Colliers Report: Greenville-Spartanburg construction completions are expected to be quickly absorbed

August 3, 2020Research & Forecast Report

Q2-2020 GREENVILLE-SPARTANBURG | INDUSTRIAL

Key Takeaways

- Increased interest in the Greenville-Spartanburg market has fueled industrial activity throughout the pandemic thus far, the market absorbed 117,104 square feet.

- Speculative construction deliveries pushed the vacancy rate up to 7.11% during the second quarter of 2020.

- The next phase of construction will not be delivered until the middle of next year, so the available industrial space is expected be absorbed within the next few quarters.

Greenville is the place to locate

Greenville is the place to locate

According to the U.S. Census Bureau, Greenville’s population has increased 19.2% from 2010 to 2019. Also, according to the Post and Courier, South Carolina’s growth percentage is ranked ninth in the U.S. The pandemic has forced people to evaluate where they live, and those cities with less dense populations in tertiary markets such as Greenville-Spartanburg are becoming popular places for large city residents to locate. Due to the influx of people throughout the state, housing demand has increased exponentially. In addition, the arrival of new residents will add to the labor pool and create opportunities for employers to choose employees from a larger group of applicants.

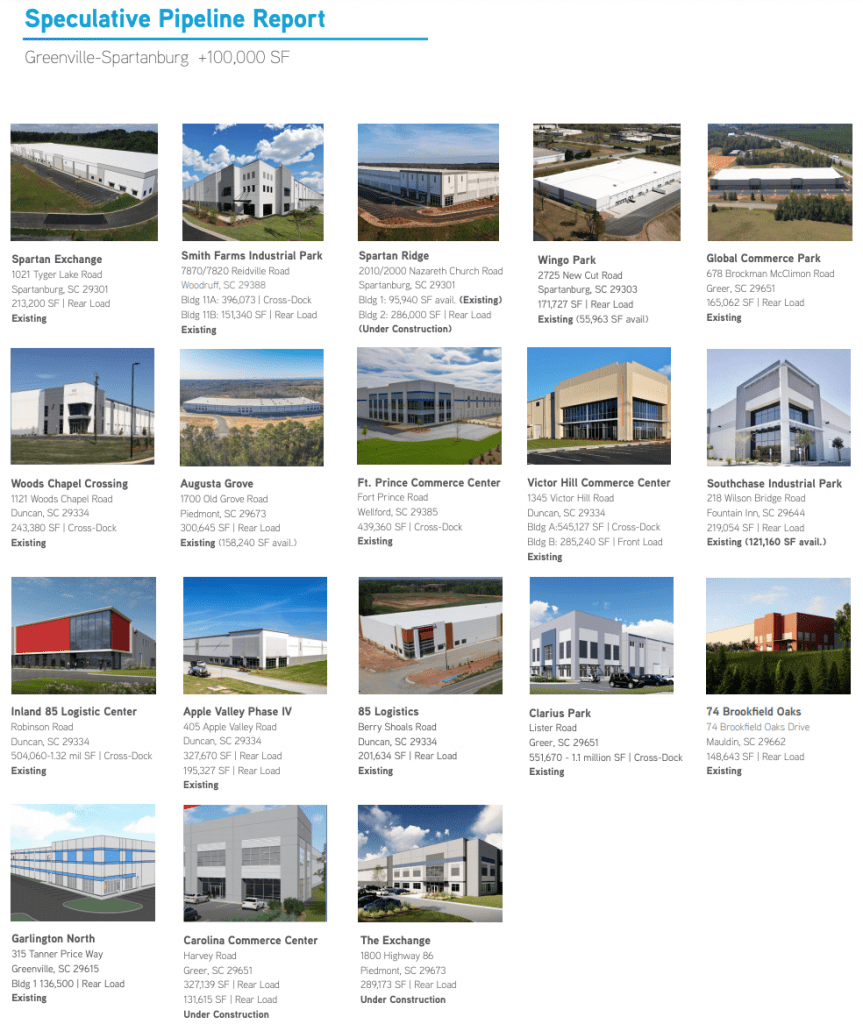

Increased interest in the Greenville-Spartanburg market has fueled industrial activity throughout the pandemic thus far. Speculative construction completed during the second quarter of 2020, and the market posted positive absorption throughout the market. Despite the vacancy rate increasing due to speculative construction deliveries, most of the construction pipeline is now built and the next phase of construction is not expected until next year. Industrial demand is high enough throughout the market that the construction delivered during this quarter is expected to be absorbed by year-end.

Market Overview

Greenville-Spartanburg Market

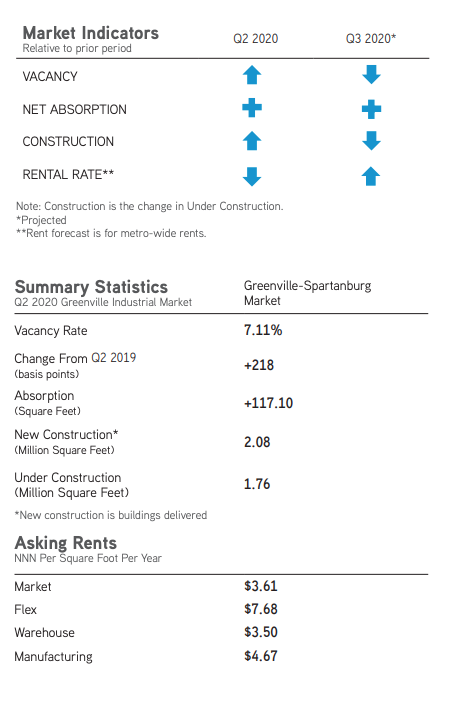

Comprised of approximately 213.86 million square feet, there are currently 1.76 million square feet among 9 buildings under construction and approximately 1.97 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the second quarter of 2020, the market absorbed 117,104 square feet; however, there were 2.08 million square feet delivered to the market. Subsequently, the quarterly vacancy rate rose from 6.20% last quarter to 7.11% during the second quarter of this year. The overall weighted rental rate during the second quarter of 2020 decreased slightly from last quarter and averaged $3.61 per square foot.

Flex/R&D

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.44 million square feet. There are currently no buildings under construction, but there are approximately 114,500 square feet proposed to begin construction in the Highway 585 Corridor. One 12,000-square-foot flex/R&D building was delivered to downtown Greenville at 10 Webb Road. This sector absorbed 16,214 square feet this quarter and the quarterly vacancy rate decreased to 8.60%. The average weighted rental rate decreased slightly to $7.68 per square foot.

Significant Transactions

Within the Greenville-Spartanburg market, CoStar reported 33 signed leases, five were over 100,000 square feet. There were also 28 sale transactions during the second quarter of 2020, including 2 portfolio sales.

Sales

- For $4.25 million, Alexander Summer, LLC purchased a 154,000-square-foot manufacturing facility in Roebuck.

- For $6.92 million, SCP of Dexter Augusta, LLC purchased a 149,550-square-foot warehouse at 6801 Augusta Road in Greenville.

- For $4.23 million, Eaton Corp. purchased a 111,600-square-foot manufacturing facility at 5502 Highway 25 North in Hodges.

Leases

- Custom Goods LLC leased 647,785 square feet at 120 Orion Street in Greenville.

- Leigh Fibers Inc. leased 552,147 square feet at 1101 Syphrit Way in Wellford.

- JIDA Industrial Solutions Inc. leased 150,000 square feet at 154 Metro Court in Greer.

- Lockheed Martin leased 149,550 square feet at 6801 Augusta Road in Greenville.

Capital Investment & Employment

Capital Investment & Employment

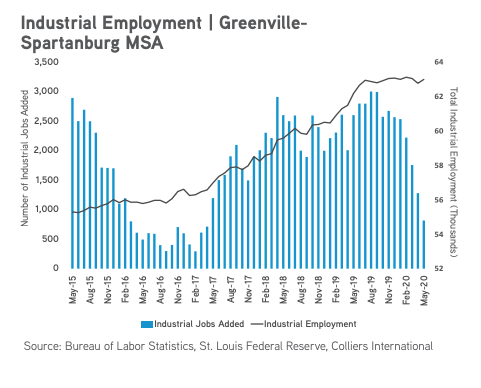

From June of 2019 through May of 2020, there were approximately $304.91 million in capital investments from new companies, accounting for 1,111 jobs. Existing company expansions accounted for $579.13 million in new capital, creating 2,601 additional jobs within the Greenville-Spartanburg region. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing and software, communications, solar farming and logistics. According to the Bureau of Labor Statistics data there are 400 more industrial jobs than there were in May of 2019, despite COVID-19 closings. While total employment has decreased by 51,600 jobs, down to 546,500, total employment is expected to normalize as Coronavirus restrictions are relaxed or lifted.

Market Forecast

According to the Site Selectors’ Guild, mid-size cities are most likely for relocation to the market or expansions within the market; therefore, the Greenville-Spartanburg market demand is predicted to increase. In addition, Greenville is listed as one of the top mid-size cities for new projects; therefore, an influx of out-of-state residents, employers and employees are predicted to fuel increased activity throughout next year. The market is viable for new projects to begin. The next phase of construction will not be delivered until the middle of next year, so the available industrial space is expected be absorbed within the next few quarters. While this seems positive for the industrial sector, the true effects of the pandemic will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.