Colliers Report: Retailers create a “new normal” due to COVID-19

May 5, 2020Research & Forecast Report

Q1-2020 CHARLESTON | RETAIL

Key Takeaways

- During the COVID-19 temporary closures, many retailers used the time for deep cleaning and revamping business structures.

- The onset of the Coronavirus will have immediate short term and long term impact affecting both the U.S. and Charleston retail markets.

For additional commercial real estate news, check out our market reports here.

Retailers will operate under a “new normal” due to COVID-19

At the end of the first quarter of 2020, the Coronavirus pandemic forced retailers to change the way they conduct business. Retail businesses were ordered to close their doors to onsite customers only allowing for carry-out or curbside service, unless deemed essential. While some retailers have asked for rent restructuring and governmental funding to offer monetary relief, others have used the temporary closings as a time for deep cleaning and revamping business structures. Retailers have: altered spacing between dining tables so they are further apart from each other upon reopening; added areas for inside pick-up kiosks affording less one-on-one interaction with employees and other customers; installed no-touch automatic entry systems and added delivery services and/or drive-thrus to their shops. Other retailers have increased their online presence making it possible for customers to order and receive curbside delivery to their vehicles. All of these new structures are done with the hope that customers will feel comfortable returning to their shops and restaurants when the quarantine is lifted. Retailers will operate under a “new normal” upon reopening. Consumer attitudes during the lock-down have gravitated toward supporting local business owners within their community. Hopes are high that retailers will reopen to increased business thanks to anxious consumers ready to support them.

At the end of the first quarter of 2020, the Coronavirus pandemic forced retailers to change the way they conduct business. Retail businesses were ordered to close their doors to onsite customers only allowing for carry-out or curbside service, unless deemed essential. While some retailers have asked for rent restructuring and governmental funding to offer monetary relief, others have used the temporary closings as a time for deep cleaning and revamping business structures. Retailers have: altered spacing between dining tables so they are further apart from each other upon reopening; added areas for inside pick-up kiosks affording less one-on-one interaction with employees and other customers; installed no-touch automatic entry systems and added delivery services and/or drive-thrus to their shops. Other retailers have increased their online presence making it possible for customers to order and receive curbside delivery to their vehicles. All of these new structures are done with the hope that customers will feel comfortable returning to their shops and restaurants when the quarantine is lifted. Retailers will operate under a “new normal” upon reopening. Consumer attitudes during the lock-down have gravitated toward supporting local business owners within their community. Hopes are high that retailers will reopen to increased business thanks to anxious consumers ready to support them.

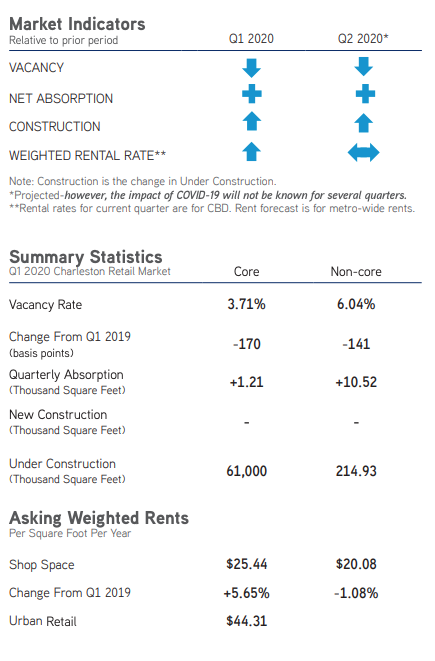

Market Conditions

The Charleston retail market consists of approximately 14.38 million square feet of retail space and absorbed 9,428 square feet of retail space during the first quarter of 2020. Core retail space posted 1,161 square feet of negative absorption during the first quarter of 2020-the negative absorption was within three core buildings in various submarkets. Non-core retail shops absorbed 10,589 square feet this quarter within various submarkets. Positive core absorption occurred within four core centers. The overall quarterly vacancy rate decreased slightly from 4.88% at the end of last year to 4.82% this quarter due to the positive non-core absorption. The overall core vacancy rate was nearly unchanged at 3.71%; however, non-core vacancy rates decreased to 6.04%.

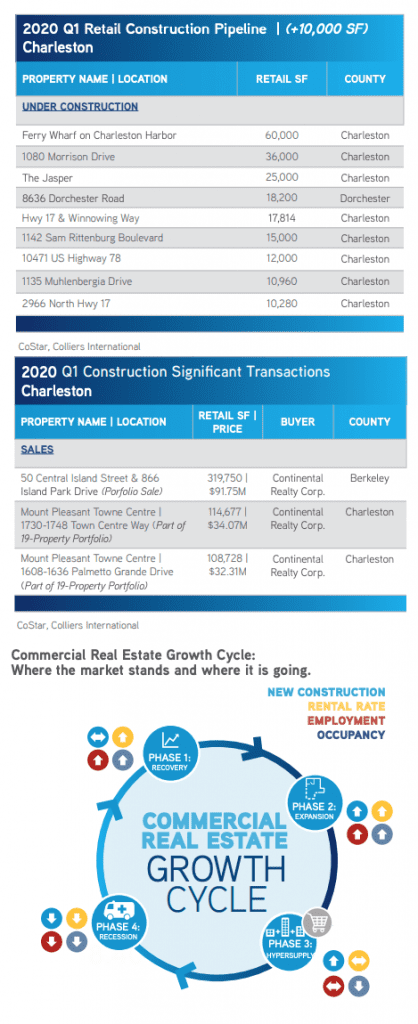

Overall, within non-core retail space, the West Ashley submarket absorbed 6,180 square feet, the East Cooper shops absorbed 2,362 square feet and North Charleston absorbed 2,047 square feet. No other non-core submarkets posted activity this quarter. Core retail submarkets posted both positive and negative activity throughout the submarkets virtually cancelling one another out, which likely means tenants moved from one market to another. The core markets which posted positive activity were North Charleston and West Ashley. According to Costar, there are currently 275,930 square feet of shopping center space under construction throughout the Charleston market; however, due to COVID-19 there may be temporary delays or altered plans in the next few quarters. The overall average rental rate for the remaining shop space availabilities ranged from $12.91 per square foot in the non-core Berkeley submarket to $29.00 per square foot in the Summerville submarket.

Market Forecast

Market Forecast

Charleston retail markets posted positive, but minimal market activity during the first quarter of 2020. Construction projects are expected to be delayed because of temporary business closings and set-backs related to COVID-19. Retailers were forced to alter their business structures to accommodate for quarantine restrictions. Retail rental rates are likely to drop somewhat in the next few quarters to accommodate for retail closures.

Consumer attitudes are geared toward supporting local businesses by continuing to order carry-out food and shopping via curbside pickup or delivery services. Market activity is expected to resume, and even possibly boom, when the quarantine regulations have been lifted. Many retailers will implement changes to the way business is conducted so consumers will feel safe when they are able to shop again. While there are predicted to be many changes occurring within the retail sector, the true effects of the Coronavirus will not be evident for several quarters.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.