Colliers Report: Greenville-Spartanburg’s positive office momentum slows as COVID-19 looms

April 1, 2020

Research & Forecast Report

Q1-2020 GREENVILLE-SPARTANBURG | OFFICE

Key Takeaways

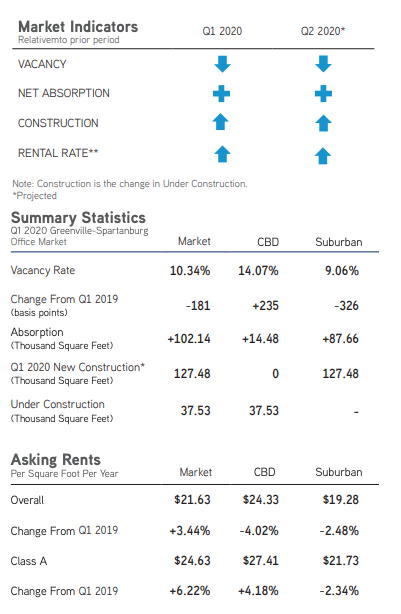

- During the first quarter of 2020, the Greenville-Spartanburg market saw vacancy decrease, rental rates increase, and positive absorption. However, COVID-19 is now disrupting the market activity and while most deals seem to be progressing, a major slowdown is likely as new deal flow is currently limited. Time will tell how the virus outbreak impacts the long-term market activity.

- Office investment sales were strong during the first quarter of 2020; however, due to uncertainty caused by the Coronavirus the absence of office investment in the coming quarters will significantly impact the office market for the rest of the year.

Favorable conditions for investors

Favorable conditions for investors

Commercial real estate investments are made with the goal of earning a high rate of return on an investment property. The return on investment is expected to come through rental income, the future resale of the property, or both. In addition, capitalization rates (“cap rates”) are a decisive purchasing factor, because it is an indicator of the rate of return projected to be generated on the investment. Conditions within the Greenville-Spartanburg market are favorable for investors to capitalize on properties that have an opportunity make capital improvements, to lease-up, drive rental rates up, etc. to increase the net operating income. Cap rates within the Greenville-Spartanburg market average 7%-8%, and while anything over 10% is generally thought to be a higher-risk investment, it could actually yield a greater profit. Below are value-add investment properties currently available in the Greenville-Spartanburg market.

- 50 Datastream Plaza

- 0% leased | Class B | 124,836 SF

- 2000 Wade Hampton Boulevard (Bldg. 1)

- 63% leased | Class C | 151,638 SF

- Piedmont Center East & West

- 72.5% leased | Class C | 145,859 SF

Tenants are renewing

Tenants are renewing

Greenville-Spartanburg office leasing activity is positive, but minimal. Submarket vacancy rates are low, indicating there are few spaces remaining throughout the market. The lack of available office space coupled with tentative decision-makers waiting out the election year have resulted in tenants renewing leases at their current locations. In addition, tenants are becoming creative within their suites through the use of modular furniture and flexible workspaces, so that one area within a suite may be used to satisfy several purposes without the need for additional space. Due to the Coronavirus unexpected spaces may become available in the market, although the impact of the outbreak will not be recognized for several quarters.

Market Overview

Overall Greenville-Spartanburg Market

The Greenville-Spartanburg office market consists of 17.53 million square feet and during the first quarter of 2020 absorbed 102,140 square feet. Most of the absorption was within the I-385/85 submarket at Legacy Square – a newly delivered building with 46,483 square feet of office space with only 3,517 square feet of vacancy. In addition to Legacy Square, a 70,000-square-foot office and an 11,000-square-foot office was also delivered to the I-385/85 submarket. There are 37,531 square feet of office buildings under construction in the Greenville-Spartanburg market, and 286,720 square feet proposed to be built. Due to new buildings delivering more square feet than the market absorbed, the quarterly vacancy rate increased slightly from 10.27% during the fourth quarter of 2019 to 10.34% this quarter. The overall average weighted rental rate rose to $21.63 per square foot this quarter, ranging from $15.00 per square foot in Pickens County to $24.33 per square foot in the Greenville central business district. Average weighted rental rates in Class A office space averaged $24.63 per square foot during the first quarter of 2020.

Greenville Central Business District (CBD)

The Greenville central business district is comprised of 4.49 million square feet. Overall, downtown offices absorbed 14,484 square feet with only Class A posting negative absorption numbers due to 12,445 square feet of negative absorption in Building 2 at 10 South Academy Street. No new buildings delivered to the downtown submarket; however, there are 160,531 square feet of office space currently under construction and 177,000 square feet of redevelopment within the Greenville central business district. The overall downtown market vacancy rate dropped from 14.39% during the fourth quarter of 2019 to 14.07% this quarter. However, the Class A vacancy rate rose from 9.35% last quarter to 9.81% during the first quarter of 2020. The average weighted rental rate within the CBD rose this quarter to $24.33 per square foot and Class A office property weighted rental rates rose to $27.41 per square foot.

Suburban

The Greenville-Spartanburg suburban office submarkets consists of 13.05 million square feet and absorbed 87,656 square feet during the first quarter of 2020. The I-385/85 submarket led the others, absorbing 127,063 square feet despite three office buildings delivering to this submarket and adding 127,483 square feet. There are currently four proposed offices to be built which, if completed, will add 274,720 square feet to the suburbs. Due to construction delivery square feet outweighing the positive quarterly absorption, the overall suburban vacancy rate increased from 8.85% at year end 2019 to 9.06% during the first quarter of 2020. The overall average rental rate for the remaining suburban office space increased from $18.80 per square foot last quarter to $19.28 per square foot to begin the year.

Significant Transactions

Significant Transactions

During the first quarter of 2020, there were 36 office sale transactions-several of which were medical office buildings. Also, according to CoStar, and 78 leases were signed within the Greenville-Spartanburg submarkets.

Sales

- For $3.8 million, Prisma Health purchased an 18,695-square-foot medical office at the Grove Office Medical Park located at 10058 Grove Road in Greenville.

- For $3.7 million, Mark Peabody and Cheryl Trust purchased an 11,315-square-foot medical office building located at 3254 Brushy Creek Road.

- For $1.8 million, Vasallo Construction Inc. purchased a 7,296-square-foot Fresenius Medical Care located at 200 Church Street in Honea Path.

Office-Using Employment

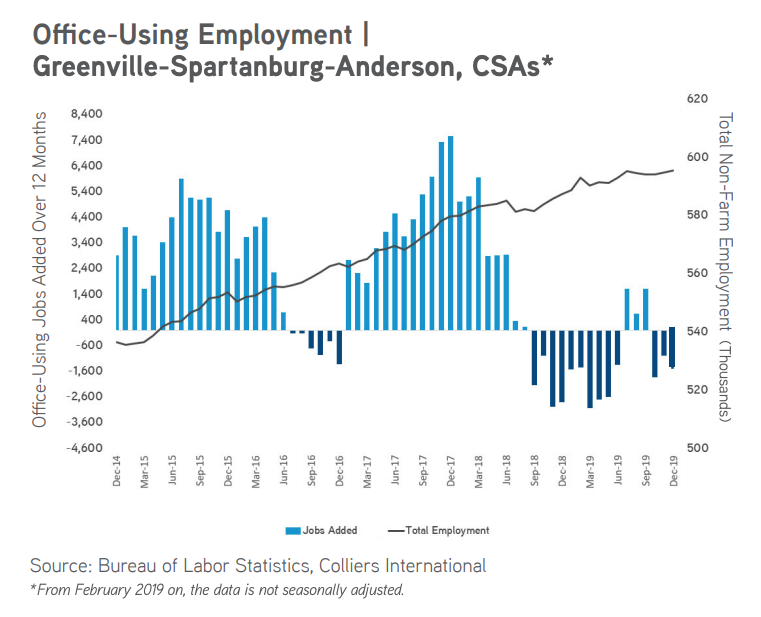

Office-using employment are those jobs related to the professional and business services, financial activities and information sectors, within the combined Greenville-Spartanburg-

Market Forecast

Because tenants are more often renewing their current leases than choosing to relocate and commit to a new lease, market activity in the Greenville-Spartanburg offices may slow considerably in the next few quarters until new construction is delivered to the market. In addition, due to the recent COVID-19 virus outbreak and South Carolina declaring a state of emergency across the state, all market activity decelerated at the end of the first quarter. The employment sector of professional and business services will likely be hit the hardest from temporary business shut-downs.

Average weighted rental rates will likely stabilize during the first half of 2020. The I-385/85 submarket is expected to be the most active for the next few quarters because that is where the construction activity is most prevalent; however, this may change as the actual effects of temporary shut-downs due to the COVID-19 virus will not be felt for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.