Colliers Report: Shifting production trends increase Charleston industrial demand

October 22, 2020Research & Forecast Report

Q3-2020 CHARLESTON | INDUSTRIAL

Key Takeaways

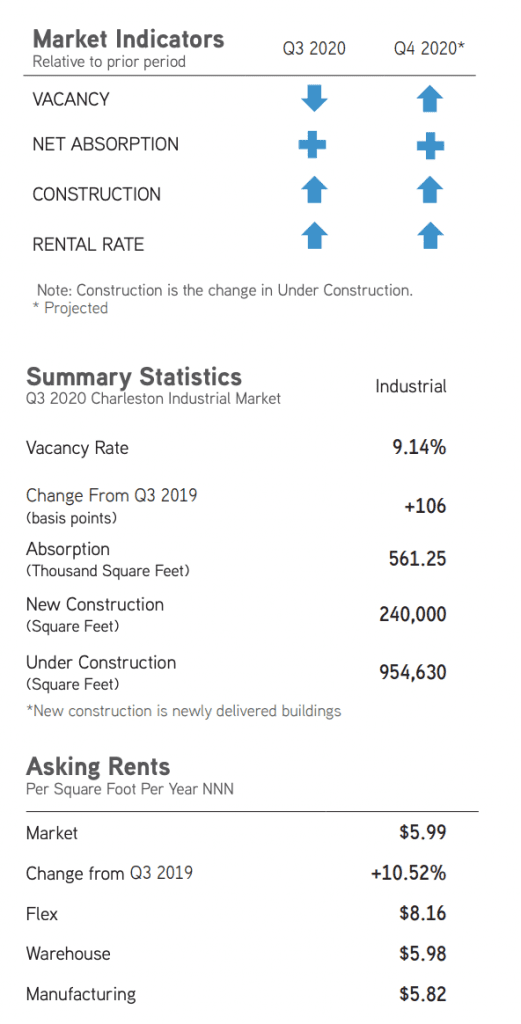

- The Charleston industrial market continues to post positive absorption; causing the vacancy rate to decrease to 9.14% this quarter.

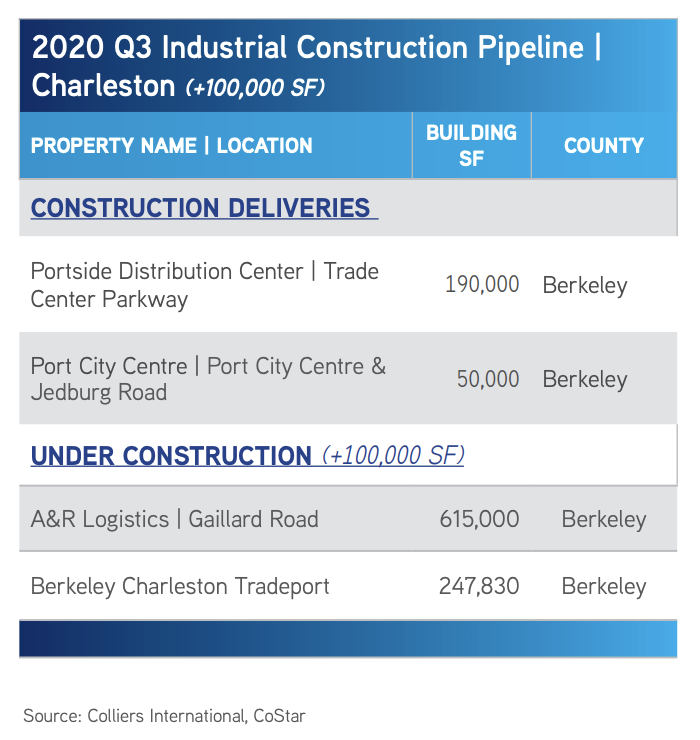

- There are 823,800 square feet of industrial construction in the Charleston pipeline.

- Increased port capabilities, consolidated aerospace production, uptick in automotive manufacturing and an increase in e-commerce are shifting production demands to the Charleston industrial market.

For additional commercial real estate news, check out our market reports here.

Industrial production trends boost activity

There are several factors leading to increased demand within the industrial sector of Charleston. Increased port capabilities, consolidated aerospace production and an uptick in e-commerce are shifting production demands to the Charleston industrial market. Due to the deepening of the Port of Charleston, increased import and export shipping operations are moving to the East Coast, specifically South Carolina. In addition, the construction of the Inland Port of Dillon and record-breaking rail moves at the Inland Port of Greer are facilitating logistics to and from South Carolina. The consolidation of the Boeing 787 Dreamliner production to North Charleston will increase the demand for aerospace-related equipment and parts manufacturers and distributors in the area. Also, the Volvo plant in Ridgeville is planning to add a second car to the production line sometime in 2021; therefore, increasing automobile manufacturing and distribution. Due to the ongoing pandemic, the need for e-commerce has increased exponentially; thus, increasing the demand for industrial space. Online grocery shopping is an expanding sector of e-commerce which, in turn, is increasing the need for cold storage to accommodate the vast amount of online grocery orders. Warehouse space close to major logistic pipelines is predicted to continue attracting interest from both investors and users as e-commerce growth increases. Therefore, due to these factors, the need for industrial space within the Charleston market is expected to rise and the vast amount of planned construction deliveries will likely be leased relatively quickly upon delivery.

There are several factors leading to increased demand within the industrial sector of Charleston. Increased port capabilities, consolidated aerospace production and an uptick in e-commerce are shifting production demands to the Charleston industrial market. Due to the deepening of the Port of Charleston, increased import and export shipping operations are moving to the East Coast, specifically South Carolina. In addition, the construction of the Inland Port of Dillon and record-breaking rail moves at the Inland Port of Greer are facilitating logistics to and from South Carolina. The consolidation of the Boeing 787 Dreamliner production to North Charleston will increase the demand for aerospace-related equipment and parts manufacturers and distributors in the area. Also, the Volvo plant in Ridgeville is planning to add a second car to the production line sometime in 2021; therefore, increasing automobile manufacturing and distribution. Due to the ongoing pandemic, the need for e-commerce has increased exponentially; thus, increasing the demand for industrial space. Online grocery shopping is an expanding sector of e-commerce which, in turn, is increasing the need for cold storage to accommodate the vast amount of online grocery orders. Warehouse space close to major logistic pipelines is predicted to continue attracting interest from both investors and users as e-commerce growth increases. Therefore, due to these factors, the need for industrial space within the Charleston market is expected to rise and the vast amount of planned construction deliveries will likely be leased relatively quickly upon delivery.

Market Overview

Overall Charleston industrial market

The Charleston industrial market has 58.51 million square feet of industrial inventory with 954,630 square feet under construction. In addition, there are approximately 18 buildings proposed to be built within the Charleston market which would add an additional 4.69 million square feet to the industrial inventory. The Charleston submarkets absorbed 561,249 square feet during the third quarter of 2020 led by the North Charleston and Summerville submarkets. Due to the high amount of positive absorption, the overall market vacancy decreased from 9.28% last quarter to 9.14% this quarter. The overall market average triple net weighted rental rate increased this quarter to $5.99 per square foot.

Warehouse/Distribution

The Charleston industrial market warehouse/distribution sector is comprised of 42.74 million square feet within 848 buildings and comprises 73% of the Charleston industrial market. There are six warehouses totaling 954,630 square feet under construction throughout the Charleston market, and an additional 16 warehouses totaling 4.15 million square feet are proposed to be built. During the third quarter of 2020 Charleston warehouses absorbed 579,075 square feet, 401,742 square feet occurred within the North Charleston submarket and 243,936 square feet was absorbed in Summerville. Positive absorption pushed the quarterly warehouse/distribution sector vacancy rate down from 10.39% last quarter to 10.14% during the third quarter of this year. The average triple net weighted warehouse rental rate averaged $5.82 per square foot this quarter.

Manufacturing

Manufacturing is primarily used to assemble goods for sale and distribution. There are approximately 11.31 million square feet of manufacturing space within the Charleston market. There is one 520,000-square-foot building proposed to be built within the Summerville submarket. There are not many manufacturing spaces available in the Charleston market; the market posted no absorption activity during the third quarter of 2020. Therefore, the overall manufacturing vacancy rate remained 6.56% this quarter. Triple net weighted rental rate during the third quarter of this year averaged $5.98 per square foot.Flex/R&D

Flex/R&D space is defined as industrial space where more than 30% of the building is utilized for office space. The Charleston flex/ R&D market is comprised of approximately 4.46 million square feet. One 17,500-square-foot flex building is currently proposed to be built within the Clements Ferry submarket. The flex/R&D sector posted a negative 17,826 square feet during the third quarter of 2020 and the vacancy rate within the flex/R&D sector increased from 5.67% last quarter to 6.07% this quarter. The average triple net weighted rental rate decreased slightly to $8.16 per square foot during the third quarter of 2020.

Capital Investment & Employment

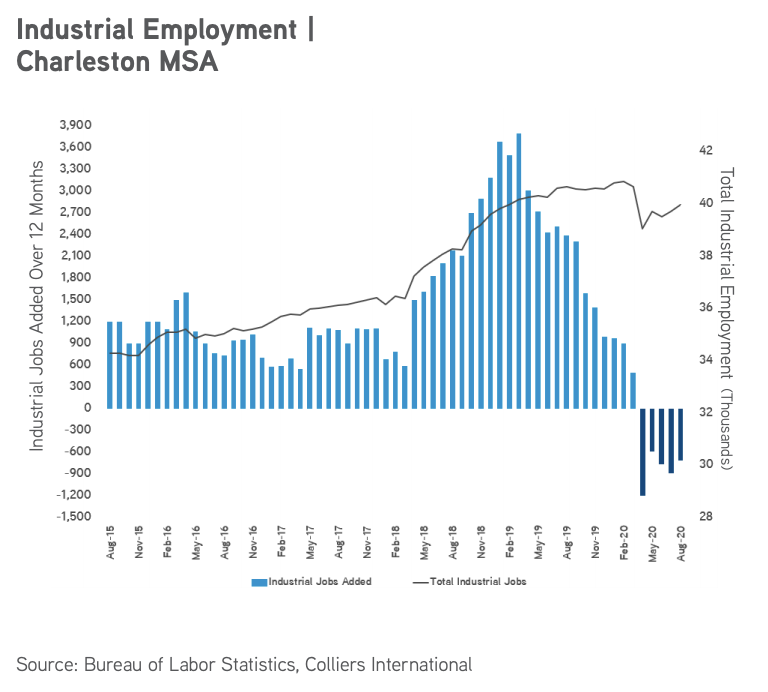

There have been approximately $425.91 million in capital investments within the Charleston industrial market from the third quarter of 2019 through the third quarter of 2020. Companies new to the market produced 1,684 jobs, while expansions created 1,020 jobs. The types of investors include cold storage, automotive and lawn equipment manufacturing, software services and various distribution and logistics centers. Also, according to the Federal Reserve data over the past 12 months due to the temporary shut-downs caused by the Coronavirus, there were 27,200 less jobs in the Charleston metropolitan statistical area, 715 of which were industrial jobs. However, that number has improved from 48,200 jobs lost in April when the affects of the pandemic were first realized. Jobs are predicted to continue being restored as temporary closings and Coronavirus restrictions are lifted, then employment numbers will likely normalize. The Charleston employment rate is still strong at 93.2%; however, the numbers are expected to continue fluctuating due to the effects of COVID-19.

There have been approximately $425.91 million in capital investments within the Charleston industrial market from the third quarter of 2019 through the third quarter of 2020. Companies new to the market produced 1,684 jobs, while expansions created 1,020 jobs. The types of investors include cold storage, automotive and lawn equipment manufacturing, software services and various distribution and logistics centers. Also, according to the Federal Reserve data over the past 12 months due to the temporary shut-downs caused by the Coronavirus, there were 27,200 less jobs in the Charleston metropolitan statistical area, 715 of which were industrial jobs. However, that number has improved from 48,200 jobs lost in April when the affects of the pandemic were first realized. Jobs are predicted to continue being restored as temporary closings and Coronavirus restrictions are lifted, then employment numbers will likely normalize. The Charleston employment rate is still strong at 93.2%; however, the numbers are expected to continue fluctuating due to the effects of COVID-19.

There were 15 Charleston industrial sales reported by CoStar during the third quarter of 2020. Leasing activity also increased slightly this quarter and according to CoStar there were 39 industrial leases executed this quarter.

Leases

- Walmart Distribution Center leased 3 million square feet at 440 Ridgeville Road in Ridgeville.

- 3G Distribution leased 316,140 square feet at the Clarius Omni 1 building located at 537 Omni Industrial Boulevard in Summerville.

- Daye North America leased 310,128 square feet at Ladson Industrial Park Building 1 located in Ladson.

Sales

- For $4.94 million, Capitol Peak Partners purchased a 95,750-square-foot food processing center at 5001 Lacross Road in Charleston for a sale-leaseback with Borden Dairy Company.

- For $2.94 million, Brookwood Capital Partners purchased a 36,000-square-foot warehouse at 9516 Hamburg Road in Ladson.

Market Forecast

Construction of speculative industrial buildings is anticipated to increase the vacancy rate throughout the Charleston market; however, demand is expected to eventually catch up to the new deliveries. High quality construction completions will lead to a rise in rental rates over the next few quarters with the vacancy rate eventually trending downward in 2021. Positive port activity and enhanced logistics continue to shift toward the East Coast from the West Coast; therefore, an increase in new companies to the Charleston region will likely absorb vacant buildings. In addition, an escalation of e-commerce due to pandemic shopping trends are boosting the need for cold storage space near logistic pipelines. Thus, South Carolina is a prime spot for growth leading to increased activity throughout the state into next year. Finally, the boom in aerospace and automotive manufacturing and distribution will be a major contributor to the increased need for industrial space in Charleston as new production plans begin. The industrial outlook in Charleston is positive and even being boosted by several factors which will increase industrial productivity within the region.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.