Colliers Report: Greenville-Spartanburg retail posts positive absorption amidst pandemic

August 7, 2020

Research & Forecast Report

Q2-2020 GREENVILLE-SPARTANBURG | RETAIL

Key Takeaways

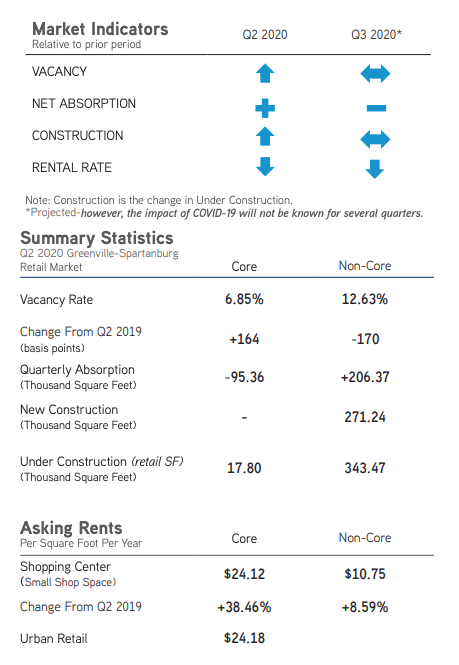

- Due to vacant shop space deliveries overshadowing the positive absorption and ongoing effects of COVID-19 during the second quarter of 2020, the quarterly vacancy rate increased from 10.25% during the first quarter of 2020 to 11.15% this quarter.

- Retailers are altering their shops and restaurants in order to provide a safe environment and positive experience for all consumers.

For additional commercial real estate news, check out our market reports here.

Providing new options for customers

In an attempt to continue conducting business throughout the pandemic, many restaurants now have opened for indoor business, but with only half of the tables available for seating to customers. In addition, parking lots are often partially blocked off to accommodate outdoor seating. Online platforms have been updated for ease of use and walk-up or drive-thru options have been implemented in order to enhance productiveness.

In an attempt to continue conducting business throughout the pandemic, many restaurants now have opened for indoor business, but with only half of the tables available for seating to customers. In addition, parking lots are often partially blocked off to accommodate outdoor seating. Online platforms have been updated for ease of use and walk-up or drive-thru options have been implemented in order to enhance productiveness.

Retailers are spacing out their indoor merchandise and having sidewalk sales so customers are able to shop in person. However, fitting rooms are mostly unavailable, but return policies have been relaxed in order to raise the customer comfort level of “buying before trying.” Businesses are also limiting the number of shoppers at a given time, setting up sanitizing stations and reinforcing mandatory masks upon entering the establishment in order to provide a safe environment and positive experience for all shoppers.

Market Overview

The Greenville-Spartanburg retail market is comprised of approximately 17.22 million square feet of retail space. During the second quarter of 2020, the market absorbed 111,015 square feet. While core retail space posted a negative 95,356 square feet; non-core shops absorbed 206,371 square feet. The majority of the positive absorption occurred within the Greer submarket. Much of the negative absorption was due to the Coronavirus; however, several of the businesses which closed their doors permanently were already struggling prior to the COVID-19 shut-down.

Essential stores offering groceries and/or medical supplies such as CVS, Walgreens, Food Lion and Publix; dollar stores such as Dollar General and Dollar Tree; and auto parts and repair shops are performing well and even expanding during the pandemic, but these have smaller footprints and their growth was not enough to offset the negative core absorption this quarter.

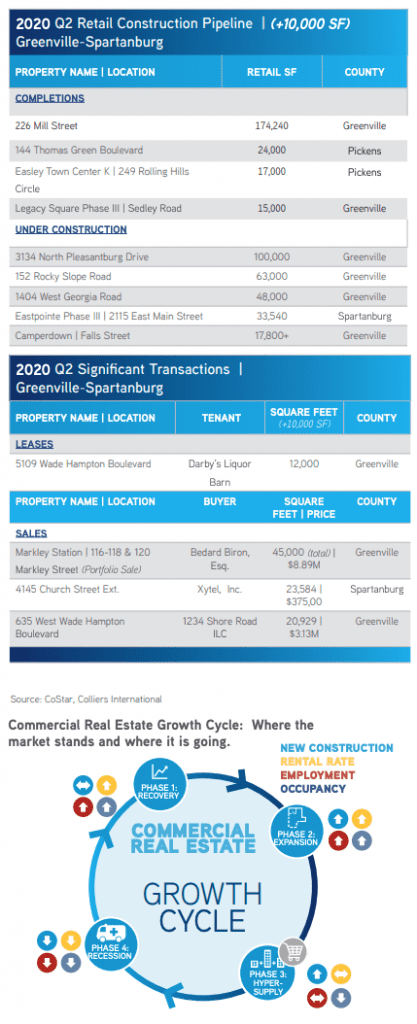

There are 361,262 square feet under construction throughout the Greenville-Spartanburg submarkets. Non-core space will comprise 343,472 square feet, and 17,800 square feet will be located in core areas within the Camperdown development upon completion. In addition, there were 271,240 square feet of retail space delivered to the Greenville-Spartanburg market. Due to the delivery of vacant shop space deliveries overshadowing the positive absorption during the second quarter of 2020, the quarterly vacancy rate increased from 10.25% during the first quarter of 2020 to 11.15% this quarter. Vacancy rates within urban retail shops increased to 10.41% this quarter. Rental rates spanned from $4.00 per square foot in non-core retail shops to approximately $35.00 per square foot in core retail space.

Market Forecast

While the Greenville-Spartanburg market performed relatively well this quarter, the market is beginning to see some of the effects the pandemic is having on the retail sector. Several retailers in the Greenville-Spartanburg market closed their doors this quarter, but many had been struggling prior to the COVID-19 loss of business. Construction activity will likely stall until more of the existing vacancies are filled.

While the Greenville-Spartanburg market performed relatively well this quarter, the market is beginning to see some of the effects the pandemic is having on the retail sector. Several retailers in the Greenville-Spartanburg market closed their doors this quarter, but many had been struggling prior to the COVID-19 loss of business. Construction activity will likely stall until more of the existing vacancies are filled.

Conversely, new vacancies will provide retailers an opportunity to evaluate their current space and upgrade their real estate. Retail spaces that will be especially popular are those which provide ease of access, and ability of curbside pickup. These shops will afford the tenant more control over their space such as being able to limit the amount of customers through their doors, setting up sanitizing stations outside of the entrance and allowing outdoor shopping and/or dining where space permits.

Retailers, as well as consumers, are learning to cope with new regulations and as everyone becomes more comfortable with the safety precautions throughout retail shops, the consumer traffic may pick up. While there are predicted to be many changes occurring within the retail sector, the true effects of the Coronavirus will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.