Colliers Report: Positive activity signifies retailers are successfully adapting

February 11, 2021

Research & Forecast Report

Q4-2020 GREENVILLE-SPARTANBURG | RETAIL

Key Takeaways

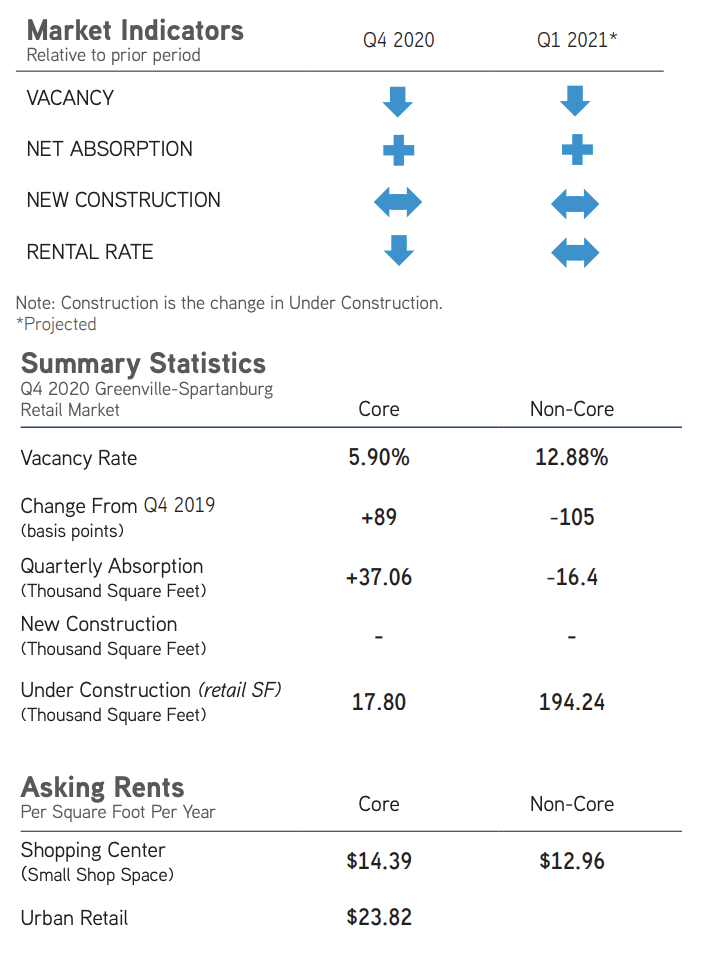

- Greenville-Spartanburg retail shops absorbed 20,660 square feet this quarter; dropping the overall vacancy rate to 10.81%.

- A shift to client-centric operations is prompting retailers to adapt their business lay-outs.

- Overall the Greenville-Spartanburg market has remained strong this year despite COVID set-backs and, going forward, business sales are expected to normalize in 2021.

Watch Video Recap: Here

For additional commercial real estate news, check out our market reports here.

QSR client-centric options are leading to change

One thing the pandemic has taught us: food is essential, mobile and can be eaten anywhere, so long as it is available. Therefore, trends are evolving to meet consumers at their comfort level. The major shift this year was from restaurant-centric preferences of service to consumer-centric preferences in an effort to ensure a restaurant’s full menu is accessible to as many consumers as possible. Quick service restaurants (QSRs) choosing to decrease restaurant space began pre-pandemic, around 2016; however, the pandemic furthered the trend of QSRs focusing on leasing or developing space with one or more drive-thru options available. Restaurants that do not already have them are planning to install them, and those that have one are often planning to add more. In addition, many restaurants are opting for a reduced footprint for indoor dining, but allowing planning for larger outdoor seating areas and additional pick-up options in the carry-out portion of the restaurant. Less dine-in space has not only led to several drive-thrus, restaurateurs are getting creative with consumer options for food pick up. Curbside pick-up is popular so consumers do not have to get out of their car in order to pick up their pre-ordered food. Those that do not mind getting out of their car but prefer not to interact with anyone have the option of enclosed kiosks with to go prepaid orders in them-clients can pick up their food with no face-to-face contact. Delivery services are extending restaurant delivery areas to a larger radius of clients in the region. While many restaurants and retailers managed to stay partially open throughout the pandemic, they continue to adapt their business practices to deliver their goods in a safe and efficient manner to all consumers.

One thing the pandemic has taught us: food is essential, mobile and can be eaten anywhere, so long as it is available. Therefore, trends are evolving to meet consumers at their comfort level. The major shift this year was from restaurant-centric preferences of service to consumer-centric preferences in an effort to ensure a restaurant’s full menu is accessible to as many consumers as possible. Quick service restaurants (QSRs) choosing to decrease restaurant space began pre-pandemic, around 2016; however, the pandemic furthered the trend of QSRs focusing on leasing or developing space with one or more drive-thru options available. Restaurants that do not already have them are planning to install them, and those that have one are often planning to add more. In addition, many restaurants are opting for a reduced footprint for indoor dining, but allowing planning for larger outdoor seating areas and additional pick-up options in the carry-out portion of the restaurant. Less dine-in space has not only led to several drive-thrus, restaurateurs are getting creative with consumer options for food pick up. Curbside pick-up is popular so consumers do not have to get out of their car in order to pick up their pre-ordered food. Those that do not mind getting out of their car but prefer not to interact with anyone have the option of enclosed kiosks with to go prepaid orders in them-clients can pick up their food with no face-to-face contact. Delivery services are extending restaurant delivery areas to a larger radius of clients in the region. While many restaurants and retailers managed to stay partially open throughout the pandemic, they continue to adapt their business practices to deliver their goods in a safe and efficient manner to all consumers.

Annual Retail Overview

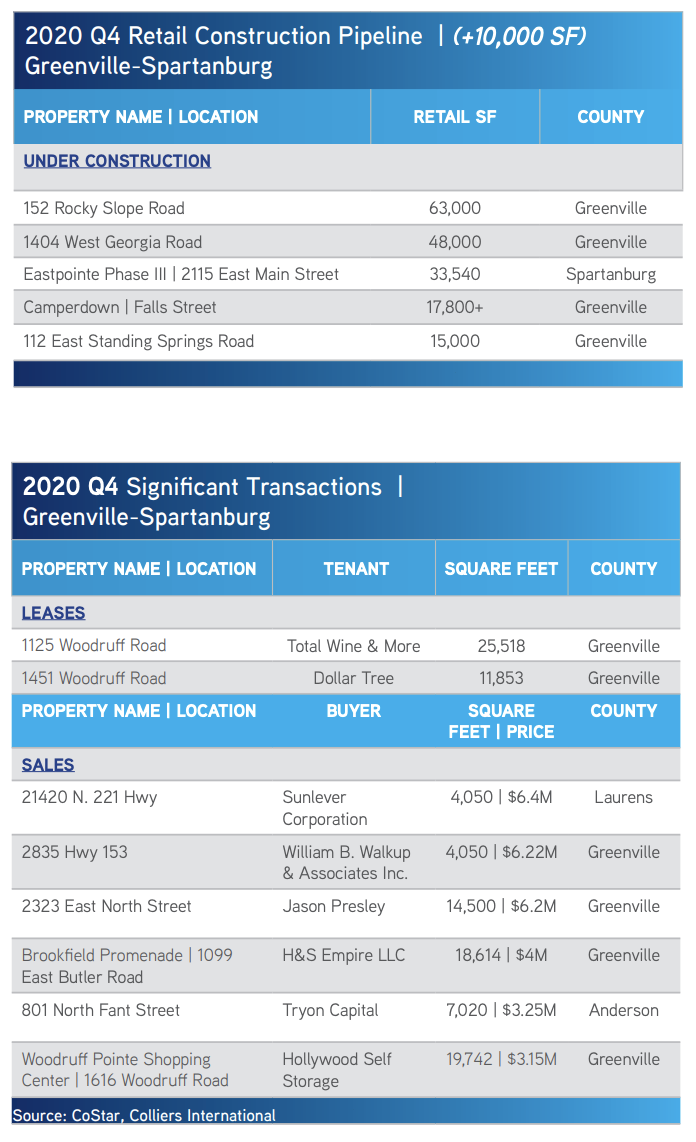

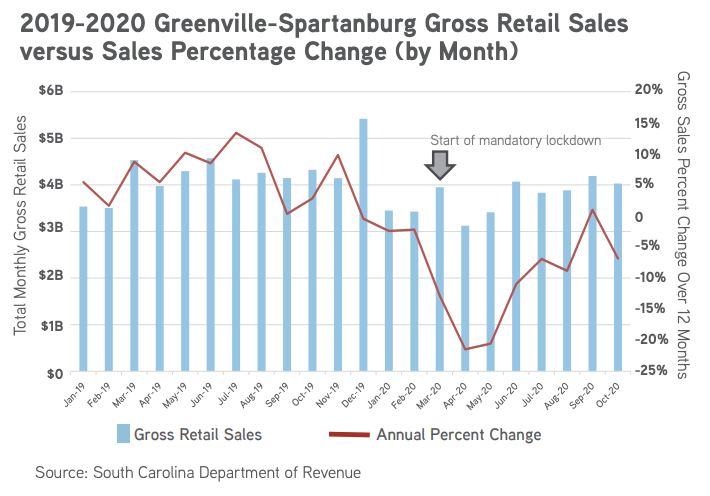

From the fourth quarter of 2019 through the 4th quarter of 2020 the Greenville-Spartanburg retail market absorbed 244,713 square feet. Annually, core retail space posted a negative 29,165 square feet, while non-core absorbed 273,878 square feet. The East Side retail submarket led the way with 147,881 square feet of overall annual absorption. Most of the absorption throughout the market took place in home goods stores, convenience stores, temporary holiday shops. While retail sale transactions were mostly driven by QSRs, suburban strip malls and small medical clinics. Despite positive absorption, the overall vacancy rate increased from 10.57% at year-end 2019 to 10.81% this quarter, due to approximately 327,540 square feet of new retail deliveries. Despite a mandatory lockdown at the beginning of March of this year, gross retail sales, while lower, managed to rebound to better than anticipated.

From the fourth quarter of 2019 through the 4th quarter of 2020 the Greenville-Spartanburg retail market absorbed 244,713 square feet. Annually, core retail space posted a negative 29,165 square feet, while non-core absorbed 273,878 square feet. The East Side retail submarket led the way with 147,881 square feet of overall annual absorption. Most of the absorption throughout the market took place in home goods stores, convenience stores, temporary holiday shops. While retail sale transactions were mostly driven by QSRs, suburban strip malls and small medical clinics. Despite positive absorption, the overall vacancy rate increased from 10.57% at year-end 2019 to 10.81% this quarter, due to approximately 327,540 square feet of new retail deliveries. Despite a mandatory lockdown at the beginning of March of this year, gross retail sales, while lower, managed to rebound to better than anticipated.

Quarterly Market Overview

The Greenville-Spartanburg retail market is comprised of approximately 17.58 million square feet of retail space. Core retail space absorbed 37,060 square feet during the fourth quarter of 2020, while non-core spaces posted a negative 16,400 square feet. Some submarkets, such as Easley, have retail redevelopment occurring thereby causing rising temporary vacancies. No new construction was delivered to the market this quarter; however, there are 194,240 square feet under construction throughout the Greenville-Spartanburg submarkets. Upon completion, non-core shops will comprise 176,440 square feet, and 17,800 square feet will be located in core retail within the Camperdown development. The overall quarterly vacancy rate decreased slightly due to overall positive absorption from 10.92% during the third quarter of this year to 10.81% this quarter. Weighted rental rates for available shops spanned from $4.00 per square foot in Belton-Honea Path non-core retail shops to approximately $27.33 per square foot in Clemson Boulevard non-core retail space.

The Greenville-Spartanburg retail market is comprised of approximately 17.58 million square feet of retail space. Core retail space absorbed 37,060 square feet during the fourth quarter of 2020, while non-core spaces posted a negative 16,400 square feet. Some submarkets, such as Easley, have retail redevelopment occurring thereby causing rising temporary vacancies. No new construction was delivered to the market this quarter; however, there are 194,240 square feet under construction throughout the Greenville-Spartanburg submarkets. Upon completion, non-core shops will comprise 176,440 square feet, and 17,800 square feet will be located in core retail within the Camperdown development. The overall quarterly vacancy rate decreased slightly due to overall positive absorption from 10.92% during the third quarter of this year to 10.81% this quarter. Weighted rental rates for available shops spanned from $4.00 per square foot in Belton-Honea Path non-core retail shops to approximately $27.33 per square foot in Clemson Boulevard non-core retail space.

Market Forecast

The Greenville-Spartanburg market activity is starting to rebound from the pandemic lockdown set-back. Retailers are adopting new ways to deliver goods to their consumers and it is affecting, not only the way they do business, but also the space in which they operate in. Retailers have been more open to locating to existing space and upfitting it to adhere to their preferences, rather than building new space. This bodes well for positive future absorption in the next few quarters, before new retail space is delivered. Overall the Greenville-Spartanburg market has remained strong throughout 2020 despite the pandemic and, going forward, business sales are expected to normalize in 2021, boosting the need for retail space.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.