Colliers Report: Constrained retail construction and turnover create opportunities

March 16, 2023Commercial Real Estate Research & Forecast Report

Q4 2022 Columbia Retail

Market Highlights

Headlines have been filled in recent years with stories announcing the “demise of retail”. In reality, vacancies have declined to the lowest levels in decades and rents have risen. In some cases, landlords have been anxious to get junior anchor and anchor spaces back to be able to lease to tenants who are expanding and who can pay higher rental rates.

Click here to read the full report.

Key Takeaways

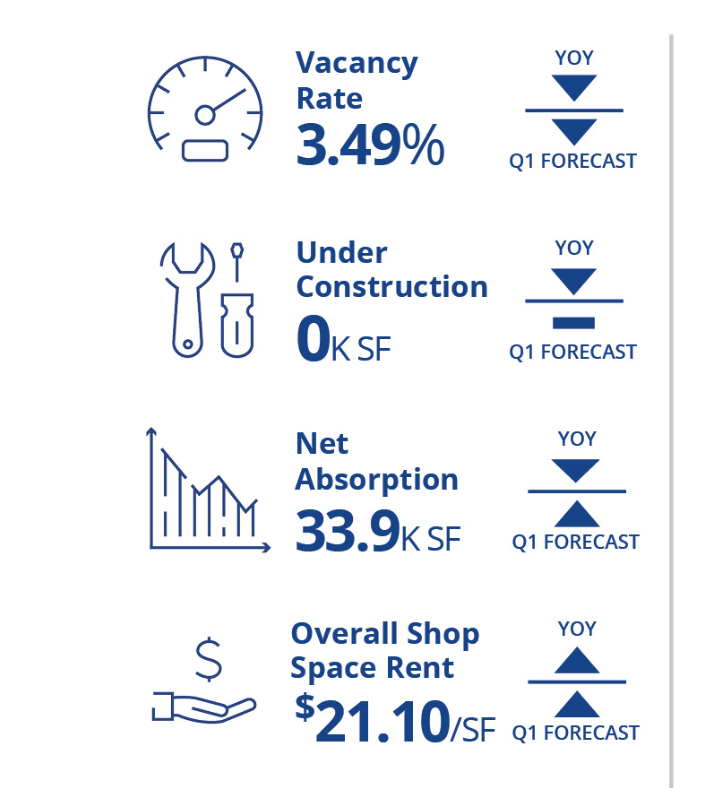

- Vacancy remains at a historic low

- New development in the primary retail corridors is very limited

- Landlords anticipate junior anchor vacancies in 2023

Forecast

Recently, Bed Bath & Beyond and Tuesday Morning announced a significant number of store closures. Because their average store size is between 20,000 and 30,000 square feet and most are in desirable retail corridors, these spaces will be quickly leased to new tenants like Five Below, Pop Shelf, Painted Tree Boutiques and Burlington.

About Colliers

Colliers | South Carolina is the largest full-service commercial real estate firm in South Carolina with 62 licensed real estate professionals covering the state with locations in Charleston, Columbia, Greenville and Spartanburg. Colliers is an Accredited Management Organization (AMO) through the Institute of Real Estate Management (IREM) and is the largest manager of commercial real estate properties in South Carolina with a portfolio of over 18 million square feet of office, industrial, retail and healthcare properties. Colliers’ staff hold the most professional designations of any firm in South Carolina. Colliers | South Carolina’s partner, LCK, provides project management services for new facilities and renovations across South Carolina.

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 65 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people. Learn more at corporate.colliers.com, Twitter @Colliers or LinkedIn.