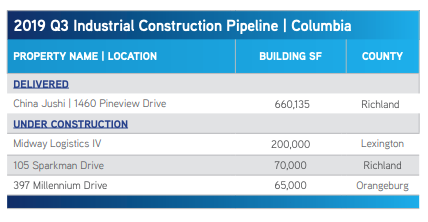

The Columbia industrial market is comprised of 72.26 million square feet of industrial space. There are approximately 335,000 square feet under construction within three buildings and one owner-occupied manufacturing facility of 660,135 square feet was delivered to the market this quarter. The Columbia industrial market absorbed 627,170 square feet this quarter mostly due to the China Jushi facility in the Southeast Columbia submarket. The overall market vacancy rate remained relatively unchanged from last quarter to this quarter at 5.42% and the average overall market weighted rental rate was $3.96 per square foot this quarter.

Warehouse/Distribution

The warehouse/distribution sector comprises the largest portion of the Midlands industrial market, with approximately 45.14 million square feet. This sector posted a negative absorption of 15,206 square feet during the third quarter of 2019 representing three spaces that became available totaling 103,000 square feet versus seven lease transactions totaling 87,856 square feet. Twenty-five percent of the negative absorption is now leased and will be represented in the fourth quarter of this year. The quarterly vacancy rate increased from 4.65% to 4.85%. There is one warehouse under construction in the Columbia market at Midway Logistics IV, a 200,000-square-foot warehouse within the Cayce/West Columbia submarket. The overall average weighted rent for warehouses was $3.91 per square foot during the third quarter of this year, and the warehouse rental rate averages range from $1.95 per square foot within the Saluda County submarket to $10.00 per square foot within the Northwest Columbia submarket.

Manufacturing

The manufacturing sector in the Midlands has 24.85 million square feet and there is currently one manufacturing facility under construction that, upon completion (which is predicted to be by the end of this year) will add 65,000 square feet to the inventory. The manufacturing sector absorbed 638,238 square feet this quarter mostly within the Southeast Columbia submarket China Jushi manufacturing facility. Due to the positive leasing activity, the manufacturing vacancy rate decreased from 5.94% last quarter to 5.87% during the third quarter of 2019. The average weighted rental rate in the manufacturing sector was $3.33 per square foot this quarter.

Flex/R&D

The Flex/R&D sector in the Midlands has 2.37 million square feet within its submarkets, with one 70,000-square-foot flex/R&D property currently under construction within the Southeast Columbia submarket. This sector absorbed 4,108 square feet during the third quarter of 2019 and the quarterly vacancy rate decreased from 11.99% to 11.82%. Flex/R&D average weighted rental rate for the remaining availabilities rose from $8.12 per square foot during the second quarter of 2019 to $8.32 per square foot during the third quarter of this year.

Capital Investment & Employment

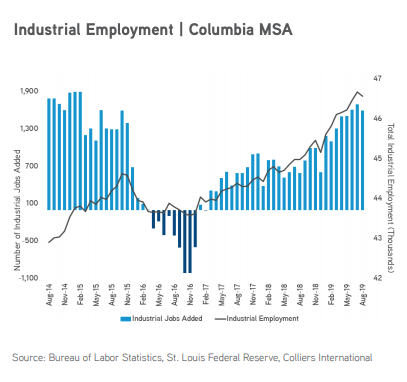

Through the third quarter of 2019 there have been $224.50 million in new capital investments and $79.10 million in capital investment expansions, accounting for 613 jobs announced within the Columbia region. Most of the jobs will be within the new JUUL assembly facility announced in Lexington County. Other types of investors range from plastic injection molding to solar energy and solar farms to a chemical manufacturer and water heater production. According to the Federal Reserve data through August 2019, industrial employment comprises 11.5% of Columbia’s total employment, or about 46.6 million jobs in the Midlands region. There were 1,594 industrial jobs added during the past 12 months ending August 2019.

Significant Transactions

According to CoStar, there were 9 industrial sale transactions and 16 industrial leases signed during the third quarter of 2019.

According to CoStar, there were 9 industrial sale transactions and 16 industrial leases signed during the third quarter of 2019.

Sales

- Clemson Belle, LLC purchased a 30,000-square-foot warehouse for $1.9 million, it is located at 681 Clemson Road in Columbia.

- Lab Properties, LLC purchased an 11,900-square-foot warehouse for $900,000, it is located at 1104 Atlas Road in Columbia.

- Jushi USA leased 280,468 square feet at 10700 Farrow Road in Blythewood.

Market Forecast

The Columbia industrial market is forecasted to finish the year with steady market activity and new construction absorption. Employment is on the rise in the midlands and is expected to continue trending upward as more businesses locate to the region. In addition, robotics are changing the face of the industrial workforce and Columbia has many colleges poised to turn out new graduates to work in a technology-based warehouse environment. Due to Columbia’s central location within a state thriving on industrial manufacturing and distribution, industrial owner interest from outside of the Columbia market is predicted to increase in the coming quarters.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q3 Industrial Columbia Report