Colliers Report: Entertainment, health and wellness boost Columbia retail occupancy

February 19, 2020

Research & Forecast Report

Q4-2019 COLUMBIA | RETAIL

Key Takeaways

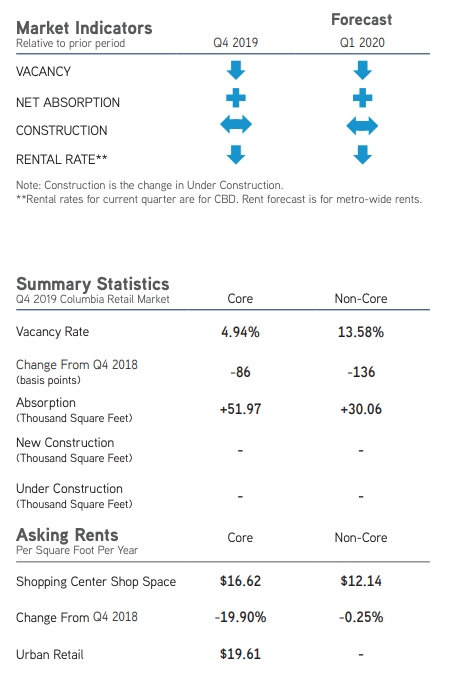

- The Columbia shopping center market absorbed 82,026 square feet during the fourth quarter of 2019; non-core retail space absorbed 30,059 square feet, while core retail shops absorbed 51,967 square feet.

- Shops catering to entertainment and healthy living are driving Columbia’s positive retail absorption.

- Urban retail affords opportunities for new retailers to locate to the area, and there are expansion options available throughout Columbia shopping centers.

For additional commercial real estate news, check out our market reports here.

Over the past year the Columbia retail market absorbed 179,431 square feet. Non-core shops absorbed 126,267 square feet and the majority of absorption was disbursed among several shops ranging from 2,000 square feet to 10,000 square feet. Core retail shops absorbed 53,164 square feet from the fourth quarter of 2018 through the fourth quarter of 2019. Positive absorption was driven mostly by entertainment and healthy living- Planet Fitness leased space at The Crossings Shopping Center and Greenwise Market moved into the Lexington Marketplace. In addition, this year a movie theater was added in the northeast next to The Meeting Place Church at 201 Columbia Mall Drive. Some of the larger negative absorption was due to Hobby Lobby and Fallas leaving East Pointe Shopping Center and Home Decor Outlets leaving Danwood Shopping Center (although Home Decor Outlets is moving to a new location and will likely create positive absorption by the first quarter of 2020).

The overall Columbia retail vacancy rate was 112 basis points lower than it was one year ago, it decreased from 10.70% during the fourth quarter of 2018 to 9.58% during the fourth quarter of 2019. Core shopping center space vacancy rate was 86 basis points less, while non-core vacancy was lower by 136 basis points. Average rental rates were less at the end of 2019 due to fewer available leasable spaces remaining in the market, and the fact the spaces that are currently available are of less quality than previous availabilities.

The Columbia shopping center market is comprised of approximately 13.38 million square feet of shop space and absorbed 82,026 square feet overall during the fourth quarter of 2019. The largest submarket in Columbia, Northeast Columbia, had the highest quarterly absorption. Core retail shops absorbed 51,967 square feet this quarter and non-core retail stores absorbed 30,059 square feet.

There are currently no shopping centers under construction within the Columbia market. In addition, due to positive absorption and no new construction deliveries, the vacancy rate in both core and non-core shop space was lower during the fourth quarter of 2019 than it was during the third quarter of 2019. However, there are several centers throughout the Columbia submarket that have expansion opportunities for existing tenants in the market or retailers expanding into the Columbia region.

The choices are dwindling from quarter to quarter in existing shop space as the occupancy rises; therefore, the rental rates for remaining available spaces continue to drop. Columbia urban retail affords opportunities for new retailers to locate to the area thanks to revitalization efforts and improving parking access in Five Points. A new 10-point plan developed by business owners, neighborhood leaders and elected officials was created to make the process easier for new retailers to move to the area. The shops along Harden Street are now empty and the buildings are ready for redevelopment. The overall Columbia retail rental rate in core shopping centers averaged $16.62 per square foot and in non-core the rental rate average was $12.14 per square foot at year end 2019. Columbia retail rental rates across the submarkets range from $8.00 per square foot up to $23.88 per square foot.

Market Forecast

Occupancy is expected to rise further in 2020 boosting the need for new retail construction, especially in the Northeast Columbia and Harbison/St. Andrews submarkets, where positive absorption is consistently occurring each quarter. Until new retail construction is added to the inventory or current available spaces are upgraded, the average rental rate will fall slightly quarter-to-quarter based on the lack of quality of the few spaces remaining.

For a market to maintain a high retail occupancy level, two factors are important: consistent consumer traffic and internet-proof shop space users. Consumer traffic and occupancy is consistent in restaurant space. In addition, the areas of health and wellness are currently internet-proof. The aging portion of the population is more health conscious, making time on a daily basis to enhance their well-being. In the Columbia market, the Northeast and Harbison/St. Andrews submarkets are on track to boost occupancy based on these two factors, and it is expected that more restaurants and health/wellness-focused centers will move into the areas of submarkets which have previously posted negative absorption.

For additional commercial real estate news, check out our market reports here.