Colliers Report: No major shifts confirm Columbia office stability amid pandemic

October 1, 2020Research & Forecast Report

Q3-2020 COLUMBIA | OFFICE

Key Takeaways

- Overall office market occupancy barely moved this quarter. The few changes within Columbia’s offices show tenants are maintaining their current office.

- Some tenants are choosing to renew their leases for shorter terms to see the impact of COVID-19.

Columbia office tenants are creating marginal activity

Tenants within the Columbia office market executed renewals for shorter terms in the third quarter than were previously being negotiated. Nevertheless, they are still leasing space. Overall, the market absorption is slightly negative. However, Columbia is weathering the anticipated storm of negativity caused by the pandemic. The activity is minimal, but the market has not taken a nosedive. The activity is described more accurately as lethargic. There are deals in the process of negotiation. However, it is a slower process than before the pandemic because it is still tainted with some uncertainty. In looking to the fourth quarter, leasing momentum should partially regain strength.

Tenants within the Columbia office market executed renewals for shorter terms in the third quarter than were previously being negotiated. Nevertheless, they are still leasing space. Overall, the market absorption is slightly negative. However, Columbia is weathering the anticipated storm of negativity caused by the pandemic. The activity is minimal, but the market has not taken a nosedive. The activity is described more accurately as lethargic. There are deals in the process of negotiation. However, it is a slower process than before the pandemic because it is still tainted with some uncertainty. In looking to the fourth quarter, leasing momentum should partially regain strength.

Market Overview

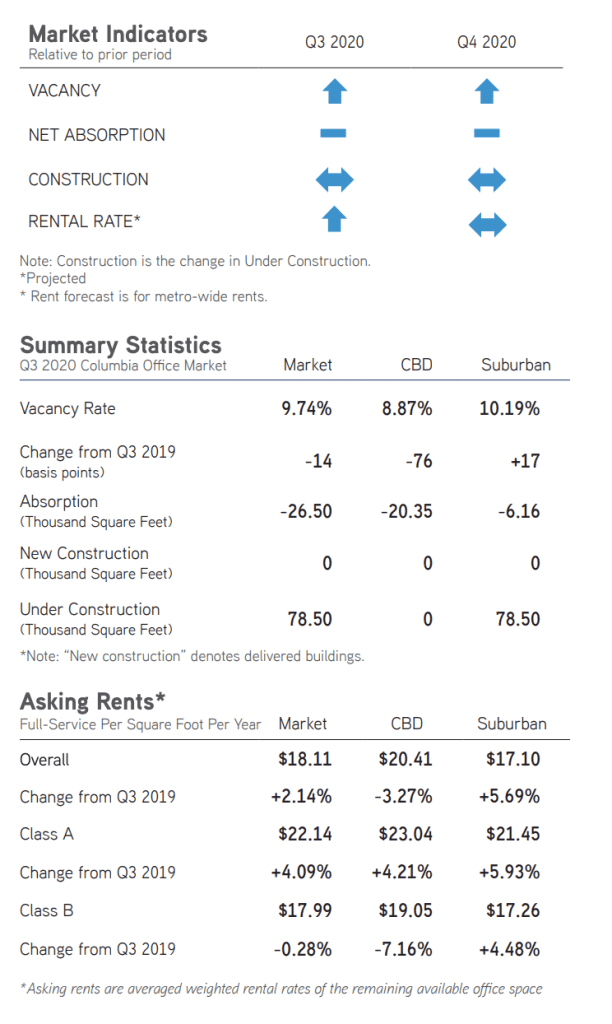

Overall Columbia Market

The Columbia office market is comprised of approximately 16.59 million square feet. The Columbia office market posted a negative absorption of 26,504 square feet which indicates minimal activity. While Class C office spaces absorbed 17,894 square feet, Class A and Class B posted negative absorption. In addition, sublease availabilities have doubled that of last quarter and now total 56,205 square feet. Landlords will likely have to temporarily lower some of their building rental rates in order to compete with the lower-priced sublease availabilities. As a result of the negative absorption this quarter, the overall market vacancy rate rose from 9.58% last quarter to 9.74% during the third quarter of this year. The overall market weighted full service rental rates averaged $18.11 per square foot. Class A office weighted rental rates averaged $22.14 per square foot.

Columbia Business District (CBD)

The Columbia central business district consists of 5.75 million square feet and no new office construction is planned for downtown Columbia at this time. The anticipated negative affects of the pandemic are starting to become evident within the Columbia central business district. During the third quarter of 2020 downtown offices posted a negative absorption of 20,346 square feet. Class C offices absorbed 21,850 square feet, while Class B posted a negative 23,027 square feet and Class A posted a negative 19,169 square feet. In addition, sublease space availabilities within the central business district has nearly tripled from 16,684 square feet last quarter to 47,098 square feet this quarter- a sign more space reductions are coming. Due to the negative absorption, the central business district vacancy rate increased from 8.52% last quarter to 8.87% during the third quarter of 2020. The overall average full service weighted rental rate in downtown offices rose marginally from $20.32 per square foot during the second quarter of 2020 to $21.41 per square foot this quarter.

The Columbia central business district consists of 5.75 million square feet and no new office construction is planned for downtown Columbia at this time. The anticipated negative affects of the pandemic are starting to become evident within the Columbia central business district. During the third quarter of 2020 downtown offices posted a negative absorption of 20,346 square feet. Class C offices absorbed 21,850 square feet, while Class B posted a negative 23,027 square feet and Class A posted a negative 19,169 square feet. In addition, sublease space availabilities within the central business district has nearly tripled from 16,684 square feet last quarter to 47,098 square feet this quarter- a sign more space reductions are coming. Due to the negative absorption, the central business district vacancy rate increased from 8.52% last quarter to 8.87% during the third quarter of 2020. The overall average full service weighted rental rate in downtown offices rose marginally from $20.32 per square foot during the second quarter of 2020 to $21.41 per square foot this quarter.

Suburban

The Columbia suburban markets consist of 10.83 million square feet of office properties. During the third quarter of 2020, the Columbia suburban office absorption activity was marginal. The suburbs posted a negative absorption of 6,158 square feet; Class B suburban offices absorbed 1,417 square feet, while Class A and Class C office absorption was negative. Third quarter negative absorption pushed the suburban vacancy rate up slightly from 10.14% last quarter to 10.19% during the third quarter of this year. The overall suburban office full service weighted rental rates remained nearly unchanged at $17.10 per square foot. The rental rate averages ranged from $23.00 per square foot in Cayce/West Columbia Class A suburban offices to $9.50 per square foot in Cayce/West Columbia Class C space.

The Columbia suburban markets consist of 10.83 million square feet of office properties. During the third quarter of 2020, the Columbia suburban office absorption activity was marginal. The suburbs posted a negative absorption of 6,158 square feet; Class B suburban offices absorbed 1,417 square feet, while Class A and Class C office absorption was negative. Third quarter negative absorption pushed the suburban vacancy rate up slightly from 10.14% last quarter to 10.19% during the third quarter of this year. The overall suburban office full service weighted rental rates remained nearly unchanged at $17.10 per square foot. The rental rate averages ranged from $23.00 per square foot in Cayce/West Columbia Class A suburban offices to $9.50 per square foot in Cayce/West Columbia Class C space.

Significant Transactions

According to Costar, during the third quarter of 2020 there were approximately 13 office sale transactions and 48 executed office leases or renewals within the Columbia market.

Sales

- For $1.4 million, South Carolina State University purchased the 43,648-square-foot Granby Building located at 1801 Charleston Highway in Cayce.

- The 15,456-square-foot, former Russell and Jeffcoat building located at 1022 Calhoun Street in Columbia was purchased for $1.33 million.

Leases

- Michael Baker International renewed a 40,825-square-foot office lease at 700 Huger Street in downtown Columbia.

- South Carolina Virtual Charter School executed a new lease for 10,432 square feet at 2023 Platt Springs Road in West Columbia.

Market Forecast

Although the market vacancy is expected to increase in 2021, this will be short-lived with leasing activity accelerating by 2022. Steady sale activity is expected to continue or ramp up. Office sale transactions are popular because cap rates are increasing and companies like the idea of being able to control their own space with minimal contact with others. Deal velocity is expected to increase through year-end as more employers and employees reopen and businesses move to accommodate their post-pandemic needs. Also, increased interest from major and secondary market tenants looking to relocate to less dense cities will continue to make Columbia an attractive option in 2021.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.