Colliers Report: Retailers adapting business operations to accommodate consumer needs

February 11, 2021Research & Forecast Report

Q4-2020 COLUMBIA | RETAIL

Key Takeaways

- Since many people worked from home throughout the pandemic, suburban retail shops outperformed urban spaces last year due to the close proximity of suburban shops to residential areas.

- Quick service restaurant trends are evolving to meet consumers at their comfort level.

- While there was some movement, overall the retail market posted minimal activity during the fourth quarter of 2020 in Columbia due to the 2020 global pandemic.

Client-centric options are leading to adaptive business plans

One thing the pandemic has taught us: food is essential, mobile and can be eaten anywhere. Trends are evolving to meet consumers’ various comfort levels. The major shift last year was from restaurant-centric food service preferences to consumer-centric food service preferences to ensure a restaurant’s full menu is accessible via various distribution options. Quick service restaurants (QSRs) began decreasing interior restaurant space prior to the onset of the pandemic; however, the pandemic accelerated the trend of QSRs focusing on smaller interior space and one or more drive-thru options. Restaurants that do not already have drive-thrus are planning to install them. Also most QSR’s are planning for larger outdoor seating areas. In addition to smaller dine-in space and more emphasis on drive-thru service. Restaurateurs are getting creative with consumer options for picking up pre-placed orders. Curbside pick-up is popular because consumers do not have to get out of their car to pick up pre-paid orders. Those that do not mind getting out of their car, but prefer not to interact with anyone, frequently have the option of accessing an enclosed kiosk with pick up prepaid orders. Delivery services are extending restaurant delivery areas to a larger radius of clients in the region. While many restaurants and retailers managed to stay partially open throughout the pandemic, the successful ones continue to adapt their business practices to deliver their goods in a safe and efficient manner to all consumers.

One thing the pandemic has taught us: food is essential, mobile and can be eaten anywhere. Trends are evolving to meet consumers’ various comfort levels. The major shift last year was from restaurant-centric food service preferences to consumer-centric food service preferences to ensure a restaurant’s full menu is accessible via various distribution options. Quick service restaurants (QSRs) began decreasing interior restaurant space prior to the onset of the pandemic; however, the pandemic accelerated the trend of QSRs focusing on smaller interior space and one or more drive-thru options. Restaurants that do not already have drive-thrus are planning to install them. Also most QSR’s are planning for larger outdoor seating areas. In addition to smaller dine-in space and more emphasis on drive-thru service. Restaurateurs are getting creative with consumer options for picking up pre-placed orders. Curbside pick-up is popular because consumers do not have to get out of their car to pick up pre-paid orders. Those that do not mind getting out of their car, but prefer not to interact with anyone, frequently have the option of accessing an enclosed kiosk with pick up prepaid orders. Delivery services are extending restaurant delivery areas to a larger radius of clients in the region. While many restaurants and retailers managed to stay partially open throughout the pandemic, the successful ones continue to adapt their business practices to deliver their goods in a safe and efficient manner to all consumers.

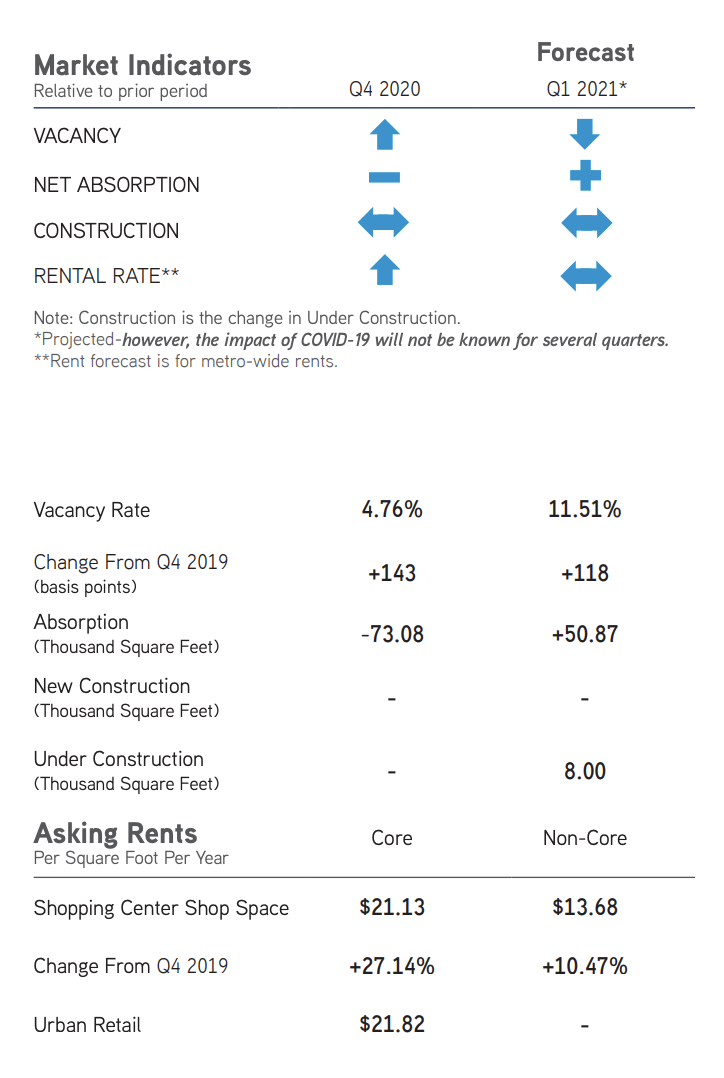

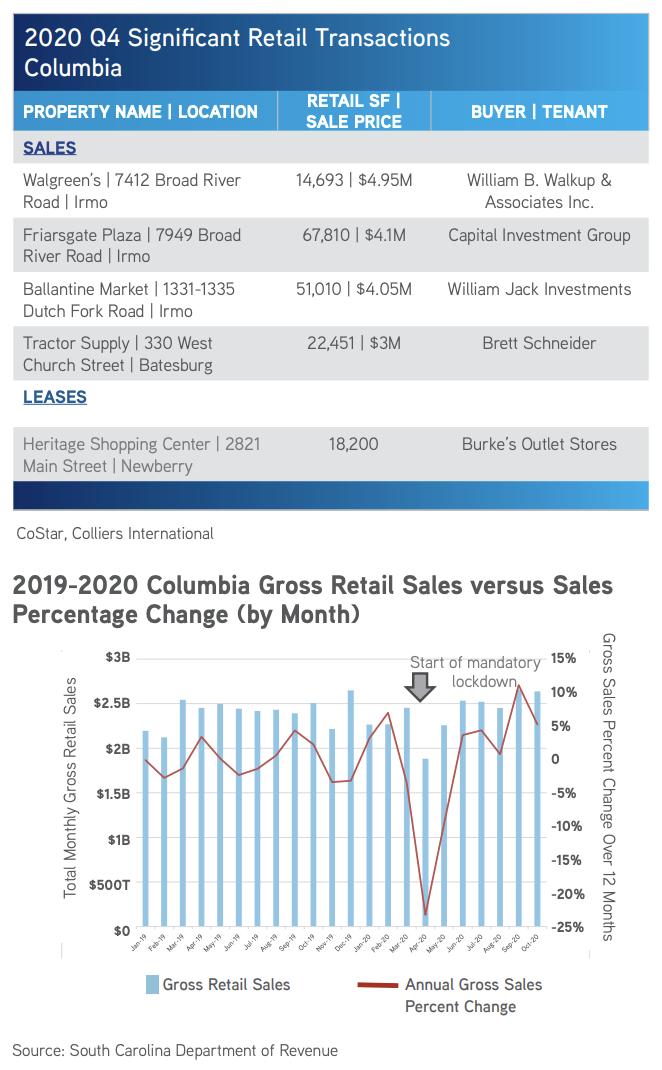

Annual Columbia Retail Overview

The pandemic brought significant change to Columbia’s retail market. Shopping centers posted negative annual net absorption of 163,425 square feet from the fourth quarter of 2019 through year end 2020. Negative absorption was accelerated due to quarantine restrictions and forced temporary closings. Businesses that did well were often discount stores such as Walmart, Target Big Lots, TJX brands, Ollies and others. Grocery stores did extremely well and increased their delivery and pick-up options throughout the pandemic. There were three buildings totaling 23,700 square feet delivered to the Columbia retail market over the past year, two in Lexington County and one in Richland County. A portion of these construction deliveries are occupied by a pilates studio and Starbucks. Due to the annual negative absorption, the vacancy rate increased by 118 basis points from year end 2019 through the fourth quarter of this year. Suburban shops located closer to residential areas fared better than CBD locations because the majority of consumers were working from residential locations and were more likely to use suburban shops throughout 2020.

Quarterly Market Overview

The Columbia shopping center market is comprised of approximately 13.48 million square feet of shop space. During the fourth quarter of 2020, core shops posted negative absorption of 73,085 square feet. The largest portion of negative absorption was Steinmart closings; however, there were only five core buildings contributing to the negative absorption. Negative core absorption was offset by positive non-core absorption of 50,870 square feet. While there was some movement, overall the retail market had minimal activity during the fourth quarter of 2020 in Columbia. Many businesses are staying put and adopting new ways of running their businesses successfully. Due to the negative quarterly absorption, the overall vacancy rate increased marginally to 8.14% this quarter. Rental rates continue to fluctuate due to ongoing changes during the pandemic; the overall average rental rate in core shops was $21.13 per square foot, while in non-core shops, the average rental rate was $13.68 per square foot.

The Columbia shopping center market is comprised of approximately 13.48 million square feet of shop space. During the fourth quarter of 2020, core shops posted negative absorption of 73,085 square feet. The largest portion of negative absorption was Steinmart closings; however, there were only five core buildings contributing to the negative absorption. Negative core absorption was offset by positive non-core absorption of 50,870 square feet. While there was some movement, overall the retail market had minimal activity during the fourth quarter of 2020 in Columbia. Many businesses are staying put and adopting new ways of running their businesses successfully. Due to the negative quarterly absorption, the overall vacancy rate increased marginally to 8.14% this quarter. Rental rates continue to fluctuate due to ongoing changes during the pandemic; the overall average rental rate in core shops was $21.13 per square foot, while in non-core shops, the average rental rate was $13.68 per square foot.

Market Forecast

Over the past year, suburban retail shops have generally outperformed urban spaces because of the close proximity to residential areas. For this reason, over the next year core retail shop success will depend on the number of people who return to work versus continuing to work from home. Overall, increasing retail activity is likely in the next year as shop owners continue to alter business plans to effectively deliver their products to consumers. In addition, retail shops will increase productivity as they open full-time, and the vaccine is widely distributed–boosting consumer confidence levels. Stores that went dark in 2020 provide opportunities for investors within the market. Rental rates are not likely to change significantly during the first half of 2021 as retailers strive to resume business operations.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.